Broaden your service offering – at any location

Our interactive, on-site solution is cost-effective, profitable, and provides customers with a broader service offering at any location.

Warm digital experience

It’s the same in-person experience, but in a more affordable way. Provide the best of all worlds for easier customer acquisition, retention, and upselling.

Holistic customer experience

Unblu Branch guarantees a holistic customer experience with the highest quality of advice, reduced waiting times, and with intuitive, low-threshold access.

Remote. But in control.

Manage the branch with the touch of a button. Remotely control touchpads, printers, ID verification, safe deposit boxes (and more) to continue the conversation flow unfazed by logistical issues.

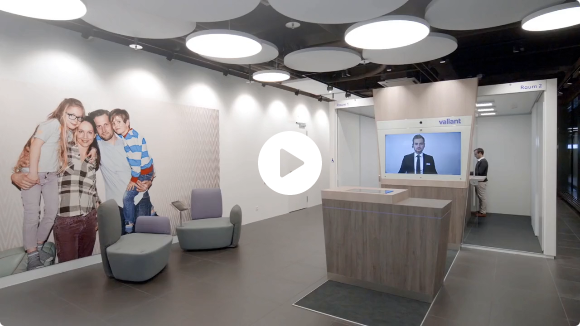

Transforming the branch experience with Valiant Bank

Faced with dwindling footfall, Valiant either had to close branches or transform their strategy. Discover how Unblu Branch helped Valiant to revitalize and expand their branch network.

Branch setup costs reduction

Reduced from CHF 3M–4M to CHF 500K–900K

CHF 0M

CHF 1M

CHF 2M

CHF 3M

CHF 4M

Revenue from expansion

in new regions

Longer opening hours

per branch

per day

-

“We saw a very smooth transfer of in-branch tasks to our digital service and the new design is better accepted by clients because digital components have been added.”

-

“The planning, preparation, and implementation of the pilot operation was very speedy and uncomplicated, which is why the pilot launch took place after just a few weeks. The wishes of Raiffeisen were integrated and implemented very quickly.”

Optimize physical branches

Ensure the same in-person experience in a more affordable, cost-effective way

Centralized and flexible

Maintain centralized control of the branch infrastructure, regardless of branch type or size. Open only when needed with up to 50% fewer staff and smaller consultation areas – without sacrificing your consistently high service experience.

Video identification and verification

The advisor can swiftly and securely confirm the customer’s identity from a remote location without interrupting the conversation’s flow.

Fully secure. Fully compliant.

Data protection guaranteed thanks to our GDPR-rules engine.

Either deploy on-premise or enjoy secure delivery from an EU Cloud provider.

Fully secure. Fully compliant.

Data protection guaranteed on-premise and in our Financial Cloud (ISO 72001 and SOC 2 Type 2)

Fast, targeted project implementation

Together with Raiffeisen Switzerland, the new Unblu Branch solution was put into operation within a few weeks.

Use cases and case studies

Ensure the same in-person experience in a more affordable, cost-effective way

See in action

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice