A subsection of credit union members are more change-averse when it comes to service experience and updating how contact centers operate can represent a point of friction. At least, that is how it is often perceived.

The truth is credit unions can and must embrace conversational engagement – and doing so will not alienate certain members. A contact center that only uses traditional channels such as phones is unlikely to remain competitive and agile in the credit union market moving forward, particularly as younger member expectations evolve.

However, implementing newer channels such as chatbots, Live Chat, and Co-Browsing does not mean that members will be unable to reach agents by phone. In fact, it will make it easier for them to resolve their issues.

Why must contact centers embrace digital transformation?

The impulse of digital transformation for contact center operations isn’t just contained to the credit union landscape. It’s not just credit union executives – all financial services industry organizations and beyond need to embrace digital technologies for a multitude of reasons.

This could be because to address a poor onboarding process, encourage stronger digital banking experiences, to improve data management, increase conversion potential, or more. While these aspects also apply to credit unions, there are some areas in particular that are more pressing.

Attracting younger members

The World Council of Credit Unions claims that the average age of credit union members in North America is 53, which is the highest regional average around the world. It is essential to attract younger members to maintain a healthy union moving forward. But what younger generations expect of their financial institutions’ business models has transformed.

The Consumer Banking Preferences & Behavior Report claims that younger individuals value digital platforms and technological features in their banking service. It found that if you are under 45 years of age, you are twice as likely to be a member of an online bank – and are 2.5 times more likely to apply for a loan on a mobile app.

And these technology trends extend to the service experience that younger customers or members want. As McKinsey reports, there is a greater emphasis on digital channels and modern technology, with mobile being the preferred means of communication for most issues. For more complex or emotionally sensitive issues, there is an increased demand for real interactions.

What’s interesting is that in this search for genuine human support, trends show that the optimum experience is hybrid, scoring higher on effectiveness, ease, and emotion than digital-only or physical-only experiences. For this demographic, there appears to be a diminishing value placed on physical branches.

Reducing the strain on call centers

The direct member experience is only part of the puzzle when it comes to contact center support. To be capable of delivering upon changing expectations, digital solutions need to be incorporated and current practices need to evolve. The simple fact of the matter is that call centers are under too much strain to effectively meet member demands.

What needs to change

The solution to an overburdened call center falls at two ends of the service spectrum. Firstly, credit unions need to decrease the total number of phone inquiries by deflecting with a digital experience that includes robust self-service options and messaging support.

Then, for queries that need more direct involvement, they must also have access to high-touch tools that supercharge collaboration and provide a more satisfying online experience.

Low-touch: Conversational AI

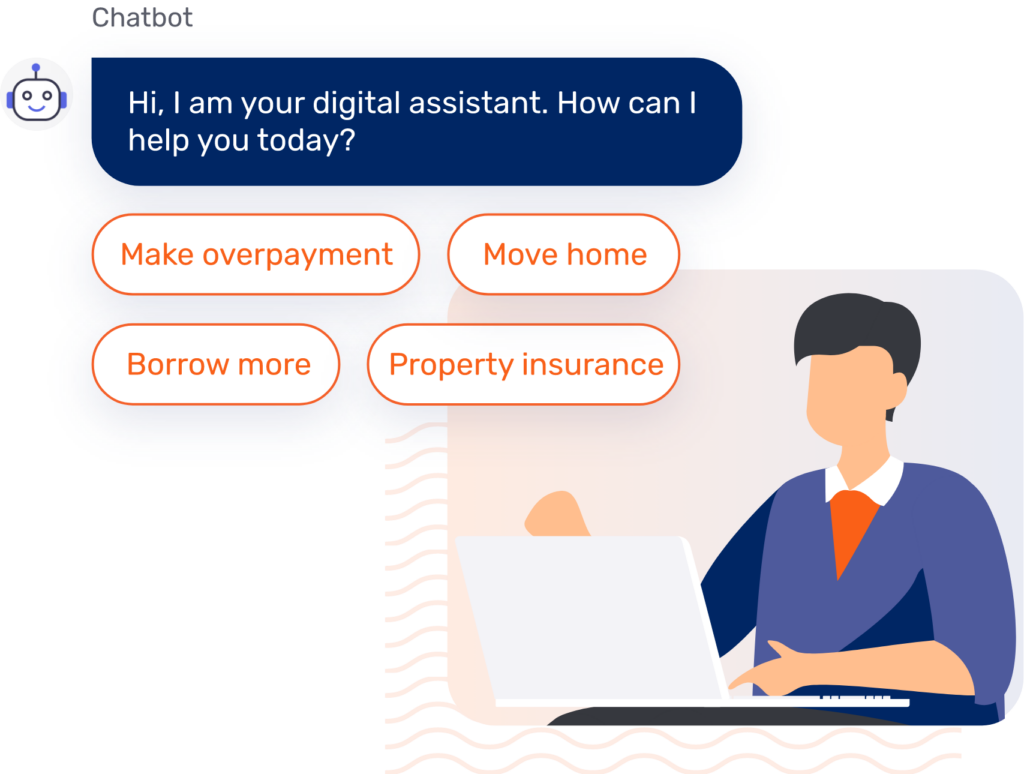

The low-touch solution to reduce call center strain is called Conversational AI, which is a mixture of self-service chatbots and Live Chat capabilities. By beginning the interactions with chatbot support, credit unions are able to implement a low-cost solution that frees up agents, while empowering members.

However, it’s also important to ensure that members can get in contact with a real, human agent whenever they need to. The Live Chat channels offer this support in a seamless way. When the member indicates that they need more direct intervention, the agent will join them in the chatbot conversation thread and can quickly understand the context.

Live Chat conversations have the further benefit of being twice as efficient as phone calls, with one agent able to manage at least two calls at the same time.

High-touch: Voice & Video and Collaboration

Not all issues can be resolved with chatbots or messaging channels. But when phone calls are necessary, agents shouldn’t feel restricted in how they offer support. Ideally, they should be able to offer an experience that is the same as – or better than – an in-person meeting.

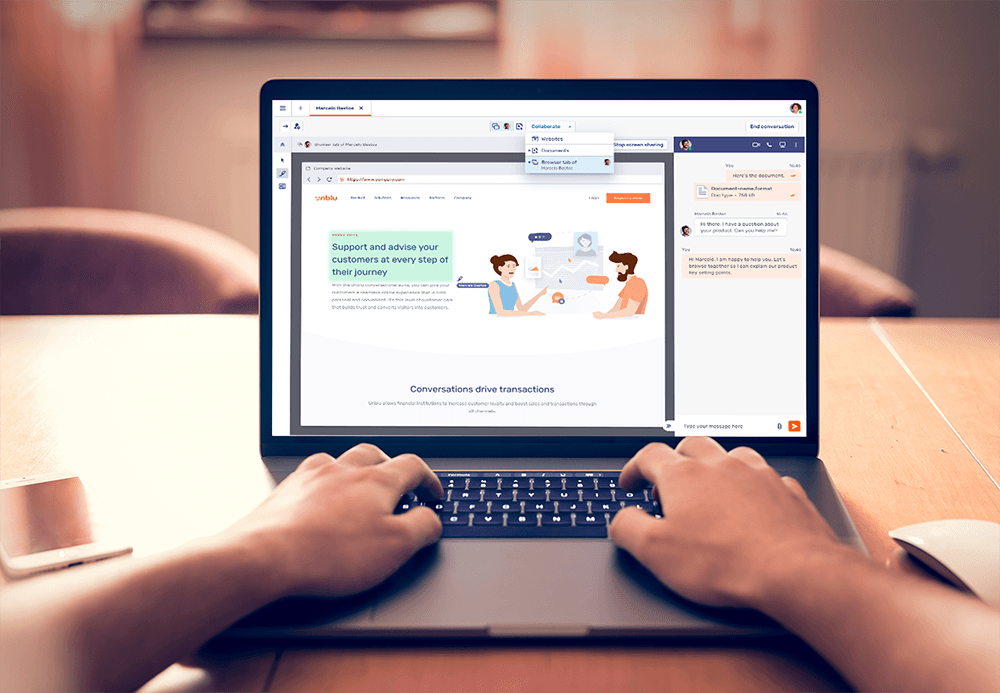

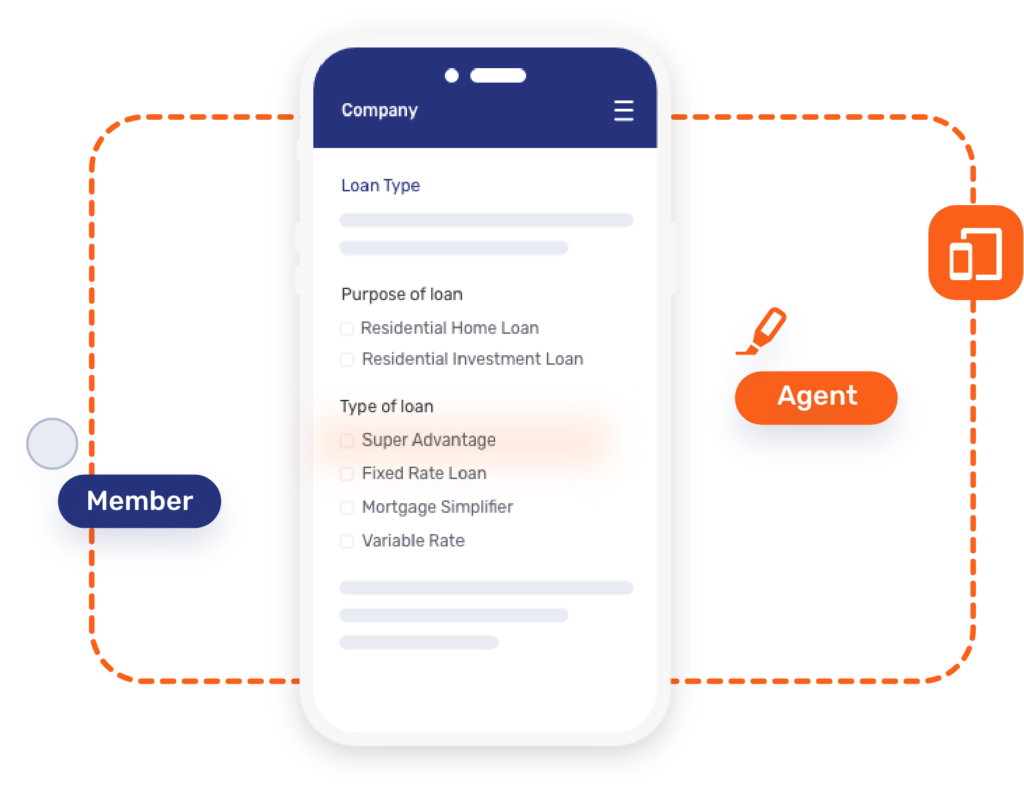

The solution to this is Co-Browsing, which augments phone or video calls by sharing the screen of the app, website, or document they are discussing. Unlike screen sharing, Co-Browsing offers the ability to discuss even the most complex issues, alongside the ability to get legally binding signatures.

The impact of digital transformation on members

The worry is that these new implementations may negatively impact members who are used to a more traditional means of communication. In reality, a conversational engagement strategy would also benefit them for a number of reasons.

Traditional phone lines are still available

It’s important to note that traditional means of communication with a strong human touch still remain. If a member would like to get in touch with the credit union by phone, they are able to do so. They should never be left without a means of direct contact.

Self-service channels are user friendly

There are few barriers to use for self-service chatbot channels, even for members who don’t feel comfortable with new technology. The individual simply has to write their issue into the chat channel and the system will guide them through to a resolution.

Opportunities for education

High-touch support such as Co-Browsing offers agents a more robust means of member support. Not only can they deal with the issue at hand, but agents can engage in proactive education to reduce repeat callers. For example, at the end of a call, the team of experts may show a member who doesn’t understand the chatbot, how it works. Then, the next time the member has an issue, they will be able to first leverage the self-service option.

A culture of innovation is essential

There are many reasons to embrace digital innovations – and more are continuing to stack up. All members, regardless of age, background, or other defining characteristics, deserve access to a support experience that works for them.

By delaying enacting changes for fear of alienating key demographics, credit unions are running the risk of alienating others. Instead, credit union leaders (and financial industry decision-makers as a whole) must act now. Elevate the digital member service experience and provide the level of personalized support that make credit unions unique.

Want to find out more?

Contact us today to request a demo and find out more about Mobile Co-Browsing technology

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice