Innovation is a main staple of the modern banking industry and institutions that don’t push forward will inevitably fall behind. Often, this means that banks outgrow their legacy systems and will need to embrace new technologies to continue delivering on customer service expectations.

While essential, the process of migrating to a new ebanking system is a delicate period for the bank. To retain control during the process, banks must focus on their customer service experience.

When the project goes off without a hitch, a strong customer support team will ensure a smoother transition and boost customer satisfaction. However, when disaster strikes, the customer service center suddenly becomes the frontline in protecting the institution’s reputation and avoiding disaster.

The risks involved with ebanking migrations

There is no doubt that migration projects can help facilitate new levels of revenue. Take BBVA for example.

In 2023, BBVA reported historic earnings, amounting to over €8 billion in annual profit for the first time ever. These figures came just one year after a large initiative in Spain and Latin America to migrate to a cloud computing environment.

While we cannot attribute all this success to the migration alone, it undoubtedly had a positive impact on banking customer service, which drives overall satisfaction.

Extensive planning requirements

That said, the success of an ebanking migration cannot be taken for granted. It is a process that requires extensive planning across multiple areas. Most banks have already internalized the need for data security and compliance, functionality, usability, and so on.

But many institutions are more lax when it comes to developing a strategic plan for user adoption after launch. As anyone who works in app or system development knows, there is usually an instant (often negative) reaction to change.

Customers who are used to a certain interface can need time or guidance to adjust to a new one. Having agents who are trained to offer enhanced support through a series of channels and using collaborative digital tools can transform user uptake and satisfaction levels.

The benefits of user adoption planning go beyond this, however. By bolstering the service capacity, the institution has the added advantage of damage control if something unexpected happens.

And this is more common than it may seem.

When ebanking migration goes wrong

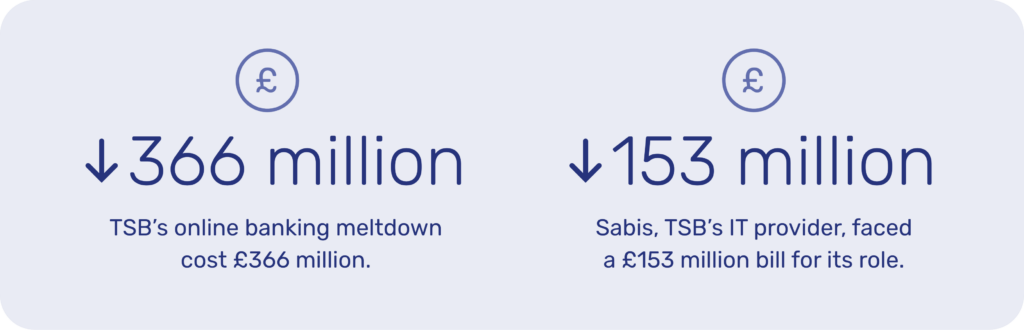

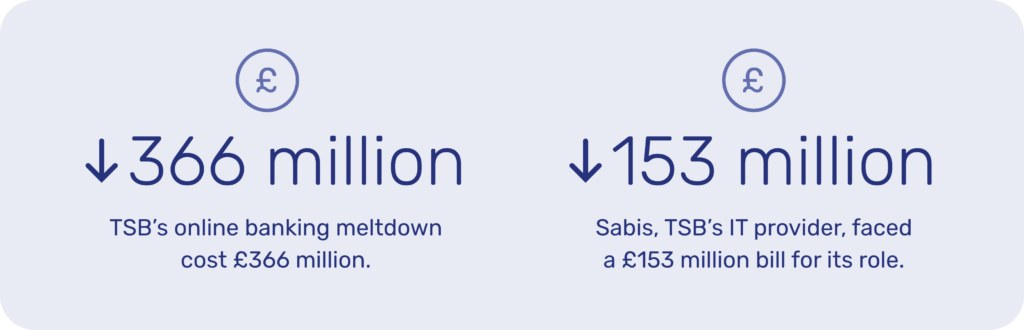

In 2018, the British retail bank TSB suffered a series of outages, which led to a complete system collapse after an ebanking system migration. In total, 1.3 billion customer records were compromised as a result. Both the bank and the IT provider suffered a large financial loss, with TSB having to pay £366 million in ‘post-migration charges’ and Sabis being handed a bill of £153 million for its role.

Deutsche Bank is a more recent example, having carried out a large migration project that appeared to go to plan at first. However, an issue arose later during the IT integration, which meant that thousands of customers were locked out of their accounts. The situation became so bad that regulators rebuked the bank in an uncharacteristic and even unprecedented move.

The fallout from ebanking crisis scenarios is severe and generally falls under three interrelated categories.

1. The knock-on effect on customer service

Given how delicate a time this is for the bank, an unsatisfactory customer service experience can exacerbate the issue. However, whatever the migration-related issue is, one thing is for certain – the customer service lines will be inundated.

As mentioned, a substantial part of the planning process for ebanking migration needs to be associated with customer service capabilities. When the project goes to plan, banks can expect an increase in customer inquiries or take a proactive approach to user education.

If the migration project suffers a failure, however, the strength of your customer service becomes a critical concern. Salvaging the situation requires well trained agents across multiple channels, bringing together AI and collaboration tools to provide efficient, qualified support.

Associated costs and fines

There will be extensive costs involved with the clean up. No migration project can be left half done, so the teams will have to finish the initiative, even if it means beginning from scratch.

That said, the costs associated with the project itself are just the tip of the iceberg when dealing with a crisis. From regulatory fines to a loss in customers, the financial repercussions are significant, as we saw in the TSB case.

A hit to the bank’s reputation

Inevitably, the bank will suffer a reputational hit if there is a problem with the migration project. However, the extent of the problem can be controlled.

Take the difference between Deutsche Bank and TSB as outlined above. Whereas TSB reported a substantial loss in customers, Deutsche bank reports it “has not yet seen a significant rise in account closures.”

Some of this is due to the extent of the crisis, but it also comes back to the customer service experience. Banks must be confident that they have robust service channels, adequate staff, and the right tools to minimize risks associated with ebanking migration projects.

Crédit Agricole: Investing in the customer experience

The Swiss-based Crédit Agricole next bank (Suisse) shows the benefits of enhanced customer service support during an ebanking migration. With a customer base of over 60,000, the leaders at Crédit Agricole realized that they needed to update their digital capabilities or risk falling behind.

As is characteristic of such an initiative, the team identified a potential moment of friction as phone calls were unlikely to meet customer demand, particularly during the migration. To overcome this issue, the team decided to invest in more robust customer engagement tools.

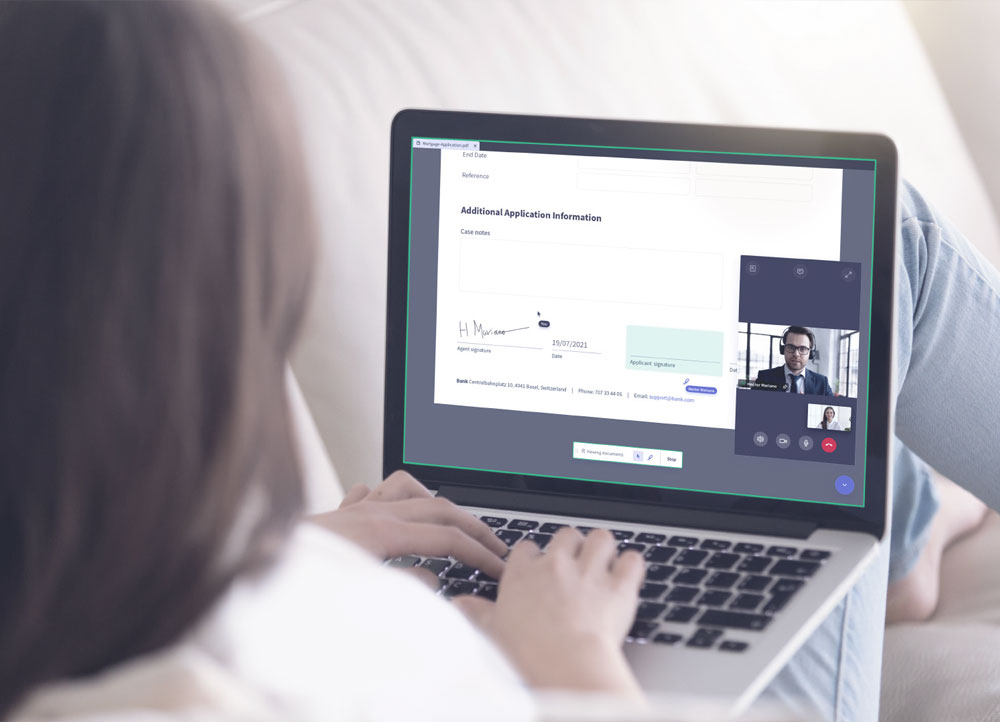

Specifically, they decided to implement Unblu’s embedded Co-Browsing, which allows agents to collaborate remotely with customers when browsing the internet or on a mobile app. This meant that they were better able to guide new customers through the onboarding process even during a delicate moment for the organization.

Crédit Agricole’s pleasant surprise

The team at Crédit Agricole was well aware of the risks involved with large migration projects. As part of their plan, they even expected the Average Handle Time (AHT) to be negatively impacted by the project.

However, by implementing Co-Browsing before the initiative was fully underway, the team were able to escalate 15% of phone calls in key moments to better guide the customer. As a result, the AHT was 80% better than originally projected and the customer satisfaction levels remained high – achieving 4.7/5.

A strong customer service foundation

The point of ebanking migration projects is to improve incumbent banks’ ability to offer more robust services, whether online banking, digital channels for communication, or more innovative financial products. However, this cannot come at the expense of the short-term service experience.

Incorporating new digital technologies is a complex process. But taking time to focus on the customer service channels can enhance a successful migration project. Not only will this drive adoption of the new system, but it can also better position the institution to avoid long-term reputational damage if something goes wrong.

Looking to maintain customer expectations during an ebanking migration? Talk to us today.

Want to find out more?

Reach out to us today for more information or to schedule a demo

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice