Conversations and the way we have them are driving a new wave of digital growth and fundamentally re-shaping the banking industry. While internet banking and omni channels have created a world of convenience, customer feedback is indicating that something is missing – the personal interaction. Conversational banking can provide a new way to establish a relationship between bank and customer.

What is Conversational Banking?

The industry defines conversational banking as a means of interacting with a non-human interface to discuss your finances or even seek advice. Conversational banking uses chatbots to exchange messages, ask questions, or give commands. It is about managing your financial life through voice or text messages.

At Unblu, we think of conversational banking in a wider sense. We define conversational banking as using conversation – whether initiated by a human or a virtual assistant – to get to know your customers and guide them through important financial decisions.

Conversational banking leverages technology such as AI into banking customer journeys to create a seamless experience that radically boosts client satisfaction. By incorporating those digital tools that prioritize conversation, financial services can create a flexible and personalized service that increases the opportunities to build successful relationships with customers.

Whether it’s chatbots providing information on mortgages, or the use of co-browsing to collaborate with customers on applications, conversational banking strategies represent the basis of successful customer service.

As long as these strategies take into account that a customer may want to speak with a real human advisor at times, incorporating digital tools has the power to transform the customer experience.

The importance of this human safety net shouldn’t be overlooked. Customers appreciate online services, but they still want a personal experience. Indeed, 50% want to be able to switch between human and digital channels (Accenture, 2019).

Conversational banking benefits

- An omnichannel approach

By incorporating different digital tools like live chat, messaging, video call, and co-browsing, an omnichannel banking strategy multiplies the touchpoints in a customer journey, therefore increasing the opportunities for financial providers to create a positive impression. Each interaction becomes a ‘moment of truth’ whereby they can increase customer satisfaction and build trust.

- Going hybrid

A customer journey that incorporates both self-service and traditional exchange — such as audio calls or in-person meetings — offers greater flexibility. Conversations are optimized by the latest AI capabilities but are also humanized, with agents on hand to help if necessary. This hybrid model can be tailored to each customer’s unique needs.

- Get personal

Customers want to feel understood. They want a service that feels personal, customized to their unique needs. Conversational banking enables a totally customer-centric approach, with innovative digital solutions empowering advisors to provide relevant and specific advice exactly when the client needs it, and in the way that best suits them.

How to use it in financial services

Chatbots, texting, video & voice call, and co-browsing — conversational banking involves a diverse range of digital tools that prioritize customer engagement and promote productive conversation between client and agent.

- Chatbots for speed and efficiency

Chatbots are cost-optimized self-service tools that resolve low-stakes customer issues. IVR, for example, asks customers to choose from a menu of automated prompts before triaging their requests. Customers can transfer to an agent at any time and so always find the help they need. Agents can delegate work to bots and use them to generate leads.

- Texting for convenience and ease

Being able to message their agent to resolve problems feels simple, seamless, and intuitive for customers. Integration with applications like WhatsApp and Facebook Messenger allows for easy and continuous conversation. Similarly, live chat means customers and agents can interact in real-time. Agents can reply quickly thanks to canned responses while keeping it personal.

- Video call for reassurance and trust

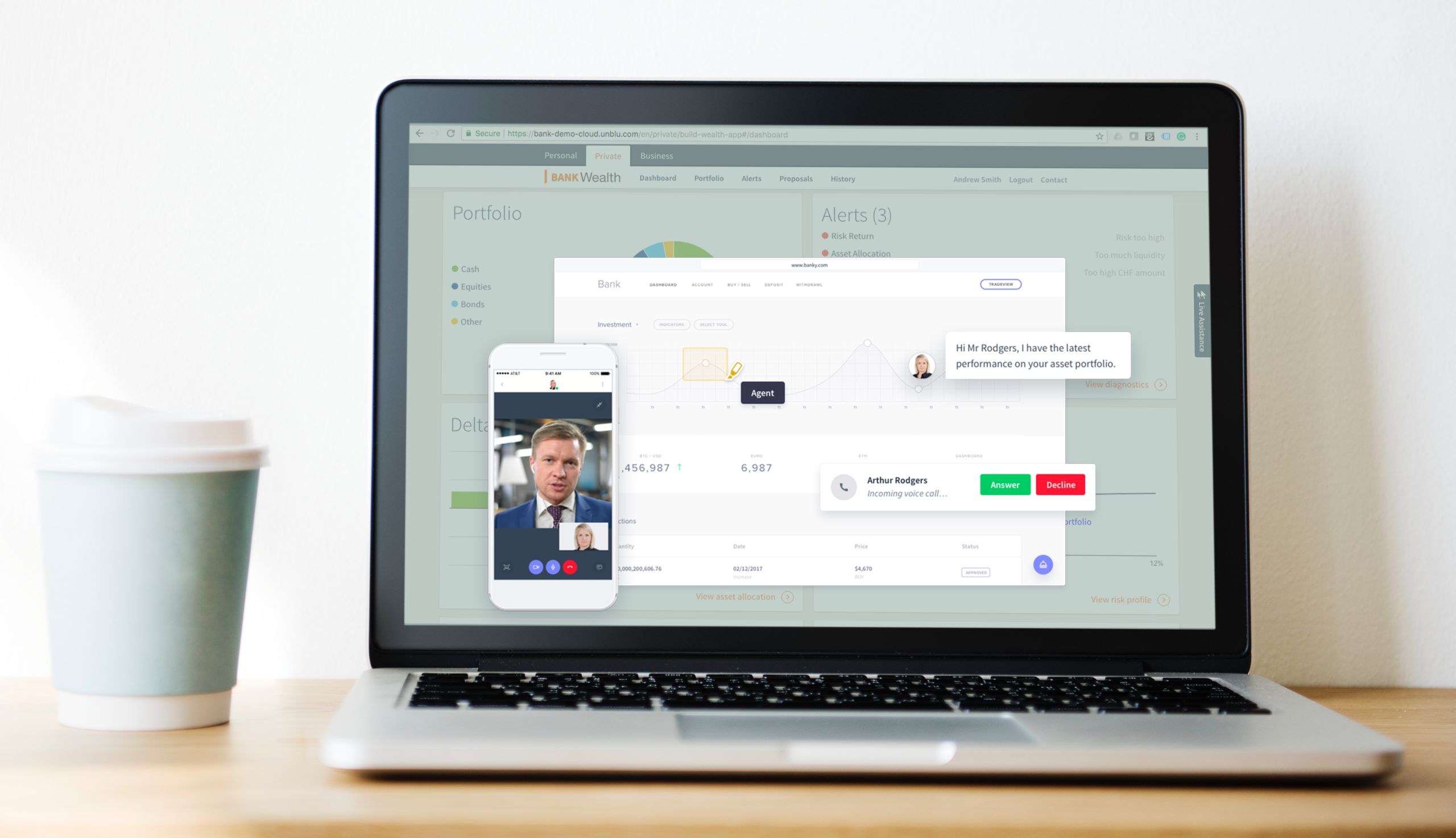

Speaking face-to-face creates a sense of empathy and trust. Video chat enables this high-touch person-to-person interaction—but can be done remotely. Advisors can and customers can connect securely, in real-time, building a relationship. This improves conversion rates and share of wallet, while voice call is always an option if a customer prefers.

- Co-browsing for remote collaboration and engagement

Co-browsing and screen sharing provide a visual context to problems. As advisors can see what a customer sees, they can offer advice that is personalized, specific to their unique problem, resolving issues faster. There’s also the opportunity for advisors and customers to collaborate on documents, making customer support far more engaging.

Conversational banking & Unblu

Unblu’s conversational banking solution offers a range of digital tools to increase opportunities for meaningful and productive conversations with customers. Build trust, reduce costs, and boost business. Find out more here.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice