Case Study

Empowering Crédit Agricole next bank’s digital transformation success.

The Swiss-based Crédit Agricole next bank (Suisse) offers tailored banking solutions to over 60,000 clients. However, to maintain their service excellence, the retail bank needed to update their digital capabilities with an end-to-end digital transformation initiative.

After migrating to a new e-banking environment, decision-makers identified a key moment of friction in the customer journey that put their reputation at risk – the limitations of phone calls in meeting new clients’ needs.

Onboarding clients in a streamlined and visual way is essential to build trust at a delicate moment in the relationship. To ensure success, the bank turned to Unblu and the platform’s powerful capabilities.

Better than the projected Average Handling Time (due to the migration)

Of phone calls used embedded Co-browsing in key moments

Average satisfaction rating from clients after a Co-browsing session

Solution deep dive

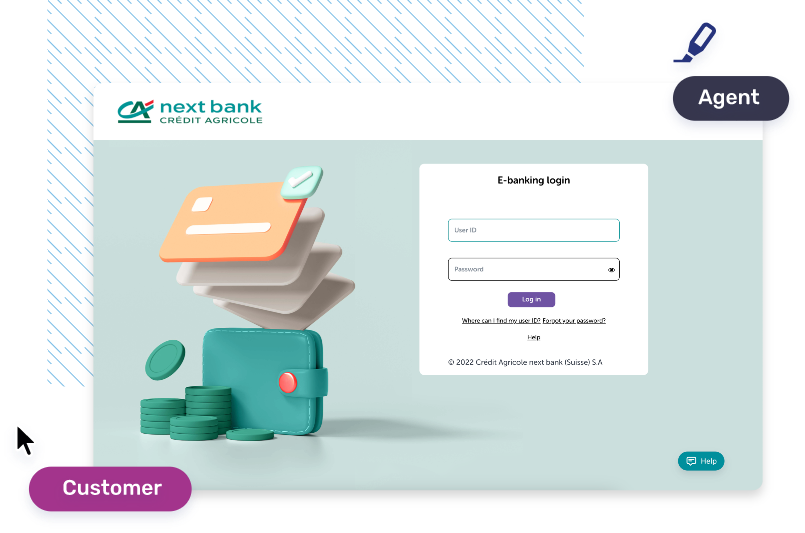

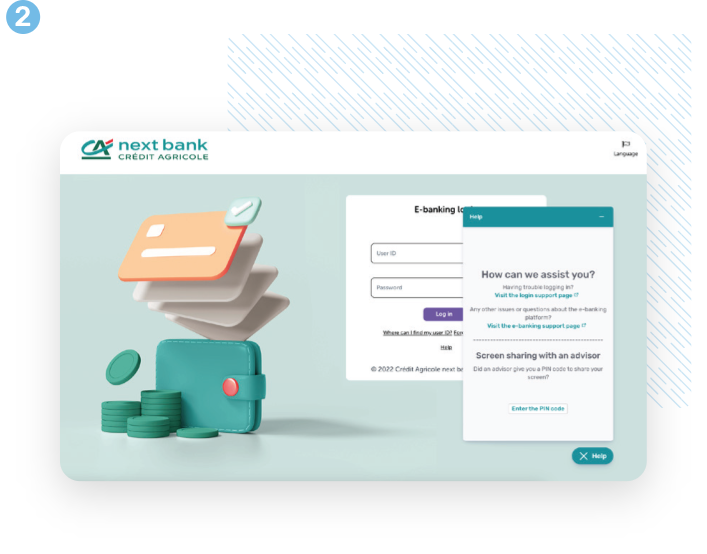

Crédit Agricole next bank decided to implement embedded Co-Browsing to transform agents’ ability to guide customers in a secure environment. With embedded Co-Browsing, agents can see and interact with customers on a web application or domain, guiding them throughout the onboarding process and establishing or boosting trust at vital moments in the customer journey. CAnb saw an increase in client satisfaction but also agent satisfaction. Moreover, even though the duration of calls as increased during the migration, it was well spent as agent took additional time to guide clients through their new e-banking environment.

Next steps: unlocking Unblu’s full potential

To unleash the full service potential of multiple digital channels, the Crédit Agricole next bank’s digital team has devised a step-by-step roadmap to leverage Unblu’s platform capabilities.

Once implemented, the Swiss-based retail bank will be able to increase service efficiency, generating value from new and existing customers while maintaining record levels of satisfaction.

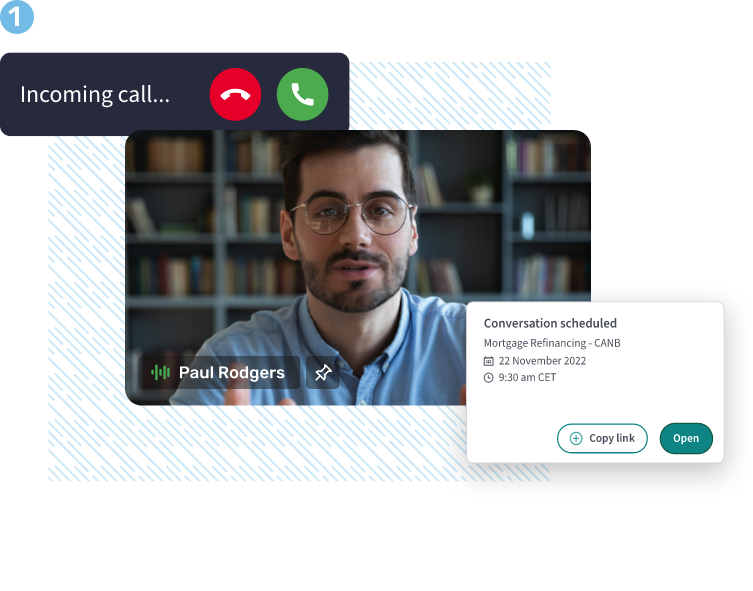

Deploy Unblu Video & Voice alongside Online Appointment Scheduling so that clients can engage with the bank at their convenience.

Implement Live Chat on CAnb’s public website and e-banking space, providing alternative options for client-agent interaction.

“45% of our calls are triggered by clients because they need support.Collaborative tools will help us drive remote sales and consultancy services.”

Want to find out more about Unblu?

If you have any questions, please email us at sales@unblu.com

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice