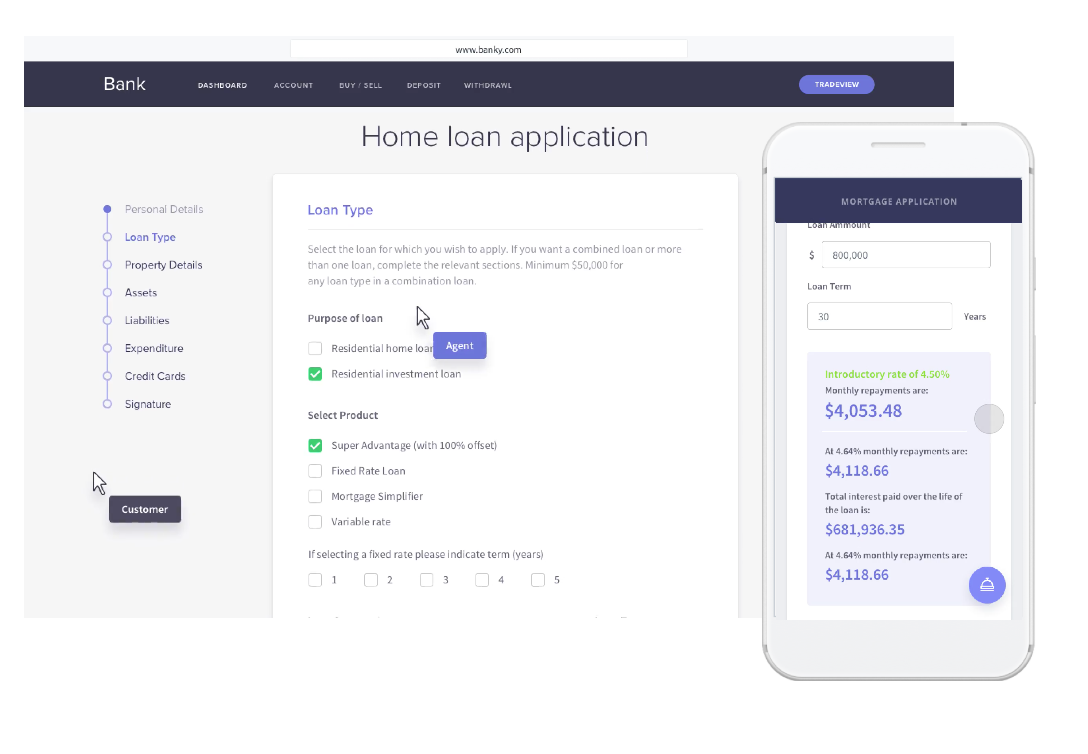

The rise of mobile banking has transformed how customers interact with their banks. In fact, 17% of US consumers consider mobile banking to be one of the features they value most when choosing a checking account.

17% of US consumers value

mobile banking most

when choosing a checking account

74.1% of these users are

in the 15-24 age group

While many of these users are younger – with 74.1% of users in the 15-24 age group – there are an increasing number of users from all demographics who rely on mobile banking on a daily basis. In response to the popularity of mobile apps or portals, banks are embracing new trends and features that are mobile-first.

This may be getting rid of cards for ATMs, smoother Know Your Customer (KYC) verification processes, debt management, or more. Regardless of the specific trends, there is an unwavering movement towards mobile ubiquity.

Mobile support is lagging behind

As more customers are using mobile apps or portals, banks can expect an increase in mobile-specific support requests.Yet this is an area where many banks are lagging behind.

Some banks only offer phone support, even if it is an issue with the app itself.

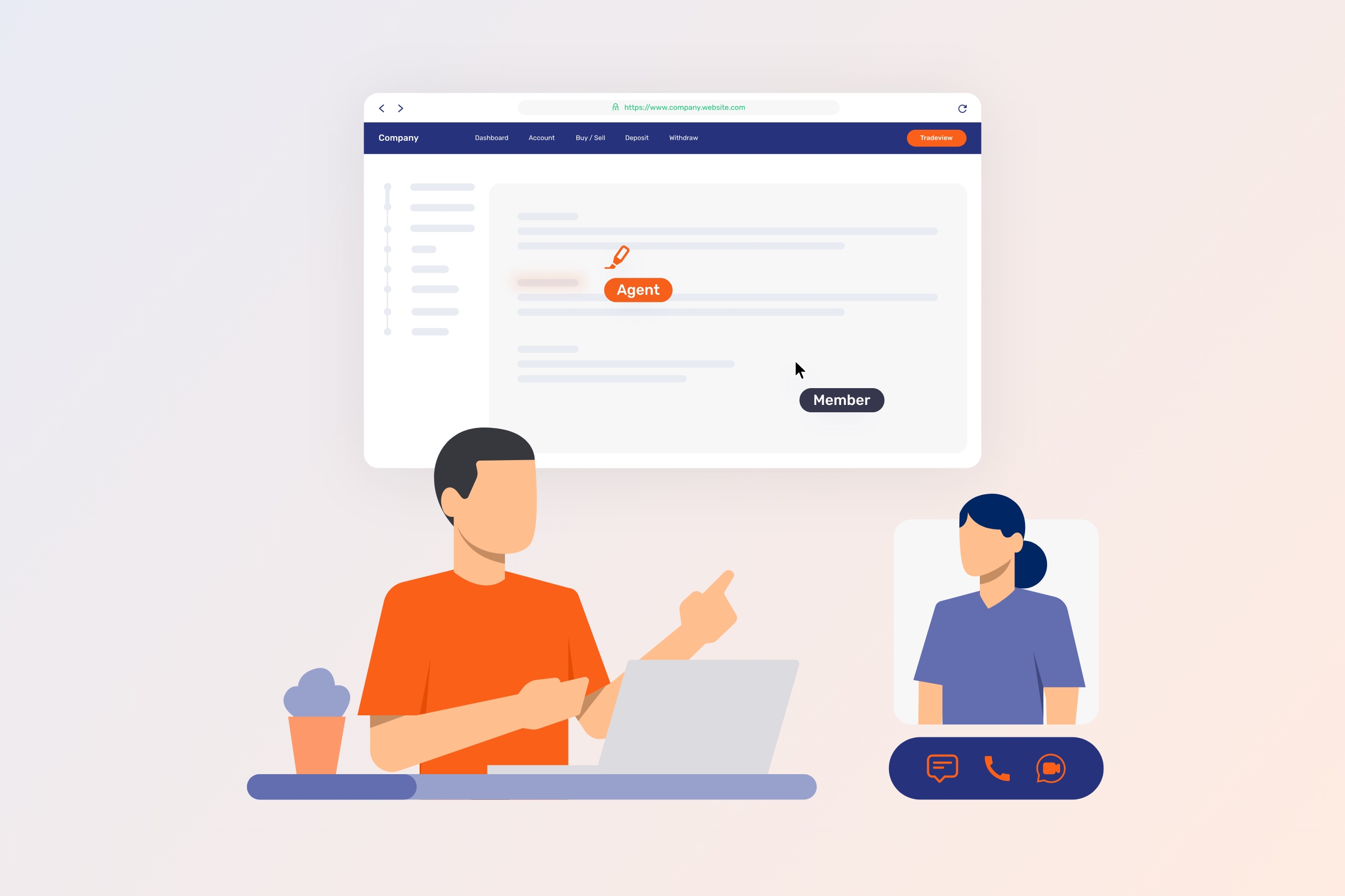

This means that customers have to exit the online application, ring the support line, and then rely on providing the agent with verbal instructions. The agent then, in turn, has to essentially feel around in the dark to find a solution to the issue without seeing exactly what is happening.

Even banks that offer direct channels of communication from within the application may find similar problems. An in-app chat messaging channel provides easy access to support for certain queries, but when they become more complex, there is still the issue of having to describe the problem without visual reinforcement.

This leads to complaints such as 64% of consumers claiming that, “they can’t solve their problem in a timely way or at all” with bank mobile apps or portals. These complaints, specifically surrounding the ineffectiveness of mobile support, have been perhaps the greatest challenge for fintech companies, as we’ve seen with Monzo in the UK. The mobile-first, digital-only nature of these innovators can backfire when customers simply want authentic, human support.

The rise of Mobile Co-Browsing

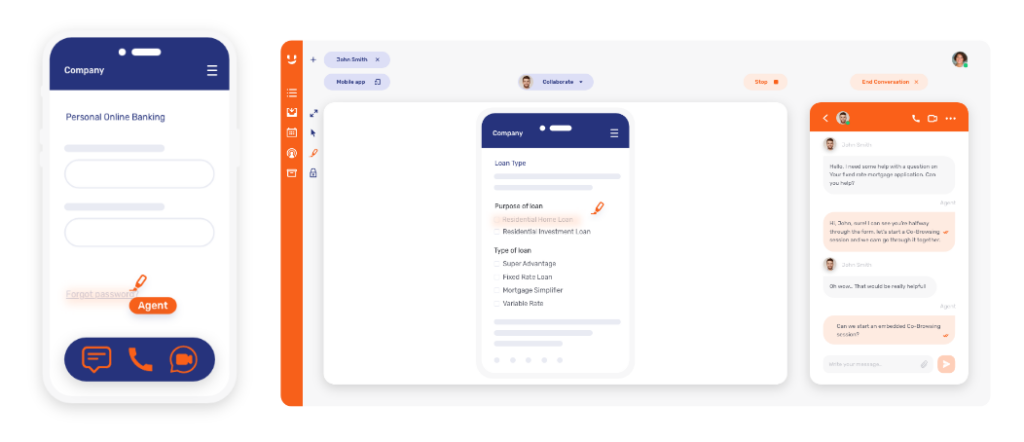

Mobile Co-Browsing, otherwise known as Co-Apping, is emerging as the preeminent support feature to solve these challenges. Many banks will already be familiar with the concept of Unblu Co-Browsing or collaborative browsing. This tool enhances online meetings, allowing agents and customers to securely view and interact with documents, web pages, or more.

It is tempting to think that Co-Apping is simply an extension of Co-Browsing, which from a user perspective it arguably is. However, on a technological level, it is something different. At Unblu, for example, the development team created Mobile Co-Browsing separately from the standard Co-Browsing software.

Standard Co-Browsing vs. Co-Apping

The reason for this is due to the limitations of Embedded Co-Browsing tools when it comes to a mobile context. A standard Co-Browsing session, for example, would be able to view browser pages on a mobile device, whereas an actual app would be beyond its capabilities. In other words, it’s the same experience as on a computer, but smaller.

With dedicated Co-Apping software, the agent and customer can view or highlight what is happening specifically in the customer’s app – and only the customer’s app. That is to say, there is no access to any other part of the customer’s smartphone. Even within the app, it’s possible to mask sensitive information (such as the bank balance) from the agent, ensuring the customer’s security at all times. Finally, as it is taking place within an authenticated environment, it is quick and convenient to launch.

Co-Apping is on the rise

Co-Apping is still relatively underutilized when compared with standard Co-Browsing, mostly due to a lack of solutions or familiarity on the marketplace. Yet organizations that use it are finding great value in the tool. One Unblu customer recently reported that their agents launched 300,000 Co-Apping sessions to solve customer issues in the first year, compared to around 65,000 traditional Co-Browsing sessions in the same period.

Co-Apping sessions to solve

customer issues in the first year

traditional Co-Browsing

sessions in the same period

In terms of customer experience and perception, being able to offer this experience remains uncommon or even novel. As mobile continues to become the de facto means of banking, we can expect its usage to increase. What’s more, banks that are developing their mobile banking capabilities should keep this capability in mind to offer exceptional support in the future.

Main Co-Apping use case: Customer support experience

The primary use case for Co-Apping in the financial industry is in a service context, which can improve customer satisfaction and reduce the Average Handle Time. At Unblu, we consider it to be an area of immense untapped value for institutions that are looking to stand out as a service provider.

From Unblu customer reports, Co-Browsing as a whole can result in a 25% increase in first call resolution, while also reducing future support calls by 16% on average. Results like these have a dramatic positive impact on customer experience, which is often lacking in a mobile context.

By being able to offer an enhanced service experience even within the mobile app, banks can tackle a particularly egregious pain point and secure higher levels of customer loyalty, satisfaction, and retention.

increase in first

call resolution

reduction of

future support calls

Sample customer journey

Mobile Co-Browsing with Unblu

Contact center agents are the first line in ongoing service experiences and play a substantial role in customer success. Mobile Co-Browsing solutions empower agents by making joint navigation possible – not just in mobile browsers, but in the app itself.

These mobile Co-Browse sessions provide collaborative experiences that boost agent efficiency, ensure faster resolution times, and drive more positive digital interactions.

But the fact is that Mobile Co-Browsing capabilities are still underused in service contexts. And this represents a substantial missed opportunity in maximizing chat interactions. By providing center teams with Mobile Co-Browsing technology, banks and financial institutions can improve customer engagement and offer a better overall service experience.

Contact us today to request a demo and find out more about Mobile Co-Browsing technology.

Want to find out more?

Reach out to us today for more information or to schedule a demo

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice

25%

25%