Case Study

Driving growth and network expansion with hybrid branches

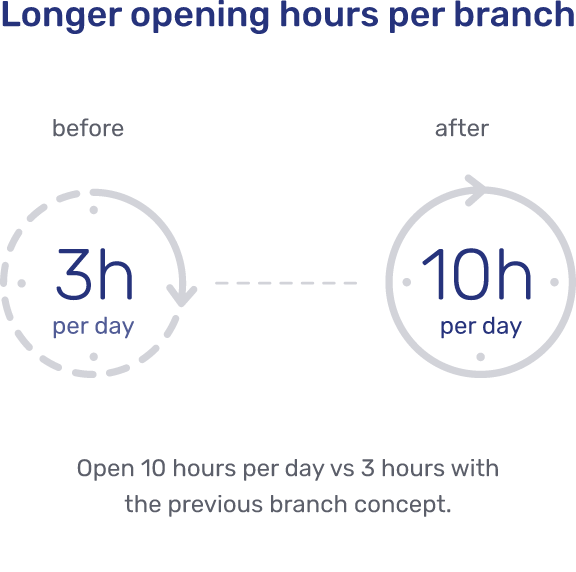

Valiant Bank is based in Switzerland and offers a range of retail banking services for private individuals and SMEs. From 2014 to 2017, there was a notable decrease in the number of personal assisted transactions, which fell by 35% overall. In response, Valiant reduced branch opening hours and, by the end of 2016, over half of the branches were open for just three hours a day.

Even so, the footfall was less than necessary to make continued operation of all branches viable. As a mid-sized bank, the choice was either to close branches or adopt a new expansion strategy. In 2016 and 2017, Valiant made the decision to expand – increasing their digital capabilities while opening new branches in Romandie, Jura, and East Switzerland.

Open branches in three new areas

Achieve one agent per 5 to 6 digital receptions

Reduce the number of specialists within individual branches

Results

Unblu Branch has been rolled out to 60 Valiant branches in Switzerland. The initiative was a success, positively impacting Valiant Bank across a number of key areas.

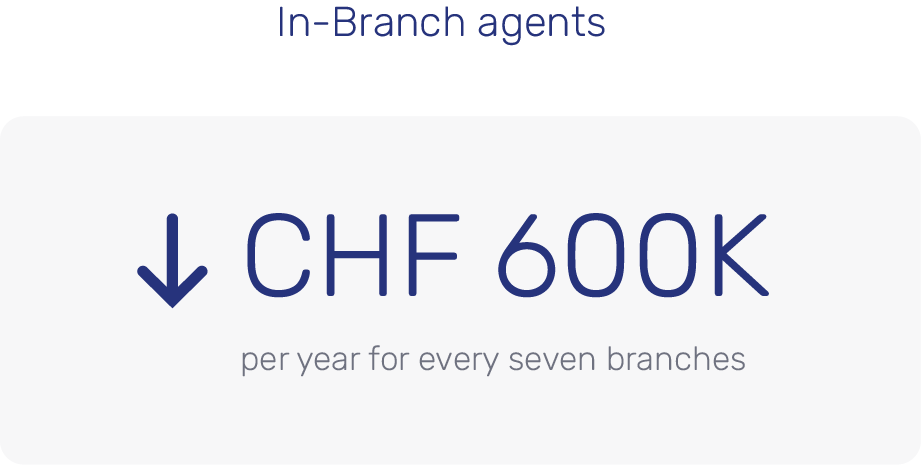

Area 1: Cost Savings

Area 2: Business Growth

Area 3: Service Experience

Want to find out more about Unblu?

If you have any questions, please contact us.

“We saw a very smooth transfer of in-branch tasks to our digital service and the new design is better accepted by clients because digital components have been added.”

Want to find out more about Unblu?

If you have any questions, please email us at sales@unblu.com

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice