There is an old proverb that says, “learning is like rowing upstream; not to advance is to drop back.” This concept can be applied to many scenarios, such as customer service agent efficiency in banking.

On one end of the spectrum, we have the cost of inefficiency. A Deloitte survey found that inefficient query resolution is a key blocker for a good customer experience. In other words, inefficiency risks dissatisfaction and customer churn.

Efficiency, on the other hand, generates added value across all contexts. Not only do two thirds of millennials want support in real time, but an incredible 72% say they will be more loyal to the companies that provide the fastest customer service.

Bear in mind, there is little middle ground in this. As with the proverb, banks and financial institutions need to always find new ways to improve efficiency in their customer service offering. Stagnation is the same as regression.

In this context, AI-powered chat assistants are emerging as the next solution to improve efficiency and customer success.

Service channels to improve efficiency

Taking a classic contact center scenario, the first step in any service experience strategy is to diversify, easing the strain on traditional lines – such as phones, emails, etc. This is exactly the approach that one Unblu customer, Swiss Post, took.

With over 2.5 million clients, the organization has high levels of incoming inquiries. By working with Unblu, they implemented a new chatbot, along with a Live Chat channel and a secure WhatsApp service.

As a result, 76% of the requests were handled by the chatbot, leading to a 3X increase in agent efficiency across digital channels. Results like these are typical of customer service strategies that leverage omnichannel platforms.

The expanding role of Generative AI

However, once the large transformation initiative is over, it is important for all organizations to continue finding ways to further empower their team and improve efficiency as a result.

There are many ways to find an edge and “continue rowing upstream,” depending on the specific needs of the company. This can include better training, increased reliance on innovative channels, or drawing on Generative AI.

In this post, we are going to focus on the last of these, exploring new use cases to increase efficiency with AI bot sidekicks.

Next-level chatbots

Chatbots have come a long way in a few years, with the most important advancement happening in 2023 after the introduction of Generative AI. In a customer service context, Generative AI aids agents by drawing on information from the web or a company’s own knowledge base to provide responses.

Generally, this is leveraged in a self-service context. The customer inputs a query into the chatbox and the bot replies, drawing on information from the internet or a company’s knowledge base.

This remains the primary use case for chatbots, especially as Generative AI has increased their ability to offer more accurate, human-like responses.

Want to find out more?

Read the fill case study here.

Secure chatbot assistants

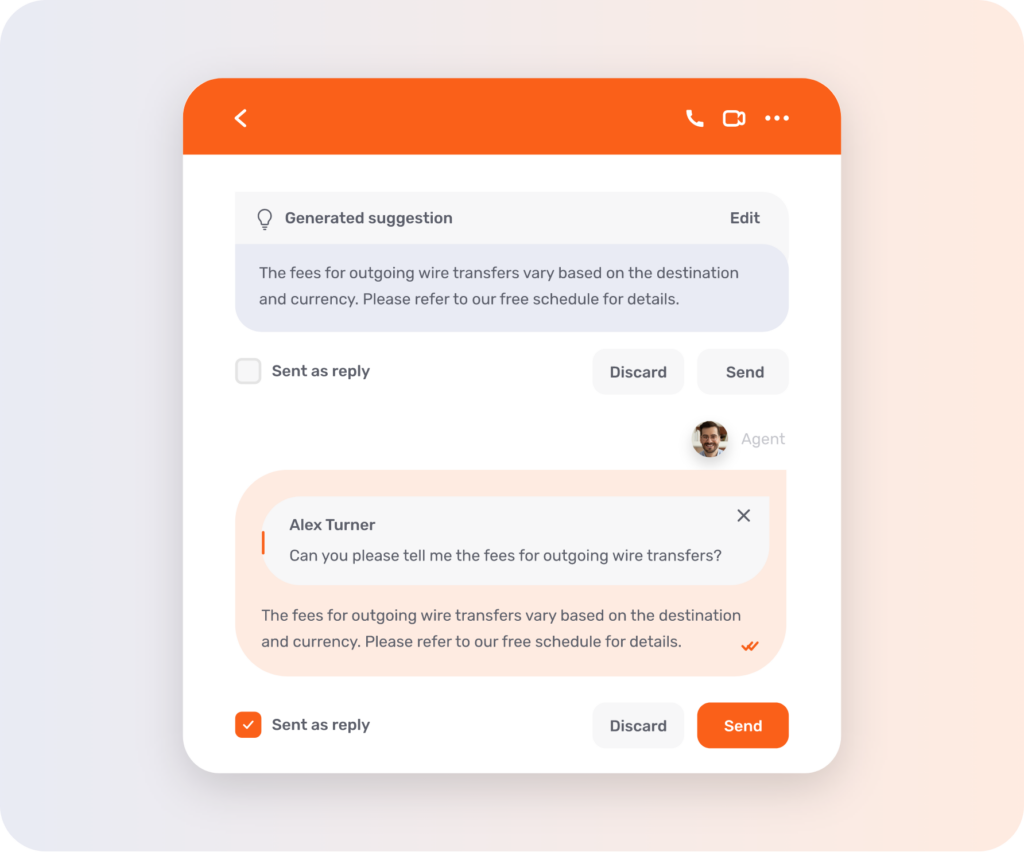

That said, this same technology means it’s possible for Unblu’s chatbot to aid agents during conversations as well – even behind authenticated areas. As with the entire Unblu Spark platform, the chatbot functionality is integrated into the bank or financial institution’s own ecosystem, allowing secure and seamless chatbot interactions at all times.

Leveraging Unblu Conversational AI to aid agents

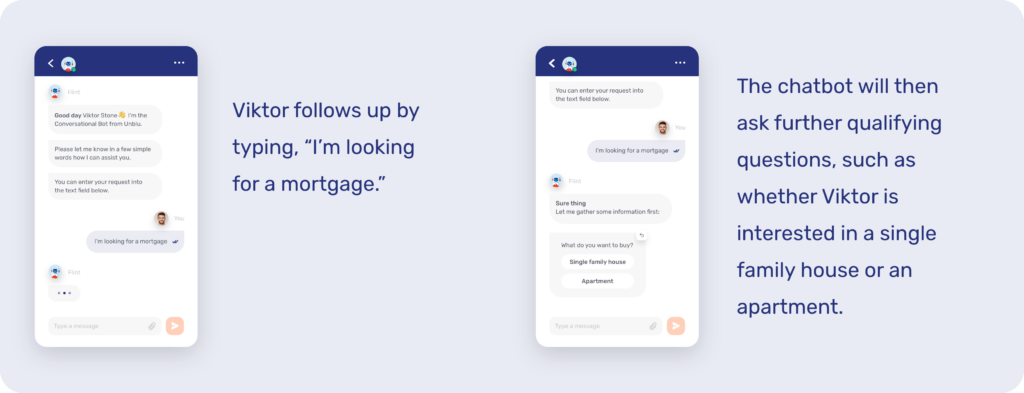

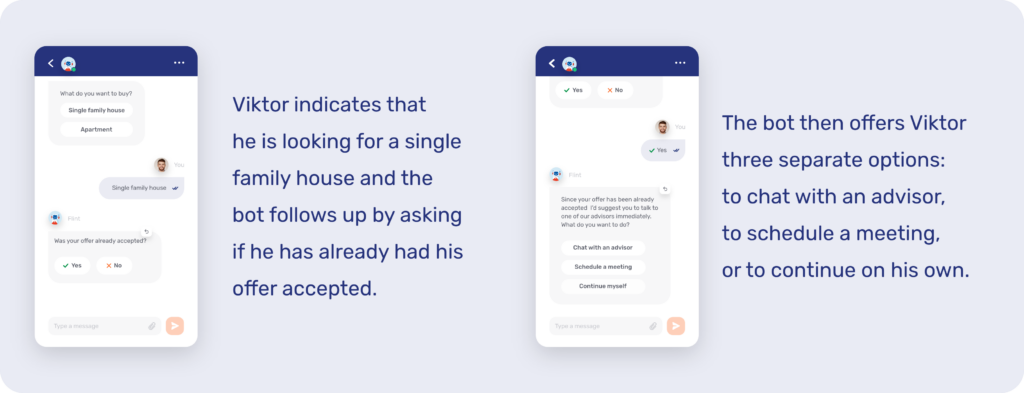

What would an artificial intelligence chatbot assistant look like? Imagine a customer, Victor Stone, signs into his authenticated banking account. Victor wants to buy a house and is looking for mortgage options.

Depending on the financial institution’s specific set up, there could be more qualifying questions before we reach this point.

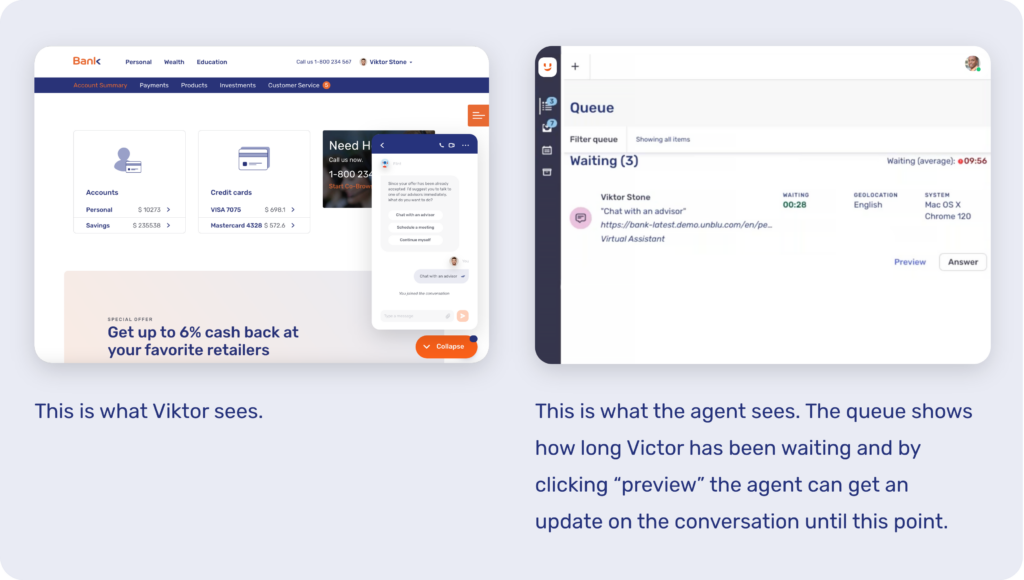

As we are focusing on the bot sidekick capabilities, let’s imagine that Victor wants to talk with an advisor. Now, we will look at the conversation from Victor’s perspective and from the agent’s one.

Empower your customer service team with sidekick AI

Customer service agents represent the front line in financial services, and are directly responsible for driving customer loyalty and satisfaction. It can be a challenging job, however. Not only do they need to achieve swift response times, but they need to carry out many repetitive tasks, while ensuring every customer interaction is positive.

The valuable time that they have is limited and it is essential to put it to the most effective use. Artificial intelligence is changing the game in this regard, allowing agents to provide digital customers with dynamic customer service.

By aiding them during interactions, they can increase issue resolution while reducing customer wait times. The result is deeper customer relationships long term.

Want to find out more about Unblu’s Chatbot sidekick capabilities?

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice