The talk of physical branches being on the way out might be premature.

It’s true that the quality and availability of banking technology in recent years has taken its toll on bank branches around the world. In the UK, there’s been widespread branch closures, with around 60 closed every month at the time this article was written.

It’s the same story in the United States, where a Fox Business report predicts that all branches will disappear by 2034. The European Union is facing a similar threat, with World Bank statistics from across the continent showing an unmistakable downward trend.

Should we fight for bank branches?

The trend of closing bank branches is met with a varying response, depending on who you ask. Even by comparing two articles from the same publication, we can see the difference of opinion that is characteristic of the issue.

In 2019, one Forbes contributor wrote the article “Do Banks Still Need Branches? (The Answer Is No).” Four years later, in 2023, another Forbes author took a different view with the article, “It’s 2023. Do Banks Still Need Branches?”

Both articles agree on the trends, accurately claiming that all financial transactions can be carried out through digital banking channels, whether on a mobile device or a computer. The 2019 article uses this information to take a strong stance against banks, essentially arguing that they are superfluous and that findings on customer preferences are nonsensical.

The issue of trust

Perhaps it isn’t entirely logical, but the studies are clear. Customers do like seeing branches in their local area – according to an Accenture study of 49,000 banking customers across geographics and ages.

The more positive Forbes article argues that this is to do with that all-important human trait: Trust. Customers, in general, are happy to carry out everyday transactions on their phones. But not all customers. Many do still value having brick-and-mortar bank branches.

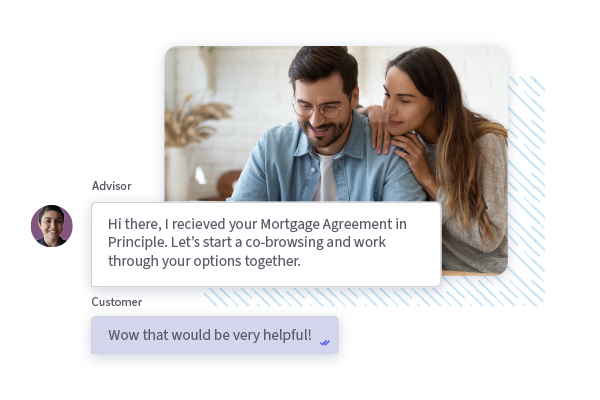

The same holds for more complex transactions. Conversational engagement software means that the entire process of taking out a mortgage or loan applications can be carried out safely and securely with online services. However, most customers still need the option of in-person support for a successful outcome, even if it’s just for the initial connection with all subsequent transactions taking place remotely. The point is, emotional connections do matter.

A new branch concept that works

Even if we acknowledge that branches still hold a valuable place in our local communities and in building relationships, the fact of the matter is that they can’t exist in the same form they always have. Digital capabilities have changed the game and the reduction in footfall means they’re simply not economically viable.

For banks, the question now arises: how do I provide the valuable service that customers require in a cost-effective manner?

There are a number of approaches, such as the Banco Santander “Work Café” initiative, which turns select local branches into hubs for community and entrepreneurial development. It’s an initiative that uses physical space in a new way to provide a level of service that offers a competitive advantage, while allowing for other activities.

Other approaches, however, involve blending the best of digital and in-person experiences to provide a hybrid branch that represents the best of all worlds.

Valiant Bank and Unblu Branch: Digital Branch 2.0

Based in Switzerland, Valiant Bank offers retail banking services for private individuals and SMEs. In line with global trends, the bank noticed a 35% decline in personal assisted transactions from 2014 to 2017, calling the viability of their physical network into question.

They began with cost-cutting measures, reducing the opening hours of branches until over half of them were open for just three hours a day. Even with these measures, the footfall wasn’t necessary to keep the branches in operation.

Expansion as a branch strategy

The bank knew it was facing the closure of their branch network if they didn’t radically shift their strategy. And that’s exactly what they did.

In 2016 and 2017, Valiant made the decision to expand their physical network with new branch openings in Romandie, Jura, and East Switzerland.

Considering the issue was low footfall, how would expansion work as a viable strategy? The answer lay in developing a streamlined physical design and introducing key digital elements to the in-person experience.

Cost-effective branch redesign

In 2015, the bank initiated the design process for their new digital branches, with the first test sites constructed in the two cities Brugg and Morges the following year. Several crucial considerations were taken into account to ensure the success of this endeavor.

To begin with, Valiant prioritized the cost-saving aspect of the branches. By adopting the modular approach that retail shops often use, they were able to create a design for the branches that used reasonably priced materials and could be easily built or transformed.

Embracing digital branches for a truly hybrid experience

From customer interviews, it was clear that individuals were receptive to having a digital setup within a physical environment. This was also a key part of the bank’s strategy as having a digital concierge, powered by Unblu Branch, meant that one agent could serve up to six branches.

The process is simple. When a branch customer enters the bank, they have the option to connect with an agent or advisor via a screen, ideally within a 20-second timeframe. Through the screen, the agent can interact with the customer from wherever they are based. If the customer requires more comprehensive assistance or wishes to discuss confidential matters, they are guided to a private room to continue the consultation.

For instance, a significant use case involved facilitating cash withdrawals for customers who did not possess debit cards. While a manned cash desk provided considerable value to these customers, it incurred significant expenses as an agent had to be physically present in each branch – not to mention the substantial costs associated with maintaining high-level security measures.

With the new setup, customers can call the digital receptionist, who directs them to a designated station for the secure identification process. Once the identification is complete, the agent remotely generates a QR code so the customer can withdraw money from the ATM.

Is the Valiant model the answer?

The question of bank branches and their future is not easy to answer and each financial institution will have to look at their own goals, customer preferences, and strategies to decide on a way forward.

That said, what is clear is that the Valiant digital branch model is viable across the three essential areas for bank branches’ continued health: cost savings, business growth, and customer service satisfaction.

Cost savings

Since the initiative was implemented, the branch has recorded significant savings in operating costs, stemming from initial setup costs and the agents themselves. For the setup, the modular system allowed them to reduce the cost from around CHF 3,000,000–4,000,000 for traditional branches to CHF 500,000–900,000 for the new ones.

As for the branch employees, having one agent able to service six branches means that there are savings across five physical bank branches as no agents are necessary there. In Valiant’s case, this represents a savings of 400k per year for every five branches.

Business growth

Retail bank branches can’t function indefinitely on savings alone – they also need to be profitable in the long term. In Valiant’s case, they have found that 50% of the digital bank branches’ revenue growth is coming from the expanded regions.

The new model has also allowed Valiant to welcome new advisors into the fold, who bring their current client bases and represent business growth for the bank.

Personalized service experience

The more cost-effective model has allowed the bank to provide an enhanced service experience with extended hours. The branches, which in some cases were open for just 15 hours a week, now have opening hours averaging 50 per week.

The average waiting time to be served is 60 seconds and there are around 10 branch visits per day, per branch. As Valiant continues to refine its in-house self-service digital channels and in-person capabilities for simple banking transactions or financial services, we can expect this to improve even more.

Finally, the general bank customer feedback has been positive, proving that Valiant’s strategic decision was sound.

Unlock a new branch experience with Unblu

Interested in finding out more about Unblu Branch and the Valiant case study? Please get in touch with us for a personalized demo to see how a hybrid branch can transform your financial institution’s service potential.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice