Wealth management trends in 2023 continue to evolve, with shifting demographics, technological advancements, and changing service expectations redefining the nature of client-advisor relationships.

The result is a push towards digital wealth management that embraces a larger group of investors, taking into consideration their diverse needs and preferences. What’s more, to ensure success, this updated offering needs to be delivered via an omnichannel experience that combines the best of technology with human expertise.

Based on insights gained from the Unblu 2023 Digital Wealth Management Outlook, we’ll take a look at the top wealth management trends driving these changes.

1. Transforming client demographics

The wealth management industry continues to experience an ongoing transformation as high net worth individual and investor demographics evolve. Much of this is due to the value of the tech and digital media sector, which has produced a new generation of affluent and extremely wealthy individuals (Capgemini).

As financial firms handle this wealth, they are noticing differences in the demands and expectations of these clients. Alongside values-driven considerations like sustainability, this subset of wealthy individuals places a strong emphasis on digital wealth management with new asset classes, likely influenced by their backgrounds.

For established firms, it is crucial to possess the necessary capabilities and insights to provide informed guidance in these areas. This might even involve reevaluating and redesigning their service offerings.

2. The Great Wealth Transfer continues

The Baby Boomer generation is aging, making “the great wealth transfer” an looming reality that digital wealth management experts must address. In fact, recent predictions state that approximately $60 trillion will move from older generations to younger ones by 2060 (Capgemini) – the largest generational wealth shift in history.

The same holds true for wealth managers or advisors, with more and more reaching retirement age and stepping back from their wealth management relationships. Deloitte estimates that around 43% of financial advisors in the US are aged 55 or older, indicating that a substantial portion of the current workforce will retire within the next decade (Deloitte).

Given the accompanying shift in expectations, stemming from the generational wealth transfer, the younger advisors set to replace their predecessors must embrace new practices to meet the needs of clients.

3. Mixed relationships with cryptocurrencies

There is a marked interest in high risk digital assets like cryptocurrencies, particularly among younger generations. A reported 44% of millennials are keen to explore this area, compared to only 12% of individuals aged 55 and above (Refinitiv’s Wealth Management Report).

However, there are undoubtedly risks involved with offering cryptocurrency products, especially when considering long-term investment strategies. As regulatory oversight of this asset class gradually takes shape, the associated risks should be mitigated to some extent, encouraging more investors to participate and offering a lifeline to wealth management firms (Refinitiv’s Wealth Management Report).

4. Ethics in decision-making

The influence of ethics on investment decisions is rising, with clients now expecting information about the impact their investments have in sustainable contexts. Studies show that 39% of HNWIs younger than 40 and 43% of ultra-HNWIs are likely to request an Environmental, Social, and Governance (ESG) score before making investment decisions (Capgemini).

However, providing investment advice or opportunities with a sustainability focus is not as straightforward as it may seem, especially when it comes to offering advanced ESG options. Wealth management firms may need to review and update their technology infrastructure to deliver the level of service expected by clients. Alternatively, they may consider partnering with WealthTechs or similar organizations experienced in collecting and aggregating ESG data.

5. Compliance in digital wealth management

Investing heavily in digital infrastructure and new touchpoints can lead to security weaknesses if not properly managed. Developing and implementing a robust cybersecurity framework capable of accommodating digital advancements is crucial, if challenging. It’s vital that clients are confident that their data, investments, and interactions with advisors are always protected in order to maintain trust in a firm.

The picture is further complicated by ensuring that communications are stored according to compliance standards, which can affect the experience that clients get. The trend of wealth advisors using popular messaging apps such as Facebook Messenger and WhatsApp simply cannot continue for this reason.

Not only is it unsafe, but regulators are adopting a more stringent approach to compliance, resulting in record-breaking fines. While fines above $200 million were typically reserved for fraud cases, eleven of the world’s largest banks and brokerage firms were collectively ordered to pay $1.8 billion in fines due to regulatory deficiencies (Wall Street Journal). This trend places pressure on firms to become more proactive in adhering to compliance regulations.

6. Employee preference for hybrid work

While there has been significant bounceback since the global pandemic eased, the majority of financial services professionals continue to prefer remote work. A reported 60% state that an inflexible approach would influence their decision to remain with a company (Gartner). To retain top talent, firms must incorporate hybrid work models, if not fully remote options, into their company policies.

Unsurprisingly, this shift raises logistical challenges as managing a dispersed workforce requires a different leadership style than traditional office environments. Each organization must find the approach that works best for them, but delegation that facilitates remote decision-making is undoubtedly a key element.

7. Addressing the female segment in digital wealth management

There has been a large increase in the amount of wealth controlled by women, currently amounting to 32% according to The Boston Consulting Group. What’s more, UBS’s Women’s Wealth 2030 predicts that this figure will rise at a compound annual growth rate of 5.7% to reach a total of $97 trillion by 2024.

However, despite their substantial share of global wealth, only 49% of online women in the US currently invest in digital assets, compared to 60% of men. Among female investors, there is a tendency to have fewer and less diversified investments in their portfolios compared to their male counterparts.

Much of this disparity can be attributed to the design of firms’ products, services, and marketing initiatives, which often target men exclusively. Given the current and projected influence of women, focusing solely on men represents a significant missed opportunity for wealth management firms (Forrester’s Design Solutions to Attract Female Investors).

8. The significance of human-tech hybrid interactions

Generational differences play a significant role in preferences for digital service capabilities, with 34% of millennials and 35% of Gen X investors considering it important when selecting a financial advisor or asset manager. However, among older generations (55 and above), this importance drops to 16%, indicating that this area will become increasingly crucial as the wealth transfer continues.

Nevertheless, many investors across all age groups and regions still value traditional channels of remote communication. Approximately 57% prefer phone calls, 49% prefer in-person meetings, and 48% opt for email. This highlights the essential role of human interaction in the customer experience. While technology is on the rise, its effectiveness relies on facilitating or allowing real human interaction when necessary.

A remote, high-touch client-advisor relationship has become the new norm, and firms unable to provide this level of service will struggle to retain their clientele. Success in this area hinges on the ability to balance automation and digitalization while retaining an authentic, human-focused element.

9. Equipping advisors with the right tools

As mentioned above, advisor expertise remains integral to the client experience. However, they cannot be expected to perform optimally or accelerate assets under management growth without proper support. For this reason, the firms that are standing out have implemented a top-down strategic shift, ensuring that digital technology enhances rather than replace human expertise.

This leads us to the hybrid model of client interaction, which combines the best of technological capabilities and human knowledge. Beyond enhancing advisor potential, this model should be flexible and adaptable, offering specific services across the wealth spectrum to ensure a unique and beneficial client journey.

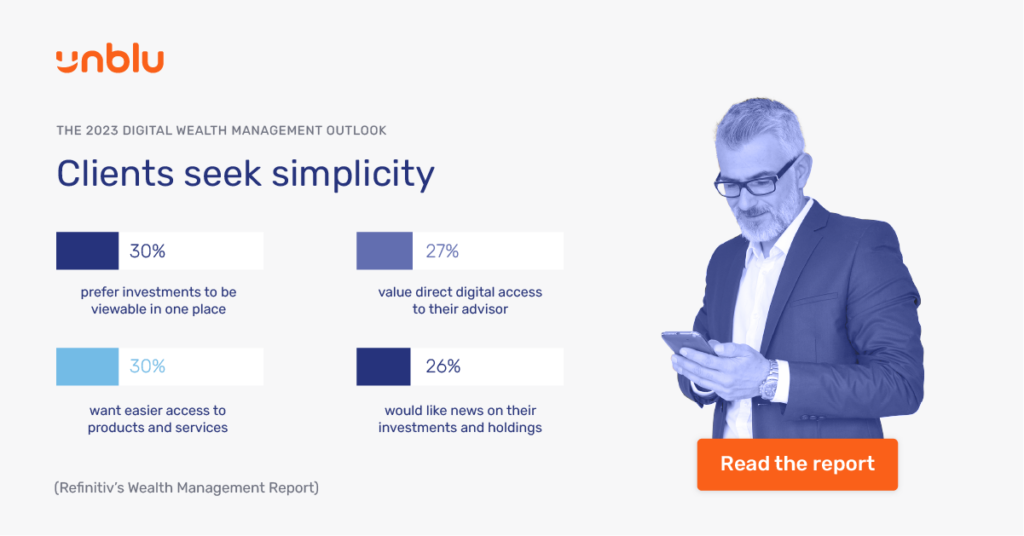

10. Client-centricity for a streamlined experience

As a general rule, investors value simplicity in their interactions and have little patience for complex products or repetitive processes. A recent survey found that 30% of investors want to view all their investments, even those from other institutions, in one place. The same percentage desires easier access to products and services, with 27% emphasizing the importance of direct digital access to their advisors.

Additionally, 26% would like to receive personalized news based on their specific investments and holdings (Refinitiv’s Wealth Management Report). Furthermore, the trend towards personalization has become so significant that 64% of millennials and 51% of investors aged 35-54 are willing to pay more for personalized investment products and services (Refinitiv’s Wealth Management Report).

Meeting client demands with digital transformation

Even given the sweeping changes taking place across the industry, one thing remains constant – service experience is essential to success. The quality of service provider’s digital offerings in terms of addressing wealth management client preferences will define success moving forward.

Traditional wealth managers will find it difficult to maintain client relationships into the long term. Strong digital engagement with robust digital channels will help relationship managers to better connect with their client base and offer a top wealth management service.

For more in-depth insights into current industry trends, you can download the Wealth Management Outlook here.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice