Digital services across all sectors are being forced to undergo complete digital transformation to meet customer service expectations and boost sales – or risk falling behind.

This is also the situation for retail banks, which must evolve and deliver hybrid experiences that merge the best of physical and digital interactions. However, unlike other sectors, financial services have added challenges and roadblocks that are making it difficult to offer the quality of service that customers expect.

Some of this is due to increased competition within the sector. Fintech companies and non-traditional banking entities are able to provide enhanced mobile-first experiences that offer the usability customers expect from the most innovative digital companies. That said, technological competition is just one piece of the puzzle as increased cyber attacks are eroding trust and compliance regulations present further barriers to progress.

The good news is that traditional banks that achieve customer service excellence are in a better position than their fintech competitors to succeed. Drawing on their years in the sector, they have the human resources, expertise in providing financial advice, and the all-round proficiency to triumph in today’s context.

By building on this strong foundation and adjusting to today’s new reality, incumbent retail banks can retain their positions as market leaders and reach new heights.

The immediate impact of implementing Unblu’s digital customer service solution

For retail banks, navigating this landscape of high customer service and product expectations against a backdrop of challenges isn’t easy. However, with the support of the right partner, it is certainly possible.

Unblu specializes in bridging this gap between banks’ capabilities and customer expectations. As branches disappear and competition increases, the best-in-class software facilitates secure connections between the customer and the financial institution that are efficient, profitable, and productive.

Incorporating Unblu’s conversational platform into your customer services strategy offers a number of advantages to the bank’s support, sales, and advisory capabilities. We can look at the benefits of Unblu within the context of real partners.

1. Unblu lowers costs by boosting efficiency

Time is money, and this is never more true than in a service environment. The entire Unblu platform has been designed to boost efficiency across the board and reduce costs as a result.

The AI chatbot – or similar self-service technology – allows customers to find the answer to simple queries on their own. In this way, they don’t need to escalate the situation to an agent, who can spend that time on more complex issues. When a customer does need to contact an agent, they have a number of options to do so.

With a choice of messages, calls, or collaboration tools, engagements take place in a natural manner, reducing the time agents spend per issue – directly impacting the first-call resolution ratio.

Case in point: Unblu for efficiency with large customer

With over 2.5 million annual customers, an Unblu customer had to deal with up to 200,000 service requests on their phone and email channels. To ease the load on these channels, and to better serve younger generations, the organization needed to supplement their current capabilities.

Solution: Alternate channels for simple support and advice

Before Unblu, the only options that customers had were to either email the organization or phone them. For more simple queries, this is very inefficient and wastes both the customer’s time and that of the agent.

Chatbots for simple queries

Chatbots act as an excellent first port of call, empowering customers to find answers to simple questions on their own. As a machine learning solution, the more they’re used the better they become, while also being easy to train and update by staff (even without technical expertise). In this way, they’re able to boost efficiency, while also aiding lead generation and product suggestions.

Live Chat to provide instant support

While chatbots are great tools, they do have limitations and can’t be expected to offer a full end-to-end experience for the customer. When an issue needs to be escalated, the Live Chat messaging bot allows the customer to get in touch instantly with a human agent.

External Messenger API (WhatsApp integration) for customer preference

Unblu’s External Messenger API integrated with WhatsApp to be present on customers’ preferred channel. As when communicating with friends and family, the customers don’t necessarily expect an instant response using this channel.

A customer can send a message, confident that the advisor will reply when they can – or have the system assign a deputy should the advisor be unavailable who will have all the relevant information to take over. For the advisor, this allows them to better organize their workload and deal with the queries that need instant responses.

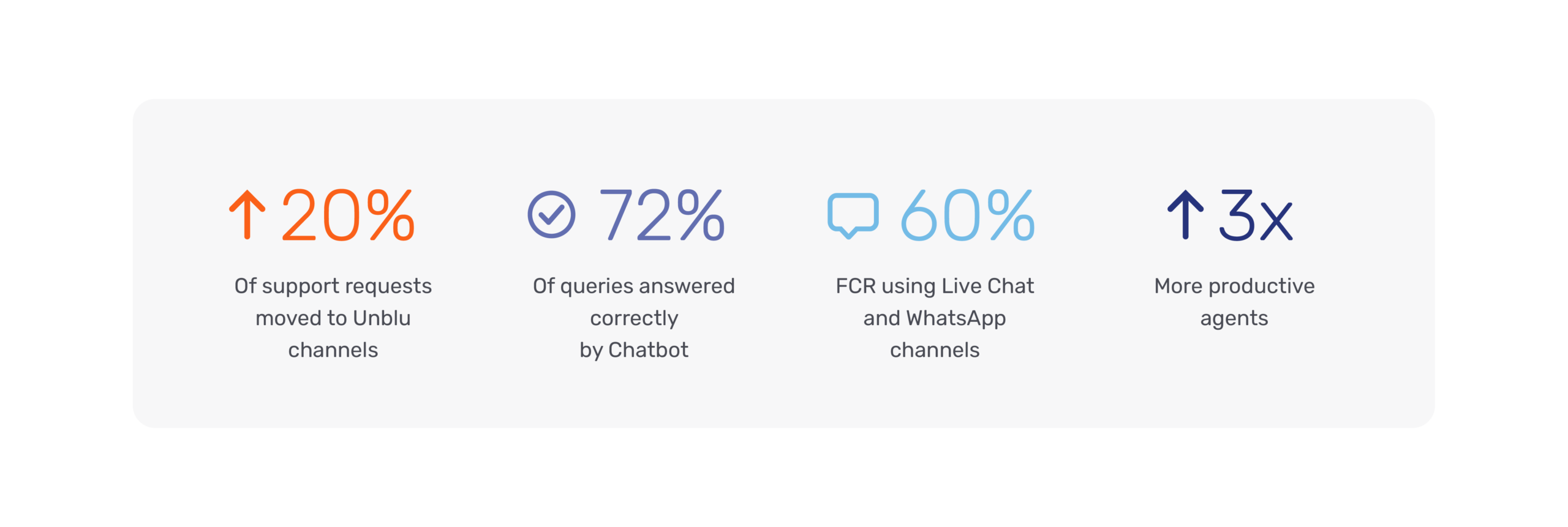

Results: A marked rise in efficiency

After implementing Unblu’s chatbot and messaging capabilities, the team saw over 20% of the support requests move to the new channels. The bot got the correct answers 72% of the time and they achieved almost 60% first contact resolution using the Live Chat and WhatsApp channels. Overall, the agents were three times more productive thanks to Unblu.

2. It improves customer engagement

Efficiency and engagement go hand in hand in a customer context. By offering a broader range of channels and collaboration tools, the increase in efficiency results in a more positive experience.

As a result, customers are more likely to engage more frequently and at a higher level with the service agents. With this increased engagement, agents can track the customer’s individual journey and offer advice or support exactly when the customer needs it.

This extends to even the most complex tasks, such as taking out a mortgage or any other large loan. The high-touch collaboration feature known as Co-Browsing empowers agents to deliver an experience that is as good as – if not better than – the in-branch one. No matter the level of complexity, agents can guide their customers and even interact with their screens (with permission), to take them through more difficult documentation and sign remotely.

Better engagement increases customer trust and satisfaction, making them more likely to become a brand promoter and reducing unnecessary churn.

Case in point: Boosting customer engagement with Kantonalbank

With around 100,000 clients, Kantonalbank prides itself on offering personalized, high-touch experiences that drive loyalty. Before Unblu, the bank identified a lack of visual collaboration to help them support clients over the phone.

Solution: PIN-based Co-Browsing for secure collaboration

In financial contexts, customers are more engaged when they have access to quality advice that meets their current needs. When more in-depth collaboration was needed, phone calls were falling short and Kantonalbank needed a new option for collaboration.

With PIN-based Co-Browsing, the agent will generate and send the customer a unique one-time number to access the session. This allows banks to ensure security while sharing and interacting with documents or browsing the internet together. With the ability to see everything that’s going on, customers are more engaged throughout and less likely to drop off the call.

Results: Greater efficiency – greater engagement

By offering better collaboration options, the customers were more engaged in the call and able to find a resolution more quickly. In an average month with roughly 200 Co-Browsing sessions (30% of total calls), Kantonalbank was able to reduce the call duration by 40% resulting in an average duration of six minutes.

3. It leads to more revenue

Satisfied customers are more likely to make additional purchases and the experience that customers have with basic products (such as current accounts) will influence if they’re happy to engage in larger products like mortgages.

Having a baseline positive experience is essential to increase the likelihood of additional purchases. However, banks still need to be present at the moment when customers are ready to make a transaction.

Unblu’s conversational software also achieves this, ensuring that agents and advisors are positioned to provide authentic financial advice the second customers require it. By spending more time with their customers, service agents can take on a sales role and increase conversion rates as a result.

Case in point: Unblu for increased revenue with Raiffeisenbank

Part of the RBI Group, the Prague-based Raiffeisenbank is the 4th largest bank in the 12 Central and Eastern Europe markets where it’s active and has a high digital adoption rate among customers. Raiffeisenbank partnered with Unblu to maintain their reputation as a top digital customer service provider.

Solution phase 1: Live Chat and Co-Browsing for improved efficiency

As in the first example, the initial goal was to improve efficiency by reducing the strain on other channels, primarily phone and email. In 2020, Raiffeisenbank integrated Live Chat into their service functionality and the solution worked as intended. However, while there was a reduction in phone calls and emails, there was an increase in inquiries overall.

To deal with this, the bank began training their chatbot to better deal with simple queries – while also implementing Co-Browsing to better deal with high-touch interactions.

Solution phase 2: Increased conversions

With an increase in inquiries, higher satisfaction levels, and access to better customer insights thanks to the new Unblu channels, Raiffeisenbank was in the perfect position to take advantage of upsell opportunities.

Through a mixture of insights from their CRM, prioritizing Live Chat on pages with high purchase intent, and identifying promising Live Chat conversations, agents were able to identify tailored products or services based on individual needs.

Results: More tailored offers and better conversions

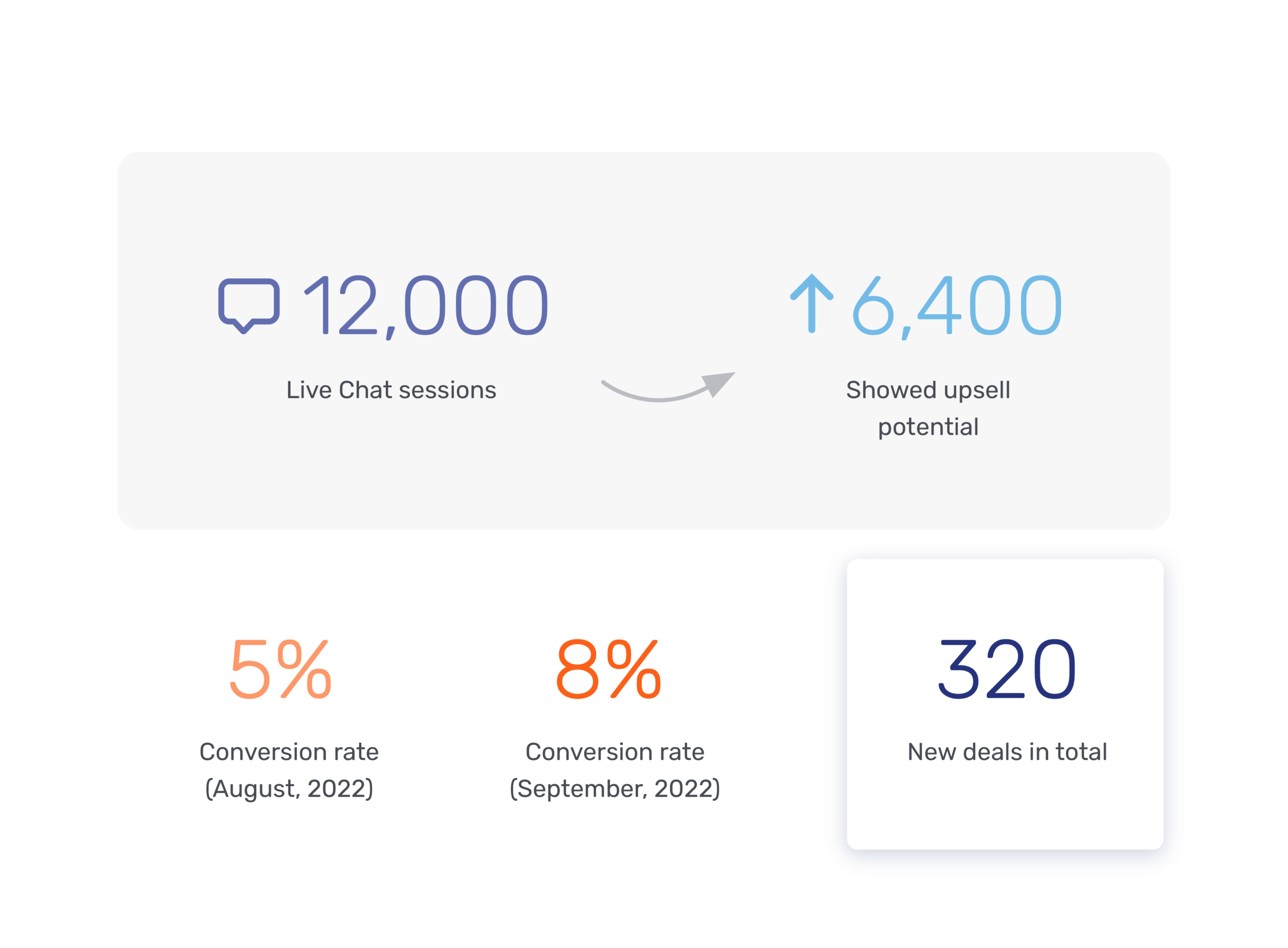

Out of 12,000 Live Chat sessions, the bank identified 6,400 that showed potential to lead to a new upsell conversion. Based on a 100% offer rate for every interaction, conversion rose to 5% in August, 2022 and 8% the following September – resulting in a total of 320 new deals.

Want to find out more about Unblu?

Unblu is a leading conversational engagement platform that’s fine-tuned for the financial services industry. Centered around three pillars – texting, video & voice, and collaboration – we help retail banks, wealth management firms, and insurance companies to provide faster, more secure customer service experiences.

Founded in 2008 in Basel, Switzerland, Unblu has been part of the Swiss Post Group since 2022, with subsidiaries in Germany, Bulgaria, UK, USA, and Canada. Over the years, we’ve served 160+ banks and insurance companies, empowering them to lower costs, secure more meetings, and increase conversions.

With seamless integration capabilities and a 90-95% client satisfaction rate, Unblu enables the ultimate in-person experience for online customer collaboration and advisory. Any time. Anywhere. And on any device.

Visit www.unblu.com to find out more.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice