Webinar with unblu’s Chief Marketing Officer Jens Rabe

With over one hundred clients in the private wealth banking space, unblu is a leader in providing secure and compliant support for the one to one relationship between a relationship advisor and their client.

As Jens explains, Secure Messenger is a natural expansion of the pervasive chatting experience – and customers are asking for it. Secure Messenger is part of the unblu suite that is helping banks close the digital gap between the customer and the bank. Whether a customer needs help with a transaction or wants more of a personal touch with investing, Secure Messenger is one more tool that empowers an advisor to guide them efficiently through transactions and provide relevant and personal advice.

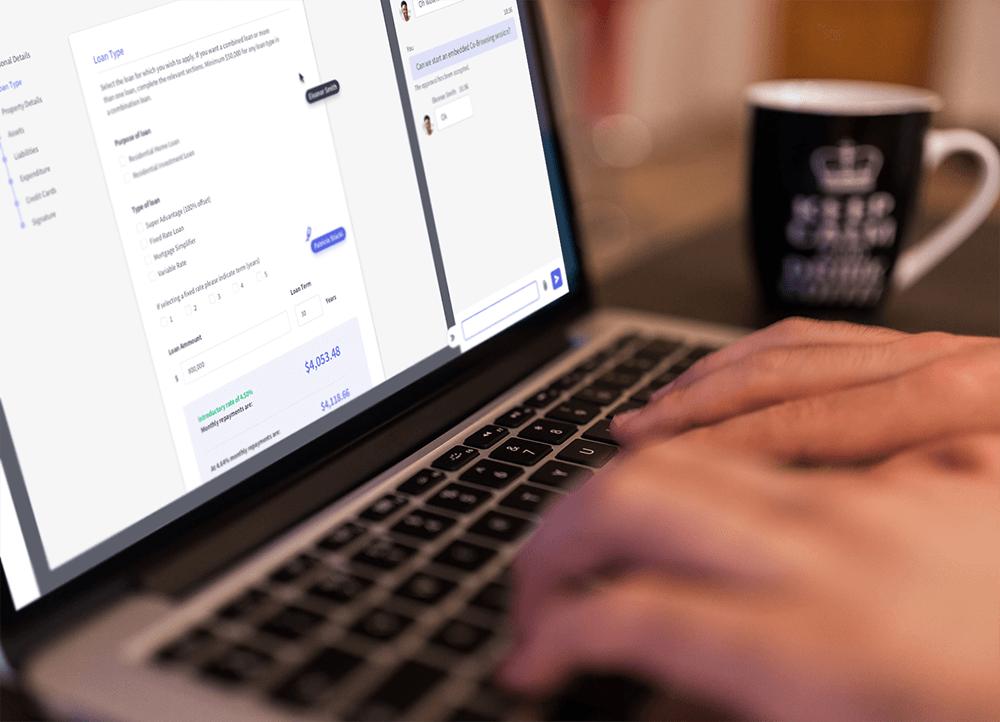

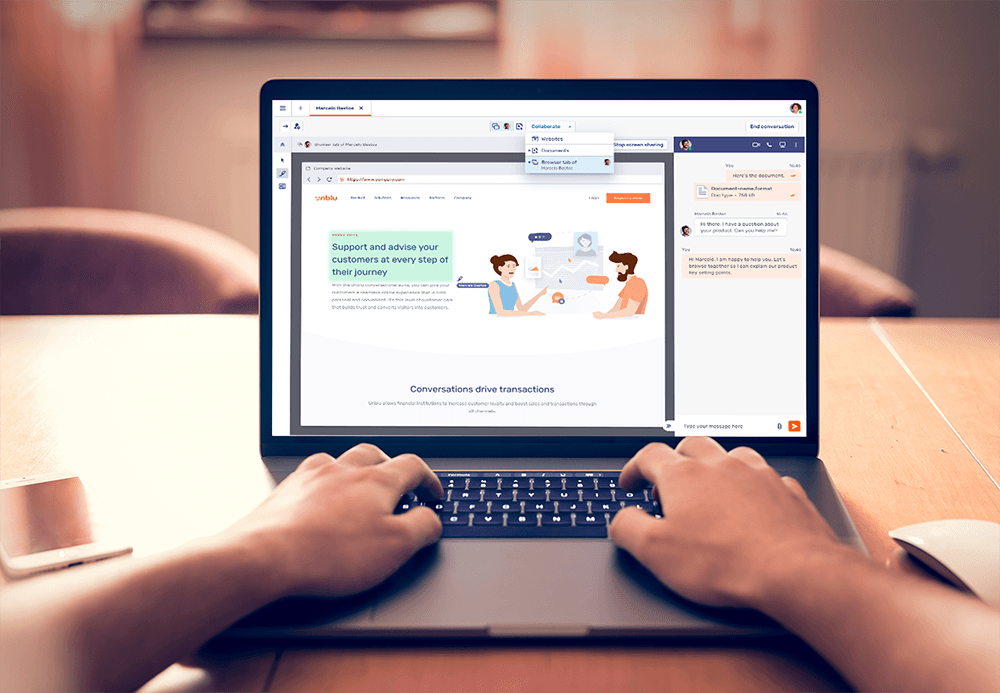

We know that customers want to carry out their banking needs when it suits them. We also know that a client prefers to solve a problem or ask a question by sending a quick message, rather than going in person to the branch or picking up the phone. Jens describes how the Secure Messenger provides an unobtrusive, asynchronous, secure manner for providing an ongoing conversation with clients. An asynchronous conversation means the advisor and the client can communicate without being available at the same time. During the webinar, Jens demonstrates how this informal style of conversation between a client and their relationship manager allows for a more natural interaction that is mutually beneficial and ultimately improves their interactions. The Secure Messenger features seamlessly work together with co-browsing, video call and live chat and can be added to the conversation when the time is right. By bringing all these elements together – enhancing the conversation with visuals, sharing research documents and having the ability to see each one another – the quality of a client’s experience increases exponentially. These improved, more frequent interactions go hand-in-hand with increasing transactions. Using tools like Secure Messenger, the relationship manager can now leverage the customer’s moment of truth and be available at the right moment to drive it home.

Jens provides an overview of how the technology fits within any infrastructure and security environment. Every interaction that takes place, whether on messenger, live chat or video – is documented as it occurs and instantly encrypted and stored either on the premise or in the cloud. As Jens explains, this archiving effortlessly fulfills the documentation required by financial regulators – taking the struggle out of compliance while allowing relationship managers to engage in relevant, worthwhile and profitable interactions with their clients.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice