Strong, positive, and regular client engagement is a requirement for success in a wealth management context.

This has been the consensus among financial professionals and analysts for years now. According to Deloitte, digital client engagement is “the Holy Grail of high profitability in the digital age.” Another industry publication argues that monitoring satisfaction isn’t enough in a wealth management context – client engagement is the true marker.

There is a direct correlation between engagement and profitability. However, despite reported high levels of client satisfaction, engagement is comparatively low. One report found that, while 93% of surveyed clients said they are “somewhat or very satisfied” with their advisor, only 26% are actually engaged.

For wealth management organizations, this can be a source of confusion. By certain metrics they appear to be doing well, and yet they are missing out on potential revenue by not focusing specifically on engagement.

Preferences in financial service engagement

We have spoken in detail about the trends influencing the wealth management sector. Each of these trends play a role in the new context that wealth managers have to deal with. For example, the changing demographics – whether new clients from the tech and digital media sector or the Great Wealth Transfer – have resulted in new service expectations.

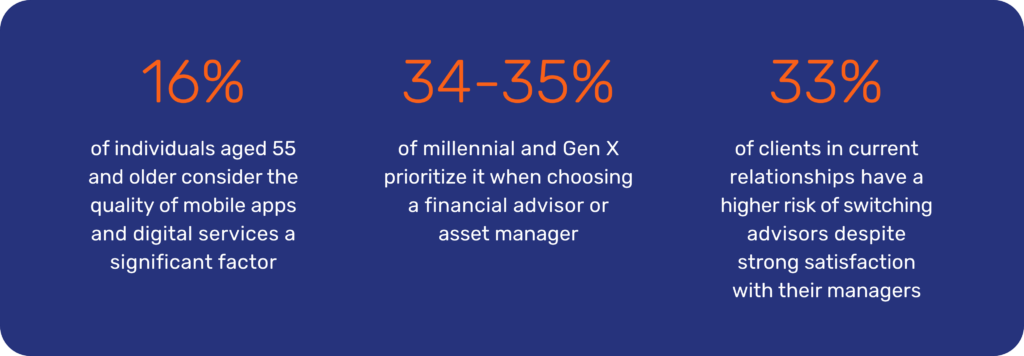

Younger generations believe the quality of mobile apps and digital services to be more important than older generations. Whereas only 16% of 55 year olds and up believe it to be a significant factor, 34% and 35% of millennial and Gen X investors respectively claim it is important when choosing a financial advisor or asset manager.

For current relationships, even with strong satisfaction levels between managers and clients, there is still a higher client loyalty risk than in other generations, with a reported 33% of clients considering changing advisors.

How wealth management client engagement needs to evolve

What does this mean for wealth management advisors? According to Bain & Company, there are six factors that influence customer loyalty and client retention. The factors are:

➊ Understanding clients’ needs, appetite for risk, and life states.

➋ Designing simple experiences that ensure an engaged client.

➌ Offering seamless experiences that combine digital and human-centric support.

➍ Proactively reaching out at the right moments to maximize upsells or conversions.

➎ Offering an integrated service that ensures clients remain confident in their financial future.

➏ Creating a client experience with higher perceived value for the fees the organization charges.

If we analyze these points, the majority boil down to offering an enhanced, convenient experience that maximizes trust – and boosts engagement.

The role of secure messaging in client engagement

It is in this context that secure messaging apps become extremely important as they are the only way to offer the smooth, convenient experience that clients genuinely want. Unlike online meetings, mobile app messaging is a low-effort alternative that facilitates easy, back-and-forth conversation. This makes it easy for clients to fit in conversations with their advisors between other business activities.

However, Secure Messenger offers enhanced features that make it more user friendly and reduce the risk of compliance issues and fines with regard to records-keeping. Clients and advisors can discuss their finances, potential investments, or other topics in a secure location, including sending and receiving sensitive documents or files.

As Secure Messenger is part of an omnichannel solution, all messages can be accessed from behind authenticated environments, whether client portals or apps. It is also fully compatible with other conversational engagement tools, such as voice and video calls or Co-Browsing.

What does a client journey look like with Secure Messenger?

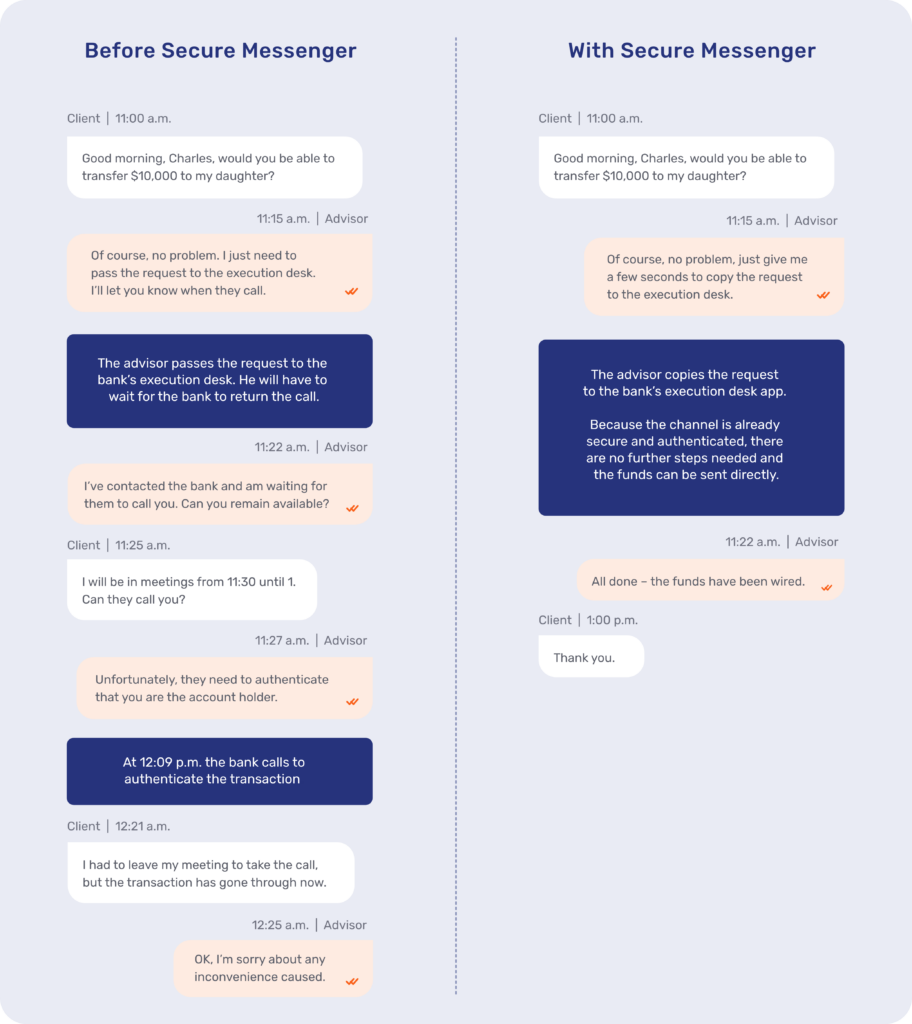

This sample client interaction shows how an advisor can provide a more streamlined experience for everyday interactions.

The results of a Secure Messaging experience

The above is an example of how wealth management firms can use Secure Messenger for simple transactional tasks as part of an ongoing client relationship. However, from our customers, we’ve found that conversational engagement – which includes Secure Messaging – can help financial services industry professionals across three specific areas.

Acquiring and onboarding prospective clients

The beginning of a relationship with potential clients is always the most delicate time. With Unblu, our customers have reported from 20-30% more meetings, which has resulted in a conversion rate that’s 15-20% higher than before.

Building trust with less input

Although conversational engagement helps secure more meetings, it also reduces the duration of each one. In fact, our customers report that the average duration is down by 20% – while achieving a 90-95% client satisfaction rate.

Cost-effective client support

Overall, advisors report a 50% reduction in time and cost dedicated to ongoing client support or financial advice and can lead to a 3X boost in productivity. This gives advisors more time to focus on making real connections with clients to build the relationship and accelerate assets under management growth.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice