Unblu Spark 8 has been released, marking a new chapter in the digital engagement platform’s potential to foster authentic interactions.

In general terms, the updates enhance agent and advisor productivity, while also empowering them to navigate relationships on a centralized platform. We’ve done this by building a customer-centric view that improves agents’ and advisors’ ability to manage customer segments and contact information, initiating conversations to spark impactful interactions.

However, this doesn’t come at the expense of the customer experience. In fact, we have also made substantial progress on that front by improving access to quick support and meaningful advice.

This has been achieved by expanding the natively supported channels to include SMS and WhatsApp, making the call experience even more intuitive, and introducing major enhancements to Document Collaboration along with native digital signature solutions.

Don’t miss our upcoming webinar where our experts will provide live demonstrations of Unblu Spark 8’s capabilities. Join us to explore firsthand how Unblu Spark 8 can elevate your customer interactions.

Interaction Management Hub: Building a customer-centric view

Behind-the-scenes processes have a knock-on effect on the overall experience, influencing agent and advisor productivity, customer satisfaction, value-generation opportunities, and more. The agent and advisor experience with our new Interaction Management Hub has been designed to enhance these areas.

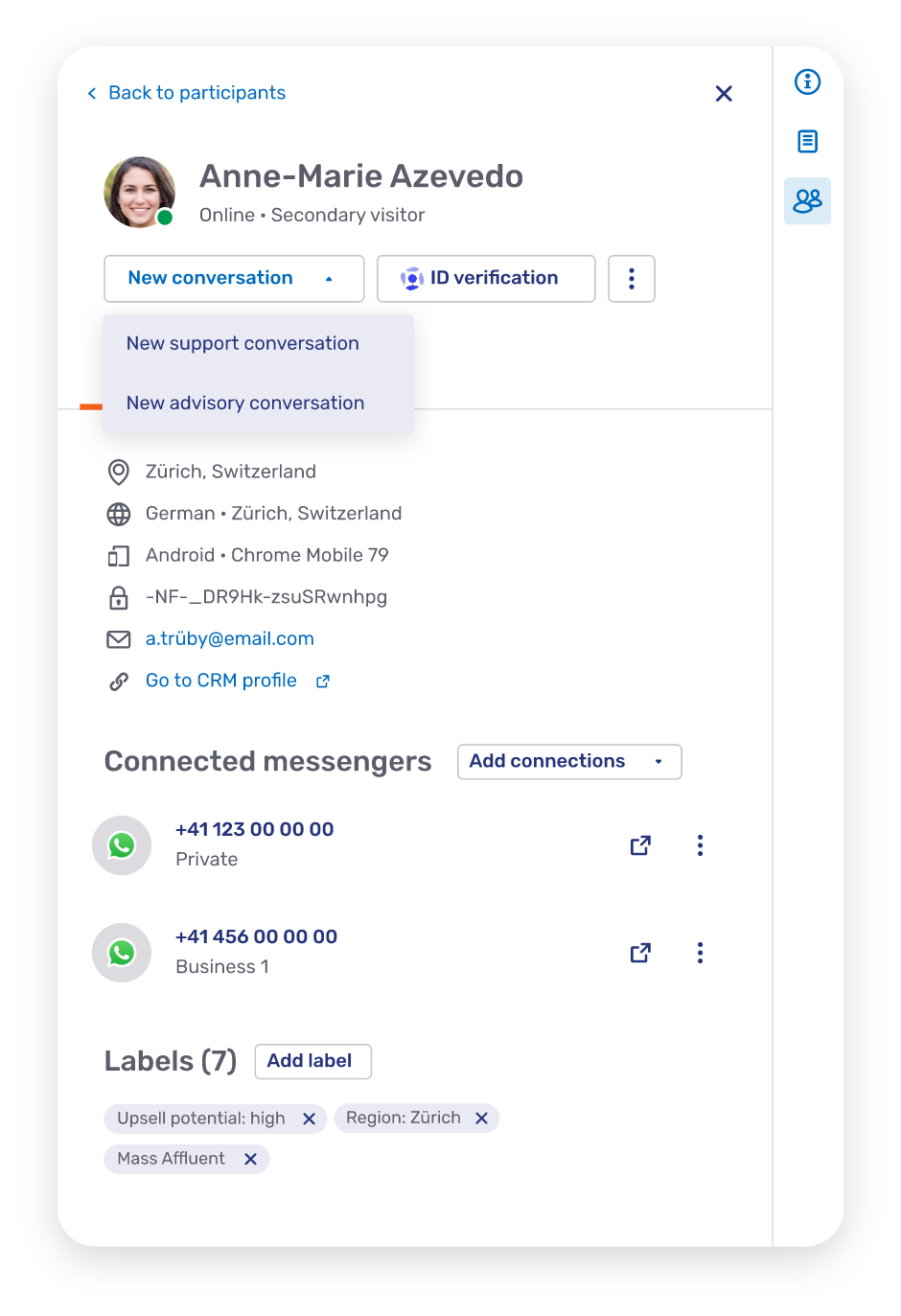

Managing customer profiles

Agents and advisors also have the option to connect, remove and re-link external messenger contacts. This allows them to add WhatsApp, SMS, or similar alternative contact details to either existing or new customers.

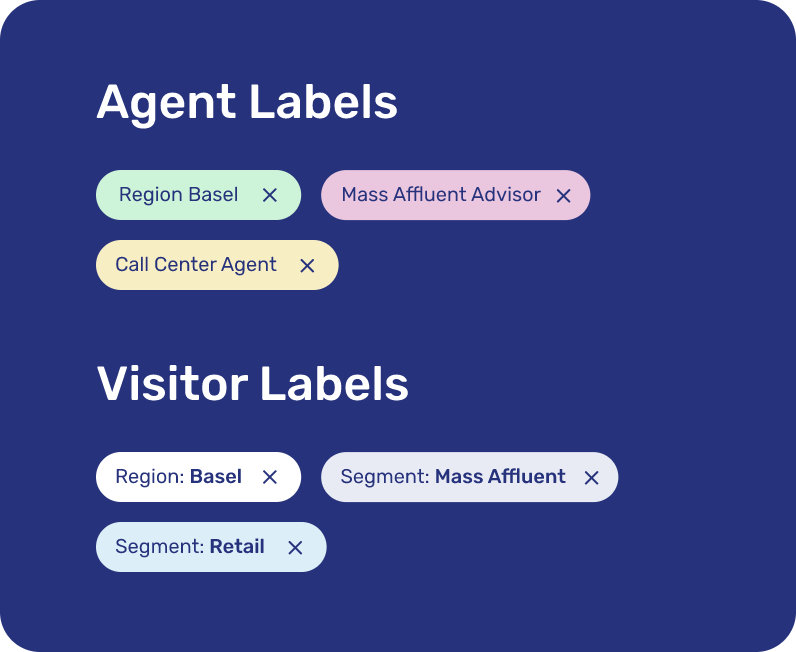

The role of labels

The most versatile feature when managing profiles is labeling for segmenting customers. This has broad applications, which we will explore later, including personalized messaging capabilities and conversation access permissions.

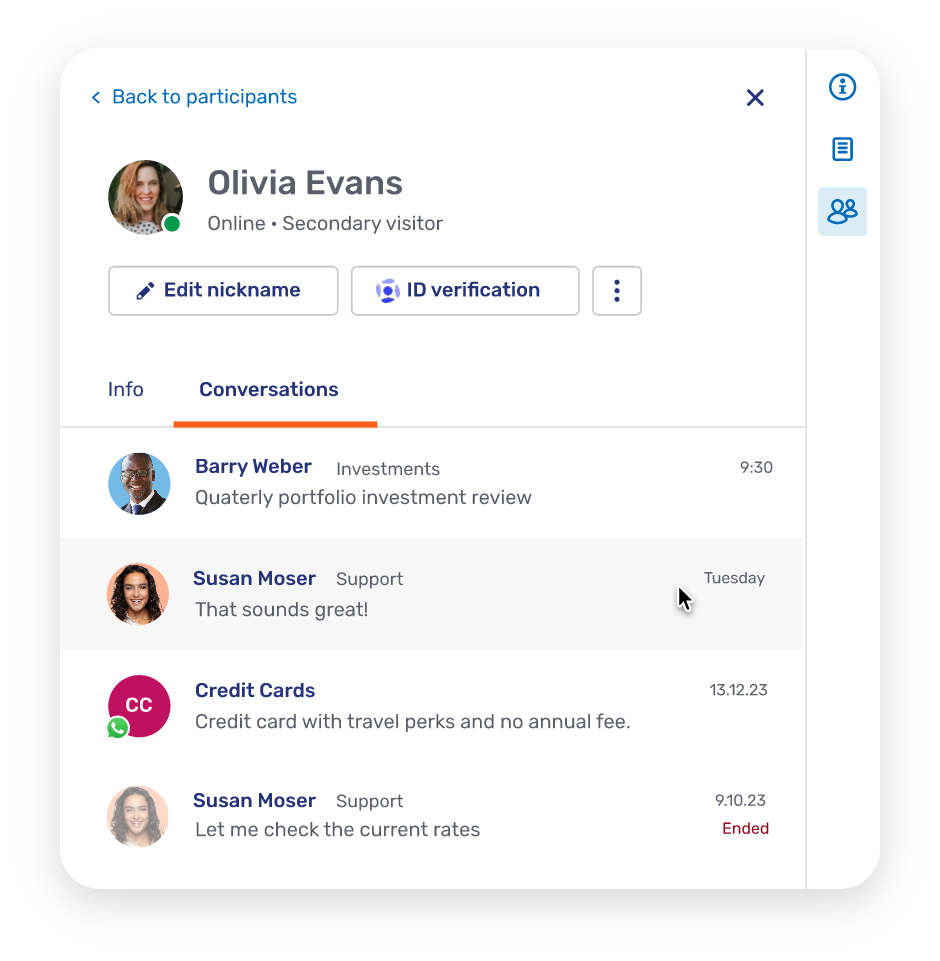

Previous interaction easy-view

For the customer, the experience is similar to a popular messaging app, but for the agent or advisor, it offers a more complete view of the context and history of each customer. Not only can agents and advisors create several threads with the customer, but all previous interactions are visible to those with access to ensure a consistent experience.

Integration-friendly setup

While customer profiles can be created and updated manually by the agent or advisor directly within Unblu, it is also possible to automate the process via integration with an ebanking solution or CRM system. In this way, the agents and advisors can easily find the customer via a search in Unblu.

Web API Version 4

Unblu Spark 8 features enhanced integration capabilities with Web API Version 4. That said, any current integrations with Version 3 will still be compatible to guarantee a smooth transition to Spark 8 for current Unblu customers.

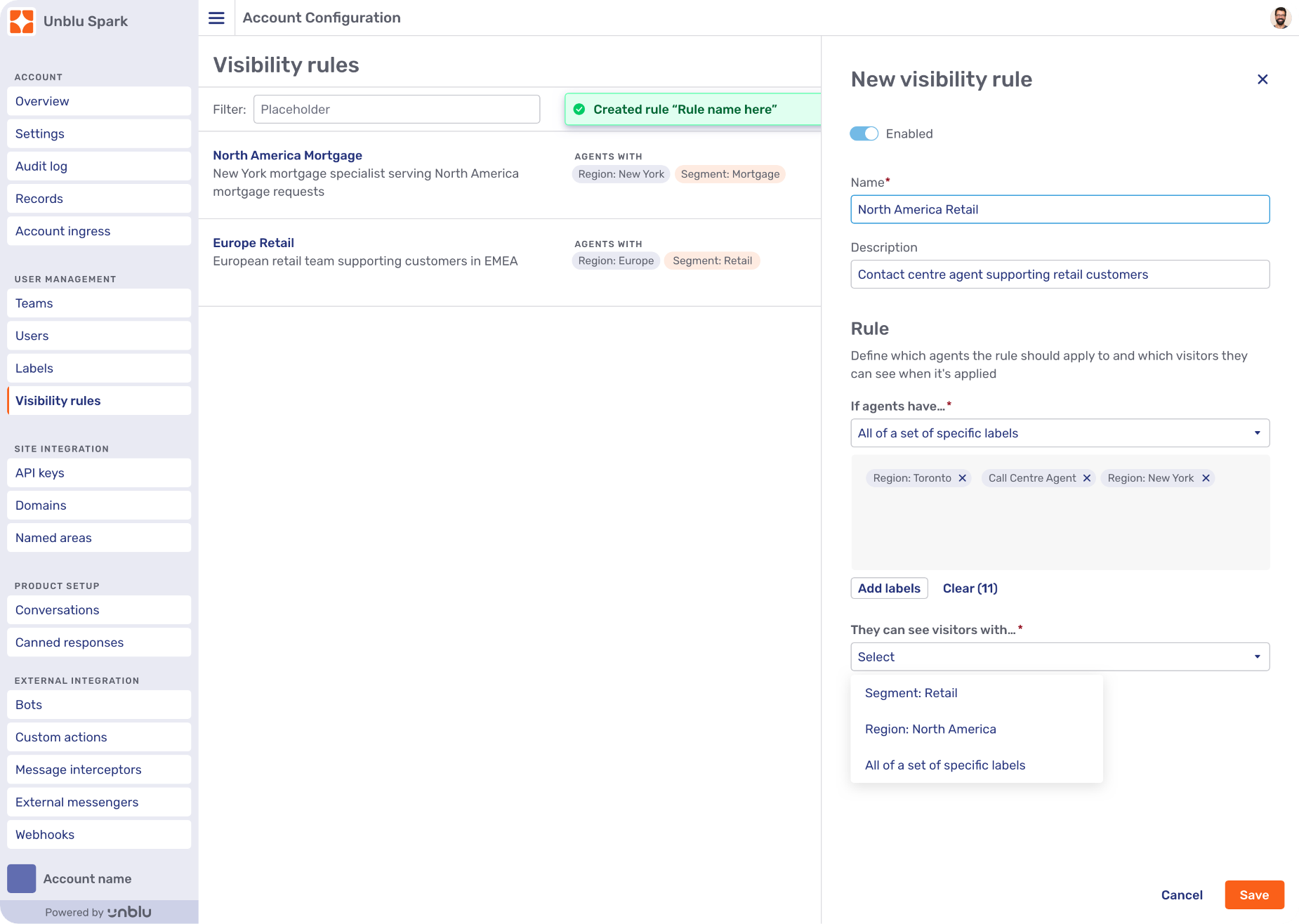

Ensuring flexible access management

Protecting customer information requires both robust security measures and following internal best practices. Not all agents or advisors who have access to Unblu need access to all conversations. We have developed a couple of ways to ensure that it is easier to organize and control access to customer conversations.

Improved organization capabilities

The label feature, which we mentioned above, can be used to segment customers – but it can also be leveraged to segment agents or advisors, and other team members.

With this functionality, we can set visibility rules in Unblu to define which customers are visible to which teams of agents or advisors. For example, agents or advisors who are labeled with the region “North America” can only view customers with the same label and access previous conversations.

Agent and advisor access control

There are also more direct features for controlling access, allowing organizations to define which type of conversations are visible to which teams of agents and advisors. For example, in a wealth context, conversations between a client and a relationship manager could contain private information that cannot be shared with the staff in the support team.

Take initiative with outbound messaging & broadcasting

Customers and clients increasingly expect proactive support from agents or advisors. This is particularly true in an advisory context, where advisors need robust messaging capabilities to initiate individual conversations or broadcast to multiple people in one go.

Outbound messages

The first new capability is the outbound messaging feature, which allows agents or advisors to search for an existing customer or create a new customer profile. They can then use this profile to begin an interaction. This is especially helpful when it comes to onboarding new customers or completing call-back requests.

Break-out conversations

Agents and advisors can decide to begin a separate conversation from within an existing one with the “new conversation” button. With this, the agent or advisor can explore a separate topic while remaining organized, particularly one that could benefit from outside advice. This feature can also be used much as emails are, but in a more secure, convenient, and accessible manner.

The native SMS and WhatsApp connector

By consolidating multiple channels into one platform, we make it easier for agents or advisors to improve the interaction experience.

With the standard connector, agents or advisors can initiate outbound messages or broadcast via WhatsApp or SMS. What’s more, customers can begin conversations through these channels and requests can be consolidated into the same queue along with regular Unblu chat requests.

It’s worth noting that the Unblu Conversational Bot is available on these channels, meaning your customers can get access to 24/7 support through SMS and WhatsApp. All of this is available via an out-of-the-box functionality with minimal implementation effort on the organization’s part. That said, the same features can be made available with a custom connector where necessary.

Broadcasting to many

With the labeling feature, we can group customers into segments, such as “Pre-qualified for line of credit” or a “Premium Account holder”. This can then be used alongside the broadcasting capabilities to send new product or service updates to customers that may be interested.

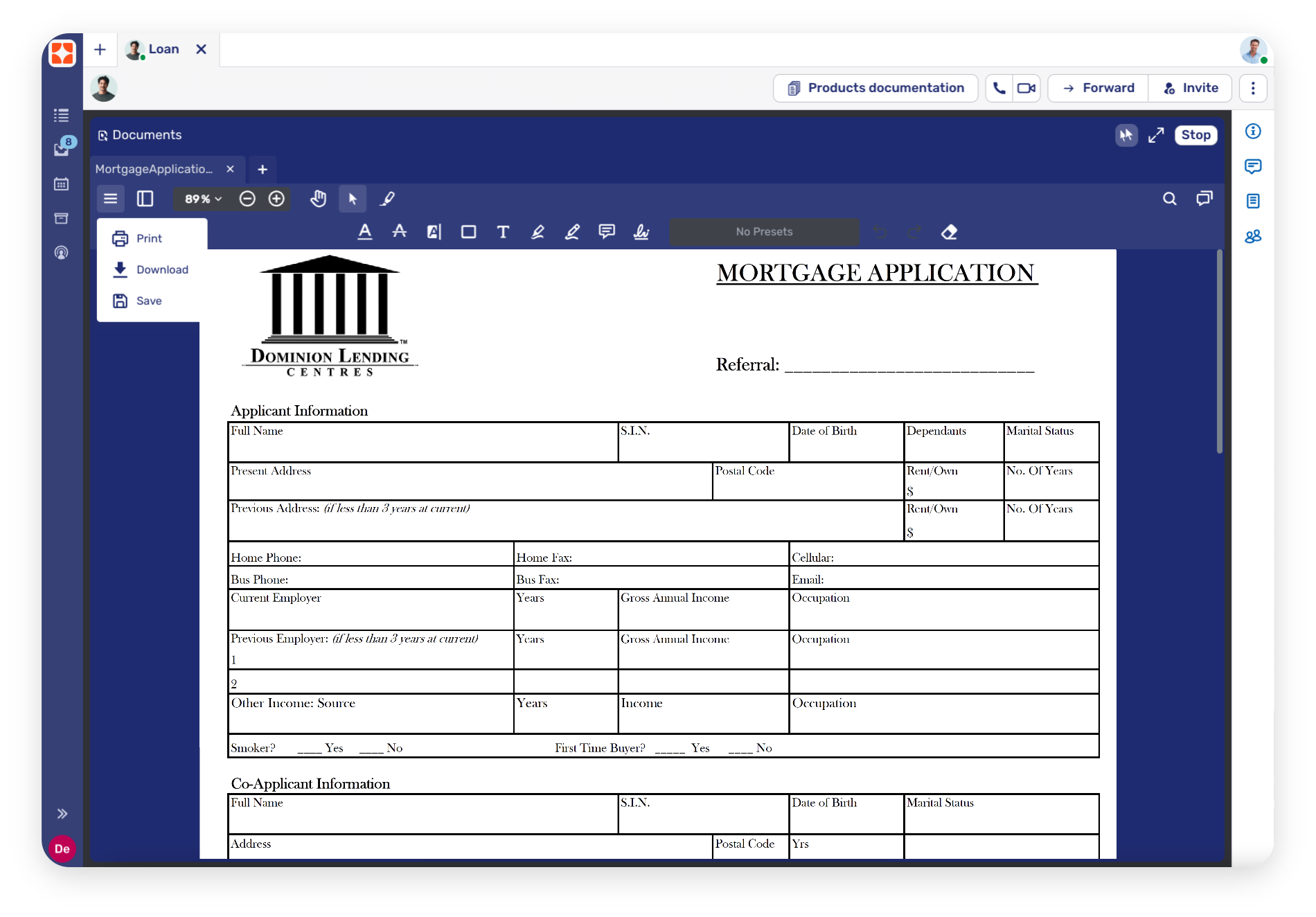

Enhanced document collaboration

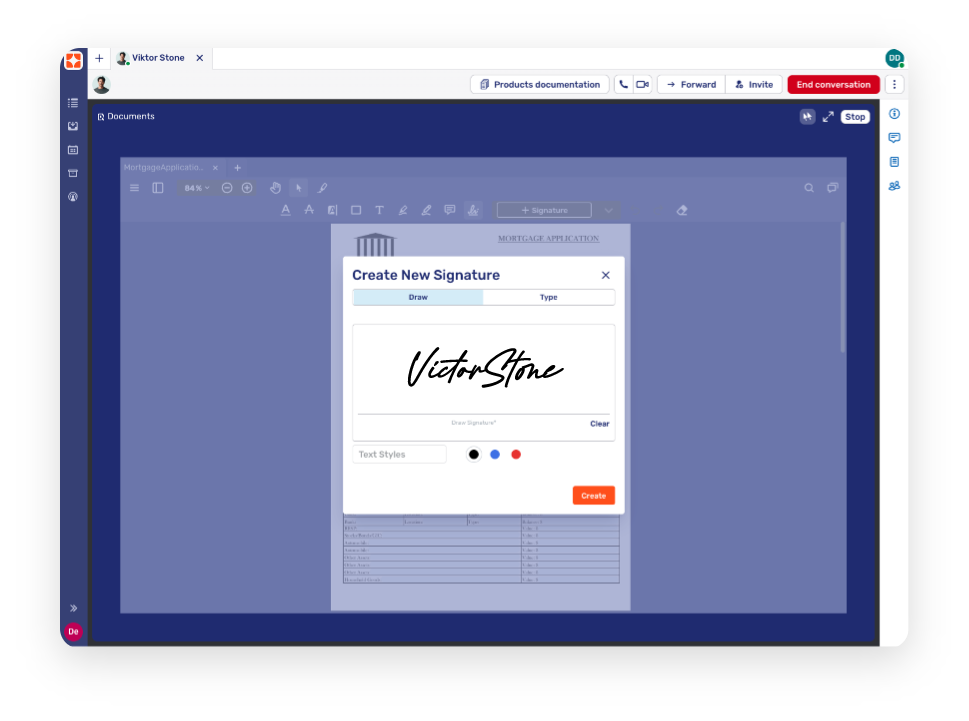

With Unblu Spark 8, we have improved our document collaboration capabilities, including an out-of-the-box signature tool without leaving the page.

Document Collaboration

With this major enhancement to Document Collaboration, agents and customers (or advisors and clients) have access to advanced collaborative tools such as temporary and permanent highlighting, and drawing or marking. They can also add texts and comments, with the ability to then save the updated documents into the conversation or download a local copy.

Unlike in previous versions of Unblu, these features are now available for all common document types (such as Microsoft Office documents) in addition to PDF files.

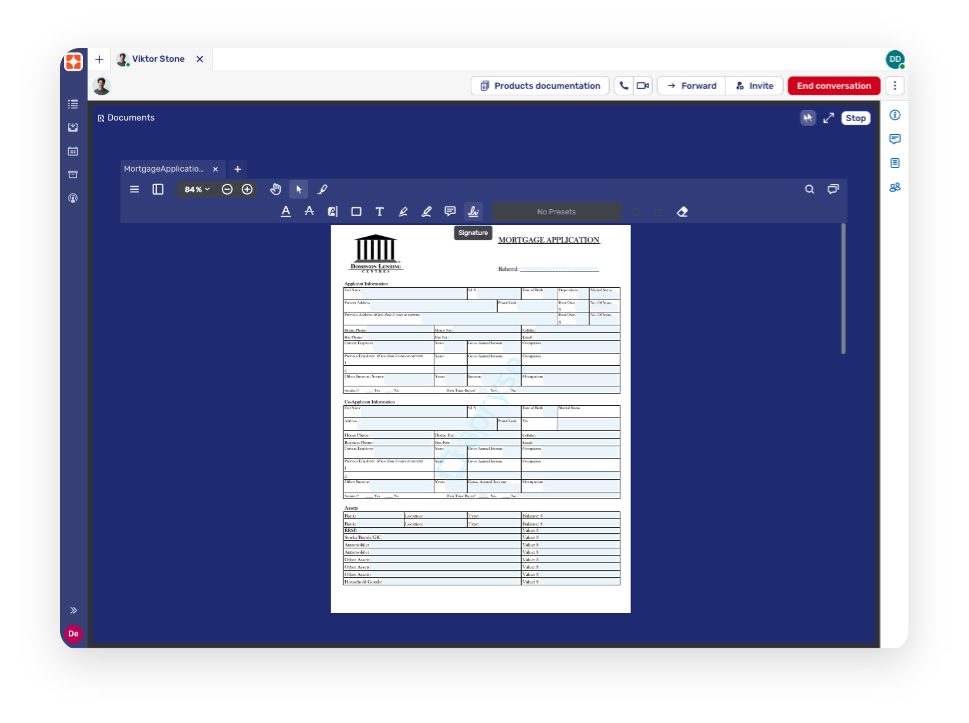

Built-in signature workflow

Our built-in digital signature, users can create signatures and apply them to documents during a Document Collaboration session.

For customers who have logged into the banking platform, when single sign-on is in place, we automatically retain shared data such as timestamps for improved signature authenticity.

Advisor and agent user experience

Unblu Spark 8 has a number of improvements with the user interface for conversations and calls.

Conversation UI improvement

The Conversation UI for agents and advisors has been redesigned to better serve user needs. This includes a new action bar, a context bar (and panels), and an improved participant view. There are also better admission flows and displays for mobile devices to ensure the conversation can take place without distractions.

Call UI enhancements

The Video & Voice function also has an improved interface on the agent or advisor side. The collaboration space has been completely revamped with a new view that merges with the call in progress. We have also added features such as improved pinning, background image replacement, and support for different layouts.

The final enhancement is the addition of Picture in Picture (PiP), which ensures that agents or advisors can always see the caller even when they navigate away from the main screen. For example, if they launch the screen sharing capabilities, the video call – including all call controls – will remain as a small, moveable window for easy access at all times.

If you would like to see how Unblu Spark 8 can be leveraged in your specific organization, our team offers personalized demos. You can request a demo by visiting our website and filling out a short form. Our team will get back to you as soon as possible to organize a time that suits you.

Want to experience

Unblu Spark 8 firsthand?

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice