No one wants to go through an insurance claim. It usually means something has gone wrong in life. On top of the unfortunate event, filing a claim is generally a headache even the most minor claims can be inconvenient, involving different customer agents and reams of confusing documents. Then there are the common scenarios that don’t help out the insured. Customers generally only hear from their insurance companies when their policy is up for renewal. Policy communications are hard to navigate and full of dense language that needs an actuary or a lawyer to understand. A simple task like making an address change is unnecessarily complicated, with some companies even requiring a form to be mailed in. It’s not surprising that only 15% of customers say they are satisfied with their insurer’s digital experience.

At the other end of the spectrum, consider this customer experience. Lilli has just moved to Basel with her husband and infant son. On her first train commute to work, she takes advantage on her commuting time to update her address on her insurance company’s app. Inputting her new address triggers a series of questions which gets Lilli thinking about her overall property policy. She realizes she needs to increase her coverage, as the new apartment is bigger and has new furnishings . Using the app, she requests to be connected to her relationship manager through a text box. (This saves her rifling through her contacts on her phone.) They have a quick chat about options for property insurance, which reminds Lilli that she’d also like to consider life insurance options, now that there is a new addition to the family. They make an appointment to delve into the details for the following week. By the time Lilli reaches her desk at work, her agent has sent a link to information on retirement products and also reminded her to consider updating her car insurance, as her new apartment is nearer her office meaning less driving, which could lead to lower premiums. During the space of her twenty-minute commute, her insurance agent has made her aware of needs she didn’t know she had and reassured her that she’s well taken care of. Except for the email, the whole interaction happened within one conversation space on the app.

Certain life events—such as an expanding family or a move to a new flat—can trigger such journeys. But most insurers are locked into a products-and-process business model, and can’t respond proactively to offer an easy, smooth interaction as the above scenario. They don’t put themselves in their customers’ shoes and consider the journeys that people need to take. They also don’t (or can’t) adjust their products to make them more adaptable to a digital journey.

When insurance companies focus on customer experience, they tend to think about touchpoints—the individual transactions through which customers interact with parts of the business and its offerings. But this approach misses the true experience of a customer journey. For instance, if someone is involved in a car accident, they are in contact with their insurance company on average five to seven times to deal with one insurance claim. Those five or seven interactions are often with five to seven different touch points within the insurance company. Each of these touch points often operate within their own silo of customer experience. Let’s assume, based on average industry satisfaction ratings, that each interaction has at least a 90 percent chance of going well. But then, the average customer satisfaction can fall dramatically over the course of the entire journey. Why does this happen, when the majority of service encounters are positive? The reason is, they are positive in a narrow sense. Agents answer the questions or solved the issues as they arise. Customers aren’t generally disgruntled about one particular phone call or individual service interaction. It is their cumulative experience across multiple touch points and channels over time. The touchpoints aren’t broken—but the process as a whole is.

The blind spot: focusing on the touchpoint

Insurers tend to look at each customer touchpoint, from visiting the website to calling an agent, as a separate event. But customers see those events as steps in a single journey of fulfilling an important need, such as protecting themselves and their families or recovering from an accident. A siloed focus on individual touchpoints misses the bigger, and more important picture: the customer’s end-to-end experience.

Customer-centric journeys pays off

There’s a compelling business case for improving the customer journeys – it is more strongly correlated with business outcomes than touchpoints. A recent McKinsey survey found that customer satisfaction with health insurance is 73 percent more likely when journeys work well than when only touchpoints do.

Investing in an improved customer experience can do far more to drive profitable growth than raising advertising spending or lowering prices. For example, in the past five years, US auto insurance carriers that have provided customers with consistently best-in-class experiences have generated two to four times more growth in new business and about 30 percent higher profitability than firms with an inconsistent customer focus, in part because satisfied customers are 80 percent more likely to renew their policies than unsatisfied customers.

Insurers need to investigate and rigorously observe the customer’s experience along the entire journey – through their eyes. This is the first step to meaningfully improvements to the customer journey. Insurers must make their customer journey improvements their top priority, ahead of cost reductions and process improvements. Insurers tend to think of improving the customer journey in a distinct category, a separate goal from lowering their cost structures, and delighting their customers But when the customer experience is top priority, it kicks off a virtuous circle of benefits. A true customer-centric transformation solves these issues simultaneously. By putting the customer in the front of problem-solving, a lot of inefficient processes get resolved, and silos are broken down and costs are lowered because customer support is more efficient.

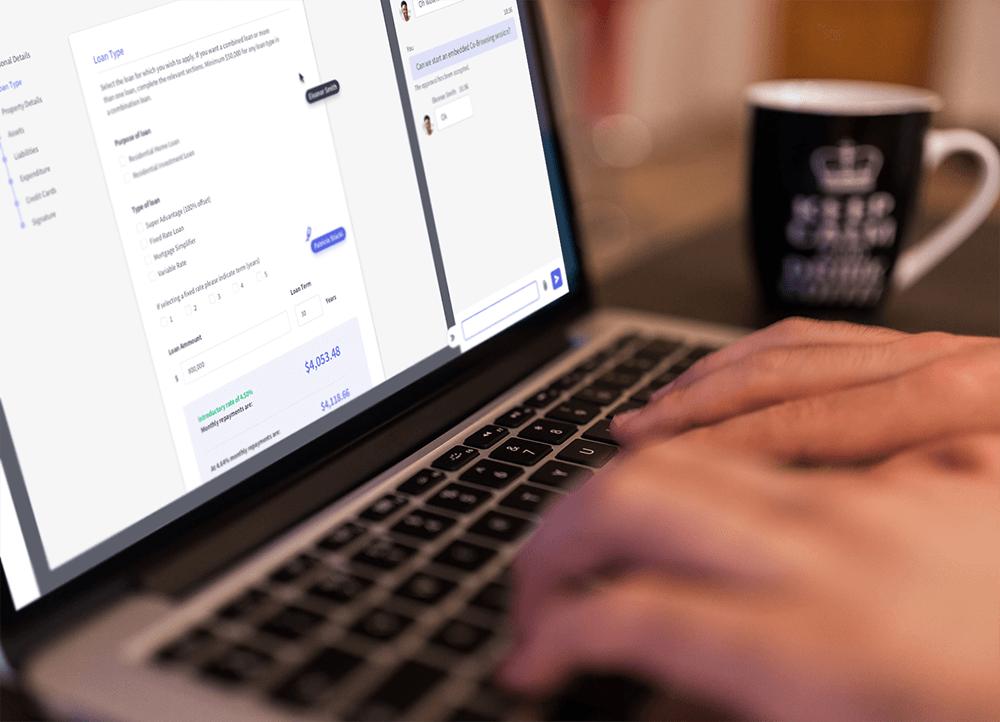

A digital solution enables an insurer to move seamlessly with the client and solve all their needs and requests without additional process loops or delays. A seamless, digitized customer journey uncovers many benefits for insurers. In particular, it boosts customer satisfaction levels significantly and can yield cost savings of 15% to 25%. It also increases organizational speed and agility, reducing the number of process loops required to complete a customer journey by up to 40%.

A customer-centric approach will require a sea change in thinking within the industry. Product features, processes, and company departments and functions must follow the customer—not the other way around. This means following and anticipating the customer journey across devices, segments, products, and channels. The industry must calculate the risk of a stagnating customer experience versus the benefits of a customer-centric, proactive journey – the benefits far outweigh the risk.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice