UNBLU FOR CREDIT UNIONS

Drive engagement with a next-level member experience

Credit Unions succeed on the strength of their membership – they deserve the best service experience possible

Request a demoImmediate impact

Unblu empowers Credit Unions to provide optimal service to their members and boost efficiency

Bot resolution rate

Member support costs

AHT for phone calls

Digital sales conversion rate

Better engagement among valued members

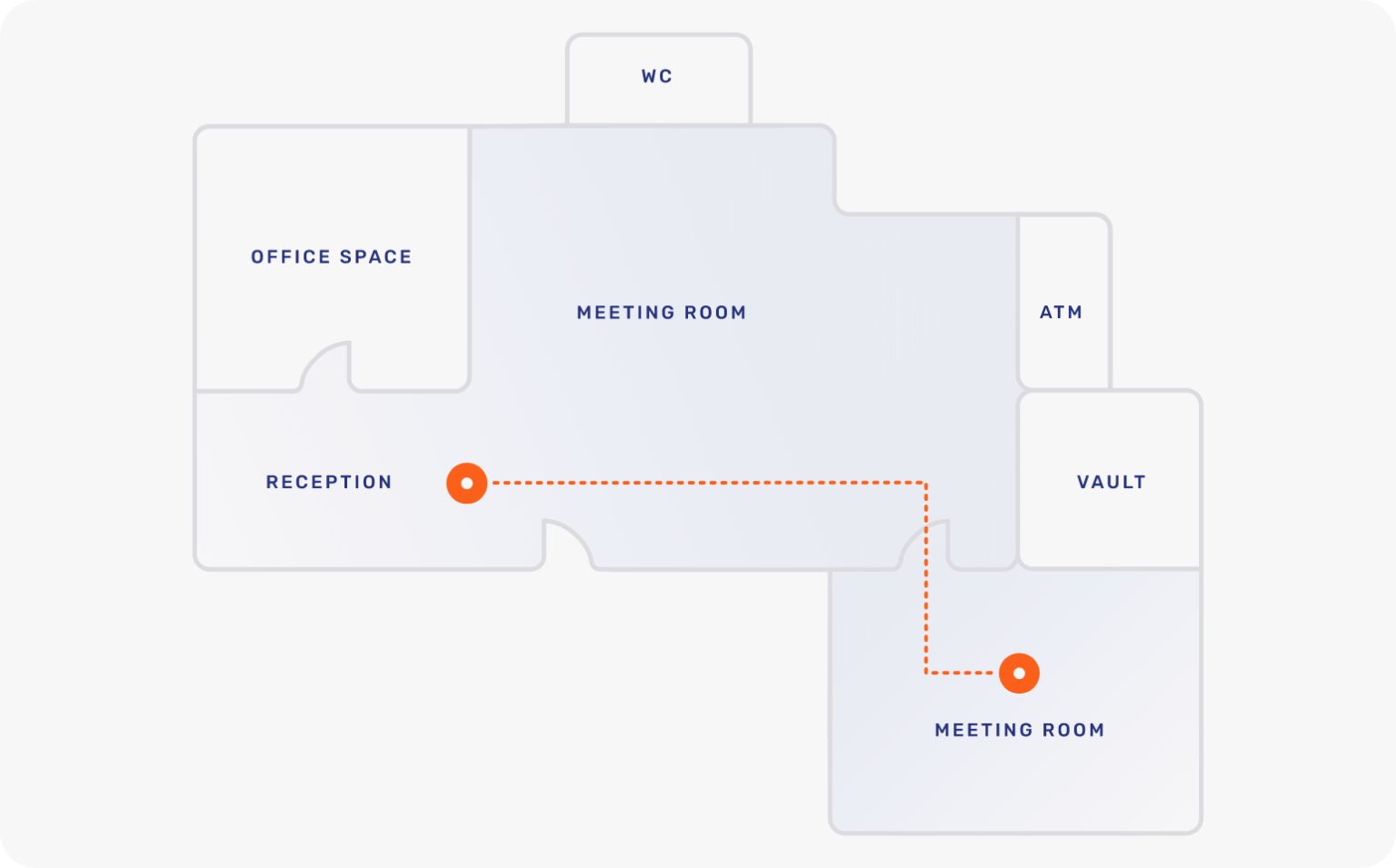

Guide members with digital experiences that feel in-branch. Delight from day one with frictionless onboarding processes and seamlessly progress to personalized, high-touch experiences that drive loyalty long term. Whether Co-Browsing to provide remote visual assistance in real time or Secure Messenger for ongoing asynchronous support, boost engagement through quality interaction

An efficient, cost-saving solution

Increase agent efficiency and boost employee satisfaction with new digital channels. Unblu Conversational AI provides members with 24/7 support access to get answers or perform transactions. Beyond freeing agents up for high-impact conversations, the Bot Assistant equips agents with accurate and personalized recommendations to increase first contact resolution rates and reduce handling times.

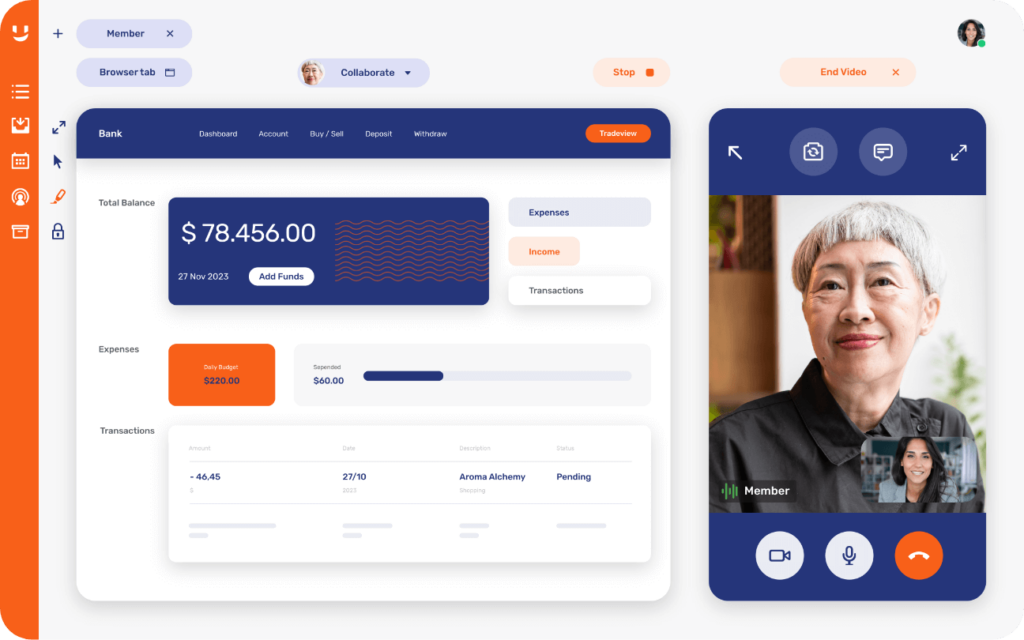

Maximum revenue through additional purchases

Happy members make more purchases. Attract and retain members of all demographics with digital channels that ensure personalized service excellence. With Conversational AI, agents can better qualify leads to prioritize engagement on high purchase intent pages or capitalize on promising Live Chat conversations. Alongside offering proactive support for account options and online banking, this empowers agents to identify tailored products and services for specific individuals.

The features that drive results

- Conversational AI

- Secure Messenger

- Video & Voice

- Co-Browsing

Conversational AI

Reduce the strain on contact centers and empower members to find the answers they need. Unblu’s Chatbot can deal with 75%+ of queries – with human support available at any time via Live Chat.

Secure Messenger

Asynchronous messaging support for the ultimate service experience. Secure Messenger mirrors the way we communicate in our personal lives, while remaining compliant, secure, and omnichannel.

Video & Voice

Securely schedule a call or launch one instantly from any channel. Enhance communication and finalize purchases with whiteboard collaboration, document storage, and e-signatures.

Co-Browsing

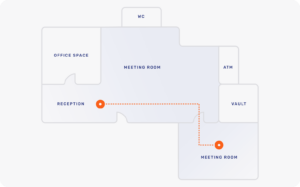

View and interact with the same document or web page in a secure remote environment. Featuring visual-enhancement whiteboarding tools, Co-Browsing ensures hassle-free, high-touch collaboration

Does your physical branch need a digital revamp?

Fewer branches since 2017 (McKinsey)

Plan to visit one less often

Still claim a local branch is “extremely or very important” (EY)

Reinventing and expanding branches with a hybrid concept

-85%

branch operating costs

revenue growth throug branch expansion

Increasing service hours (10h per day)

Unleash the power of digital in a physical branch context

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice