USE CASE · CONVERSATIONAL BANKING

Taking customer conversations to the next level

Customers want the convenience and practicality of online and omnichannel banking, but they also want personal interaction. Quite simply, they want to be able to speak with their bank.

We allow financial institutions to

Humanize the customer experience.

Unblu helps providers to combine high tech with high touch to deliver productive and personal interactions across multiple touchpoints, leveraging each exchange to build trust.

Have meaningful conversations with customers

Allow customers to interact with their bank in the way that best suits them at that moment, providing relevant and personal advice, and creating meaningful relationships.

Design seamless journeys

Banking should be available anytime, anywhere, and on any device. Unblu’s omnichannel solution streamlines banking operations for customers, making the experience more flexible and efficient.

Build trusting relationships

Financial topics can be stressful. Customers appreciate sensitivity. When they arrive on a page, a bot transfers them to a specialist who then initiates a video call, allowing for face-to-face discussion. Show that you care about their needs.

Why Unblu?

Different products for diverse needs

Texting: advice anytime, anywhere

Secure messenger allows customers and advisors to chat asynchronously. It’s intuitive, flexible, and familiar—and can even be integrated into applications like WhatsApp and Facebook Messenger. Meanwhile, live chat offers the opportunity for real-time exchange with canned responses to speed up replies.

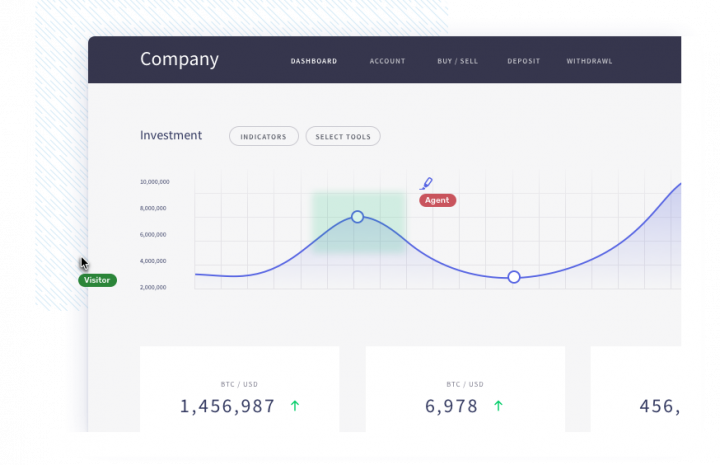

Learn more about secure messaging Learn more about live chatCo-browsing & screen sharing: communicate, collaborate

The client-advisor relationship can be further strengthened with a combination of co-browsing and screen sharing, which provide a visual context to problems, allowing advisors to offer more specific and relevant guidance.

Learn more about co-browsing Learn more about screen sharing

Chatbot: support at that very second

Chatbots save time and resources, offering instant customer support for simple and low-stakes inquiries, giving agents time to focus on more complex issues. Customers have the option to transfer to an agent at any time, making chatbots a risk-free solution.

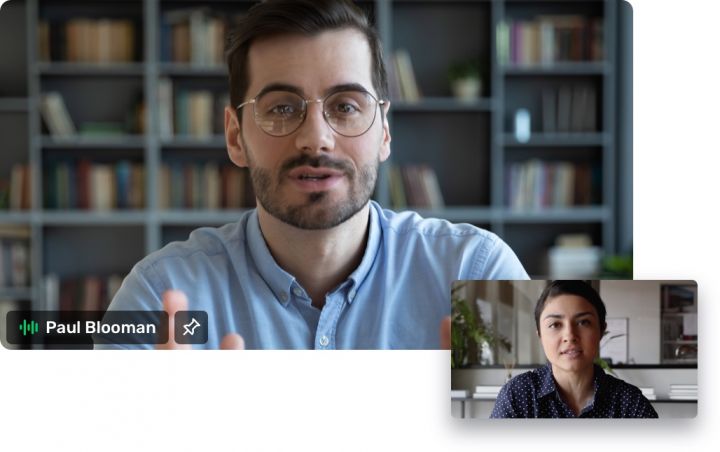

Learn more about chatbot integrationVideo & audio call: seeing eye-to-eye

Enjoy face-to-face interactions without the customer having to come into branch thanks to video calls. Build relationships in real-time, offering both reassurance and convenience to busy customers. Customer having a bad hair day? Audio call is always an option.

Learn more about video & audio call

How we are different

Total compliance

Data protection, access to audit trails, masking, encrypted archiving, and geofencing all ensure that Unblu’s conversational tools are compliant with the necessary financial regulations.

Enhanced security

The SecureFlow Manager (SFM) ensures even the most highly secured applications can be safely accessed. Unblu’s technology can also be integrated into existing security set-ups without compromising them.

Innovative technology

Unblu Solutions require no downloads or installations for end users.

Comprehensive usability

Different digital tools can be combined into a single seamless journey, with advisors and customers able to switch smoothly between solutions and channels as necessary.

Flexible integration

On-premise installation is available. Other options are the Unblu Financial Cloud or a dedicated cloud operated by Unblu.

Enhanced efficiency

Unblu’s implementation methodology allows full operationality within a month. Our modular system means you can license some functions now and activate others later, without additional installation projects.

Absolute trust

Unblu has been transforming financial customer service for over ten years, helping more than 150 banks and insurance companies with innovative conversational tools that build trusting and meaningful relationships.

Book a demo

For secure and efficient online advice and a seamlessly integrated customer experience, choose Unblu.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice