Financial institutions have their work cut out for them in 2024. A complex geopolitical landscape, stubborn inflation, and new developments in Generative AI require holistic risk-based strategies to succeed.

There are undoubtedly many factors that industry leaders need to consider moving forward. But arguably none are more important than ensuring effective customer service that promotes customer retention.

This begs the question, what should banking professionals look out for? Here’s our take on the trends in customer service for 2024.

Generational differences with consumer preferences

Millennials – likely due to the lingering effects on perception of the 2008 financial crisis – still exhibit a lingering distrust of major banks, as highlighted in a recent report. The younger Gen Z demographic has similar limitations when it comes to their loyalty to financial institutions. However, unlike their Millennial counterparts, this lack of allegiance does not stem from distrust. Gen Z’s inclination towards financial institutions comes more from a difference in service expectations.

Essentially, Gen Z favors the digital experiences provided by fintech institutions, characterized by robust mobile-centric features and digital products. Traditional financial institutions aiming to attract younger demographics must modernize their approaches. This entails not only ensuring real-time data-driven seamless interactions but also embracing social media, utilizing financial influencers, and providing financial education on platforms like YouTube.

Generative AI: Challenges and opportunities

In 2023, Generative AI made a remarkable entrance, reshaping our collective understanding of the potential of artificial intelligence (AI). A McKinsey survey reveals that two-thirds of senior business leaders in digital and analytics anticipate a fundamental transformation in their business practices due to the influence of Gen AI.

With the emergence of Generative AI in 2023, a whole new well of possibilities was opened up. According to one McKinsey survey, two-thirds of senior leaders anticipate a fundamental transformation in their business practices due to the influence of Gen AI and machine learning. It’s unsurprising given that Gen AI has the potential to contribute up to $4.4 trillion in annual value across the 63 examined use cases. Specifically, in the corporate and retail banking sectors, the technology could generate an additional $56 billion and $54 billion, respectively.

The challenges of advanced technology

That said, there are significant hurdles due to Generative AI as it is still in its early stages, and its complete impact is becoming clear. The rapid integration of Generative AI as a crucial capability caught banking leaders off guard, leaving minimal time to ready their workforce, attract new talent, or manage associated risks.

According to Forrester’s forecast, a minimum of eight neobanks and two established institutions could encounter a Generative AI-related crisis that will necessitate regulatory intervention. They argue that even though banks are diligently overseeing their pilot programs, there are still vulnerabilities, whether malicious or due to malpractice. This could result in breaches of copyright, leakage of customer information, biases, and other risks.

The overall apprehension surrounding the risks associated with Generative AI has prompted industry observers to call on governments, both nationally and locally, to introduce new regulations to address these concerns.

AI for positive customer experiences

This doesn’t imply that all applications of Gen AI should be avoided. There are particular scenarios where the technology is not only safe but also highly efficient. An illustration of this is the incorporation of Gen AI in Unblu’s Conversational AI offering.

Through the utilization of Gen AI, companies can tap into established knowledge bases using Language Models (LLMs), employ the bot trainer assistant to enhance intent creation, and enhance the efficiency of Live Chat.

Seamless and secure CX

Customer experience remains a prominent retail banking trend – and a key challenge for banks. Financial institutions must take substantial measures to redefine digital experiences. Achieving this involves enhancing mobile apps for better user-friendliness, alongside leveraging automation and digitalization to enhance speed in back-office processes.

Forrester reports that challenger banks and mutuals provide superior customer experience (CX) when compared to incumbents. Specifically, in France, Germany, Italy, and the UK, traditional banks were found to fall below the industry average according to the survey.

To achieve experience excellence, Digital ID is emerging as a pivotal element for enhancing end-to-end CX by efficiently verifying user identity to reduce fraud and enhance security. Governments, such as Denmark’s national ID boasting a 90% adoption rate among users, are at the forefront of promoting this initiative. Additionally, there is an ongoing EU Digital Identity Wallet initiative aimed at unifying digital identification across Europe, with similar projects in progress in the US, Australia, Canada, and other regions.

Mobile devices for complex tasks

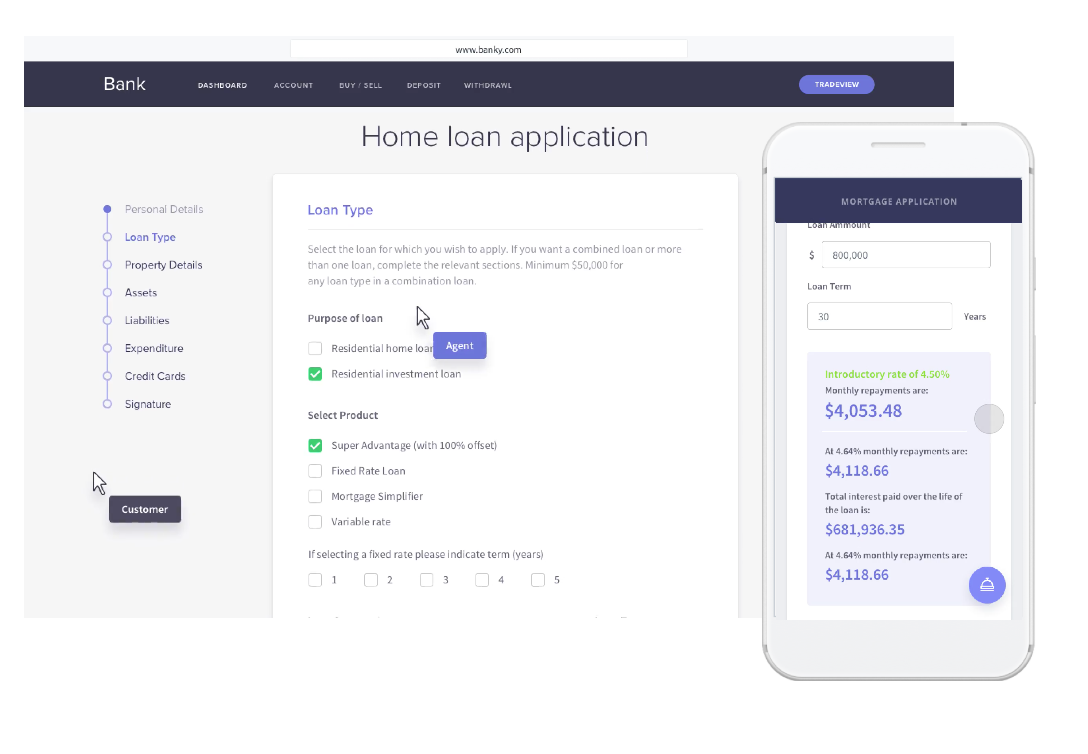

With each passing year, there is a growing reliance and inclination towards mobile platforms. While mobile banking has become a necessity for banking services, the competition for user experience has now shifted to a more detailed level. Financial institutions that can provide a seamless, integrated, and comprehensive experience are poised for success in the future.

This is driven by a marked change in behavior on the customer side. Whether due to trust issues, technological limitations, or ingrained behaviors from traditional in-person experiences, customers only once used mobile platforms for simple tasks.

Now, however, there appears to be a shift towards using mobile banking as a self-service tool for more in-depth contexts. According to Forrester, in 2022, 51% of UK adults with internet access who applied for a loan conducted their research on a smartphone, a notable increase from 34% in 2021. In total, 34% completed the application via their smartphone, and 14% utilized their mobile app for this purpose.

Customer loyalty in banking

European banks are not performing well when it comes to emotion. Forrester claims that, although 62% of European banking customers reported having an “effective” experience, and 63% found it “easy,” only 48% described their experience as “emotionally positive.”

Emotion plays a primary role in fostering loyalty, more than both ease and effectiveness. Scoring high on emotion involves customers feeling understood, respected, confident, valued, and appreciated.

Forrester’s findings reveal that if a customer experiences at least one of these positive emotions, 69% or more would remain loyal to the brand, 65% would increase their investment in the brand, and 62% would become advocates. However, across the six European countries surveyed, no more than one in five respondents reported feeling any of these positive emotions.

Conversely, negative emotions such as disappointment, frustration, neglect, annoyance, and anger are identified as major contributors to disloyalty or loss of loyalty when solving customer issues. While these feelings may not immediately result in customer churn (largely due to inertia), if left unaddressed, they can have significant repercussions for banks. The survey indicates that 43% of banking customers experiencing just one of these negative emotions would still stay with the brand.

Digital transformation in banking

The primary goal of digital transformation, according to 77% of surveyed organizations, is to boost revenue. There is also a significant focus on enhancing the customer experience, reducing costs, fortifying operational resilience, and ensuring regulatory compliance.

The core of financial institutions’ digital transformation initiatives revolves around achieving these objectives. Most banks have attained a certain level of maturity in this regard, indicating a shift from starting afresh to concentrating on ongoing digital transformation. More than 53% of decision-makers surveyed in banks express ongoing efforts to enhance their digital transformation endeavors, marking a 20% increase since 2021.

Despite widespread success, not all banks share the same trajectory. Surprisingly, 1% claim no interest in digital transformation, while 8% lack plans to initiate any related initiatives. A slightly better scenario involves the 10% that are still in the planning stages of implementation, contributing to a total of 19% of global banking decision-makers yet to fully embrace the potential of digital transformation.

For the 10% planning digital transformation initiatives, obstacles are apparent. Among those surveyed, 33% identify the company’s technology strategy as one of the most challenging aspects of their role. This is complemented by associated challenges in data and project management, with 29% and 27% citing these factors, respectively.

Need more insights on customer service trends?

Despite global challenges, customer expectations cannot be ignored. Personalized experiences and easy access to customer interactions undoubtedly represent the future of customer service success. Against a background of such uncertainty, customer support teams can gain a competitive advantage in focusing on the customer base.

As with other years, this means that customer service representatives – meaning actual human agents – must be easily available at any point in the customer journey. Yes, artificial intelligence will play an increased role in providing an excellent customer service experience, but customer satisfaction is gained during key moments of human connection. By focusing on customer relationships and innovative products, business leaders can ensure an exceptional service grounded in positive experiences.

Looking for more in-depth insight into the retail bank trends set to define 2024?

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice