How clients interact with their wealth advisors has entirely transformed and firms that don’t evolve will find it difficult to meet expectations.

Many are choosing to automate repetitive parts of the process, such as streamlining aspects of the client onboarding experience and data entry. These are steps in the right direction that will free up advisors to spend more time providing personalized, high-touch interactions. However, it doesn’t go far enough to emulate the relationship-building potential that was originally present in traditional, in-person meetings.

Recent trends reveal that clients want to interact almost exclusively or at least predominantly via digital channels. Not only do they want all the perks of in-person experiences, but they also expect to be able to contact their advisors at a moment’s notice and receive varying levels of interaction depending on the situation.

In this context, the only way to deliver on the experiences that clients now expect is by providing a fully streamlined omnichannel service. Whether the client wants to communicate by asynchronous text to validate an idea or have their advisor walk them through the ins and outs of complex investment opportunities, advisors need to be available. But beyond merely being there to offer prompt replies, they need to do so while remaining compliant, secure, and with the necessary tools to collaborate on even the most complex issues.

With clients less willing to arrange in-person meetings, the onus is on wealth management firms to provide a superior service online that delivers on expectations from beginning to end and across multiple channels.

How Unblu’s conversational engagement platform can instantly transform client relationships

Unblu’s platform facilitates this new reality by offering engagement and collaboration tools that emulate and enhance what’s possible in an in-person context. With all conversations taking place and recorded in a secure environment, advisors can communicate on the channels that clients prefer while adhering to regulatory requirements regarding the storage of information. Furthermore, by providing such a collaborative, high-touch experience online, advisors can reduce travel expenses and better control the cost-income ratio.

Unblu’s conversational platform can better service your clients and your firm in several key ways.

1. Client convenience without compromising compliance

The personalized, in-the-moment nature of modern client-advisor interactions mean that advisors often resort to the channels that clients most feel comfortable with, whether WhatsApp, Facebook Messenger, or similar. However, interacting on these channels on personal devices without properly storing the messages means many firms can fall afoul of regulatory requirements.

Beyond facilitating compliance by recording all interactions, Unblu’s Secure Messenger exceeds the experience of WhatsApp or similar asynchronous messaging apps. While providing a user-friendly interface that clients expect, the channel also facilitates easy escalation to secure voice or video calls or sharing documents that can be browsed together.

What’s more, all conversations that take place on Secure Messenger can automatically be stored on the client portal, meaning the client can pick up where they left off no matter what device they’re on.

Case in point: A secure foundation for improved digital service success

A Belgium-based private bank made the decision to limit face-to-face meetings in an effort to remain competitive. To ensure ongoing service quality and compensate for a high customer-agent ratio, the bank invested in a strong online presence.

Solution: Encrypted, compliant experience-enhancing tools

By integrating Unblu’s platform, the bank was able to identify issues more quickly and with less friction for customers. The Unblu solution also empowers advisors to provide better assistance and increase conversions through the e-banking website.

For all of this to take place, it was essential that client trust was maintained at all times by adhering to regulatory standards and protecting the clients’ data and information.

Putting the secure in Secure Messenger

Secure Messenger allows you to leverage your existing digital channels, such as e-banking applications on mobile and web, while ensuring compliance. All information shared is treated appropriately, including full customer history, call recording, collaboration recording, archiving video sessions, and video archives.

The records of conversations are stored as MP4 files for up to a year in a secure database, and are available for authorized users only. They can also be exported into your own infrastructure, resulting in a superior customer experience with high security and privacy.

Safe transfer from video call to Co-Browsing

This can either take place in an already-encrypted channel or by using a one-time PIN code that the advisor passes to the client. In this way, all parties are entirely sure that they are speaking in a closed environment.

Results: An improved experience built on trust

Not only did the bank manage to reduce the number of face-to-face meetings, but they did it while increasing client satisfaction.

Most notably, clients actively trust the bank with their data security at all times during the interactions. When talking about Co-Browsing specifically, the Unblu customer remarked that “clients sometimes ask us if we could take control of their computer to help them out even further. They all appreciate it.”

2. Build trust with your clients

Unblu allows advisors to build trust by always being available in their client’s pocket for meaningful interactions, whenever they have any questions, doubts, or need advice. With a range of channel options at their disposal, from texting to video calls and beyond, clients know that they can gain access to the information they need, when they need it.

Whether avoiding frustrating self-service experiences, providing instant responses, or gracefully escalating conversations to better address the issue at hand, the client has access to excellent support at all times. The quality and ease of this experience, along with its ability to facilitate more productive, personalized interactions, drastically increases satisfaction, trust, and loyalty among existing clients.

Case in point: How a Spanish bank improved their service channels to boost client satisfaction

A private bank based in Spain wanted to grow their client base, modernize their relationship with clients, and expand their reach. Achieving this involved maximizing their digital presence and delivering a more personalized service.

Solution: Enhanced texting capabilities for convenient interactions

The bank had a strong digital foundation, with a developed web and mobile e-banking presence as well as CRM and analytics capabilities. By integrating Unblu into their tech stack, they were able to build on this foundation and harness their insights to better relate to their clients.

This included deploying both Live Chat integrations and asynchronous Secure Messenger.

Live Chat for convenient, instant responses

Secure Messenger to mimic the convenience popular messaging apps

It allows clients to contact the advisors on the channels that are most convenient for them, whether that’s WhatsApp, Facebook Messenger, or other popular messaging applications. What’s more, during any interactions, the conversation can be easily escalated to a video and voice call or collaborative Co-Browsing in an intuitive manner.

And it works both ways. If an advisor finds an investment opportunity, they can easily share it with their client, who can view the document on their mobile app or on a computer via the client portal at the time of their choosing. For advisors, Secure Messenger offers a powerful productivity tool, helping boost efficiency while providing a secure space to have more engaging interactions with clients.

Result: Increased all-round satisfaction

As a result of using Unblu, the bank found that clients, prospects, and advisors reported higher levels of satisfaction. They are able to use this feedback to continue improving their service quality and are in the process of deploying Unblu in their online and mobile banking platforms.

3. Accelerate AUM growth

By making it easier for clients and advisors to keep in contact, Unblu helps foster a close, reassuring relationship built on trust. This allows advisors to naturally suggest additional products and services that are fully tailored to each individual’s needs. Given the strong relationship, clients appreciate their advisor’s advice and are more likely to receive the suggestions positively. Over time, this will have a direct impact in increasing a firm’s AUM.

As advisor-client relationships involve extensive back and forth, high-value clients can often require a substantial time commitment. When all relationships are taken into account, this can be a source of strain on the advisor who has to juggle multiple, authentic interactions. Unblu helps mitigate this problem by drastically increasing the efficiency of a firm’s staff. With less time necessary chasing up on information or admin-related tasks, advisors can devote their attention fully to each client.

Finally, as wealth passes from one generation to the next, the expectations of the new clients may not correspond with their parents’, grandparents’, or other benefactors. With Unblu, the digital experiences that clients now expect are built into the relationship, boosting the chances of the new generation continuing with the same firm after inheritance.

Case in point: Large investment bank boosts conversion rate with Unblu

A large European investment bank with a sizable UHNW client base wanted to adapt to changing demands and enhance their client experience. Digital channels were identified as the main focus area to ensure clients could gain access to seamless, engaging advice on their preferred channel.

Solution: Co-Browsing for high-touch interactions

In a wealth management context, the quality of interactions is paramount. Many seasoned advisors, who work with some of the wealthiest clients globally, value the personal experience of face-to-face interactions. For this project to work, Unblu needed to match or enhance the quality of real, in-person conversations.

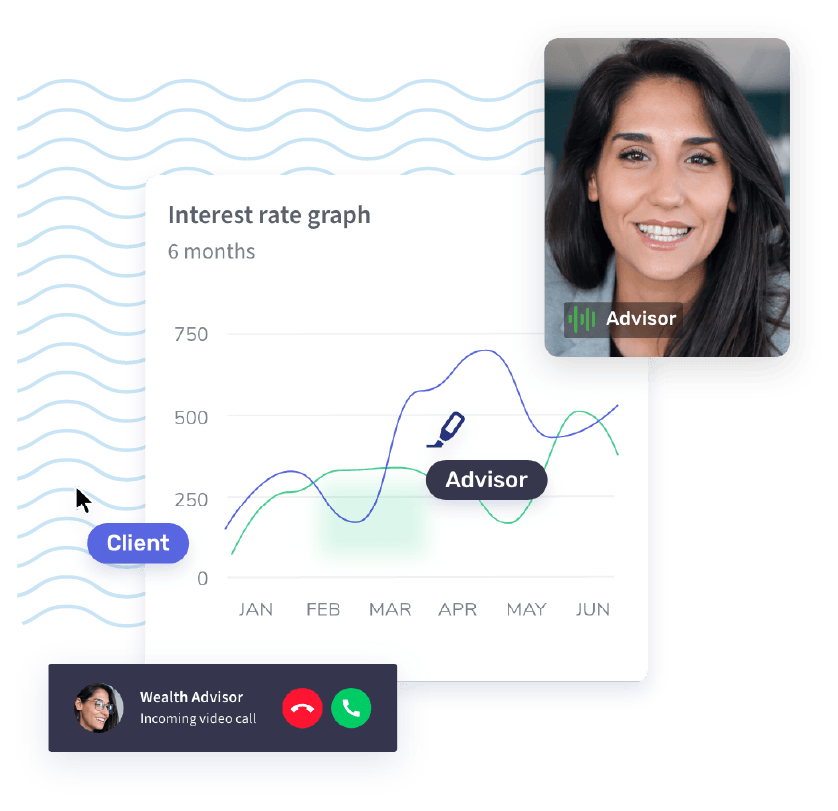

Enhanced collaboration with Co-Browsing

Co-Browsing goes beyond standard screen sharing, allowing both individuals to interact with a particular document or browse the web in an entirely secure and compliant manner. In this way, any questions, doubts, signatures, or supplementary research can be dealt with in the moment.

Result: Increased efficiency and satisfaction boosts bottom line

By incorporating Co-Browsing into the service experience, advisors were able to boost the number of meetings by 20-30% and achieve a client satisfaction rate of 90-95%. This had a direct impact on the bank’s bottom line, resulting in a 15-20% increase in the conversion rate.

- 20-30% increase in meetings

- 90-95% client satisfaction rate

- 15-20% increase in conversion rate

All-round satisfaction: Increased comfort for the advisor

By bringing all elements together – enhancing the conversation with visuals, sharing researching documents and being able to see each other – the quality that clients experience increases exponentially.

However, it also makes the advisor’s role much more comfortable. While voice and video conferencing are great for addressing complex questions, it’s more difficult to actually convert clients using this software alone. Having access to the channels clients use as well as high-touch collaboration tools empowers the advisor to offer advice as and when it arises – and makes them more likely to convert.

There’s no doubt that specific client interactions take time in a wealth management context. While Unblu’s tools encourage efficiency, they also free up the advisors so they can dedicate more time to their clients.

Unblu also offers its own chatbot technology or the ability to integrate with your current AI solution. While chatbots are only capable of playing a limited role, they do offer clients the ability to take care of simple queries (avoiding time-consuming interactions) or escalate as necessary. What’s more, with advisor input and insights gained from Live Chat and Secure Messenger conversations, this technology can be constantly updated and improved to better serve your client needs.

Want to find out more about Unblu?

Unblu is a leading conversational platform that’s fine-tuned for the financial services industry. Centered around three pillars – texting, video & voice, and collaboration – we help retail banks, wealth management firms, and insurance companies to provide faster, more secure customer service experiences.

Founded in 2008 in Basel, Switzerland, Unblu has been part of the Swiss Post Group since 2022, with subsidiaries in Germany, Bulgaria, UK, USA, and Canada. Over the years, we’ve served 160+ banks and insurance companies, empowering them to lower costs, secure more meetings, and increase conversions.

With seamless integration capabilities and a 90-95% client satisfaction rate, Unblu enables the ultimate in-person experience for online customer collaboration and advisory. Any time. Anywhere. And on any device.

Visit www.unblu.com to find out more.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice