2024 update: We published this post in 2023 based on financial sector trends to identify the impact they were having on customer experience in the digital banking landscape. As a year has passed since the original publication, we thought it would be interesting to analyze the trends and predictions to see how they have developed, and what’s in store for 2024.

How does your bank or credit union compare to other financial institutions in terms of customer service? Are they offering new digital banking services that improve their customers’ experiences? What digital banking trends are impacting the way consumers interact with banks and credit unions today?

The dramatic shift in digital habits, behaviors, and technological capabilities has led to a tumultuous landscape filled with challenges and opportunities. Not only are traditional banks facing unprecedented competition from nonbank competitors and digital-only banks, but banks and credit unions are also competing against each other for consumer dollars. To further complicate things, the rise of mobile payments has led to increased competition between traditionally brick-and-mortar banks and online or mobile banks.

As these changes continue to unfold, banks and credit unions must adapt to stay competitive. The future of banking lies in providing better active customer experiences through innovative technologies and strategies.

Although trends have been evolving over the last few years, an emphasis on digital transformation has been a common overarching theme. Banks and credit unions are well aware of the need to innovate drastically – but how well is the industry doing as a whole?

The current state of digital transformation in the banking industry

The digital impulse is continuing to cause a stir in financial organizations, making transformation a matter of urgency. For the frontrunners, the “new normal” phenomenon is an opportunity to harness digital tools and reinvent the customer experience – a prospect that had been on the horizon for some time.

2024 update: The emphasis on the “new normal” is fading to simply being the “normal”. This year, most banks have reached an acceptable level of digital maturity. Now, the focus is shifting to continuous digital transformation. Over 53% of banking decision-makers claim their organization is working on improving their digital transformation efforts – that’s up 20% since 2021 (Forrester).

So, how does the financial services industry stack up when it comes to digital transformation? At present, financial trends show that 35% of global banking executives say they are pushing forward with digital initiatives and related buying decisions. On the other end of the scale, 12% of these decision-makers only have plans to execute their transformation, and 6% say they have no immediate plans to do so at all (Forrester).

2024 update: In 2024, 1% of banking decision makers claim to not be interested in digital transformation at all, dropping from 6% last year. Likewise, 8% say they have no plans to implement an initiative, compared with 12% in 2023 (Forrester).

Considering the dramatic shift in consumer expectations, these numbers are surprising. Trends are clearly showing that customers want their financial services to be digital. Most importantly, according to Forrester’s data, this is a ubiquitous, global phenomenon. After surveying customers with online banking around the world, they found that 77% of Canadian customers, 71% of US customers, and 69% of Spanish use it at least every month (Forrester). The trend is undeniable and a higher proportion of financial institutions need to seriously consider investing in full digital banking transformation initiatives to adjust to this new reality.

However, in a banking context, transformation is a slow, complex process that presents sizable challenges for institutions. In order to succeed, they must first understand customer trends and expectations to identify the areas that are most important to ensure a winning customer service experience.

2024 update: Consumer expectations remain digitally focused. While the primary objective (according to 77% of decision makers) is revenue increase, the secondary goals reflect this continued trend: reducing costs, increasing operational resilience, and strengthening regulatory compliance.

1. Omnichannel and mobile-first or you don’t exist

Immediate accessibility is a strong characteristic of customer service expectations across all industries and banks have been forced to respond. This explains the increasing focus on mobile banking apps in the sector – and its proving popular. A recent survey found that around 89% of banking customers use mobile banking, and when you zero in on Millennials that rises to a staggering 97% (Insider Intelligence).

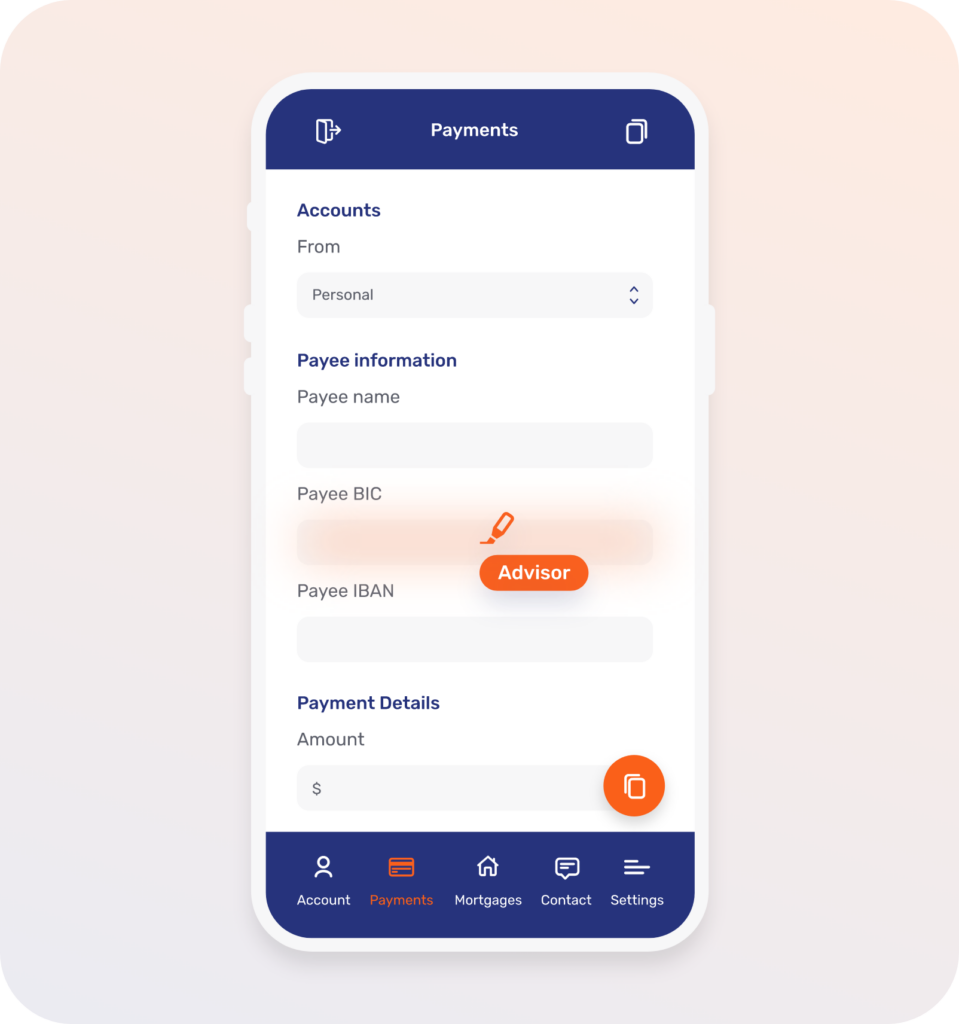

2024 update: Mobile banking continues to be popular but service options are more limited when compared to desktop alternatives. We predict that Mobile Co-Browsing or Co-Apping will thrive in 2024. One Unblu customer has had great success with this, initiating 300,000 Co-Apping sessions in the first year, compared to approximately 65,000 traditional Co-Browsing sessions in the same timeframe.

However, mobile apps alone aren’t enough to satisfy ever-expanding expectations. To provide a holistic service, banks need to provide multiple engagement options, from self-service platforms to face-to-face interactions with customer service agents. What’s more, this includes maintaining offline channels alongside developing new online ones. Although 24% of consumers expect to visit a branch less often in the future, 82% still say they view the presence of a local branch as extremely or very important (EY).

2024 update: Branch closures may begin to ease off as consumer needs fall in line with branch availability. JD Power reports that 72% of respondents will use their local branch at the same rate that they did the previous year, and 38% claim physical branches are essential (JD Power).

The future of branches is still in the balance, however. A number of models are emerging to overcome these challenges that banks will need to embrace.

Want to find out more?

Read the full case study here,

For banks and traditional financial institutions, it’s essential to quickly embrace this omnichannel user experience and supplement offline support with online options. Of course, providing a solid omnichannel experience will inevitably require overcoming technological limitations.

In many cases, creating entirely new digital architecture or proprietary tools is time-consuming, expensive, or simply overwhelming. Instead, to meet current expectations, many financial institutions are turning to solutions that integrate easily with their existing digital architecture, whether that’s an e-banking portal or a mobile app. Provided they are configurable and customizable, each bank can benefit from the functions they need and ensure the consistency of their brand image.

2. Self-service options fall flat without hybrid support

Customers have high expectations of what online services should allow them to do. Not only do they want to be able to communicate online via self-service options, but they want to be able to do it exactly at the time of their choosing. Furthermore, when a digital banking platform doesn’t meet their needs, they want the option to speak to a real person – something that is proving to be a sticking point in service offerings.

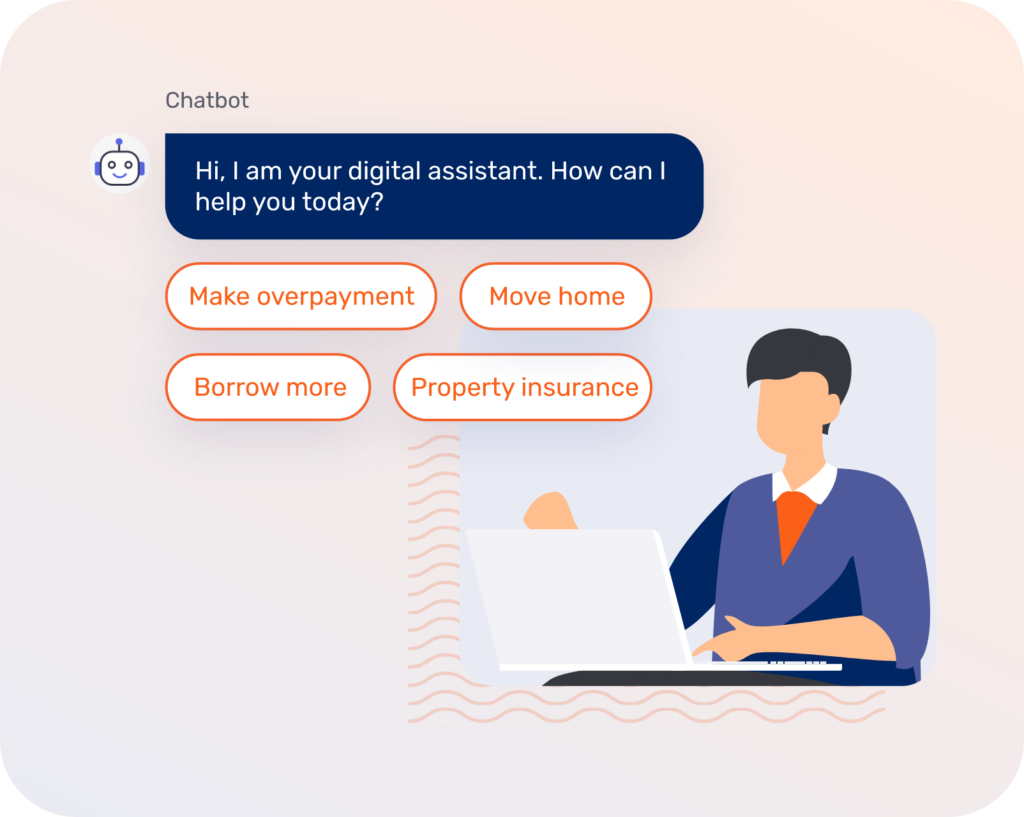

There’s no doubt that the rise of artificial intelligence (AI) has transformed the capabilities of modern customer services. Even so, as anyone who has interacted with a chatbot will know, the technology is unable to provide a holistic service. For more complex issues, customers still prefer having a human on hand to offer the emotional reassurance necessary in certain financial contexts. No AI, no matter how advanced, is able to emulate the strong customer relationships that can only be built through face-to-face interactions.

These were the findings of a recent Deloitte survey, which looked at customer preferences with regard to chatbot and human-led interactions. The survey found that customers are more than happy to use automated or AI-driven digital channels for simple online banking activities. However, when it comes to high-touch customer service interactions that deal with more complex products and services – such as mortgages and financial advice – real human agents are essential (Deloitte).

These findings were backed up by Forrester, who claimed that hybrid experiences scored higher on effectiveness, ease, and emotion than their digital-only or physical-only counterparts (Forrester).

2024 update: There have been enormous developments on this front with the rise of Generative AI. Yes, having human support is still essential but chatbot capabilities have leapt forward and we are simply in a new era of what’s possible.

At Unblu, for example, our Conversational AI offering leverages Gen AI to draw on existing knowledge bases with LLMs, use the bot trainer assistant to create better intents, and increase Live Chat efficiency (Unblu).

3. Artificial intelligence plays an important (but limited) role

AI and automation is now a main staple of customer interactions and can be found in diverse business sectors. The finance sector is no different.

Almost all traditional banks currently use AI to a certain extent or have plans to do so in the next three years. These plans stretch across all business areas, ranging from operations to customer support teams. Looking more closely at the numbers, 17% plan to focus on personalizing investments, 15% on credit scoring (15%) and 13% on portfolio optimization in the next one-to-three years (Economist).

Another critical aspect of AI in customer service is the use of chatbots. As the most visible and frequently-used self-service option, bank customers have regular exposure to chatbots. However, their performance has fallen short of initial expectations as poor customer service experiences have left a lot to be desired. Banks and Credit Unions need to start balancing automation and human advice by looking at the intent of the customer and its complexity.

In contrast to a 66% satisfaction rate with online chat technology (which connects customers to a human customer service rep), a mere 26% of customers were satisfied with AI-powered chatbots (The Financial Brand). Furthermore, over 80% of customers who have used chatbots for product inquiries in the last 12 months wouldn’t want to use them again – and 46% said that they’d prefer to use branches (Deloitte).

While customers have started using smart speakers for basic banking activities, Forrester research shows that banking customers remain wary of voice assistants. To a certain extent, this is a matter of familiarity. The more banks experiment with voice assistants and incorporate voice into their digital experiences, the more customers appear to be using them.

However, the trend still shows that people only trust them for routine banking tasks. In 2021, 30% of US online adults with a bank account used a smart speaker to check their bank account balances. In the UK, the same percentage report having sent money to another person using one, and 22% of respondents in Canada have transferred money between their own accounts (Forrester).

2024 update: The above paragraph relating to Generative AI is true here as well. However, it is worth noting that there are also risks associated with the new advanced technology. Gen AI exploded onto the scene quickly and became hugely popular. But the tech is still in its infancy and that means enhanced risk.

Forrester predicts that at least eight neobanks and two incumbents will experience a disaster related to the technology that will put them in front of regulators (Forrester). It only takes one rogue employee or a negligent third-party collaborator to expose them to risk.

This may be breached copyright, leaking customer information, bias-related, or more. Gen AI should certainly be embraced – but in defined use cases and not without extensive due diligence.

4. Improving customer engagement is a must

With so much competition, including outside fintech companies and Big Tech, customer loyalty is more difficult than ever to achieve and retain. However, it’s an area that remains as important – if not more so – as attracting new clients.

As we’ll discuss in the next section, trust is lower among finance institutions than in previous years and improving customer retention rates is no easy task. According to the research, the key to success in this area lies in enhanced communication capabilities, which includes expanding channel options.

Take the onboarding process for example. A J.D. Power report found that if the customer receives up to seven messages in the first six months, satisfaction increases (The Financial Brand). The same rise in satisfaction due to communication can be seen in a wealth management context. Clients who meet with their advisors more than four times a year are twice as likely to feel optimistic about their financial situation, which helps boost retention in firms (VouchedFor).

2024 update: In 2024, the concept of customer engagement is closely associated with emotions.

This is why we are highlighting customer-centricity as the main focal point of 2024. Forrester predicts that “empathy” and “dependability” will be the desired emotions that will lead to tangible benefits such as engagement – alongside willingness to forgive, and overall brand loyalty (Forrester).

5. The race is on to rebuild trust

In traditional banks, trust is at an all-time low, especially among young people who don’t believe their financial providers prioritize their needs. Overall customer satisfaction, with regard to the quality of guidance and advice provided by national and regional banks, is 30 points lower on a 1,000-point scale than the previous year – according to the J.D. Power 2022 U.S. Retail Banking Advice Satisfaction Study (J.D. Power).

There’s also a noticeable move away from traditional banks, with 37% of banking consumers claiming that they trust a fintech brand the most. This leads traditional banks, who only received support from 33% of the respondents, with wealth management firms trailing at 12% in terms of trust (EY).

Regaining this trust is a matter of establishing meaningful relationships that put the customers’ needs first. Given the service expectations among customers, this would inevitably require innovative tools that prioritize the right level of support, depending on the situation. Furthermore, customers would need to be able to contact real human agents whenever necessary. The fact is, in banking, an empathetic customer relationship is especially important as banking customers need to feel a sense of trust with those who manage their finances.

While strong communication capabilities are essential, both protecting customer data and being seen to do so should be a key consideration for all financial institutions. In fact, between 14% and 18% of customers from all age groups name this as their top consideration (EY).

After security, customers care about the quality of the product and services offerings, followed by simply being heard. Feeling valued by their financial institution is a cost-effective and much underutilized differentiator in banking contexts that has genuine business implications. A Forrester report showed that 92% of banking customers who feel valued plan to stay with their current brand. What’s more, 87% of this group plan to purchase more and the same percentage will actively promote the brand (Forrester).

2024 update: Despite economic uncertainty, there are signs that banks are beginning to regain some trust. A global Statistica report found that customers award their banks around four index points out of five for trust (Statistica).

Much work still needs to be done, however. National banks, for example, are perceived as more trustworthy than local ones, with 58% of consumers trusting the former and 42% opting for the latter (Kantar).

Generational divides also still exist. Both millennial and Gen Z respondents are more likely to have lower levels of trust in financial institutions in general. Gen Z tends to opt for more robust digital experiences and financial incumbents need to update their approaches to attract them. This may also involve leveraging social media on platforms such as YouTube for financial education, etc. (The Financial Brand).

6. Collaborate or fail – embracing tech rivals

For years now, new players have been entering the financial service market and drastically altering the landscape. Whether fintech startups or non-financial digital brands that are moving into the space, there has been a rise in faster, cheaper, and often higher-quality services. Incumbent banks were initially taken off guard and forced to accelerate digital transformation initiatives to achieve the same level of customer experience.

However, the technology powering the new players is complex and multifunctional, extending from mobile and cloud to application programing interfaces, real-time data, and flexible architecture. With these capabilities, they’ve been able to build broader platforms and ecosystem businesses. For traditional banks, it’s proving challenging to compete on these terms.

Banking is at a transformation crossroads and time is of the essence. Many banking CEOs are realizing this and are moving to find means of collaboration, rather than straight competition. By working with fintech startups or Big Tech companies, banks are in a good position to leverage the strong market presence that they do still occupy, while building more dynamic ecosystems.

These collaborations have been in place for years already, with the number of interbank ecosystems almost doubling since 2014 (Deloitte). Looking to the future, we can expect to see more collaboration between the distinct market players.

2024 update: Collaboration remains a key strategic necessity for incumbents and much of the above is still true. A clear example of this is the increased uptake of open banking.

Although the EU PSD2 directive has been in force at a Union-wide level since 2018 (EU), the Swiss “Memorandum of Understanding” emitted by Swiss Bankers Association (SBA) means banks in that country will also have to follow suit (Swiss Banking).

The prevalence of open banking can be seen as a challenge to traditional banking institutions who have lost a lot of their power. That said, anything that promotes customer-centricity can be seen as an opportunity. It does mean, however, that there needs to be even more emphasis on pooling resources with fintech companies.

What’s stopping banks from going digital?

In general, traditional financial institutions’ digital transformation initiatives are progressing more slowly than expected given the evolving context. For some banks, credit unions and building societies, this is simply because they don’t have a defined plan for digital transformation yet.

That said, there are genuine roadblocks that are delaying the implementation of digital customer engagement strategies, namely security, data, and brand dilution.

2024 update: As we saw above, there has been progress made in the digitalization of banks compared to the previous year. That being said, roadblocks still exist.

1. Navigating complex security challenges

In 2021, financial services firms faced a surprising increase in fraud and data-privacy breaches – which even peaked at record levels. As previously discussed, this had a direct impact on customer trust and is customers’ top priority moving forward.

This sentiment is echoed by executives, with a quarter of those surveyed naming security as one of their biggest obstacles to digital transformation (Forrester). What’s more, there’s further concern among finance institutions about increasing sophistication in this area, with cyberattacks potentially compromising customer interactions and the integrity of their data.

In the finance sector, even the most simple digital services require overcoming complex compliance, privacy, and data security challenges to bring to market. There’s also no room for error whatsoever as execution needs to be flawless to maintain customer trust.

What may be a relatively simple implementation procedure in other industries, is a slow process in the finance sector. Before a new digital tool or customer engagement platform can be launched, it needs to go through stringent security procedures, including protocols for customer privacy and compliance.

However, as we’ve seen with voice assistants or similar tools, customers can be slow to believe that these methods are genuinely secure. For this reason, beyond the security measures themselves, there also needs to be dedicated communication campaigns to reassure customers that their data, money, and privacy are fully protected.

2024 update: Unfortunately, cybersecurity remains a key concern in the financial world. As institutions adapt to confront emerging threats, the complexity of these threats also grows.

Consequently, cybersecurity and anti-fraud regulations are on the rise, adding to the compliance challenges faced by institutions. There is a specific focus on handling risks linked to third-party vendors, necessitating more thorough due diligence.

The combination of these regulatory demands and economic challenges will likely expedite the consolidation of industry institutions, with M&A agreements playing a role in risk mitigation (The Financial Brand).

2. Technology strategies and lack of resources

There appears to be a bottleneck when it comes to technology in a banking context. A reported 25% of decision-makers in a services context claim that technology strategy is one of the biggest challenges they face when executing digital transformation (Forrester).

2024 update: The challenges here remain relevant to decision makers. In fact, more recent statistics point to technology strategies being even more complex. An updated report found that 33% of respondents claim that the company’s technology strategy is one of the most challenging aspects of their role, up from 25% last year (Forrester).

Of those surveyed, 33% claim that the company’s technology strategy represents one of the most challenging aspects of their role. This is accompanied by the related challenges of data and project management, with 29% and 27% reciting these respectively (Forrester).

What does this mean, exactly? There are several areas where technology is impeding progress. The first is due to legacy systems and the complex task of upgrading them. Digital-first companies and fintech startups have flexible architecture and proprietary platforms that have been specifically designed for today’s context.

Traditional financial institutions, on the other hand, have to contend with core solutions that have potentially been part of the organizations’ fabric since computers were first introduced. These systems may have been upgraded and enhanced over time, but this new challenge of digital transformation is an entirely different ball game – nevermind the intimidating implications it has for their traditional business models.

Beyond the technical challenge this presents, there’s also an emotional toll. A lack of skill and knowledge among staff leads to a fear of failure, which can prevent transformation initiatives from beginning in the first place. Despite evidence to the contrary, a majority of banks still consider digitalization to be a technology problem, rather than an existential issue that impacts a bank’s continued relevance to its customers (Forrester).

2024 update: The problem of skills shortages remains and is becoming a real challenge for HR professionals in the industry, both in terms of recruitment and in up-skilling current staff. This is compounded by changing expectations. Workers became used to remote flexibility during the pandemic are balking at the idea of returning to the office.

Part of the solution seems to be, again, in direct collaborations with fintech institutions that provide enhanced technological solutions and also come with a well trained workforce. Up-skilling programs are still a priority, however (The Financial Brand).

This reluctance or hesitance in fully transforming their application landscapes and business models, means efforts frequently get stuck in the planning stage. Even when they do escape the planning stalemate, these efforts often focus on a single functional or organizational area, rather than the holistic digital transformation necessary.

There are also practical challenges to deal with in terms of resource management. According to 25% of the Forrester survey respondents, finding time for employees to carry out digital transformation initiatives around their current job responsibilities is also a challenge.

And the challenges continue up the chain, where differing views of who is responsible for spearheading these efforts results in inaction. For example, 48% of decision-makers in services departments at banks claim that the responsibility for initiating digital transformation falls on the CIO or the CTO. Meanwhile, 39% believe it’s the CEO who should head the effort – although the same percentage say that the execution of digital transformation rests on the CIO or CTO.

3. Data and analytics challenges

Banks have huge amounts of consumer information and the task of managing this data is sizable. When using digital channels, the way that customers behave will generate patterns that can be analyzed to make business decisions.

With personalization such a defining factor in delivering the experiences customers expect, processing this data properly can help banks to stand out competitively. However, when doing this, banks must be careful to always use the data at their disposal in an ethical way. Navigating this context is anything but straightforward. In fact, 73% of bank executives admit that they find it difficult to translate consumer data into patterns and trends (Capgemini).

Failure to properly utilize data can have a direct impact on product improvements. The same survey shows that 95% of executives believe that operating systems tend to restrict data optimization (Capgemini).

There are challenges and opportunities inherent in this. On the downside, it presents a major roadblock for innovation. But on a brighter note, this is true across the board. Since very few financial institutions have found end-to-end solutions, data and analytics represent a well of untapped potential for stand-out digital engagement.

What remains to be seen is who will be able to leverage the data at their disposal to draw out preference insights and facilitate more meaningful customer experiences.

The final word: Where are we in 2024?

The banking industry’s greatest changes from this year to last are certainly linked to the developments in Generative AI. While banks need to be careful and mitigate risk, the opportunities to differentiate their financial products, digital platforms, and customer service offerings is immense.

We have seen promising advancements in digital banking experiences with more digital solutions impacting the customer journey. The focus has moved from completing digital transformation to honing initiatives and finding new areas of opportunity.

Overall, the source of these opportunities appear to be rooted in customer centricity, whether personalized experiences, enhanced digital technology, or more. Customer expectations remain high and so providing elevated experiences for customers through personalized services will help banks secure or claim market share.

Want to find out more?

Reach out to us today for more information or to schedule a demo

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice