Banks and financial services companies are spending big on technology. One report predicts that global retail banking IT spending will grow at 4.6% annually on average until 2027, reaching a total of $308 billion.

While the current spurt of investment spending can be traced back to the pandemic, the pressure to transform has outgrown this initial catalyst. Even with increasing M&A deals, challenger banks and fintech companies remain a key concern for incumbent banks. Likewise, customer expectations, particularly around service offerings, are forcing banks to update and deliver.

Investment alone does not equal results

There’s a temptation to believe that simply throwing money at the problem will solve this issue, and it is true that substantial investments are needed. But wild spending without proper consideration of the moving parts in play – particularly your solution’s strategic role – will result in underperformance.

This is an industry-wide problem. A McKinsey report went so far as to estimate that for every dollar spent on tech, just five to ten cents are converted into additional business value.

Where are banks going wrong?

McKinsey points the finger in three areas, highlighting biased tech priorities, too many roles focused on administering internal processes, and inexperienced tech talent.

There is truth to this, but it doesn’t tell the whole story. Take for example the issue of legacy technology. Traditional banking institutions struggle to compete with fintechs on technological capabilities because they are often weighed down or fenced in by outdated systems.

Challenges in this area range from maintenance to continued regulatory compliance and beyond. And that’s without mentioning the issue of bloat and siloing. Every time an organization invests in new technology, if it isn’t fully compatible with the current system, you are left with an increasingly unmanageable and costly behemoth.

The benefits of investing in customer service

Let’s look more closely at this in a customer service context. The benefits of investing in more robust customer service channels is undeniable. For one, customers are more disposed to make use of innovative channels and self-service tools, with 45% of customers more likely to use these options when compared to pre-pandemic numbers.

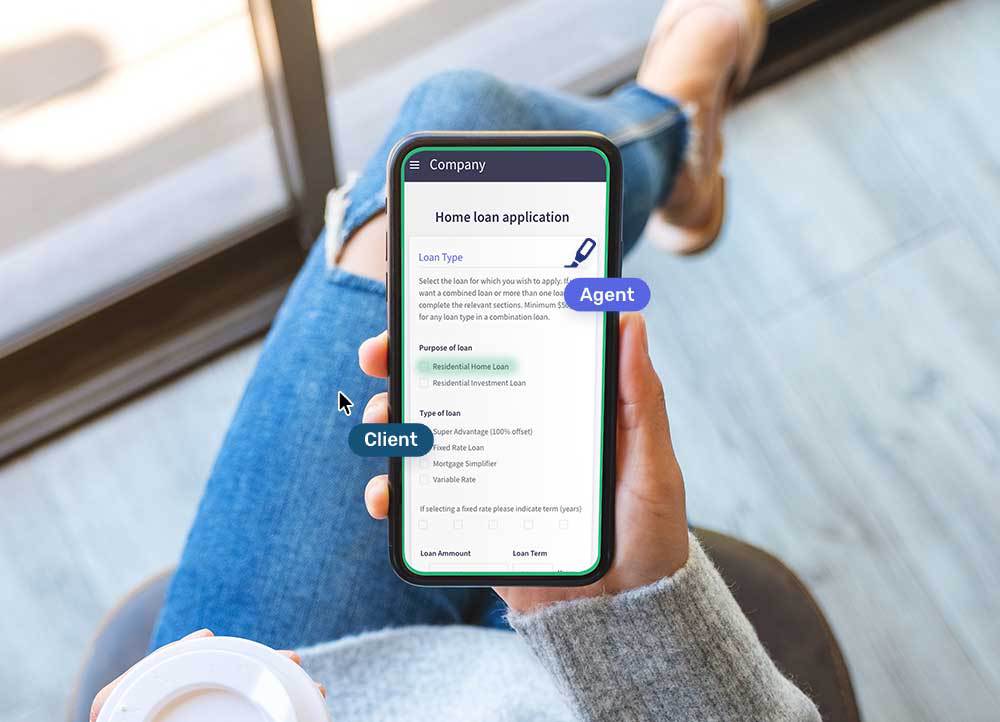

Efficiency also equates to cost savings, whether through multiple concurrent Live Chat conversations or a 40% reduction in calls thanks to Co-Browsing. What’s more, achieving excellence in this area can also drive new revenue streams, with contact centers holding the potential for added value.

Customer service tool overload

Achieving the above benefits, however, does depend on the coherence and well-roundedness of your system.

Here is the important takeaway – a disjointed and individualized tool stack will lead to a disjointed and siloed user experience, while also driving up the total cost of ownership.

And it is easy to fall into this trap. Above, we mention that customers are more receptive to self-service channels. With the rise of Generative AI, this is only going to become more common. Many banks will subsequently run out and buy a chatbot tool that draws on advances in Artificial Intelligence to address customer issues.

But does that tool connect with your internal messaging system? If a customer needs to escalate to a Live Chat conversation, will their previous conversation be available for the agent to get up to speed?

A complete, scalable platform is essential

A tool stack of individual channels and capabilities simply isn’t viable for an effective customer service strategy. Instead, financial services institutions need to look at their holistic needs throughout the full customer lifecycle to find one platform that supports many journeys.

What to look for to achieve customer service excellence

When considering investing in your customer service capabilities, there are various areas that you need to consider.

1. Omnichannel as a minimum

As an absolute bare minimum, your customer service experience needs to be omnichannel. What do we mean by this? To put it simply, omnichannel refers to a seamless and consistent customer experience no matter the channel, achieved through single system integration.

It is the exact opposite of having a tool for phone calls, a tool for Live Chat, a tool for your chatbot, a tool for Co-Browsing, and different tools for different teams and departments within the business. This ensures a consistent experience no matter the customer’s specific need. Customers can contact you on any customer touchpoint or channel and their interaction will be recorded. What’s more, if they contact your institution on another channel at a later point, the customer service rep will still be able to see previous interactions and pick up the conversation where they left off.

2. Current system integration

Banks and financial institutions often have strategic agreements with hosting providers, CRMs, or banking applications. As part of this, when looking to adopt new technologies, the banks need to undergo significant analysis, selection, and implementation processes.

Carrying this out for a series of independent tools is at best unwieldy, but can be more accurately described as logistically impossible. At Unblu, the fact that we offer an omnichannel platform isn’t enough on its own to overcome this challenge. For this reason, we take active steps to facilitate integration into institutions’ existing ecosystems.

3. Low ongoing maintenance

Ease of implementation is a key consideration, but just as important is the ongoing maintenance of the platform. At a high level, the main value of an omnichannel customer service platform is convenience and usability. But this isn’t just relevant on the customer side – to work as intended, it needs to be equally user-friendly for the customer service teams. This should cover everything from training the chatbot to software updates and beyond.

4. Blends physical and digital experiences

Finally, you need to consider how your customer service solution adapts to physical contexts. The trend towards increasing branch closures doesn’t benefit banks or customers. Instead, banking institutions need to look at alternative ways to support their physical locations and maintain a presence in the local community.

Stronger digital interactions platforms like Unblu can be impactful in this area. Not only do we offer a full digital branching solution, but it can integrate with our Spark offering – ensuring that the omnichannel experience for customers extends beyond digital channels and into the real world. Importantly, this real-world experience is consistent with what customers are familiar with online, fully blending the digital and physical worlds for next-level customer service.

An omnichannel approach to customer service

A seamless experience across all communication channels is essential to promote customer interaction and drive customer satisfaction. Customer relationships are built upon consistent experiences that address specific needs at any point in the customer journey, while appealing to customer preferences.

However, an omnichannel approach goes beyond the single channels themselves. It’s not just about providing preferred channels or self-service options. It’s not just a matter of investing in customer service software or training your customer service representatives.

It is all these things – and much more. For a truly successful customer service strategy that recuperates investment costs and benefits customer service agents and customers alike, it needs to blend with your entire ecosystem and serve along the complete customer journey.

Unless you achieve all this, you are throwing money down the drain.

Want to find out more?

Discover how Unblu can go the extra mile with your omnichannel strategy.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice