There’s no denying that recent trends in customer service have transformed how banks or credit unions around the world deal with their clientele.

More often than not, avoiding customer frustration is the driver of this change. As expectations evolve, banks and financial institutions are under increasing pressure to produce better services and faster response times to guarantee amazing customer service.

But avoiding a bad experience isn’t the only factor influencing customer service trends. Not only has the landscape changed thanks to incoming FinTech players, but new regulations require that certain customer service standards are met.

Overall, current customer service trends reflect the complexity of today’s reality. By incorporating new technologies and empowering their agents, financial institutions can ensure they provide quality customer care that meets these needs, reducing churn and driving loyalty in the process.

1. Digital adoption continues to grow

One of the largest trends in recent years is the continued digitalization of financial services. Gaining momentum throughout the Covid-19 pandemic, this shift has been consolidated over the past year and customers are responding to the new context.

The preference for digital banking at the user end is unquestionable. Forrester’s data tells us that 77% of Canadians, 71% of North American and 69% of Spanish consumers with online banking use it at least every month. Another estimate suggests that this figure stands at 89% for all US banking customers, and even rising to 97% when only millennials are considered.

2. A new level of convenience

While people are quick to adopt new digital methods, the standard of technology on offer in digital banking doesn’t always meet customer expectations.

The technology is certainly advanced enough, but it’s how well it’s leveraged that makes the difference. This is because the proliferation of big tech has raised the bar in what’s considered to be an “excellent customer experience.” In other words, customers are more picky. Nowadays, a consumer’s first impression is based on instant responses and quick answers to a wide range of issues. They expect customer service teams to be prepared to answer queries anytime, anywhere.

This is the heart of the issue—when engaging with brands, consumer expectations are sky high. The fact is, the digital customer experience must match the positive experience customers get elsewhere. Since they’re used to the convenience of asynchronous channels, they expect the same level of service with third-party channels like Messenger, WhatsApp, or other social media platforms.

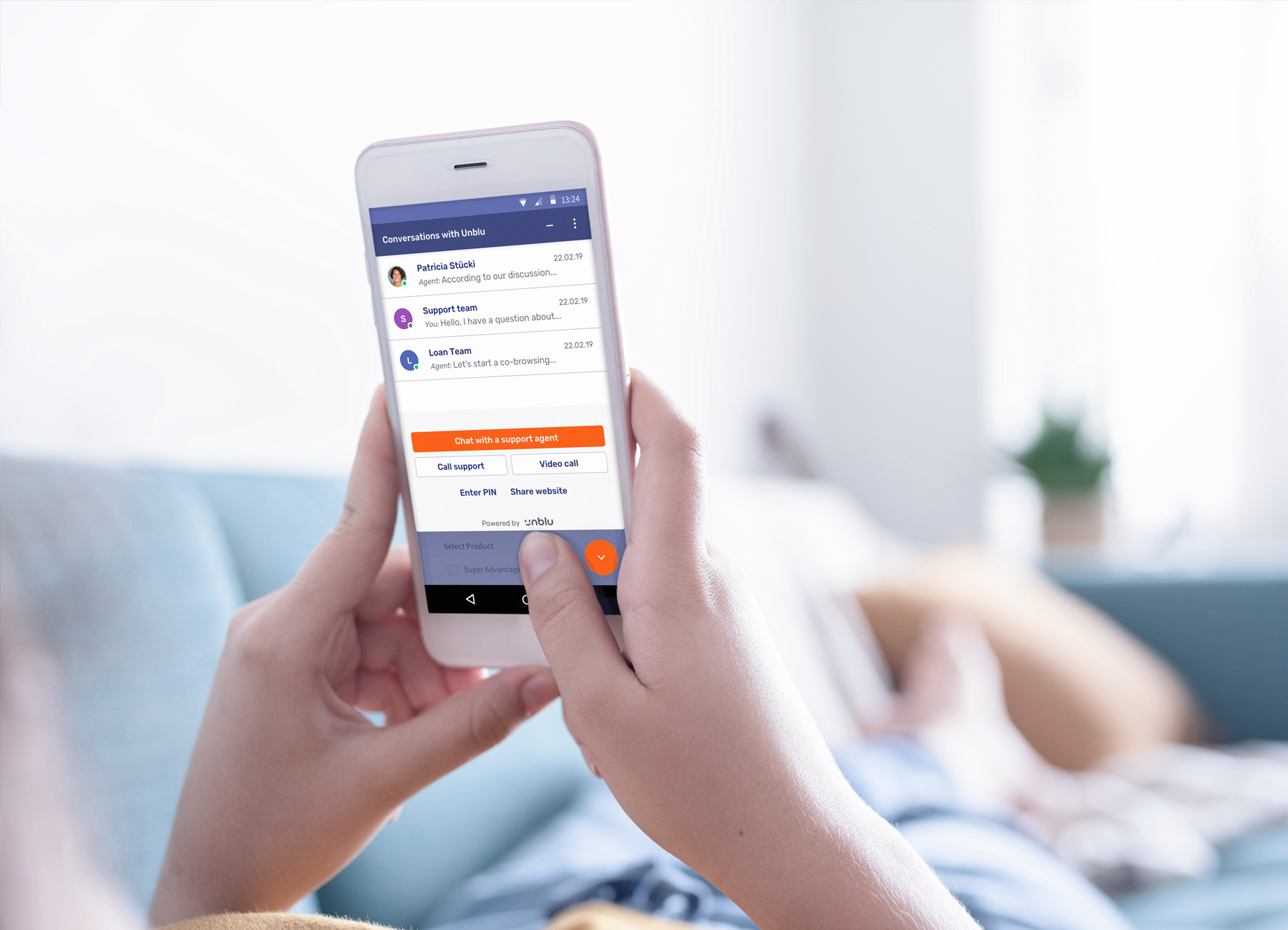

In a mobile banking context, self-service options move beyond answering basic questions to empowering the customer to make a bank transfer or open a savings account. And when they do deal with a representative, it’s essential to avoid obstacles like channel switching, repeat information, and transfers to other parts of the e-banking environment.

Personalization of spending insights, frictionless peer-to-peer payments, and even quick-order tools that can find and pay for nearby services are some of the functionalities popular among younger age groups and represent the future of customer service.

3. AI’s role in the digital customer experience

Almost all banks currently or plan to use AI across practically all business areas, from operations to customer support teams. Top areas for future growth include personalizing investments (17% plan to adopt in next 1-3 years), credit scoring (15%) and portfolio optimization (13%).

The applications of AI in finance customer service are extensive, but just because a bank uses cutting-edge technology, doesn’t mean that they’re going to satisfy customer expectations.

Take the use of chatbots for example, which draw on a system’s knowledge base to provide support. As the most visible and frequently used self-service option, banking customers have regular exposure to chatbots. Although chatbots do play a role in dealing with common queries, poor customer service experiences have left a lot to be desired—especially when it comes to complex issues.

In contrast to a 66% satisfaction rate with online chat technology (which connects customers to a human customer service rep), a mere 26% of customers were satisfied with AI-powered chatbots. Furthermore, over 80% of customers who have used chatbots for product inquiries in the last 12 months wouldn’t want to use them again and 46% said that they’d prefer to use branches (Deloitte).

4. Moving toward a hybrid experience

That’s not to say that AI can’t play a role in customer service. While chatbots are not a mature or self-sufficient technology yet, AI clearly enhances customer service teams. It still requires a human touch to guide it and, in any case, the demand for human-led customer interactions isn’t going anywhere. Even the best of AI would struggle to replicate the customer relationships that are built through face-to-face meetings.

A survey carried out by Deloitte indicates that consumers will continue to use digital channels for simple transactional activities, but many consumers desire high-touch customer service interactions for more complex products and services, such as mortgages and financial advice.

Hybrid experiences with human agents scored higher on effectiveness, ease, and emotion than digital-only or physical-only experiences.

5. Unified and secure communications

Secure identity authentication is a vital part of modern banking. Customers need to know that their assets are safe. That said, if it becomes repetitive or time-consuming, it can impact the experience for all parties.

The solution is to integrate all communication channels into a unified digital platform as a foundation for creating secure environments. By doing this, not only will it reduce costs, but it will avoid the need for repetitive (and time-consuming) identity authentication.

By using diverse tools to ensure a seamless customer experience, banks can offer customers choice and flexibility. Video chat provides reassurance. Co-browsing allows for collaboration. And rather than isolated touchpoints, each interaction is part of a greater whole. Customer service agents have access to the conversation history and any shared documents so they’re always up to speed on the customer’s needs.

6. Branches are still useful

It’s true that a digital omnichannel approach that allows customers to choose their preferred channel is essential. Whether the customer makes contact on phone, chat, text, video, or email, there still must be a smooth flow of data and information to ensure a positive experience.

That said, traditional branches are still important to customers and having convenient access to one is a deciding factor when selecting a banking provider. While 24% of consumers expect to visit a branch less often in the future, 82% say they view the presence of a local branch as extremely or very important. In fact, more than 90% of respondents say it is highly important to have a physical presence available to address problems at any moment of their customer journey.

7. How trust leads to customer success

Customer loyalty is the final goal of any customer service team’s strategy. And gaining and retaining the trust of customers has been particularly difficult during the pandemic. Among customer satisfaction statistics, the overall customer satisfaction score with the advice and guidance provided by national and regional banks is notably 30 points lower (on a 1,000-point scale) than a year ago.

Thirty-seven percent of consumers now say a FinTech firm is their most-trusted financial services brand, compared with 33% who name a bank as their most-trusted brand, and 12% who say they trust a wealth management firm the most.

The biggest driver of financial trust is confidence that the finance institution is protecting your customer base’s data, with between 14% and 18% of all ages listing it as the top consideration. The quality of product and services offerings is the next biggest driver, while showing the customer that they care about their needs places an important role on customer service professionals. Building trust means showing the customer that they are being heard.

Among customers who feel valued, 92% plan to stay with the brand, 87% plan to purchase more, and 87% will advocate for the brand.

8. Data challenges

Now that personalized experiences have emerged as a clear demand among finance audiences, banks must find ways to use this data ethically and effectively—but this isn’t always straightforward. In fact, 73% of bank executives admit that they find it difficult to translate consumer data into patterns and trends.

Customer data is often locked within company silos, which makes it difficult to deliver meaningful and personalized customer experiences. Companies will combine data in new ways to unlock opportunities for AI to deliver anticipatory and highly personalized customer experiences.

This can have a very direct impact on product improvements, with a further 95% of executives in the survey reporting that operating systems tend to restrict data optimization. On the downside, that presents a major roadblock for innovation. But on a brighter note, since very few financial institutions have cracked it, data and analytics certainly look to be a promised land for stand-out digital engagement. Those that can leverage their data to draw out preference insights will facilitate more meaningful customer experiences.

The road to digital transformation

Digital transformation is no smooth road, especially when it comes to dealing with customer issues. Incumbent banks report that 25% of customer service leaders list data management as one of the main barriers to digital growth, while 24% report that security is the biggest challenge. That’s without factoring in the quality of the one-on-one interactions that strongly influence customer options.

What this means is that the customer experience trends must evolve to address wide-ranging factors and maintain excellent service standards. More than ever, people want secure human interactions with customer service representatives—without sacrificing the convenience of instant technological solutions. Every part of your service matters, from response times after a customer service query has been made to providing quality self-service support.

With the right customer service technology, you can improve your average response times, empower your sales teams, ensure the customer’s security, and provide a seamless experience that boosts loyalty.

Talk to us today to find out how you can improve your customer service interactions to boost your business performance.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice