Build strong client relationships that last

Trust is the cornerstone of wealth management relationships. With Unblu, advisors can deliver a consistent and personalized wealth management client experience that drives loyalty.

Request a demo

Immediate impact

Unblu’s Conversational Engagement Platform offers engagement and collaboration tools that emulate and enhance what’s possible in an in-person context.

Call-backs

Emails on active advisory

Positive customer satisfaction

Increase in conversion rate

Compliant conversations. On all channels

Offer clients secure and convenient access to advice that mimics how they interact in their daily lives – while also adhering to messaging compliance regulations. Whether through user-friendly native channels or platform integrations (including WhatsApp, SMS, or more), Unblu gives clients the experience they deserve.

Accelerate AUM growth

Grow your base, modernize your relationships, and expand your reach with stronger client experiences. Unblu’s digital technology can be used ad-hoc or through scheduled meetings for key client conversations. Beyond offering dedicated spaces for focused client interactions, all communications are available behind secure areas (i.e. apps, portals, messenger). Embrace the power of conversation to accelerate AUM growth.

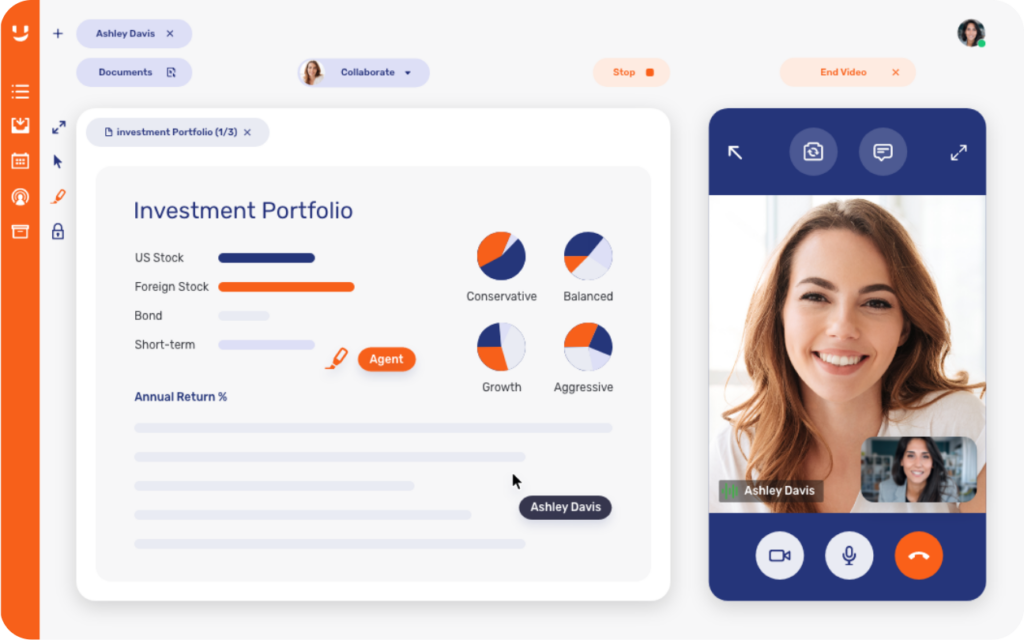

Build trust through experience

Lift and enhance financial advisors’ skills and expertise. Unblu’s Conversational AI can quickly comprehend client inquiries and provide financial advisors with accurate recommendations – or integrate with existing platforms to leverage the full potential of client data. Deliver a consistent and personalized digital channel experience that increases client satisfaction and drives loyalty.

Discover Unblu’s Conversational Solutions

The most complete suite of conversational engagement products for the financial industry

Hot off the press

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice