Within financial services, it is arguable that those who deliver advisory services have been most disrupted in recent months. Wealth Managers, Private Banks, & Insurance Brokerages have reacted to the worldwide pandemic in different ways. While the overwhelming priority has been to enact a course of action to ensure business continuity, few are seeing the strategic opportunity that this forced focus on alternative client interaction methods brings. Those that do are placing themselves ahead of the pack for the “next normal”.

Business continuity measures vary from simply sticking with traditional client communication tools to using “off the shelf” digital collaboration tools for specific tasks. We are now past the initial immediate response phase and into a phase of recovery, which is also the time to concentrate budget for, and steer towards strategic initiatives.

A growing profitability challenge preceded the Covid-19 outbreak for those delivering trusted advice. Rising cost-to-income ratios have affected private banks and insurance brokers alike – despite the differing focus of their services. Digital is known and widely accepted to hold a solution to this challenge. The pandemic has simply accelerated this digital agenda.

The challenge of improving the cost-to-income ratio boils down to this: how can you lower costs, or increase revenues, or both, during a period of upheaval?

It is no surprise that embracing digital will be part of the answer but this can be interpreted in diverse ways by different people. You must ensure that you view the complete client value chain and understand what truly best serves the client relationship. Be objective and critical with the solutions you’re assessing as it will help you unearth opportunities that you were not thinking about when initially planning your recovery. If you’ve not yet been sincere with adopting a customer-centric approach then now is the time to ditch those old product-centric ways. Adopting the right digital platform can bring you a rapid and significant positive impact by realising efficiencies and lowering costs for advisors while providing greater convenience for clients leading to more interactions and increasing revenues.

To realise these goals, it is important to think strategically and not slip into a common mistake of just looking for digital equivalents of how client-advisor interactions were. For example, this means looking beyond isolated video meetings as a replacement for in-person face-to-face meetings and try to understand what would deliver real convenience to your clients.

Research already suggests that clients desire and expect more varied ways of engaging digitally with their advisors, including lighter interactions through the use of messaging. To date, for many financial services companies, the experience of messaging apps has come with the headache of regulatory risk. Client-advisor communication via the likes of WhatsApp is direct and private between the two parties leaving the company exposed due to regulations like MiFID II within the EU.

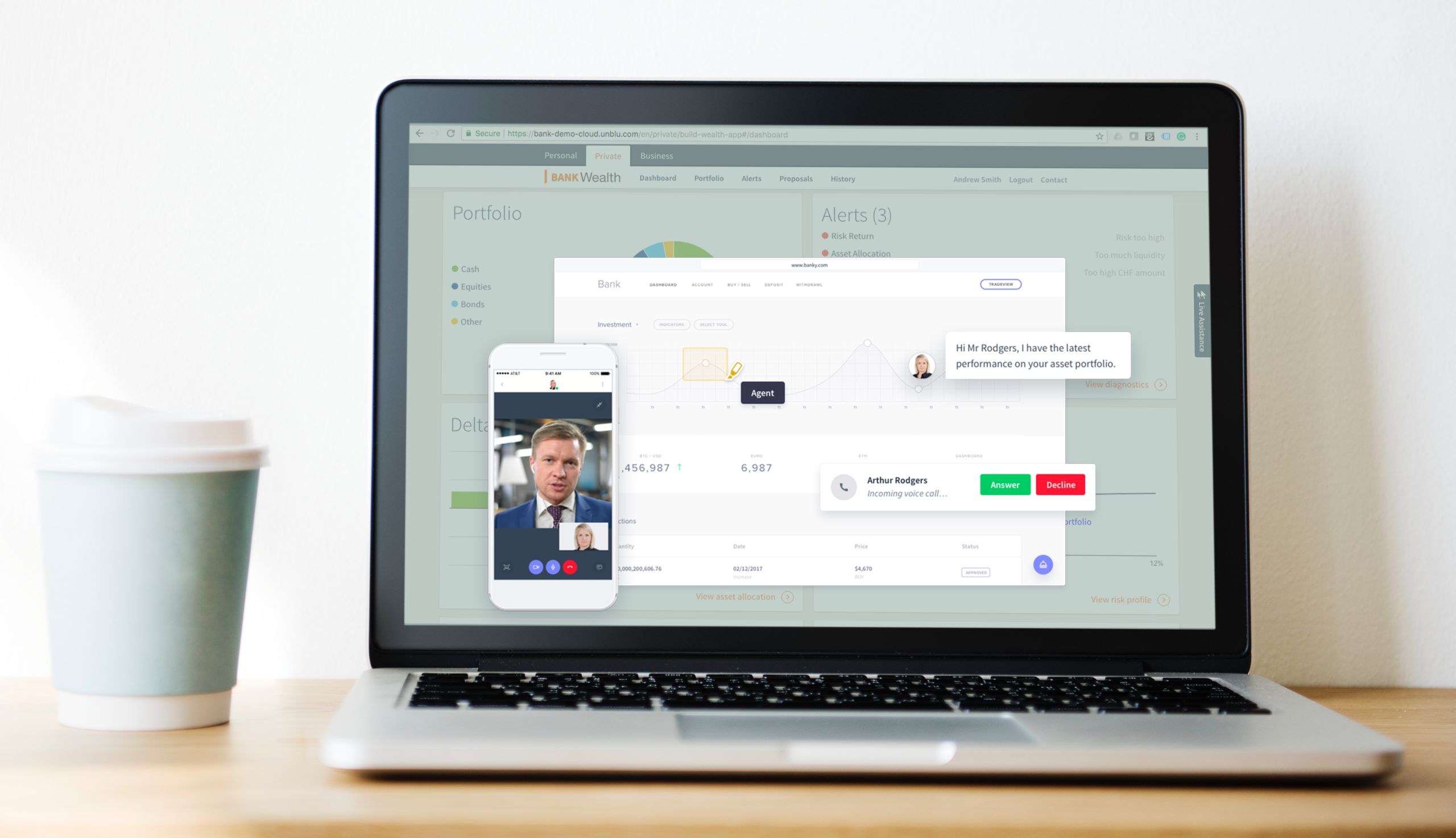

Platforms explicitly designed for the client-advisor relationship exist and allow for compliant “light touch” messaging and deeper, collaborative video meetings. Complex documents shared via a message during a commute can be easily opened and viewed together within a secure environment in a latter, more personal, video advisory meeting. The omnichannel infrastructure such a platform provides helps explore and embrace the future role of AI. This could be simple assistive AI helping with administrative tasks like a change of address or more in-depth Robo-advice helping to make suggestions for clients to conclude with their advisor but delivered through a familiar messaging interface.

Although this focus on digital has been thrust upon us, the opportunity to now lay a strategic foundation is compelling. Doing so will position your company as a leader in a new era that will better serve a growing digitally savvy segment of your client base in a way that will also grow your revenues and help reduce costs.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice