Customer engagement and customer experience are two separate concepts that are important in their own way. Most of us will be familiar with the concept of customer experience, which measures the perception your customer has with your brand – through any interaction.

This could be related to the branding, the experience with the product, the quality of the service, and more. Customer engagement, on the other hand, is more concerned with the process of direct customer interaction, regardless of the channel used.

The benefits of customer engagement

That’s not to say that the two concepts aren’t related. The quality of customer engagement will have a marked impact on the overall experience. In fact, we could go so far as to say that customer engagement is the critical influencer of experience that determines the strength of the customer relationship long term.

According to a US-based Gallup study, engaged customers led to a 63% reduction in customer attrition and an overall performance improvement of 23%, compared with competitors who didn’t prioritize engagement.

Swift responses to queries

This carries over to the banking industry. According to a recent customer feedback survey, 98% of customers want their queries to be answered quickly, but only 58% feel that banks reach this threshold. How swift and actionable the responses are – in other words the quality of the engagement – go a long way in boosting satisfaction.

More active engagement

But for true engagement differentiation, traditional banks (or even digital banks) cannot rely solely on being responsive. The same study found that although 93% of customers want their bank to know them and their banking needs, only 33% feel their bank delivers this. In other words, what they are asking for is active personalization.

Increasing purchases and profitability

The overall results of higher levels of customer engagement are both satisfaction and profitability. A good example of this was when Raiffeisenbank decided to increase their digital channel capabilities and improve the way they engaged with customers.

The initial goal was to deflect from the call center and increase bank employee productivity, both of which they achieved by implementing Live Chat channels and Co-Browsing. However, once the stronger service experience was up and running, the team noticed that they could gain insights from interactions.

Through these interactions, they were better able to tailor service offers, which customers were also more receptive to because they had just received a positive service experience. In this way, the Prague-based bank was able to increase their conversion rate by 5% in August 2022 – and by 8% the following month.

Want to find out more?

Read the full case study here.

Customer engagement strategies

Given the strength of positive customer engagement, the next question is – what do financial services organizations need to do to achieve it? Below we outline some of the most effective ways.

Ensure digital customer service excellence

It’s not enough to simply engage with customers. You also need to ensure that every interaction across all touchpoints is positive and on their preferred channel. Here are some ways to achieve that.

1. Use AI-enhanced chatbots

AI technology has come on leaps and bounds in the last year alone with the launch of Generative AI. Now, more than ever before, it is essential to have a strong AI presence on your website.

There are a number of reasons for this. Firstly, it allows you to provide customer service support 24/7, which is particularly useful now that the bots are much more adept at understanding question intent and delivering accurate responses.

But AI also provides support to human agents that increases productivity by up to three times. Not only can the chatbot deflect queries from overwhelmed channels like phone lines, minimizing the number of callers overall, but it can help agents to improve efficiency during customer interactions.

This brings us to our next point.

Deploy a wider range of connected digital channels

The days of just email or phone calls being the channels for customer support are over. Now, agents need to be available on whatever channel customers prefer.

Take for example the Live Chat channels. As with a website chatbot, Live Chat can be used to deflect from the more limiting phone channel as two conversations can be held simultaneously. And here is where the AI part comes in useful – the chatbot can also suggest answers during customer interactions to further boost efficiency.

A variety of digital channels that are equipped to deal with the level of query that the customer has is essential to improve the customer experience.

Focus on mobile banking platform support

Continuing in the same vein, banking executives need to optimize their mobile experience, particularly with how they provide support via the app. Modern customers frequently use their apps to carry out transitions, with the most recent trends even showing a move towards complex app-based interactions.

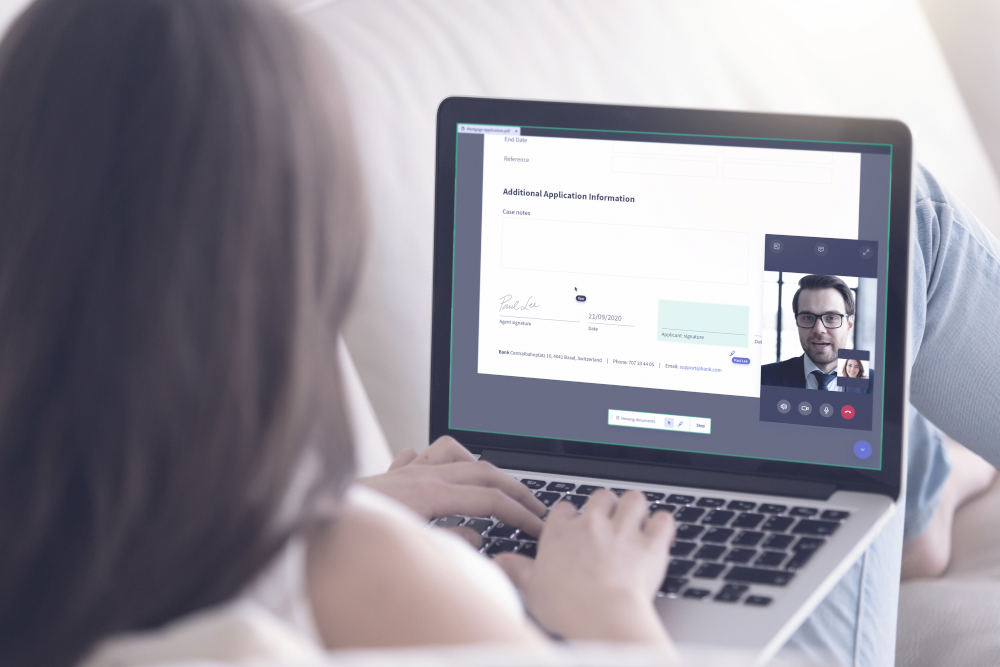

This means that your agents need to be available at the click of a button, and with the digital tools to offer swift resolutions. Take for example the collaboration tool Co-Browsing. This is well known in a desktop scenario, where agents can guide customers through difficult documentation, browse websites, or more.

However, the way recent trends are going, it is proving more and more vital to have the same capabilities available in a mobile app context. Known as Co-Apping, this similar but distinct technology is emerging as the next must-have to ensure customer satisfaction.

Embrace educational content

The saying “good things come to those who wait” has limited applicability in a retail banking context. In fact, the opposite is true – you need to be where your customers are and remind them why they should bank with you.

Some of this may be done in the form of push notifications, which are a key tactic in data-driven personalization strategies. But in a more service-based context, it’s important to also engage in customer education strategies.

Say, for example, you notice a common issue arises with a feature that prevents customers from using it properly. At the end of a customer service call for a separate issue, you can use the time to proactively educate the customer as to how the feature can be used. By showing them, they will be more likely to use the feature, boosting engagement as a result.

Base your strategy on relationships with customers

Regardless of the specific engagement strategy that you employ, the golden rule is to provide personalized experiences at key moments that boost customer loyalty. The quality of the digital experience goes a long way in achieving this, but it’s not the only factor.

There also needs to be a human element involved to guide individuals along their financial journeys and offer the banking services that they actually need. By going above and beyond customer expectations and offering financial products based on data-driven decisions, financial services companies can provide more positive experiences that lead to long-term relationships.

Want to find out more?

Reach out to us today for more information or to schedule a demo

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice