Turn your customer service into a new revenue stream

Boost efficiency and customer engagement while increasing revenue with Unblu’s Conversational Engagement Platform.

Request a demoImmediate impact

Deflect queries and enhance customer communication with interactions that are efficient, profitable, and productive.

Bot resolution rate

Support inquiries via email

AHT for phone calls

Digital sales conversion rate

Greater efficiency – fewer costs

Increase agent efficiency by more effectively distributing channel requests – while leveraging Conversational AI, Live Chat and other Unblu capabilities to reduce the strain on phone lines and email channels. This allows agents to better support customers with accurate and personalized responses.

Improved customer engagement

Empower your agents to proactively guide customers in a streamlined and visual manner. Ensure a frictionless experience that establishes trust and increases satisfaction throughout the customer journey, from initial onboarding to ongoing online transactions.

Better service. More revenue

A happy client is more likely to make a purchase. Excellent customer service creates a foundation for cross-sell or upsell opportunities to take place. This means being available on the customer’s preferred communication channel, whether it’s a chat, call, or Co-Browsing session.

Increase Digital Sales

As a happy client is more likely to make a purchase, at the end of each successful…

Learn more

E-banking migration without hiccups

Decision-makers identified a key moment of friction in the customer journey that put…

Learn more

Discover Unblu’s Conversational Solutions

The most complete suite of conversational engagement products for the financial industry

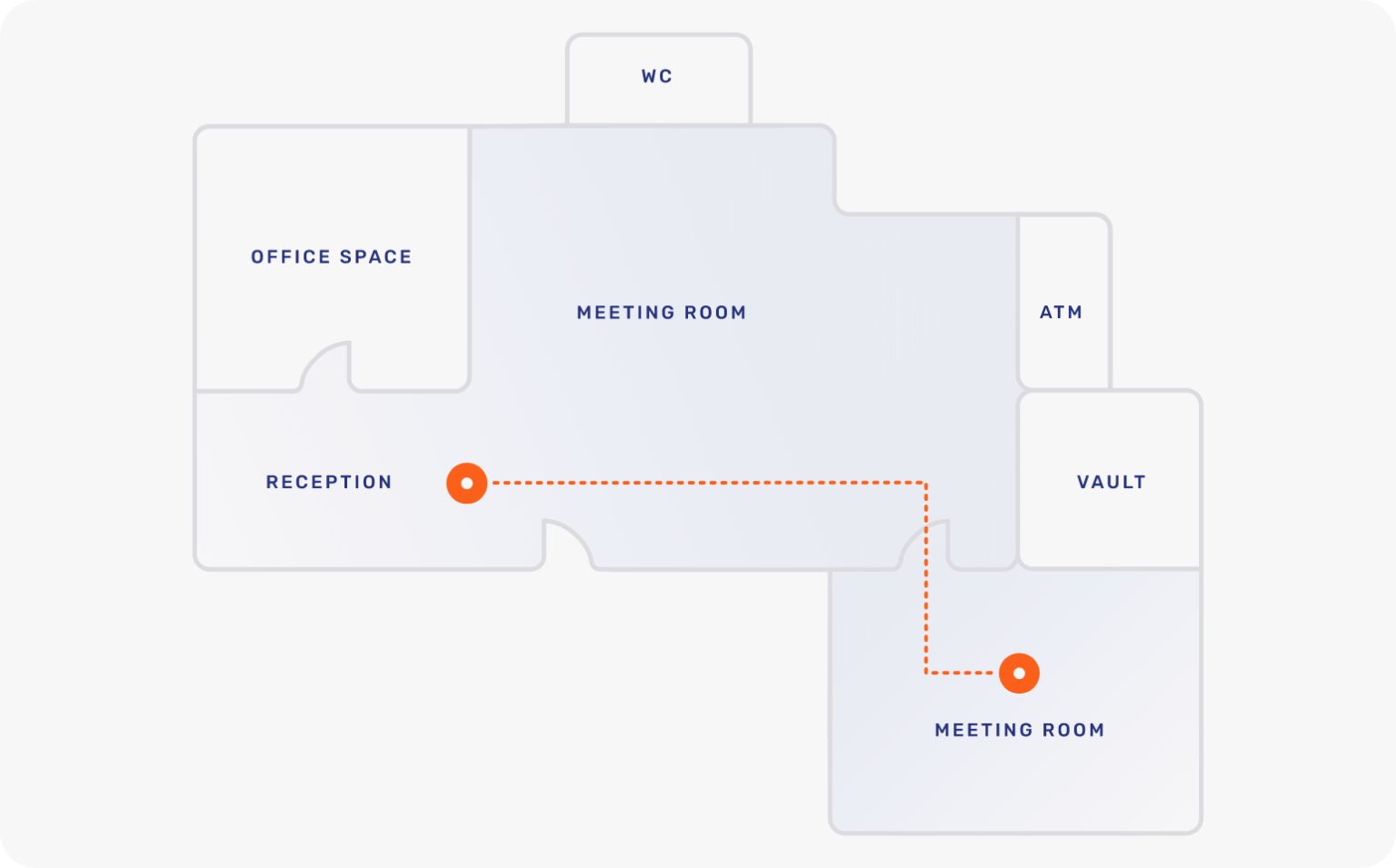

Reinventing and expanding branches with a hybrid concept

Fewer branches since 2017 (McKinsey)

Plan to visit one less often

Still claim a local branch is “extremely or very important” (EY)

-85%

In branch operating costs

Revenue growth through branch expansion

Increasing service hours (10h per day)

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice