Drive engagement with a next-level member experience

Credit Unions succeed on the strength of their membership – they deserve the best service experience possible

Request a demo

Immediate impact

Unblu empowers Credit Unions to provide optimal service to their members and boost efficiency

Bot resolution rate

Member support costs

AHT for phone calls

Digital sales conversion rate

Better engagement among valued members

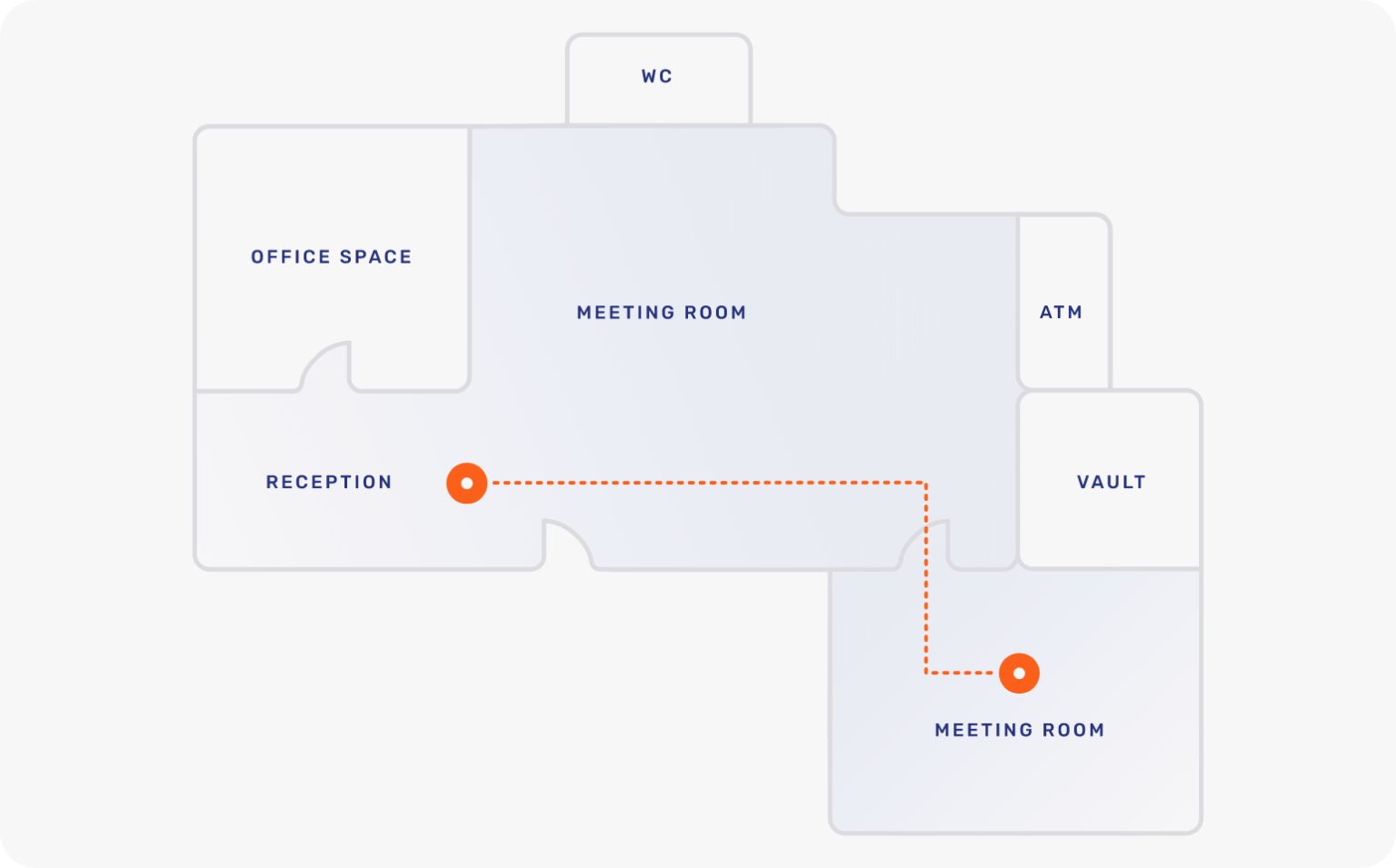

Guide members with digital experiences that feel in-branch. Delight from day one with frictionless onboarding processes and seamlessly progress to personalized, high-touch experiences that drive long-term loyalty. Whether Co-Browsing to provide remote visual assistance in real time or Secure Messenger for ongoing asynchronous support, boost engagement through quality interaction

An efficient, cost-saving solution

Increase agent efficiency and boost employee satisfaction with new digital channels. Unblu Conversational AI provides members with 24/7 support access to get answers or perform transactions. Beyond freeing agents up for high-impact conversations, the Bot Assistant equips agents with accurate and personalized recommendations to increase first contact resolution rates and reduce handling times.

Maximum revenue through additional purchases

Happy members make more purchases. Attract and retain members of all demographics with digital channels that ensure personalized service excellence. With Conversational AI, agents can better qualify leads to prioritize engagement on high purchase intent pages or capitalize on promising Live Chat conversations. Alongside offering proactive support for account options and online banking, this empowers agents to identify tailored products and services for specific individuals.

Discover Unblu’s Conversational Solutions

The most complete suite of conversational engagement products for the financial industry

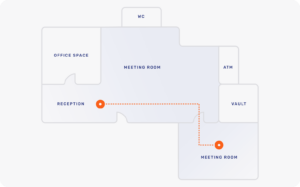

Reinventing and expanding branches with a hybrid concept

Fewer branches since 2017 (McKinsey)

Plan to visit one less often

Still claim a local branch is “extremely or very important” (EY)

-85%

branch operating costs

revenue growth through branch expansion

Increasing service hours (10h per day)

Hot off the press

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice