What’s in store for Credit Unions in 2024?

At the macro level, it’s undoubtedly going to be a challenging year as we collectively tighten our belts and get ready for more difficult economic times, combined with the ongoing effects of rising global tensions and ongoing wars. This year will also be an historic one in terms of elections, with a total of four billion people – more than over half the world’s population – going to the polls this year (The Economist).

When looking at CUs specifically, consolidation initiatives are continuing, characterized by a greater level of unity across the industry (BNNBloomberg). However, the challenges posed by consolidation cannot consume Credit Unions’ entire focus. As the mergers take place, there needs to be equal focus on digital transformation initiatives and in offering more innovative products, services, and personalized experiences for members.

The world is changing at a dramatic pace and Credit Unions must keep up to overcome the sizable challenges, while also meeting ongoing member product and service expectations.

Navigating economic uncertainty

Inflation rates, while falling, are doing so at a slower pace than ideal, remaining stubbornly high as a result. This is having an impact on consumer behaviors, which can be positive for CUs. During challenging times, individuals have more confidence in Credit Unions or similar institutions that are more likely to display higher levels of empathy (The Financial Brand).

This can be seen in the profile of Credit Union members. A recent survey found that members have a mean financial resilience score of 51.19 – and 78% show some level of financial vulnerability (Central1).

As a result of these pressures, we can expect further industry consolidation, which is proving an effective strategy for Credit Unions. In fact, this won’t just be taking place in Credit Unions (which have been undergoing consolidation for years now), but also among retail banks. Mergers and acquisitions are seen as a viable means to boost revenue growth through efficiency, risk mitigation, and scale. Alongside partnerships with fintech firms, it should increase resilience and help institutions to cope with the upcoming financial challenges (The Financial Brand).

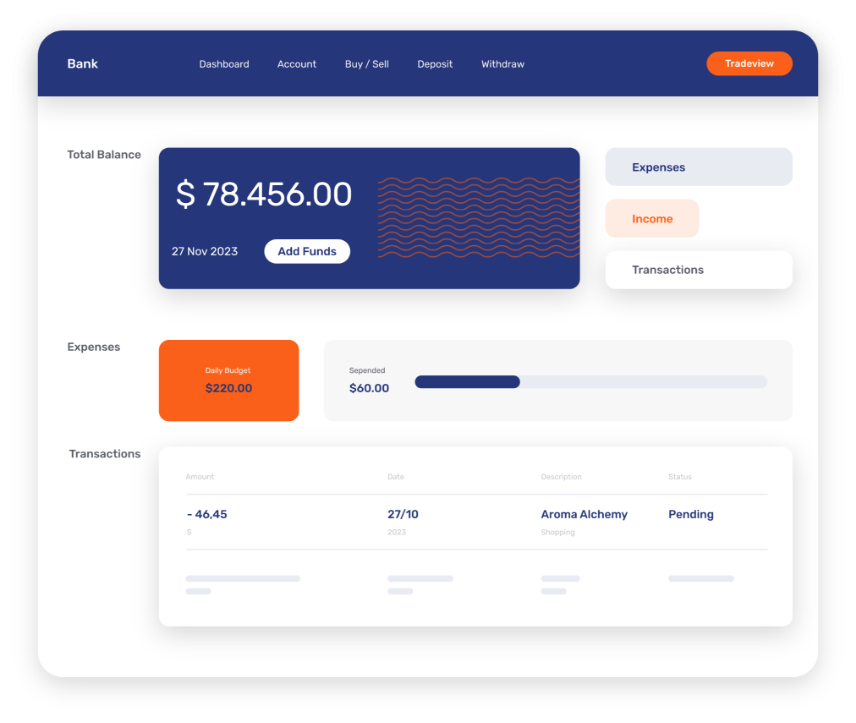

The digital transformation of Credit Unions

Incorporating more digital tools has long been a priority in the retail banking industry, with only 19% of banks behind on initiatives for various reasons (Forrester). It’s something of a different story with Credit Unions.

Although 60% of Credit Unions say that they have digital transformation strategies in the works, a smaller percentage actually have put this into action (BDO). There really needs to be greater progress in this area, particularly as member expectations change.

For example, members are increasingly looking for service options that seamlessly move between physical and digital environments. They expect to get access to services that are agile, flexible, and personalized – regardless of the specific channel (KPMG).

A closer look at members demands

Credit Unions score higher on trust

Credit Unions, even more than other financial services institutions, need to inspire trust in their members. The good news is that there does appear to be higher levels of trust, with 48% of Canadians claiming that their CU has contributed to improved financial wellness in the last year. When compared to their primary financial institution, only 43% of respondents make the same claim (Central1).

48% of Canadians credit

their CU for improving their

financial wellness in the past year

But what does increased trust mean in real terms? The main result is to do with loyalty. A recent study found that members who trust their institutions tend to remain members for their entire lifetime (KPMG). Securing this level of loyalty is an incredible feat, but it’s also not one that CUs should take for granted.

Younger generations are more challenging

Lifetime loyalty is earned – particularly when it comes to the younger generations. There’s simply no denying that the nature of quality customer service in general has transformed, directly impacting member service expectations as a result.

For younger generations, CUs are not exempt from modern service expectations. These members don’t just want personalization, but they want it to come through digital channels – valuing real-time service capabilities, transparency, and flexibility in all their interactions (KPMG).

Preferences in general have shifted

It isn’t just younger generations that have new expectations surrounding financial services expectations. Studies show that 71% of Canadian, 65% of US, and 60% of Italian adults who are active online use their online banking accounts at least once a month (Forrester). Credit Unions must offer a service that matches that of national banks if they hope to maintain loyalty in today’s new context.

Industry trends to keep an eye on

Consolidation is leaving its mark

There has been an ongoing trend of consolidation over the last decade, which has led to a 37% decrease in the number of CUs from 2012 to 2022 (BNNBloomberg). While cooperation in the credit Union industry – particularly when it comes to technological capabilities – has long been the norm, the complexity of newer online banking platforms means that simple resource pooling isn’t enough.

This in large part is what spurred the consolidation efforts, as individual banking resources became more vital. However, the consolidation initiatives are bolstering Credit Union capabilities, making the institutions more competitive against their retail banking alternatives. Provided that credit Unions continue building their tech capabilities during consolidation and not waiting until after to undertake digital transformation, they should be on a strong footing to meet customer demands.

Considering Buy Now Pay Later (BNPL)

BNPL is perceived as being more flexible than standard credit options, like credit cards, particularly by younger generations (CNBC). The previous few years have seen a surge in this option and this is expected to continue, although at a slower rate, in 2024.

BNPL spending is expected to reach $94.87 billion, which amounts to a 25.5% year-over-year growth. However, this is significantly less than in 2022, signaling that the sector is reaching maturity for this service (Insider Intelligence).

That said, the Credit Union industry should keep a close eye on the trend as fewer CUs offer the option when compared to neobanks or fintechs. Members will likely increasingly expect it as an option, which could present a challenge for Credit Unions that don’t offer it (Celero).

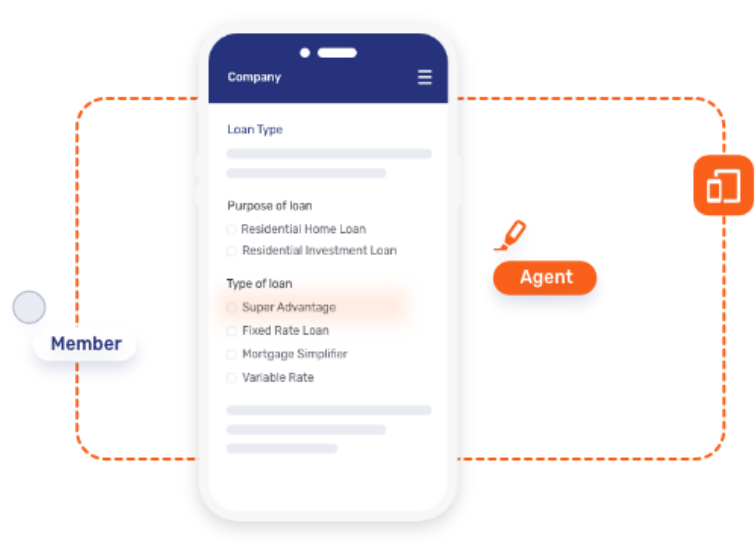

Finger on the pulse of open banking

Open banking – where customers can connect various mobile banking apps – could represent an opportunity for Unions. In fact both the Canadian Credit Union Association (CCUA) and the Large Credit Union Coalition (LCUC) are actively encouraging CUs to pay closer attention to this technology (Celero).

Cybersecurity and risk management strategies

Cybersecurity can never be far from Credit Union leaders’ minds in the financial services industry. This year will be no different as the attacks become increasingly sophisticated.

The response from anti-fraud regulators is to increase the compliance burden on institutions, with particular emphasis on carrying out due diligence with regard to third-party vendors (The Financial Brand).

Embracing digital technology in 2024

Digital experiences need to be top of the agenda for CUs in 2024 – both in terms of digital banking and in offering an enhanced service experience. Manual process and in-person visits are increasingly giving way to mobile banking or other digital services.

This means offering digital tools for communication, innovative financial products, and other offerings to compete with traditional banks, whether national banks or regional banks. Digital transformation remains the key trend that CUs need to focus on if they are going to deliver a personalized service that members want.

Beyond this, the priority for Credit Unions is to reassure their members as we enter difficult economic times. CUs are perceived as being more empathetic than other banking services and this brings with it opportunities for Credit Unions to forge life-long relationships.

While there is a fair amount of potential risk that CUs need to contend with, there are also plenty of opportunities to build stronger relationships in 2024 and beyond.

Want to find out more?

Reach out to us today for more information or to schedule a demo

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice