Online meetings are an important part of the customer lifecycle and the benefits in terms of customer service experience and satisfaction are substantial. However, not all solutions are created equal.

It’s important, particularly for larger organizations in the financial sector, that there are a range of features – encompassing everything from calling features to tools to provide personalization options to secure storage and encryption of recordings.

So, what criteria should financial institutions be using when choosing a secure audio or video conferencing service?

1. Know Your Customer (KYC)

Sending your customers a link to join video conferences by email or Google Meet calendar invite tells you only one thing: That you know an email address that you think belongs to the user.

On that basis, your employees and customers can only have a limited amount of confidence that the person they are speaking with is actually the person they should be speaking with.

No passcode or other information also sent by email helps with this. If the email is wrong or someone has breached that person’s email, by whatever means, then this kind of setup is open to fraud. Thus, it’s debatable whether it is either secure or compliant to have financial services interactions based on this mechanism.

So, how to solve this dilemma?

- Host the video calls or virtual meetings in a secured environment, i.e. from a logged in portal or e-banking. You’ll need a secure meeting platform that can be fully integrated into your existing channels and features enhanced collaboration capabilities.

- Verify the identity of each participant in the call. Without automation in place this would be a cumbersome process for your employees.

2. Seamless customer experience

The popular options on the consumer market were designed for one-off interactions. You create a meeting, share the meeting link by email or Google Calendar invite (or alternative), have the call, and move on to the next. Some were even designed for an entirely different original purpose, such as to allow employees and teams to interact with one another inside an organization.

Either way, they were not meant to form part of a wider enterprise customer experience strategy and lack a number of key features, video conferencing tools, and security policies.

So, what happens when you’d like to have a secured conversation with an authenticated client to provide personalization options? The answer is probably that you will need another solution to cover that use-case.

Wouldn’t it be better to have a fully integrated set of digital tools and advanced features that can be combined into a single and seamless customer experience covering multiple journeys?

3. The limitations of screen share

Protecting customer privacy isn’t only about regulatory compliance. You have to consider the other implications of allowing your employees to interact with your customers using encryption-free digital tools. For example, most audio or video conferencing solutions also leverage screen sharing as a way for the participants to see the same thing, be it a document, browser, or application. Here though, you may have a problem.

What seems convenient inside an organization – such as using Google Workspace tools – can be dangerous when leveraged with external parties, like customers. For example, what happens if your employee were to share their desktop, which could have inappropriate materials, or other customer’s CID present. The most likely outcome is a simple lowering of trust with the customer exposed to this material, but worse, it could be used fraudulently.

The same goes for the customers sharing their screen with the agent. Do you feel comfortable with your employees being exposed to almost any customer information that they happen to be shown? These matters need to be thought about carefully especially in a financial services company setting.

Instead, it’s worth exploring options that go beyond screen sharing to leverage a collaboration tool that’s more secure, in-depth, and user friendly.

4. Ensure your solution is integrated

On the face of it you just need your advisors and staff to be talking to your customers every day, helping them to achieve their goals. However, in our experience it’s not always that simple.

You may need to tweak the customer journey with a configuration change that only affects this group of users or customers. On other occasions, you might want to introduce a bot into the conversation.

Then there’s the issue with omnicanality. It’s not uncommon for employees to also use other channels, like WhatsApp, with the same customers – which can lead to security issues.

What if you need to integrate an e-signature process, client onboarding, or access to chat history? What if the employee experience needs to be embedded inside your CRM or call center application?

All of these things can be done with a secure video conferencing platform that has been designed to flexibly adapt to a customer journey across channels and mobile devices. With a point solution remote calls, it might do that one thing well, but an integrated video conferencing service provider is essential for ongoing success.

5. Robust security features

Avoiding security issues needs to be a top priority for organizations – especially as three-quarters of organizations claimed to have suffered from one or more data breaches in the previous year. Any solution worth considering must of course have the latest industry standard encryption standards in place, based on proven, open standards. These are central features. In fact, they’re so important that it’s worth going a bit deeper though and truly considering how hardened the solution is relative to the requirements set by your regulator.

For example, if the solution is cloud based, can you be certain that the cloud operator (and its employees) cannot see or store the IP address of the call participants? If there is a risk, can it be mitigated by deploying certain elements on-premise, such as an IP proxy or your own TURN server?

Ideally, you should be able to use the secure video conferencing software in secure areas, even ones protected by two-factor authentication, like client portals.

6. Recording, encryption, and secure storage

Regulatory requirements demand that certain types of communication and storage are limited to certain geographies. For your chosen secure video conferencing app to be compliant with regulations, it must allow for regional routing and geo-fencing as well as recording.

This means you can pick a data center in your preferred region, store archives from different geographical locations, and restrict server-side processing to certain regions.

In fact, failure to properly record communications has led to billions of dollars in fines in recent years, highlighting the importance of using secure channels.

7. Adaptable to your brand

The popular options were not designed from the ground up to fit seamlessly into your customer journeys. In fact, they want to remain recognisable for what they are so that their brand enjoys the serendipity of the network effect.

This is not normally what a bank or insurance company wishes to do though. Instead, you want your customers to be thinking about you and what a great company and brand you are to work with, not your tools. Unblu is an enterprise software company, which means we don’t wish to be in the limelight with your customers.

We want to help you be successful, creating a win-win, which is why our platform is hugely customizable, from the colors, shapes, texts, logo, sizing, positioning and on and on. You can make Unblu look exactly how you want it and even change it based on where it is integrated in the customer journey.

Secure video conferencing solution with Unblu

At Unblu, our secure video conferencing platform is part of a larger omnichannel solution that’s designed to enhance customer service in financial organizations. It is the perfect solution that ensures a smoother experience that is also safe and compliant.

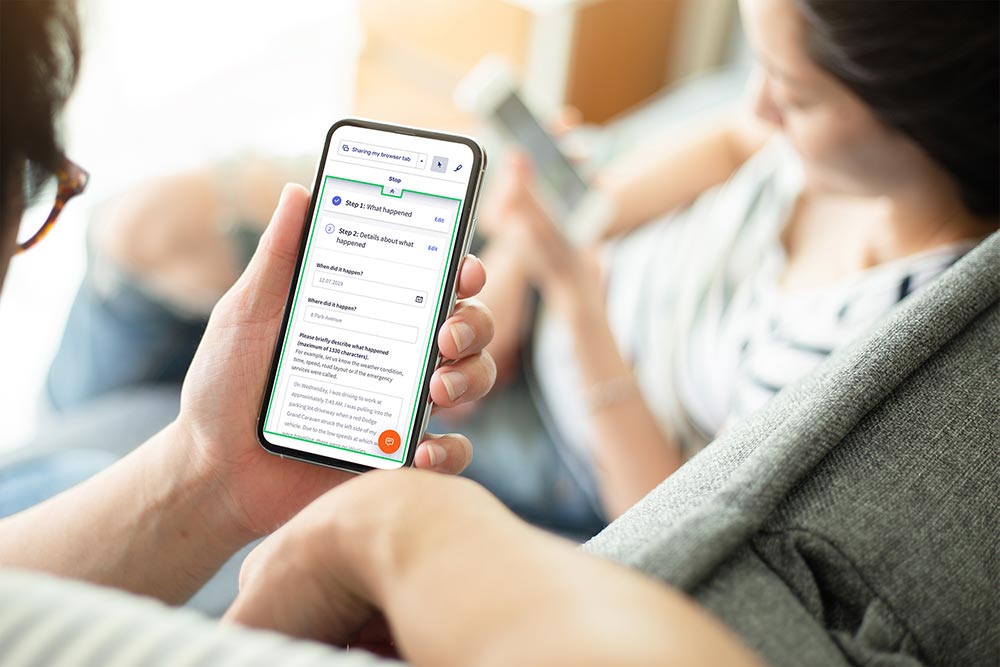

Our solutions feature everything from calling features and Co-Browsing to recording and secure storage of all interactions for robust cybersecurity and compliance measures. Customers can share documents with their advisors and make use of the vast range of tools with complete peace of mind.

To find out more about our secure browser based online meeting tool, reach out to us today.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice