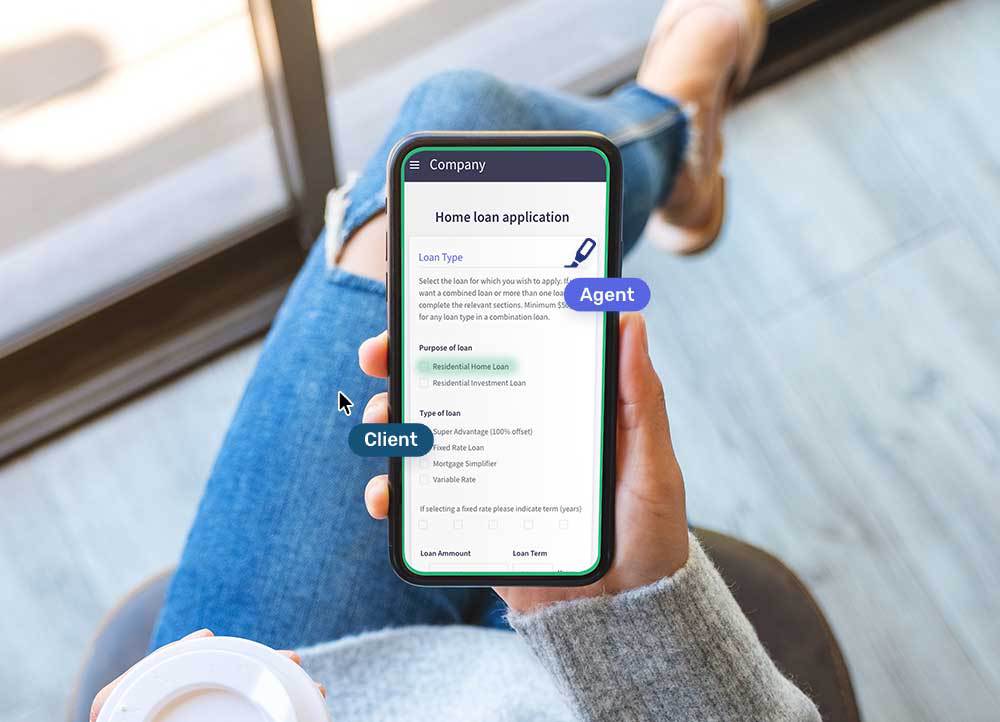

Mobile Co-Browsing or Co-Apping is emerging as a key tool for app-to-app customer service collaboration. But what exactly is it?

Credit unions must embrace conversational engagement to reduce contact center strain and serve all members, regardless of age.

With the SBA’s “Memorandum of Understanding” that promises to introduce multibanking to Switzerland, banks based in the country need to take action.

Credit unions undergoing consolidation initiatives shouldn’t put off digital transformation – they should leverage its power during migration.

Customer service is vital in the financial services industry, allowing retail banks or credit unions to capitalize on upsell or cross sell opportunities.

There is a substantial challenge involved in achieving sustainable customer acquisition at a reasonable cost. What works for retail banks?

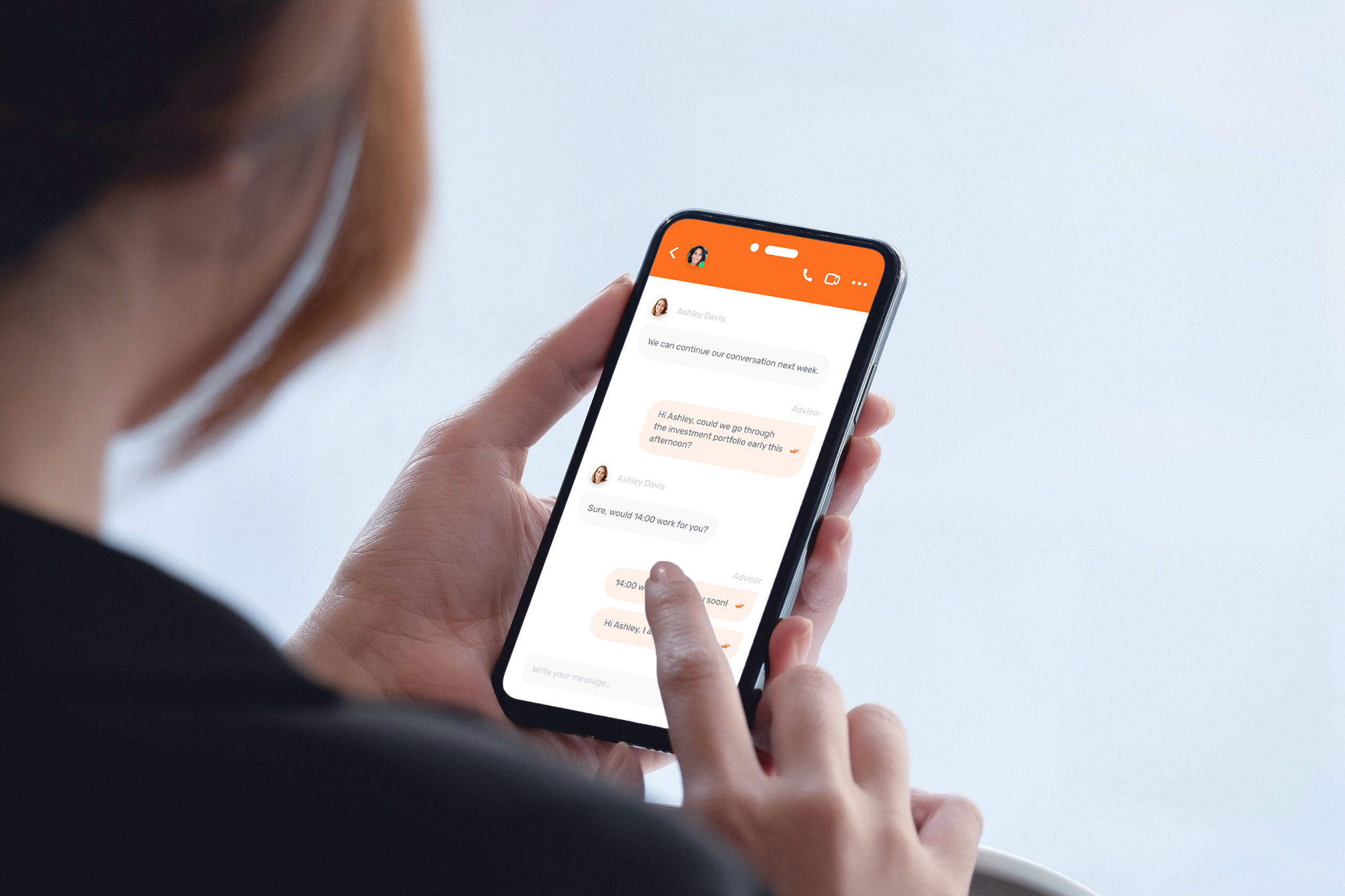

Client engagement is one of the principal markers of success in a wealth management context. But how do you increase client-advisor contact?

Want to invest in Co-Browsing solutions? Discover the most important KPIs to gauge your customer support team's readiness.

Unblu’s conversational platform empowers wealth management firms to strengthen client relationships by delivering an outstanding service experience.

Conversational AI should be intertwined with human support to provide a seamless customer experience.

AI financial advisors are all the rage – but what are their limitations and how should wealth management firms respond?

Retail banks must deliver an outstanding customer experience to meet changing service expectations – and Unblu plays a key role in achieving this.

The 2023 EY Global Wealth Management Research Report, “When volatility causes complexity, how can wealth managers create opportunity?” draws its insights from a sample of 2,600 investors across generations, geographies, and wealth segments. The report, which you can find here, paints a picture of the current wealth landscape, including challenges, client expectations, and ways to

What criteria should financial institutions be using when choosing a video conferencing platform? At Unblu, this is a topic we discuss on a daily basis.

Digital branches can be the answer to the growing challenge of branch closures – according to what Valiant Bank achieved alongside Unblu Branch.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice