Leveraging Unblu to increase product conversion

Raiffeisenbank’s collaboration with Unblu demonstrates how strong customer service can empower banks to increase their product conversion rate.

Learn more

Outstanding client service

For the past two years, Swiss Post has been working with Unblu to deploy a new means of client engagement and support: chatbot, live chat and WhatsApp.

Learn more

Ensuring a smooth digital migration

Crédit Agricole next bank (Suisse) identified and anticipated potential areas of friction in their customer journey when planning to migrate to a new e-banking environment.

Learn more

Leveraging Live Chat and Co-Browsing to increase and improve client interactions

Banca Dello Stato’s collaboration with Unblu demonstrates how text channels can divert phone calls to more efficient channels while increasing client satisfaction.

Learn more

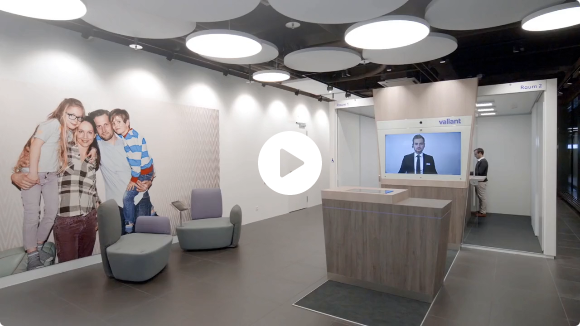

Transforming the branch experience with Valiant Bank

Faced with dwindling footfall, Valiant either had to close branches or transform their strategy. Discover how Unblu Branch helped Valiant to revitalize and expand their branch network.

Learn more

Branch setup costs reduction

Reduced from USD 3M–4M to USD 500K–900K

USD 0M

USD 1M

USD 2M

USD 3M

USD 4M

Revenue from expansion

in new regions

Longer opening hours

per branch per day

FINTECH

Creating robust digital channels for an efficient, white glove service

As a technology provider specializing in a complex subject matter, Carta needed a mix of robust self-service tools and high-touch collaboration capabilities to ensure customer satisfaction.

Read Case Study

“We’ve found that investing a bit more handle time on a single interaction can pay significant dividends in customer happiness and long-term team-level productivity.”

UNIVERSAL BANKING

Next Gen Mobile Video Banking Service goes live in Qatar

Qatar Islamic Bank has deployed Unblu mobile collaboration capabilities to support their clients around the globe. With Unblu’ Video & Voice, Chat and Mobile Co-browsing capabilities added to QIB mobile App, clients will be able to benefit from a Video Banking service. Currently available when a customer applies for instant finance, it will be rolled out to cover other products and services in the future.

Read press release

“Video Banking is another market-first for QIB, which merges the online and offline world, taking our digital customer experience to a new level. Digital innovation and customer-centricity are core components of our business strategy and mission to revolutionize the banking scene in Qatar and beyond”

UNIVERSAL BANKING

Co-browsing for better live consultation in Digital Banking

UBS has deployed Unblu’s collaboration capabilities for advising and supporting customers on their Digital Banking platform. The new service is available to all UBS clients using UBS Digital Banking.

Read press release

“Sometimes customers have questions they are not quite sure how to formulate. This is why we offer co-browsing”

CREDIT UNIONS

Enabling Member-Centric Digital Banking Experiences for Credit Unions

Celero, a leading provider of digital technology and integration solutions to credit unions and financial institutions across Canada, has chosen Unblu’s Conversational Platform to enable their credit union clients to deliver member-centric experiences via digital channels that are as equally engaging as those within the credit union branch. This integration is integral to Celero’s clients’ goals of increasing members’ comfort and engagement with Celero Xpress, which will ultimately drive adoption and use of the platform.

Read press release

Using Unblu’s Conversational Platform, we can provide our clients with a way to support and guide members at every step of their digital journey.

WEALTH MANAGEMENT

Bringing clients closer to their advisors

Thanks to Unblu’s technology, Renta 4 Banco has enabled its managers to engage with customers via chat, secure messaging, video calls along with a number of collaboration tools that allow them to do their work with customers remotely.

Read press release

The bank’s main concern over the last few months has been to protect our investors’ assets, and once this objective has been achieved, we now seek to be closer to our clients. We want to be able to offer them the same quality of service that they are used to, even if the channels we have to use are different.

Book a demo

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice