The EU PSD2 was entered into force on January 12, 2016, with member states expected to transpose the directive into national law by January 13, 2018. Now, as Switzerland moves to fully embrace open banking, banks should increase the quality of their mobile applications, websites, and portals to enhance their customer interaction capabilities. Failure to do so may result in a serious fall in customer-facing time as third-parties can offer a more complete experience.

PSD2 and what it meant for banks

The PSD2 was devised to bring EU payment service regulations in line with technical developments, allowing third-party providers to access and conduct transactions. It aimed to create a single payment framework within the European Union, but the ramifications extended beyond this.

Overall, the PSD2 meant that:

Payment transactions made over the internet or on mobile devices are better regulated and impose stricter security requirements for payment transactions.

There is reduced consumer liability for unauthorized payments, with unconditional right of reimbursement for direct debits.

The market is more open to new authorized payment service providers.

A new market for data-sharing

The most notable of these consequences for banks is the final one. It means that customers can choose to link their Fintech accounts or similar with their banking provider and the bank is obliged to let them. With the newer financial players often able to offer an enhanced service experience, the monopoly that banks enjoyed on native-app customer data is put at risk. In short, it heralded the era of open banking.

The initial Swiss response

Switzerland is, of course, not a member of the European Union or the EEA and was not subject to the directive. Following the 2008/2009 financial crisis, Switzerland does seek “equivalence” with EU regulations, which plays a large role in its continued access to the European market as a third-party state.

However, when it came to the PSD2, Switzerland chose to avoid committing fully to the EU recommendations, choosing instead to make it optional for banks. Rolf Brüggemann, Member of the Swiss Bankers Association Executive Board, expressed the Swiss position on the matter in 2018.

His argument moved from unsettled legal questions which he believed could undermine confidence in the payments market to the impressive track record that Switzerland already had in financial innovation. He believed that regulatory compulsion was unnecessary intervention and “would lead to competitive distortion to the disadvantage of the banks.”

Changes are coming in Switzerland

There have been new developments, however, that appear set to change the status quo in Switzerland in favor of multibanking. Led by the Swiss Bankers Association (SBA), over 20 banks in Switzerland have signed “Memorandum of Understanding”. Their goal is to introduce multibanking offers for individuals by the middle of 2025.

By doing so, they hope to improve “interoperability and data exchange between different banks, Fintech companies and other financial institutions,” which will provide customers with a better understanding of their financial situation.

How should banks in Switzerland prepare?

Rolf Brüggemann’s fear that traditional banks would be at a competitive disadvantage is indeed a risk. With more appealing options from a UX perspective, banks could find that their ebanking apps become less “sticky” and reduce customer facing time. But it’s also true that these risks can be mitigated if banks have the foresight to invest in the customer experience.

Listen to the customers

According to Deloitte, there is “a strong latent demand among a technologically savvy population for new and improved banking services.” The survey, which focused on the UK market, is a good indicator of general customer preferences in banking.

When asked about the factors that would persuade them to switch banks:

56% said that the pricing needs to be easier to understand and more transparent than their current bank.

58% valued the ability to carry out more banking actions using the mobile app.

49% said that the general app ease of use would persuade them to move banks.

The challenge for banks

Banks need to provide better analytical tools that customers can use autonomously. It is vital that customers have the ability to understand their financial status, plan effectively, and have access to relevant products and services. However, they also need to be able to get in touch with a human agent whenever necessary.

This means enhancing the experience of their current apps to include robust conversational engagement tools. Banks must devise methods to build bridges between online self-service interaction and traditional communication to rival third-party vendors. Achieving this will have a positive effect on customer satisfaction, conversions, and, ultimately, customer loyalty.

To put it simply, banks must offer a digital customer experience that goes above and beyond traditional offerings if they are to compete with more digitally savvy challengers.

Banca Dello Stato: Improving the support experience

It will be difficult for banks to compete with either big data companies or Fintechs when it comes to data-driven insights or app UX. These institutions’ experience with data analysis, AI, and automation enables them to deliver well built financial solutions.

However, they often struggle when it comes to the quality of their service experience, as a recent Financial Times article points out. Recounting the experience of a man whose Fintech account didn’t emit scheduled direct debits, he says “we couldn’t get a human being.”

While the situation was eventually sorted out, the customer closed his account, demonstrating just how important the customer service experience is for trust and loyalty.

This is something that the Swiss bank, Banca Dello Stato, understood well. With a support team of 20 members serving over 60,000 customers, they recognized the importance of offering new support channel options.

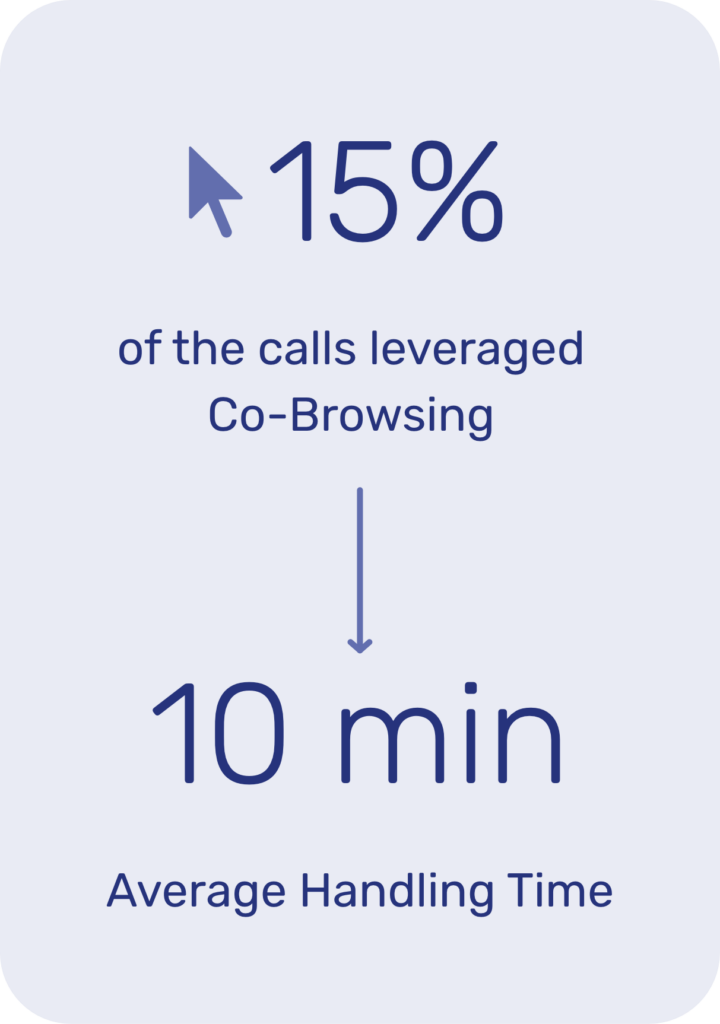

By implementing Unblu’s Live Chat and Co-Browsing, the bank was able to enhance their overall service experience. The Live Chat channel enabled them to handle multiple requests and boost efficiency, while Co-Browsing offered high-touch human support when necessary.

Swiss banks need to embrace the change

The advent of multibanking will undoubtedly bring challenges for Swiss banks. However, it also offers opportunities to leverage their most powerful strengths – deep financial understanding and a customer service experience that cultivates trust.

It isn’t a matter of fighting third-party vendors or trying to beat them at their own game. Instead, Swiss banks should focus on providing the customer the level of service that makes their own apps and ebanking platforms indispensable.

Want to find out more?

Reach out to us today for more information or to schedule a demo