How can banks help their customers become better planners and savers? By finding the right balance of automated and human advice.

Find out how the latest in video banking technology is improving customer interactions, and what we can learn from early adopters.

Millennials and banking: How can banks align their business strategies with the demands of this next generation of investors?

To provide a truly customer-centric experience, banks must take on the role of a supportive financial partner. How can they achieve this?

Banks need to focus on the individual. But where should they start? By getting ahead of your customer and using their data wisely.

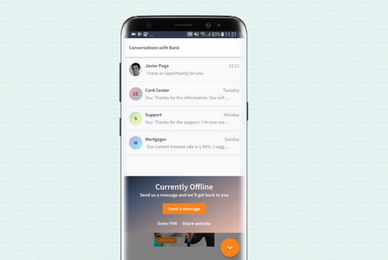

Over a third of business customers have walked away from a banking relationship because the personal touch was lacking. How should banks address this?

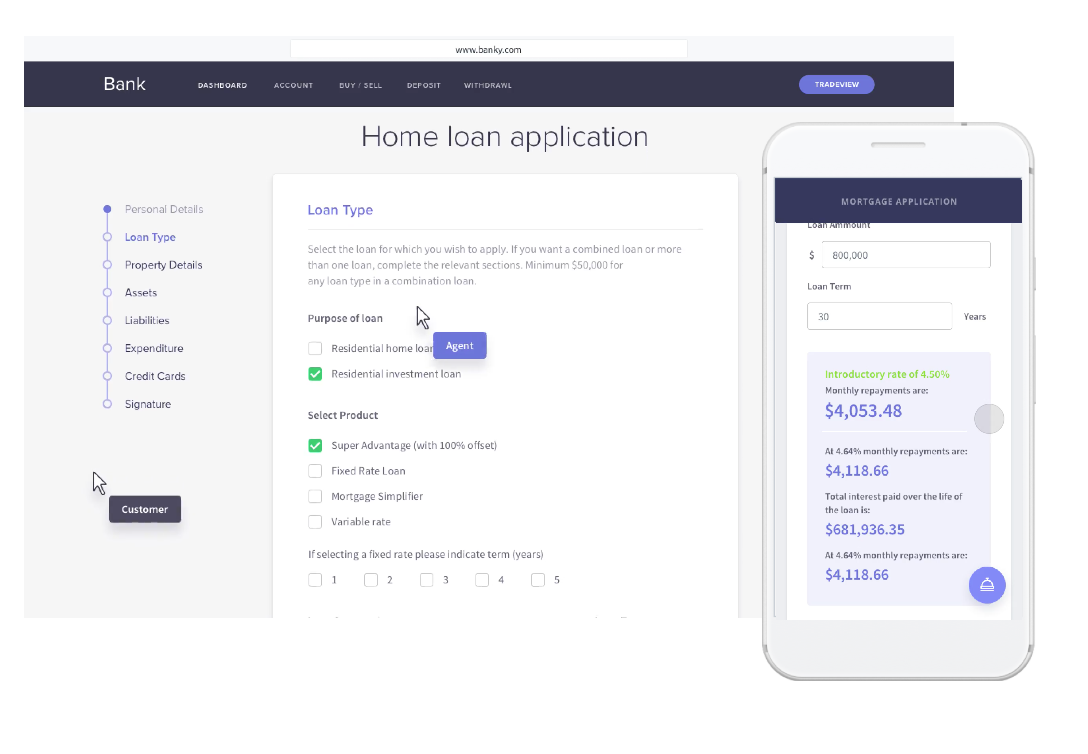

Discover how Co-Browsing helped a Swiss financial service provider create buzz and enthusiasm for a new product offering and for the bank itself.

Only 16% of customers are satisfied with their digital experience. By mapping customer journeys, banks can identify and resolve their pain points.

To remain competitive, banks need to fundamentally shift their perspective and tactics to provide truly meaningful customer experiences.

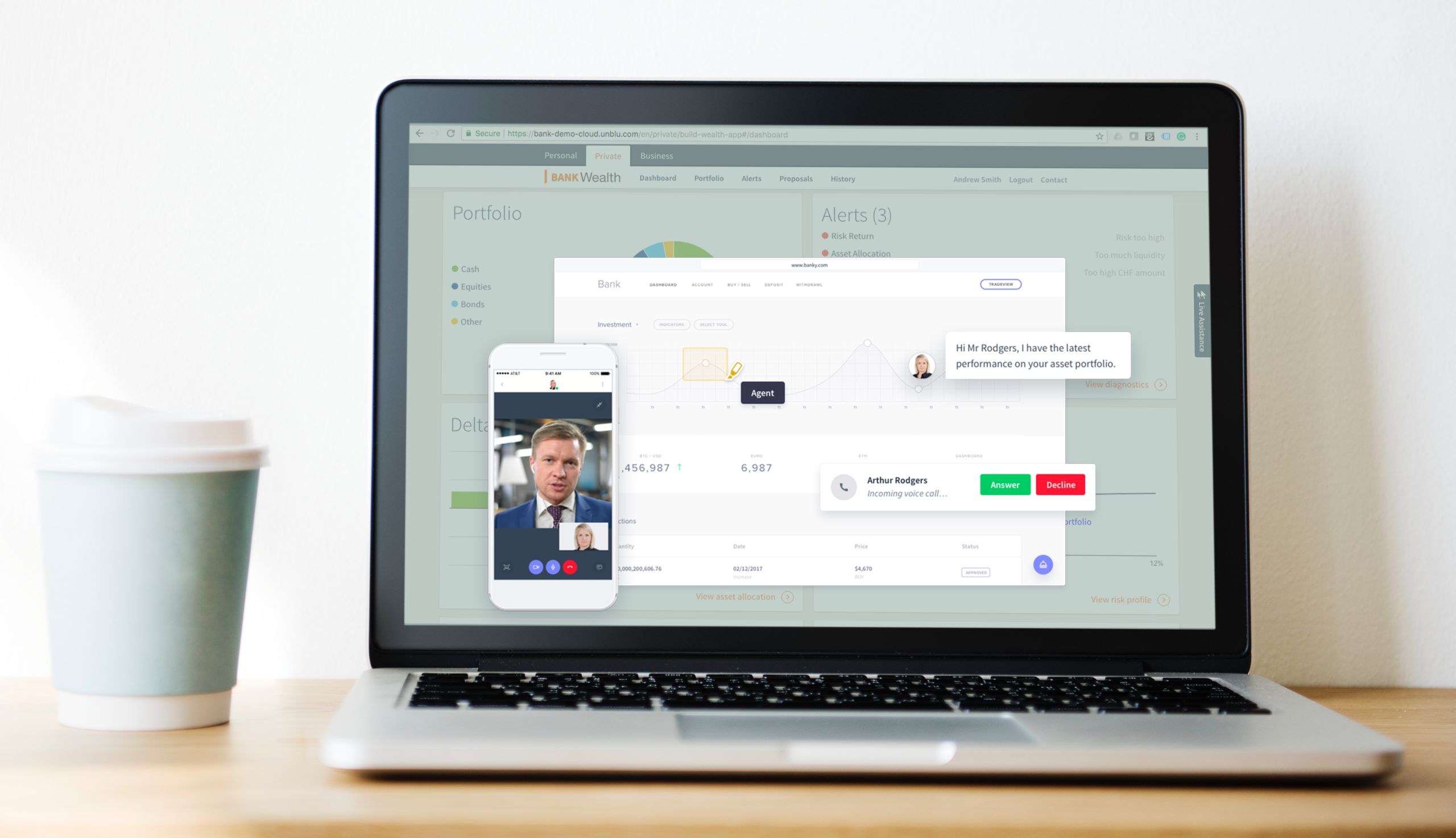

With over one hundred clients in the private wealth banking space, Unblu is a leader in facilitating secure and compliant client support.

Branches across the EU are closing at an increasing rate. In response, forward-thinking banks are creating memorable, relevant experiences for customers.

MiFID came into effect in January. What does this mean for financial institutions looking to build a truly customer-centric business model?

Join Jens Rabe in conversation as he shares his insights into how unblu is partnering with banks to change the future of banking.

There are different approaches to customer experience across an organization. Discover some in this article.

Customers want to connect with their advisor and their investments at any time and on any channel - effortlessly and seamlessly.

Banks are increasingly offering digital self-service platforms to keep up with customer preferences – but they still require human interaction.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice