There’s been substantial discussion surrounding the upcoming customer duty deadlines, with wealth management firms and private banks working overtime to adhere to new regulations.

The guiding principle of ensuring a high standard of behaviour and taking proactive action to deliver positive outcomes for clients is admirable – but not always easy to achieve practically.

For firms, it isn’t enough to simply adhere to the guidelines, they must also have a plan in place to clearly demonstrate that they are doing so. With some aspects of the regulation more subjective than others – particularly surrounding effective communication – this can present a substantial challenge for firms who are already under pressure to update their processes.

Deadlines have already passed

By now your wealth management firm or private bank should have agreed upon the plan moving forward, with firm evidence that the plans have been scrutinised to ensure they will help create positive outcomes.

The next customer duty deadline for firms comes into force on 31 July 2023, and focuses on, ‘new and existing products or services that are open to sale or renewal.’

Can you prove ‘clear and concise’ communication?

With the upcoming deadline, the proverbial stabilisers are off and firms have active responsibilities in rigour for how they deal with clients. In this context, two key points arise:

- The regulation effectively states you need to ensure clear and concise communication with your clients.

- You need to evidence that your clients have understood the advice.

This begs the question, how are you evidencing that you’ve provided clear and concise advice and that your client has understood that advice?

The rule around understanding and support outcomes is challenging due to its somewhat subjective nature. Adhering to and evidencing this requirement involves developing robust communication channels that are at once convenient, secure, and record all interactions as a matter of course.

The Unblu Conversational Engagement Platform

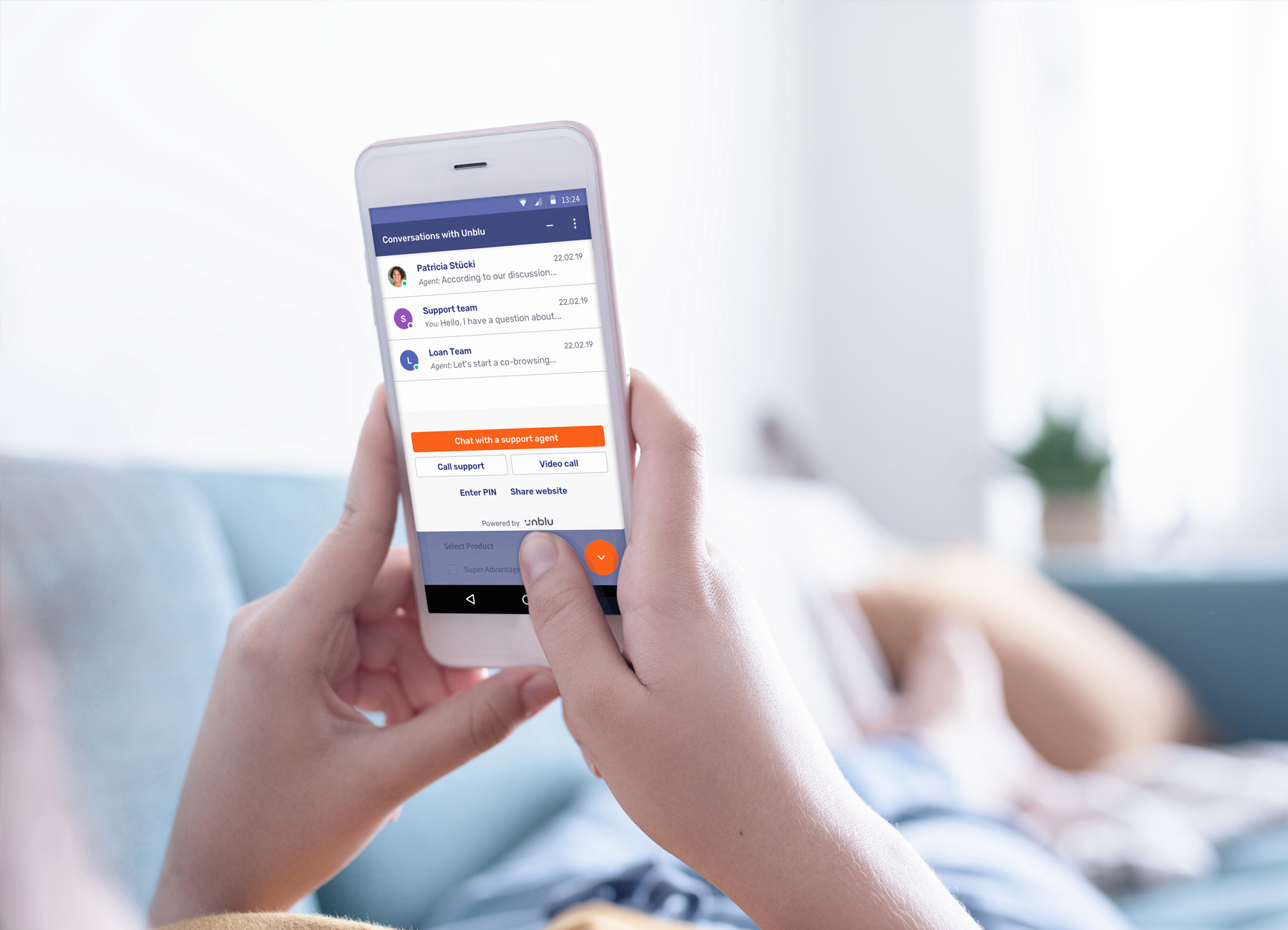

If you’re struggling with this aspect of the Customer Duty, Unblu’s Conversational Engagement Platform offers convenient and meaningful touchpoints that increase your clients’ access to your advisory services.

The platform is centred around three pillars – text-based communication, video & voice conversation, and visual collaboration that can be embedded into the channels your clients are already using to enhance and extend how you communicate today.

Of particular use is features like Secure Messenger, which allows advisers to communicate in a way that clients prefer, without putting the organisation at risk or losing access to conversation history.

Secure Messenger works like popular messaging applications, such as WhatsApp or Facebook Messenger, but with added security features and full omnichannel functionalities. Any interactions that take place via the platform are automatically recorded in an encrypted location, and can even take place behind client portals or similarly secure environments.

Are you ready for 31 July?

Are you unsure whether you’re able to fully evidence client understanding of product or service offerings? Request a demo with one of our sales representatives and take active steps to reduce your exposure.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice