Integrating digital customer service tools has the potential to dramatically increase efficiency and speed within customer support teams. By making operations more streamlined and allowing advisors to delegate work to automated technology such as chatbots, banks experience reduced support times and costs. Advisors can capitalize on this increased productivity by focusing on more valuable client communications, such as face-to-face engagement.

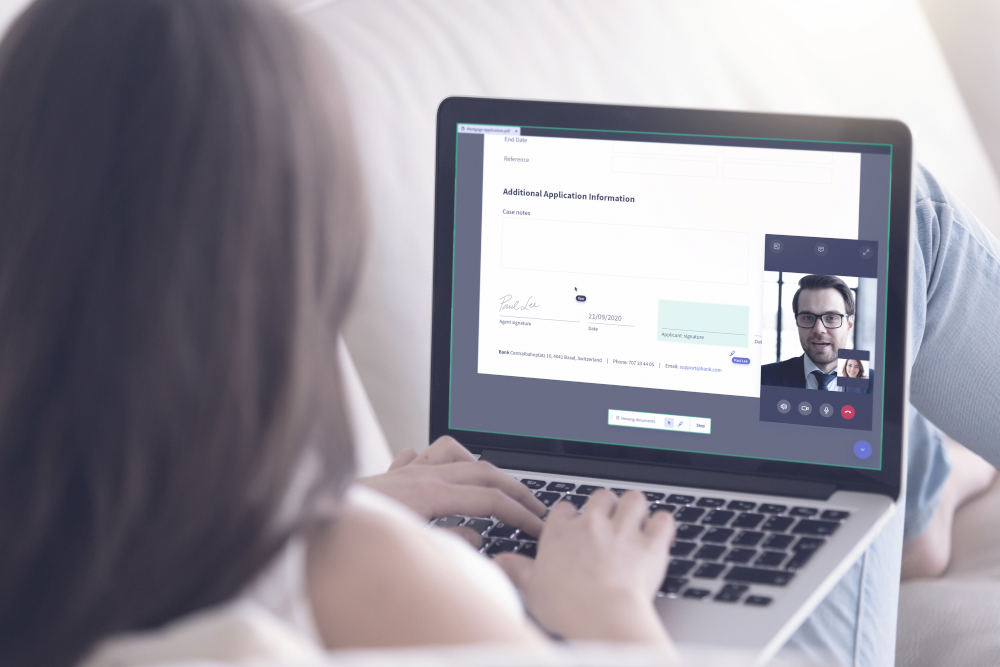

One example is signature software. Using document sharing features in conjunction with a communication tool like video chat, advisors can walk customers through documents and close the conversation with e-signature – rather than the time-consuming process of mailing documents to be signed.

The term electronic signature – or e-signature – refers to anything that demonstrates an intention to sign something. For example, a scan of a hand-written signature or a recorded verbal confirmation. For an electronic signature to be secure and compliant, it must meet the requirements of the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

DocuSign

All major financial decisions entail a signature at some point. These agreements are crucial for anything from opening a bank account to securing a loan. DocuSign allows you to capture customers’ consent accurately and quickly while remaining secure and compliant. As an ISO 27001-certified platform, DocuSign allows you to adapt easily to the latest requirements and meet regulatory guidelines.

Rating: 4.7/5 stars on GetApp based on 3,859 reviews

eversign

Acquiring signatures smoothly and efficiently is just one feature of good signature software. The best signature solutions also offer tools for managing documents in the cloud and for keeping all relevant parties in the loop. Eversign does this and more – all while remaining compliant, keeping user data safe and secure, and using encryption to ensure all transactions meet security standards.

Rating: 4.8/5 stars on GetApp based on 1,191 reviews

PandaDoc

PandaDoc allows financial providers to obtain agreements conveniently and securely with a legally binding e-signature. Customers are able to sign digital documents on any device, from any location, while advisors can use analytics and notifications to speed up the process. PandaDoc e-signature technology is compliant with ESIGN and UETA requirements. Each signed document comes with an electronic certificate.

Rating: 4.4/5 stars on GetApp based on 703 reviews

RightSignature

For banks looking to transition to e-signatures, RightSignature allows clients to sign documents online and return documents with minimum time and hassle. RightSignature replicates the traditional pen-and-paper signing experience in your browser, making the process easy and intuitive to use. The software fulfills all the key requirements of the ESIGN Act and UETA and incorporates advanced security solutions to ensure data protection.

Rating: 4.6/5 stars on GetApp based on 107 reviews

SignRequest

Had enough of fax machines and scanners? SignRequest allows banks to obtain secure and legally binding digital e-signatures in an affordable and simple way. The software integrates with apps such as Google Drive and DropBox and can be used on any device. Features such as a signing log ensure the highest level of security – and documents cannot be altered later without the client’s knowledge.

Rating: 4.7/5 stars on GetApp based on 275 reviews

Digital banking customer service & Unblu

Unblu’s technology empowers banks to boost productivity and efficiency with a fully-integrated set of digital tools that make customer service operations faster and more streamlined.

Discover how Unblu’s conversational banking technology could elevate your customer service today by booking a demo and a member of Unblu will be in touch.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice