Video chat has boomed in popularity with global lockdown. But embracing digital isn’t just about greater speed and efficiency. Equally important is the flexibility it entails, allowing banks to offer customers more choice.

Many video conferencing tools are already used by companies to allow teams to collaborate remotely. However, the opportunity for client collaboration, especially within financial services, hasn’t yet been fully explored.

A mindset currently exists that video is simply an extension of face-to-face meetings and its sole purpose is to get a job done. But video call isn’t an isolated touchpoint nor a cure-all for all client problems. It’s one step in a cohesive and uninterrupted customer journey that involves multiple different tools, from live chat to co-browsing.

Even video call with screen sharing, such as Zoom and Microsoft Teams, has its shortcomings, risking the disclosure of sensitive information. Plus, the media shared isn’t automatically available in the next conversation, which is inefficient and frustrating.

Moving towards a customer-convenient experience

A seamless and secure journey

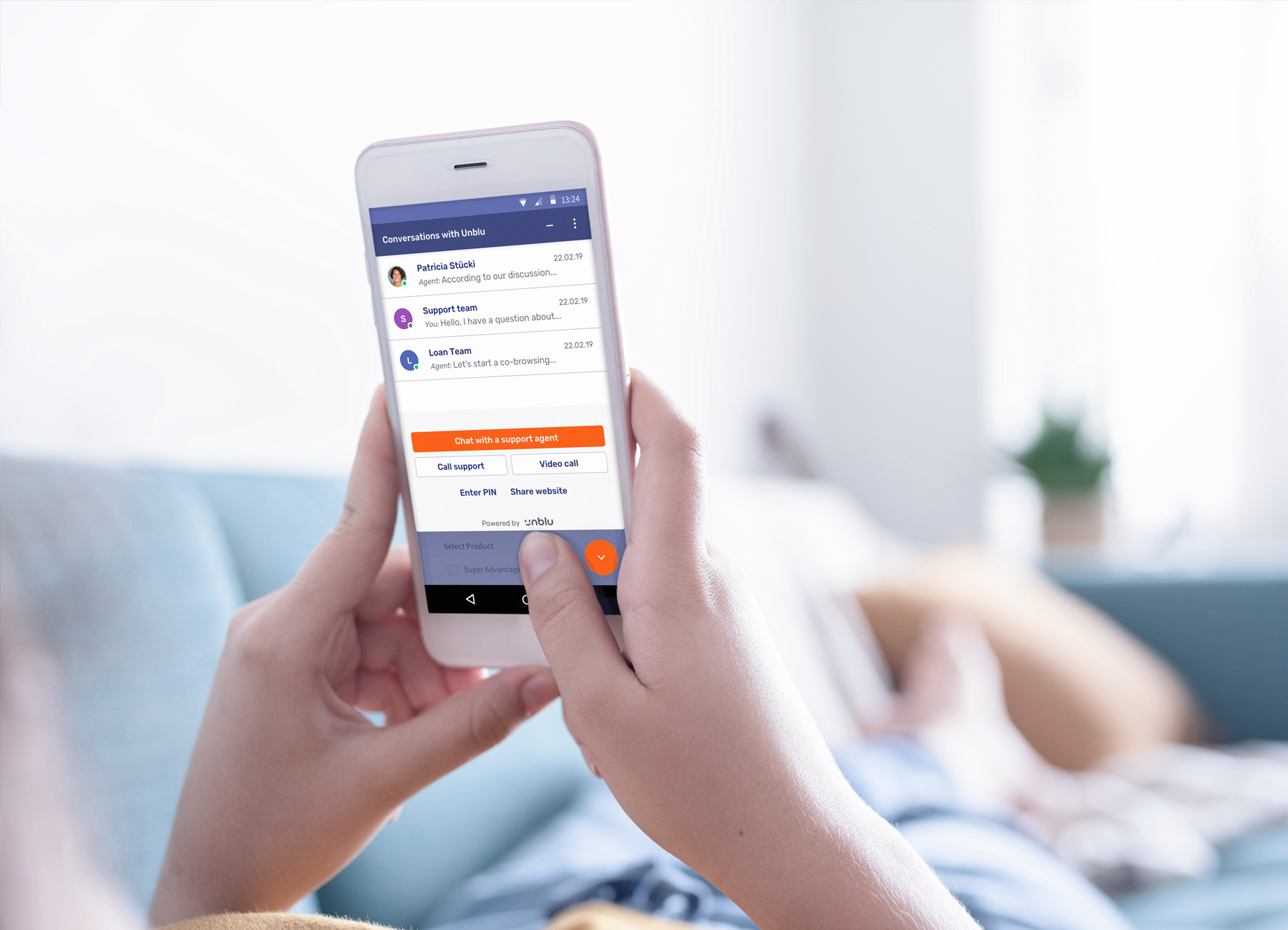

It’s clear that video chat alone isn’t enough to deliver a meaningful customer experience. It needs to be incorporated into a seamless omnichannel experience that combines multiple interactions with different conversational solutions, from secure messenger to embedded co-browsing.

Video is one of several possible touchpoints that forms part of an open-ended conversation between client and bank. A journey where every information exchange is securely archived, ensuring that all interactions are compliant with regulatory requirements and can be accessed if necessary.

A new level of convenience

Text messaging, for example, is another digital tool that can be used to promote productive interactions between bank and customer. Secure messenger allows for remote and asynchronous exchanges, with the client able to ask questions at their own convenience—at a time that best suits them. Texting is intuitive, familiar, and fast, building a relationship in an easy and convenient way. Alerts can be sent via text to allow customers to take action faster, as can appointments for video calls.

A chance for collaboration

Customer convenience isn’t just about more speed and efficiency. It’s also about enabling a more productive exchange. Features like co-browsing add a valuable collaborative dimension to video meetings. By providing a visual context to issues, advisor and customer start on the same page—literally. They can even navigate to certain web-pages or use document co-browsing to fill in forms. The conversation can be closed with an e-signing platform like DocuSign. It’s simple, effective, and makes the advice-giving more personal and relevant.

Video conferencing solutions risk being perceived as a ‘quick fix’, able to stand in for in-person meetings at times when talking face-to-face is impossible. But relying on video call alone as the basis for positive and productive customer service threatens to overshadow the necessity for flexibility in bank-customer interactions. Customers need a choice over how, when, and where they communicate with their bank. A true omnichannel and seamless customer journey offers this level of agility and freedom.

Financial advice & Unblu

Unblu’s platform of conversational banking solutions allows banks and advisors to meet the customer on their terms. Incorporating a range of digital solutions into a single and seamless customer journey, Unblu empowers financial providers to respond to client needs more efficiently, providing opportunities for personalized and meaningful exchanges that build trust, generate leads, boost loyalty, and improve satisfaction. Find out more by booking a demo today.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice