One thing is for certain – bank branches are changing. As in-person footfall declines and digital or hybrid experiences become the norm, banks are faced with a do-or-die dilemma. That is to say, do you invest in branch transformation or allow your branch network to slowly fade away? Most customers and the banks themselves would

Banks and financial services institutions always need to improve efficiency. The Unblu bot sidekick can help agents find information mid conversation.

Updating or launching a new ebanking app? Help customers to get the most out of it by guiding them with Unblu Co-Apping.

Bank branches offer unique value for customer service during key moments. But they need to transform to remain financially viable.

What’s in store for Credit Unions in 2024? Discover the most important industry developments and where credit union leaders should focus their efforts.

Discover the 8 most important retail banking trends to stand out from the competition and solidify your market share.

Strong customer experiences lead to larger purchases – provided you engage them at the right time.

Digital banking trends are showing a move toward hybrid customer service experiences as banks strive to rebuild the trust that has fallen in recent years.

Apps are an essential aspect of the modern wealth management digital experience. How can you leverage them to provide the best service?

Strong customer service will aid a successful ebanking migration project – and protect a bank’s reputation if something goes wrong.

There are two sides to customer growth: acquisition and retention. How do banks reduce churn to empower growth?

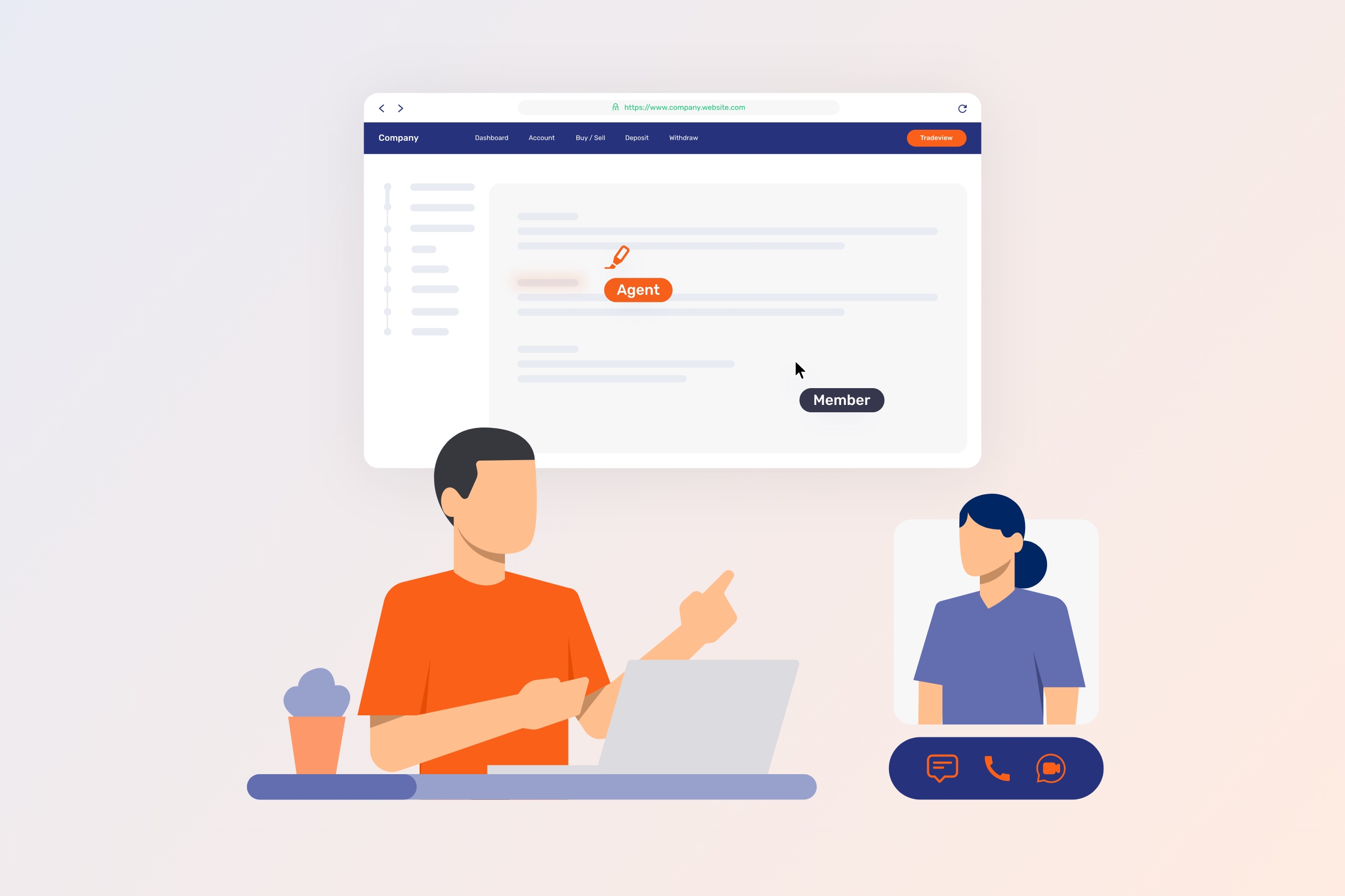

In-person and digital environments are blended. To meet customer expectations, PostNetz have launched in-branch video consultations in eight test branches.

Credit Union service agents need access to high-touch collaboration tools to provide the quality support members deserve.

Digital banking statistics are showing a back and forth between challenges and opportunities

As financial institutions push for digital transformation, CX strategists should keep these 22 customer service statistics in mind.

As growth slows, it’s becoming harder to retain clients. The wealth management firms that succeed are those that can cultivate a strong sense of trust.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice