Customers use more than six channels on average to keep in touch with their bank. But they still want human help. Here's how to strike the right balance.

With an end-to-end digital journey, insurance can radically improve customer engagement by making the claims process simpler and faster.

Only 15% of customers are satisfied with their digital experience. This is usually because of a disjointed customer journey that insurers need to fix.

Although customer trust is low, banks still hold and manage individual wealth. This is a huge advantage that must be leveraged wisely.

Customers still endow banks with their trust of keeping their money safe. This is huge advantage that must be leveraged wisely.

Davos experts discuss cryptocurrency, consumer trust, consumer empowerment on data privacy, digital identity and more.

Banks must reconnect with the community they serve. Discover the benefits of building a customer-centric bank with a cause at the core.

In banking, customer experience is everything. How do we balance the convenience of digital with the need for human interaction?

Each conversation is an opportunity to add value. How can you transform interactions and transactions into meaningful conversations?

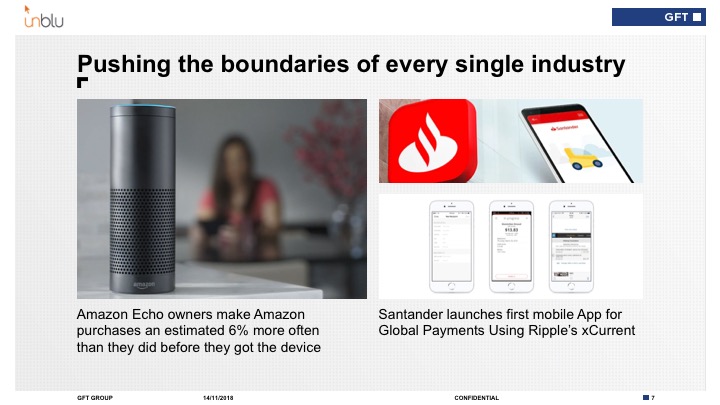

Customer service expectations and market forces are changing the financial services landscape. How should banks respond?

For a long time the risk-averse insurance industry had no compelling reason to change. But customers have changed – and so have their demands.

The Unblu-GFT partnership enables financial services to leverage exponential technology in reshaping the bank-customer experience.

If digital transformation is going to succeed, it has to be a cultural transformation. So how does a digital culture act and behave?

Digital transformation is also about changing behaviors and attitudes among employees. They will bring the technology to life – keep them front of mind.

Discover what Amazon founder and CEO Jeff Bezos's shareholder letters can teach us about creating a great customer experience.

Senior citizens are the last adopters in digital banking. Banks must support this important customer segment by encouraging seniors to adopt digital tools.