How does your bank or credit union compare to other financial institutions in terms of customer service? Are they offering new digital banking services that improve their customers’ experiences? What digital banking trends are impacting the way consumers interact with banks and credit unions today?

The dramatic shift in digital habits, behaviors, and technological capabilities has led to a tumultuous landscape filled with challenges and opportunities. Not only are traditional banks facing unprecedented competition from nonbank competitors and digital-only banks, but banks and credit unions are also competing against each other for consumer dollars. To further complicate things, the rise of mobile payments has led to increased competition between traditionally brick-and-mortar banks and online or mobile banks.

As these changes continue to unfold, traditional banks and credit unions must adapt to stay competitive. The future of banking lies in providing better active customer experiences through innovative solutions and strategies (Read Unblu’s post on customer experience trends in banking).

Although trends have been evolving over the last few years, an emphasis on digital transformation has been a common overarching theme. Banks and credit unions are well aware of the need to innovate drastically – but how well is the banking sector doing as a whole?

The current state of digital transformation in the banking industry

In 2024, 1% of banking decision makers claimed to not be interested in digital transformation at all, dropping from 6% the previous year. Likewise, 8% say they have no plans to implement an initiative, compared with 12% in 2023 (Forrester).

Even in 2025, the digital banking landscape shows room for improvement.

An estimated 60% of financial institutions are relying on legacy systems and claim to still be in the early stages of their digital transformation initiatives.

This makes it highly difficult for them to provide a competitive edge on more established competition or a wide range of consistent experiences. In all likelihood, these players will fall behind the pack (Digital Banking Report).

What’s more, as AI and data analytics become more powerful, 42% of bankers are turning to digital banking solutions as their highest investment priority. In total over 53% of banking decision-makers say they want to improve their digital transformation efforts with advanced financial technology – which is an increase of 20% since 2021.

Part of the reason for this shift in priorities is because, aside from a few organizations that are lagging behind, the financial industry as a whole has reached digital maturity. These initiatives are being used by 77% of survey respondents in the Digital Banking Report to increase revenue. However, there is also a strong focus on customer experience improvements, cost reduction, increasing operational resilience, and strengthening regulatory compliance.

Digital banking market analysis

According to Forrester’s January 2025 insights, digital banking is entering another transformative phase – driven by demands for human-like, integrated, and empowering experiences (Forrester). In 2024, a majority of consumers across markets relied on mobile apps as their primary channel: 65% in the US, 68% in the UK, and 73% in Australia said they expect to complete any banking task via app (Starthub).

Forrester also highlights a rising trust-value flywheel: about 72% of UK adults and 64% of US adults trust banks most to safeguard their personal data, which is a level unmatched by other sectors (Forrester). This trust enables richer personalization and deeper engagement as banks can more confidently offer data-driven recommendations and insights.

Key trends at a glance

Strategic takeaways

- Mobile banking is now the default. With most banking tasks expected to happen in-app, banks must prioritize seamless mobile experiences, not as an afterthought but as the primary service channel.

- Trust enables personalization. High levels of consumer confidence in banks securing their data not only foster loyalty but unlock opportunities to deploy anticipatory services, whether insights, nudges, or tailored advice.

- Conversational UX is accelerating. AI-driven interfaces that feel natural, intuitive, and emotionally aware are no longer futuristic aspirations but 2025 essentials. Conversational banking is poised to become mainstream this year.

In 2025, digital banking isn’t just about having an app – it’s about building trust, enabling real-time personalization, and offering seamless, intelligent experiences that feel intuitive and human. The banks that succeed are those combining modern infrastructure with a data-conscious, customer-first mindset.

Digital trends and demographic shifts

The digital transformation in banking is redefining how different generations perceive and interact with financial institutions. For younger demographics like Gen Z and Millennials, convenience, speed, and self-service are front and center.

That’s not to say Gen X and Baby Boomers aren’t embracing digital banking – they are! However, there is greater demand for clarity, trust, and accessible support. The Boomer generation is increasingly happy to carry out routine tasks like checking balances or transferring funds online. But when it comes to more in-depth scenarios, they still expect access to human advisors.

In fact, the desire for real-time, human support remains strong across all age groups (MX.com). Gen Z and Millennials show high preference for Live Chat (53% and 42%, respectively, also favor finding answers online), while Baby Boomers still lean toward in-person or phone support. However, all groups ranked Live Chat and call centers among their top choices.

The future banking trends already in progress

Given the above market analysis and the ongoing trends – what are the current trends defining the future of digital banking?

1. Omnichannel and mobile-first or you don’t exist

The number of digital banking users continues to rise. As with previous years, the key trend towards mobile has reached a stage of almost complete ubiquity, with a mobile banking experience being essential to meet minimum expectations.

One report found that, “Customers’ account holders log in, on average, 20-22 times a month, and digital touchpoints have become the most important engagement channel that account holders have with their financial institutions” (Digital Banking Report).

However, offering a mobile banking app is a baseline requirement and does not guarantee customer satisfaction in general. A Forrester report found that a decrease in customer experience quality is threatening traditional banks profitability (Forrester).

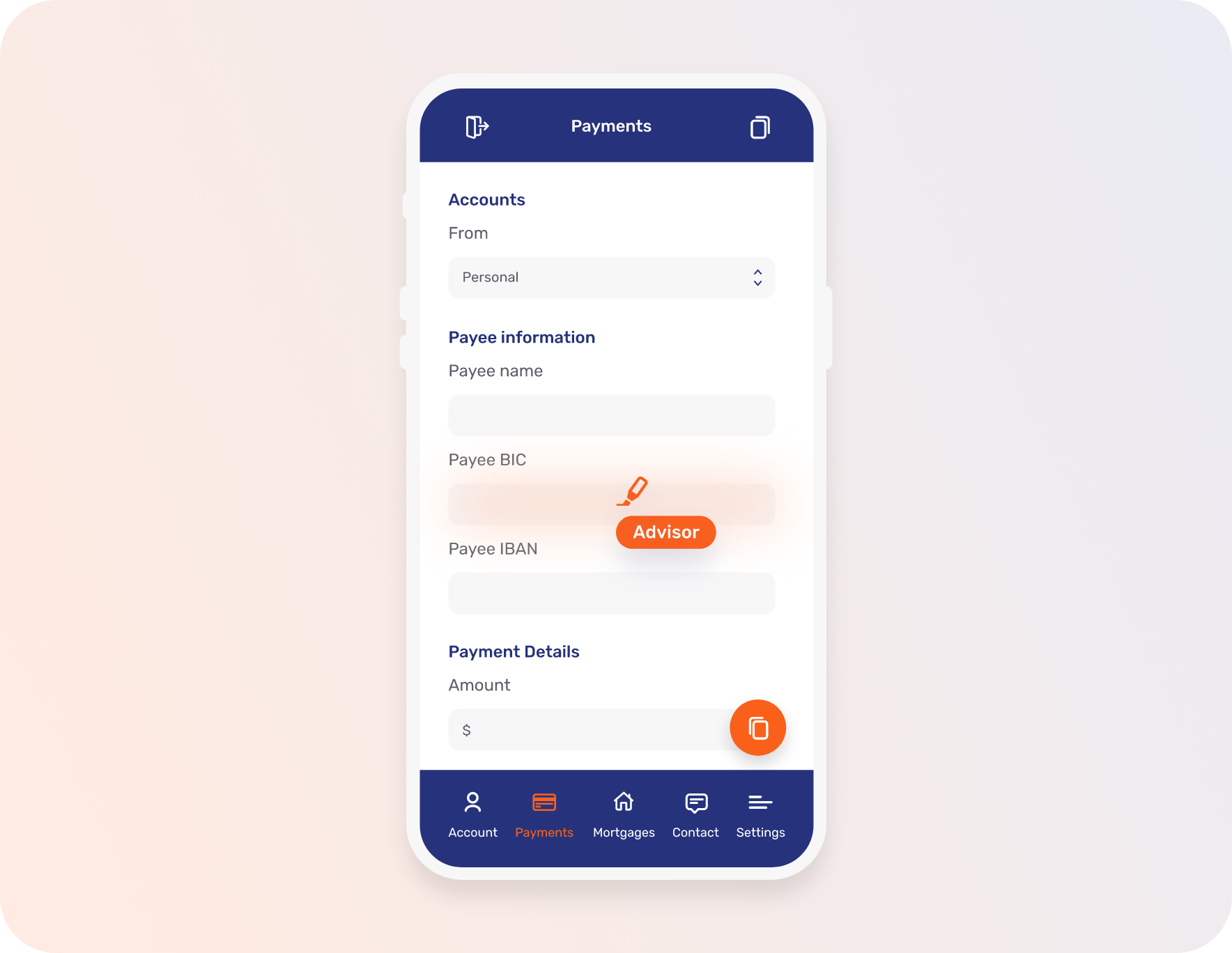

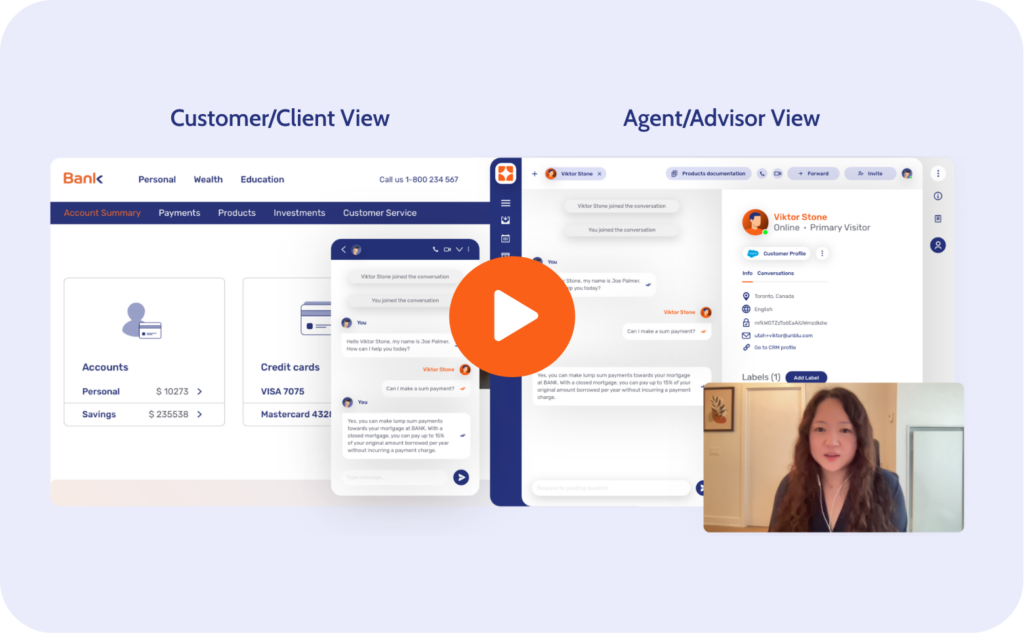

The frontlines of mobile banking success have moved to the quality of the service experience, with more emphasis needed in delivering on customer expectations within that environment. One method to doing this is equipping agents with Co-Apping. This snative in-app collaboration experience empowers the agent and customer to carry out research, browse the app together, or look at documents in real time.

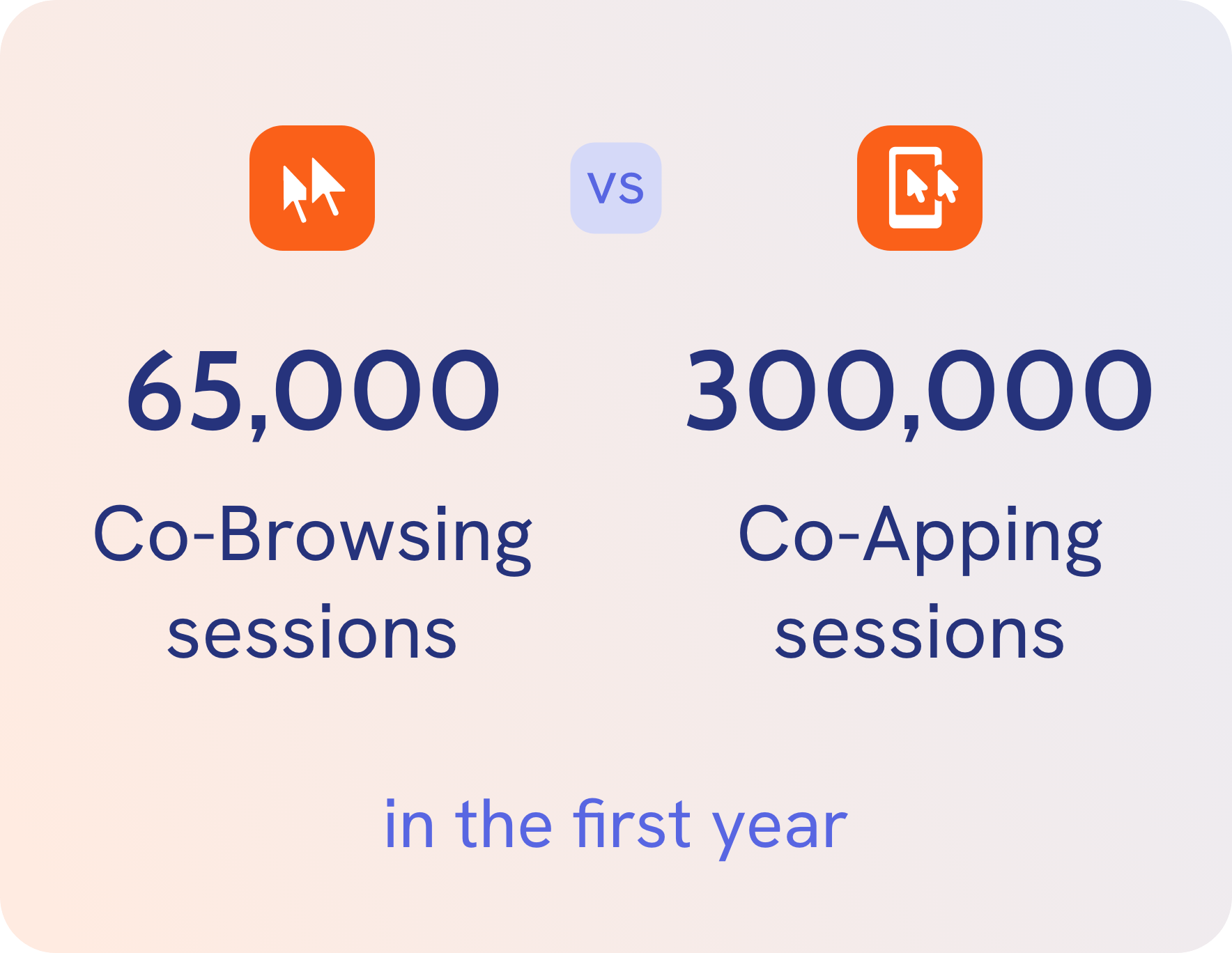

One Unblu customer has had great success with this, initiating 300,000 Co-Apping sessions in the first year, compared to approximately 65,000 traditional Co-Browsing sessions in the same timeframe.

This omnichannel approach should extend to physical spaces as well as online channels, resulting in a hybrid approach that merges in-person and online experiences. For more information, see our ebook on the Branches of the Future.

Want to find out more?

2. Self-service options should aid agents too

Customers have high expectations of what online services should allow them to do. Not only do they want to be able to communicate online via self-service options, but they want to be able to do it exactly at the time of their choosing.

Furthermore, when a digital banking platform doesn’t meet their needs, they want the option to speak to a real person – something that is proving to be a sticking point in service offerings.

A reported 61% of bank customers have claimed to contact agents because they were unhappy with chatbot resolutions (Capgemini World Retail Banking Report).

The enormous developments with regard to Generative AI is making this poor experience more of a rarity for customers. As the technology continues to improve, we can expect this number to drop.

However, there are still areas for improvement, particularly regarding how the technology is implemented strategically. One barrier to success is the employee experience within the structure of the organization when it comes to manual tasks or routine tasks. According to one report by Capgemini, staff allocate, “nearly 70% of their time to operational activities, leaving only 30% for customer interactions”.

The employees themselves believe the problem is due to contact center automation and digitalization, which they rated as low to moderate (Capgemini World Retail Banking Report).

3. New opportunities with Generative AI

Generative AI is now officially the standard around which all organizations must rally, having become a vital part of the customer service offering. We predict that this will only increase in years to come.

For example, the advanced technology is expected to increase productivity by 22-30%, while boosting revenues by 6% (Accenture).

In banking specifically, the dominant use cases in the retail banking industry will include automating loan underwriting for up to $250,000 and reducing credit card delinquency rates by 32% (Deloitte).

Generative Artificial Intelligence will also improve financial industry adoption. Deloitte found that when it comes to personalized financial product recommendations, AI can help increase click-through rates by five times.

However, the flip side of this reality is that specialized human support will become even more in demand in certain areas. Deloitte claims that, “Generative AI shifts the role of human workers towards oversight, design, and customer engagement, while scaling processing capacity at a fraction of the cost” (Deloitte).

We have seen this with the Italian bank BPER, which took a hybrid approach as a strategic linchpin. As a result, cross-sell conversion rates increased by 65% when an agent was present, moving from just 10% with a fully tech user experience to 75% with a bank employee (BPER).

4. Improving customer engagement is a must

Financial services industry clients who meet with their advisors more than four times a year are twice as likely to feel optimistic about their financial situation, which helps boost retention in firms (VouchedFor).

However, primary banks in general appear to have poor engagement and retention strategies in place. According to one report, many are struggling to maintain (nevermind build) customer relationships after the initial bank account sign-up. The report claims that, “Banks risk building leaky buckets through the front door but silent attrition out the back” (Digital Banking Report).

To address this, 98% of banking consumers point to prompt responses to queries as the answer. Currently, only 58% believe that their financial organization achieves this, demonstrating the gap that needs to be closed (Unblu).

Another area that can improve satisfaction is, as previously mentioned, improving the experience for transactional features, particularly on online banking and mobile banking channels (Read Unblu post on retail banking trends for more information).

When asked for feedback, over 60% of customers rated advanced features as “average,” underscoring a need for improvement in usability and convenience (Digital Banking Report).

5. The race is on to rebuild trust

With 61% of consumers now claiming to prioritize trustworthy information over other considerations, it’s becoming clear that trust is intrinsically tied to customer loyalty (The Financial Brand).

To a certain extent, the main driver of mistrust is a byproduct of bank’s successful efforts to digitalize their experiences, particularly a lack of emotional connections. According to Accenture, while this has increased convenience, the experiences have “become functionally correct but emotionally void.” The result is that 42% of consumers find it hard to distinguish between financial services brands, which weakens loyalty as a result Accenture).

It’s not bad news for all institutions. National banks, for example, are perceived as more trustworthy than local ones, with 58% of consumers trusting the former and 42% opting for the latter (Kantar).

Digital banks can also struggle on the trust front as it can be difficult to speak with human agents.

While emotional connections are the primary issue, generational digital divides also still exist. Both millennial and Gen Z respondents are more likely to have lower levels of trust in financial institutions in general. Gen Z tends to opt for more robust digital experiences and financial incumbents need to update their approaches to attract them. This may also involve leveraging social media on platforms such as YouTube for financial education, etc. (The Financial Brand).

Regaining this trust is a matter of establishing meaningful relationships that put the customers’ needs first. Given the service expectations among customers, this would inevitably require innovative tools that prioritize the right level of support, depending on the situation. Furthermore, customers would need to be able to contact real human agents whenever necessary. The fact is, in banking, an empathetic customer relationship is especially important as banking customers need to feel a sense of trust with those who manage their finances.

Despite economic uncertainty, there are signs that banks are beginning to regain some trust. A global Statistica report found that customers award their banks around four index points out of five for trust (Statistica).

The final word: Where are we in 2025?

The banking industry’s greatest changes from this year to last are certainly linked to the developments in Generative AI and improving digital growth. While banks need to be careful when it comes to risk assessment and risk management, the opportunities to differentiate their financial products, digital platforms, and customer service offerings is immense.

We have seen promising advancements in digital banking experiences with more digital solutions impacting the customer journey. The focus has moved from completing digital transformation to honing initiatives and finding new areas of opportunity.

Overall, along with ensuring robust security measures, the source of these opportunities appear to be rooted in customer centricity, whether personalized experiences, enhanced digital technology, or more. Customer expectations remain high and so providing elevated experiences for customers through personalized services will help banks secure or claim market share.

Want to find out more?

Watch the demo here.

.png)