Customer preference for mobile banking apps is going from strength to strength. In the US, there is proving to be a steady uptake in digital banking usage through to 2025 and a reported 71% prefer to use their bank’s app on a regular basis.

This trend is consistent with what we’re seeing around the world, with 42% of French, 49% of Italian, 58% of Spanish, and 56% of UK adults who have access to the internet using their mobile banking app in the month previous to a Forrester survey.

Creating distance: The challenge of mobile banking

The popularity of mobile banking is no surprise as the benefits it offers the end customer are immense. It allows individuals to gain access to all of their information whenever they want, night or day, empowering them to carry out all types of transactions.

This has many upsides for the banks as well, but there are also a few drawbacks, particularly when it comes to customer engagement. Although the customer frequently interacts with your app, there is an increase in distance when compared to more traditional means. When a customer encounters a difficulty, they are likely to give up unless there is a simple way of accessing support.

Functionality vs user experience

We can see that banks are finding it difficult to strike the right balance in this regard. For example, Forrester claims that European banks still struggle to get a balance between functionality and user experience.

The reason for this is because banks are eager to build greater functionality into their mobile banking experience. And with good reason. Trends are showing for the first time that customers are more open to use mobile banking for complex transactions.

In 2022, Forrester found that 51% of UK adults with access to the internet carried out their research on a smartphone before applying for a loan. Compared to the year before, this is an increase of 17%. What’s more, a total of 34% finished the application using their smartphone, with 14% using the mobile app itself.

But enhanced functionalities cannot come at the expense of the user experience. A 2020 research study found that failure in just one area – whether security, functionality or usability – can have a marked impact on customer satisfaction levels.

Forrester sums up this issue exceptionally well, saying, “Customers won’t be able to unleash the benefits of otherwise powerful features if they first need to overcome navigation issues, struggle with confusing information architecture or unoptimized interactions, or are left figuring out how things work for lack of proper guidance.”

If you have just launched a feature-rich app, this can lead to increased strain on the customer service lines, negative app reviews, or more long-term consequences. In other words, if a bank’s app isn’t up to scratch, people will be less likely to reach out via the app, leading to fewer conversions or higher dropoff as a result.

Getting closer to promote user adoption

To overcome this hurdle, banks need to focus on getting closer to their mobile-centric customers. One key way is to develop a strategy to promote user adoption when launching a new or updated mobile app. The idea is to employ active education as a tactic to increase adoption and make users aware of newer features.

This is an area where banks have often struggled. As a Financial Brand article says, “Financial institutions have optimized their mobile banking apps for routine transactions, but their UX falls short when it comes to handling more complex tasks.”

The fact is, the design team can only do so much – users also need to be shown the options that are available to them.

Co-Apping to facilitate adoption

There are various factors involved in an active customer education campaign, such as training the staff to know when and how to act. For example, the common approach is to tag onto the end of a simple query.

A customer may contact the bank via the app to ask how to perform a simple task, such as a change of address or how to make a transfer. After helping the customer with the query, the agent would then take the proactive step of educating the customer on a separate feature.

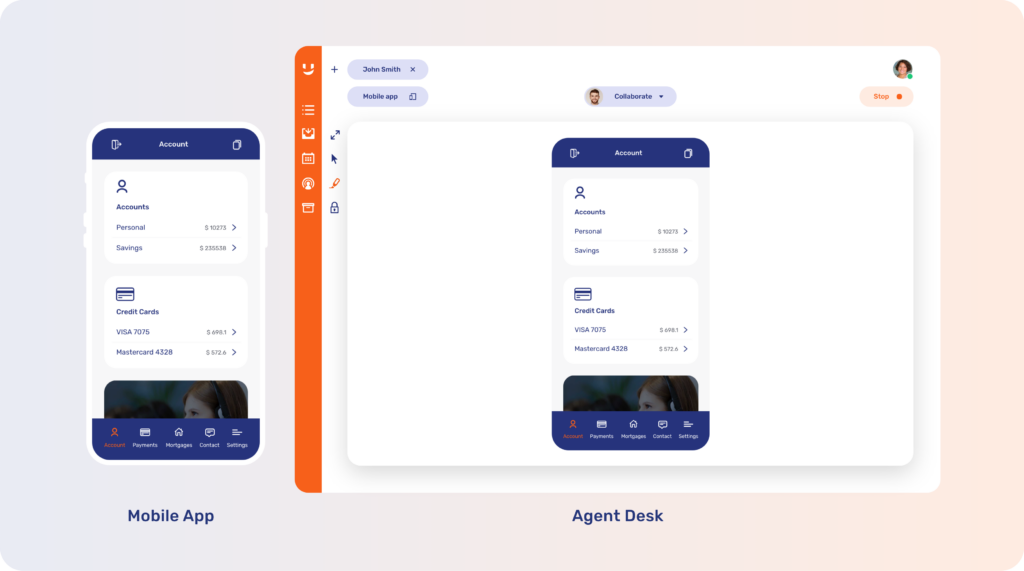

The question is – what’s the most effective way to do this? One approach is by using something called Mobile Co-Browsing, which is also known as Co-Apping.

What is Co-Apping?

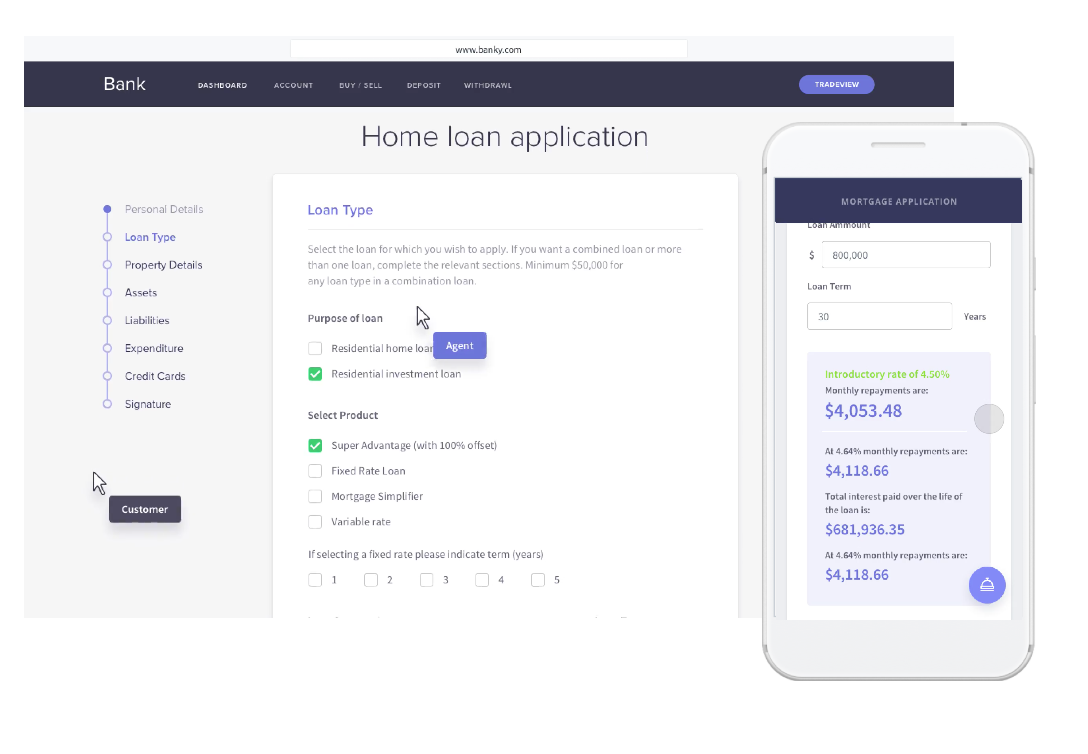

Co-Apping is similar to the concept of Co-Browsing, except instead of collaboration taking place over a document or web browser, it allows the users to interact on a customer’s app. With Co-Apping, agents can show the customers where to go on the app to perform a function, without jeopardizing their security at any point.

Taking a proactive approach in this way can help reduce customer frustration before it becomes an issue. The agents can identify common areas that users have difficulty with, and use these insights to improve user uptake and education when on other calls.

Using Co-Apping as part of an adoption strategy

We can get an example of how Co-Apping could be used by looking at how Swiss-based Crédit Agricole next bank (Suisse) leveraged Embedded Co-Browsing as part of their ebanking migration strategy.

When undergoing an ebanking migration, the team at Crédit Agricole noticed that phone calls were limited in meeting client needs. With the changes, the risk was that the phone lines would become overwhelmed and the agents wouldn’t have a way to properly guide customers through their issues, raising the Average Handle Time even more.

Overcoming this required using Co-Browsing to visually guide the customers in these key moments. For the case of Crédit Agricole, this was used in a desktop ebanking environment, which meant that Embedded Co-Browsing was the logical choice.

However, the exact situation can be transposed to an app context, where the agent would launch an app-based Co-Browsing session (i.e. Co-Apping) to help the customer in the relevant environment.

For Crédit Agricole, this approach paid off – resulting in an 80% improvement in the expected AHT due to the migration. In total, 15% of phone calls used Co-Browsing during key moments and they achieved an average customer satisfaction rating of 4.7/5.

Discover how Co-Apping can bridge the gap between you and your customers to build strong, long-term relationships.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice