In 2024 we predict an increased emphasis on customer centricity in retail banking. For us at Unblu, that means delivering consistent, empathetic service experiences for younger generations, without negatively impacting older customers.

In general, European banks are not performing well when it comes to emotion. Forrester found that only 48% of respondents in a recent benchmarking survey found that their digital banking experience was “emotionally positive.”

What’s more, the report found that emotion is the primary determinant of customer loyalty and the importance of customers feeling understood, respected, confident, valued and appreciated cannot be overstated.

48% of respondents in a recent survey found their digital banking experience “emotionally positive.”

Achieving true customer centricity in 2024 is no mean feat, however. It requires an in-depth understanding of ongoing trends in the industry. Below, we will discuss some of these standout developments. For a more detailed view of retail banking sector trends for 2024, please download the report here.

1. Responses to economic uncertainty

We are entering a period marked by heightened economic uncertainty, with banking customers confronting escalating inflation rates and the potential for a recession. In response to these challenges, customers are actively seeking financial institutions, including traditional banks and credit unions, that demonstrate not only innovation in their financial products and services but also a genuine sense of empathy (The Financial Brand).

These concerns are not without basis, as elevated interest rates are impacting incumbent banks and credit unions. A discernible trend toward stricter lending practices and increased competition in deposit rates is putting pressure on bank margins (The Financial Brand).

Alongside regulatory changes, these pressures may speed up industry consolidation. Mergers and acquisitions can be used to drive revenue growth through enhanced efficiency, while mitigating risk. Coupled with the growing trend of fintech partnerships, these strategic measures position financial institutions to better navigate potential economic challenges (The Financial Brand).

Despite the uncertainties, there is some hope in the United States, where the Federal Reserve has signaled its intention to implement rate cuts in 2024 as inflation exhibits signs of easing (Bloomberg). There is potential for a positive shift on the horizon.

The lingering question is how these strategic shifts will impact banking customers directly and whether these measures can alleviate their concerns about economic uncertainty.

2. Increased emphasis on mobile banking apps

Contact center managers want to streamline their operations by minimizing the numerous vendor relationships they handle. This was a key finding in our report last year. To address this challenge, many opted to integrate unified communications and contact center platforms.

As we head into 2024, this remains a pivotal concern within the industry – aiming to amplify customer choice and flexibility while enhancing interaction experiences through features such as video chat or Co-Browsing. However, with the growing reliance on mobile apps and digital banking services among customers, there is escalating pressure to deliver these personalized experiences within a mobile-first context.

One tool that is emerging in this context is Mobile Co-Browsing or Co-Apping, which is beginning to be recognized as a key part of an overarching digital engagement strategy. For example, an Unblu customer launched 300,000 Co-Apping sessions with mobile banking apps in the last year to address customer issues. This is compared with 65,000 traditional Co-Browsing sessions during the same period.

3. A continued upward trend of ESG

Despite economic uncertainties and financial concerns among consumers, the demand for sustainable practices and products continues. In fact, the emphasis on green consumerism and consciousness remains a significant priority for customers.

Remarkably, 66% of global consumers identify sustainability as a primary factor influencing their purchasing decisions. The study further reveals that 32% of consumers anticipate paying a premium for sustainable products, ranging between 22% and 44%. However, a majority of consumers, totaling 68%, express unwillingness to pay a premium for ESG-related products (Simon Kucher & Partners).

Addressing the barriers to ESG adoption, the main concern is the perceived lack of affordability, accompanied by issues such as limited availability, trust, and the nature of the messaging.

4. Buy Now Pay Later is evening out

Last year, we reported a surge in Buy Now Pay Later (BNPL). Now, we expect the pace to ease off as the sector approaches maturity. Projections indicate that user penetration is poised to achieve or potentially surpass 40% among digital buyers in 2023, marking the first time reaching such levels. The anticipated ongoing growth is primarily attributed to younger users.

The total spending is expected to reach $94.87 billion, reflecting a 25.5% year-over-year growth. While this signifies more than double the user growth, it signifies a substantial slowdown when compared to the rates observed in 2022 (Insider Intelligence).

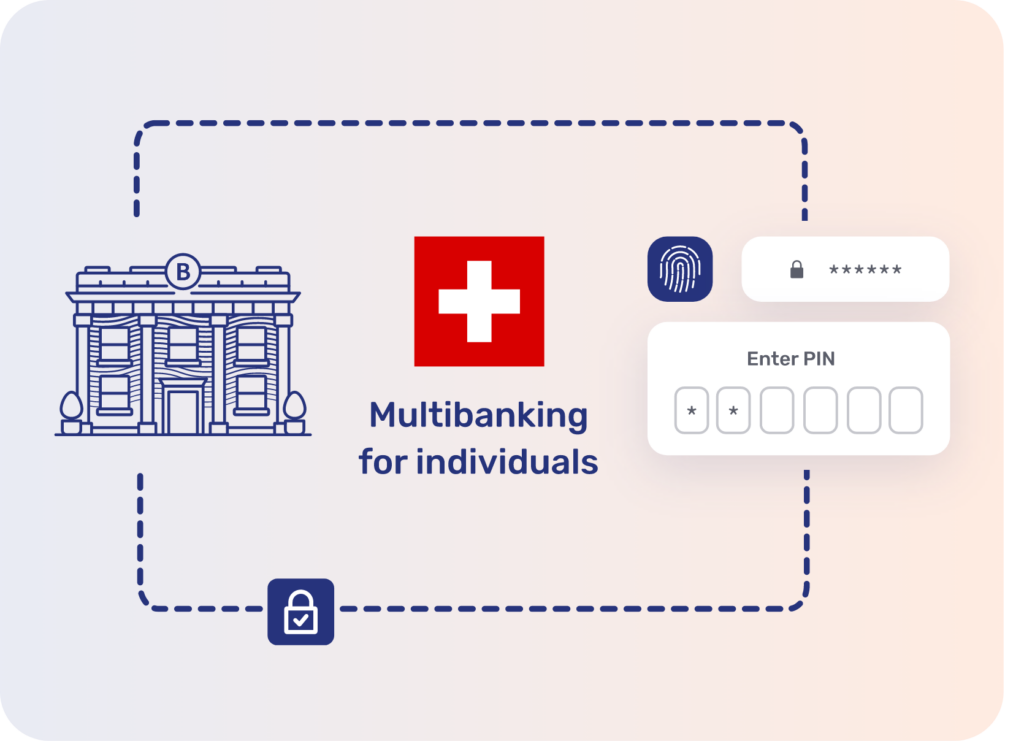

5. Open banking is a customer win

Open banking was a truly customer-centric development, empowering individuals to get an enhanced understanding of their data, investments, and overall financial health.

It’s been more of a double-edged sword for traditional banks who lose the domination of their business models. This is not new for EU banks, who have been following the PSD2 since 2018 (EU). For Swiss banks, however, the recent “Memorandum of Understanding” by the Swiss Bankers Association (SBA) means that they will also have to follow suit (Swiss Banking).

The main ongoing consequences of this are likely to be increased collaboration partnerships with fintechs. And this is also good for banks who are genuinely interested in being customer centric. By leveraging the niche power of fintechs, banks can further embrace more innovative product and service offerings.

6. The challenges and opportunities of Generative AI

No review of 2023 would be complete without a mention of Generative AI. It was a staggering development of advanced technology that is set to change the nature of banking institutions in fundamental ways.

In fact, this is exactly what two-thirds of banking executives believe, according to McKinsey (McKinsey). What’s more, Gen AI could add as much as $4.4 trillion annually in value across the 63 use cases analyzed. In the corporate and retail banking sectors alone, the technology could add $56 billion and $54 billion respectively (McKinsey).

It’s not all plain sailing, however. Gen AI is still a developing technology and its sudden arrival left little time for banking leaders to prepare their employees, attract new talent, or navigate the risks.According to Forrester, an estimated eight neobanks and two incumbents will experience a Generative AI-related disaster (Forrester). After all, it only takes one rogue employee or a negligent third-party collaborator to expose them to risk – whether breached copyright, leaking customer information, bias-related, or more.

The result is by no means that Gen AI should be avoided. There are many use cases where the technology is proving safe and effective, such as with Unblu’s Conversational AI offering. The GPT integrations allow retail banks to draw on existing knowledge bases with LLMs, use the bot trainer assistant to create better intents, and increase Live Chat efficiency (Unblu).

7. Keeping on top of workforce changes

Recruitment and staff retention remains challenging. There is limited access to technology and analytics professionals equipped with advanced skill sets, exacerbated by the complexities involved in training existing staff to adapt to digital transformation.

Compounding this is the return to the office. Employees, accustomed to the flexibility of remote or hybrid work, are resistant to companies that require full in-person attendance.

Retail banks and credit unions have responded by fostering collaborations with an increased number of digital-first fintech companies while prioritizing up-skilling programs. Despite these initiatives, the search for skilled talent remains a persistent and pressing challenge as we enter 2024 (The Financial Brand).

8. The status of digital transformation

The years of impetus appear to be taking effect and digital transformation in the financial services industry is reaching a stage of maturity. Financial institutions are primarily using their initiatives to increase revenue (77%), but there is also strong emphasis placed on customer experience improvements, cost reduction, increasing operational resilience, and strengthening regulatory compliance. In total over 53% of surveyed decision-makers at banks say their organization is working on improving their digital transformation efforts with advanced technology, up 20% since 2021.

53% of bank decision-makers are advancing digital transformation with advanced tech.

With all that said, there are still institutions that are behind where they should be. Shockingly, 1% still claim to not be interested in digital transformation at all and 8% have no plans to implement an initiative. A total of 10% of respondents say they only have planned implementation initiatives, meaning a total of 19% of global banking decision-makers are yet to harness the power of digital transformation in any capacity.

For the 10% that want to implement initiatives but haven’t, 33% claim that the company’s technology strategy represents one of the most challenging aspects of their role. This is accompanied by the related challenges of data and project management, with 29% and 27% reciting these respectively (Forrester).

The year of customer centricity

In 2024, everything comes down to customer centricity in the retail banking industry. However banks decide to approach this, it must fulfill the emotional requirements of the customer base to build deeper relationships based on trust and loyalty.

Looking for more in-depth insight into the retail bank trends set to define 2024?