Superior service. Superior gains.

Reinvent the in-person experience online for improved customer satisfaction, operational efficiency – and additional revenue generation.

Request a demoIn-built efficiency cycle

Enhance operational efficiency to reduce traditional channel strain and boost productivity

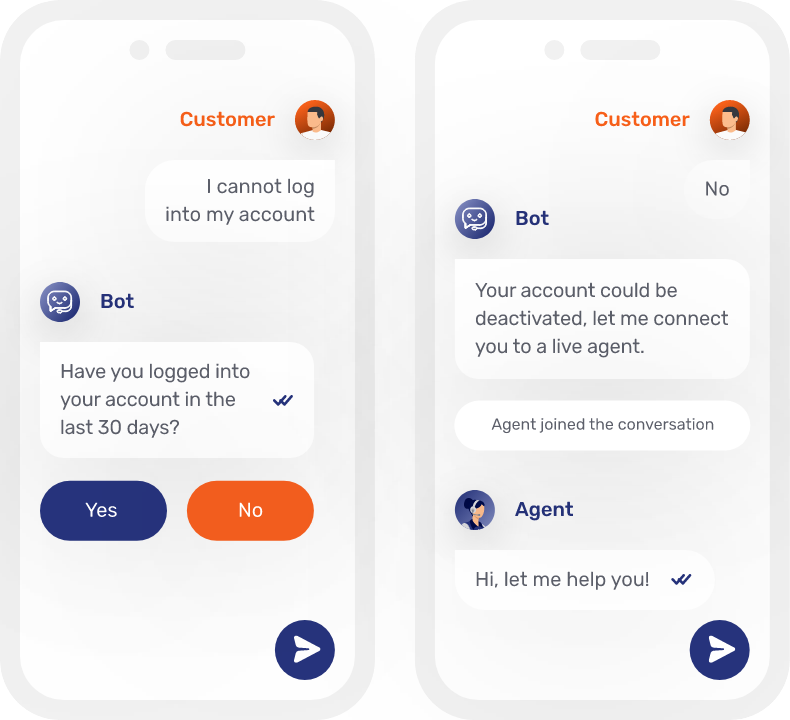

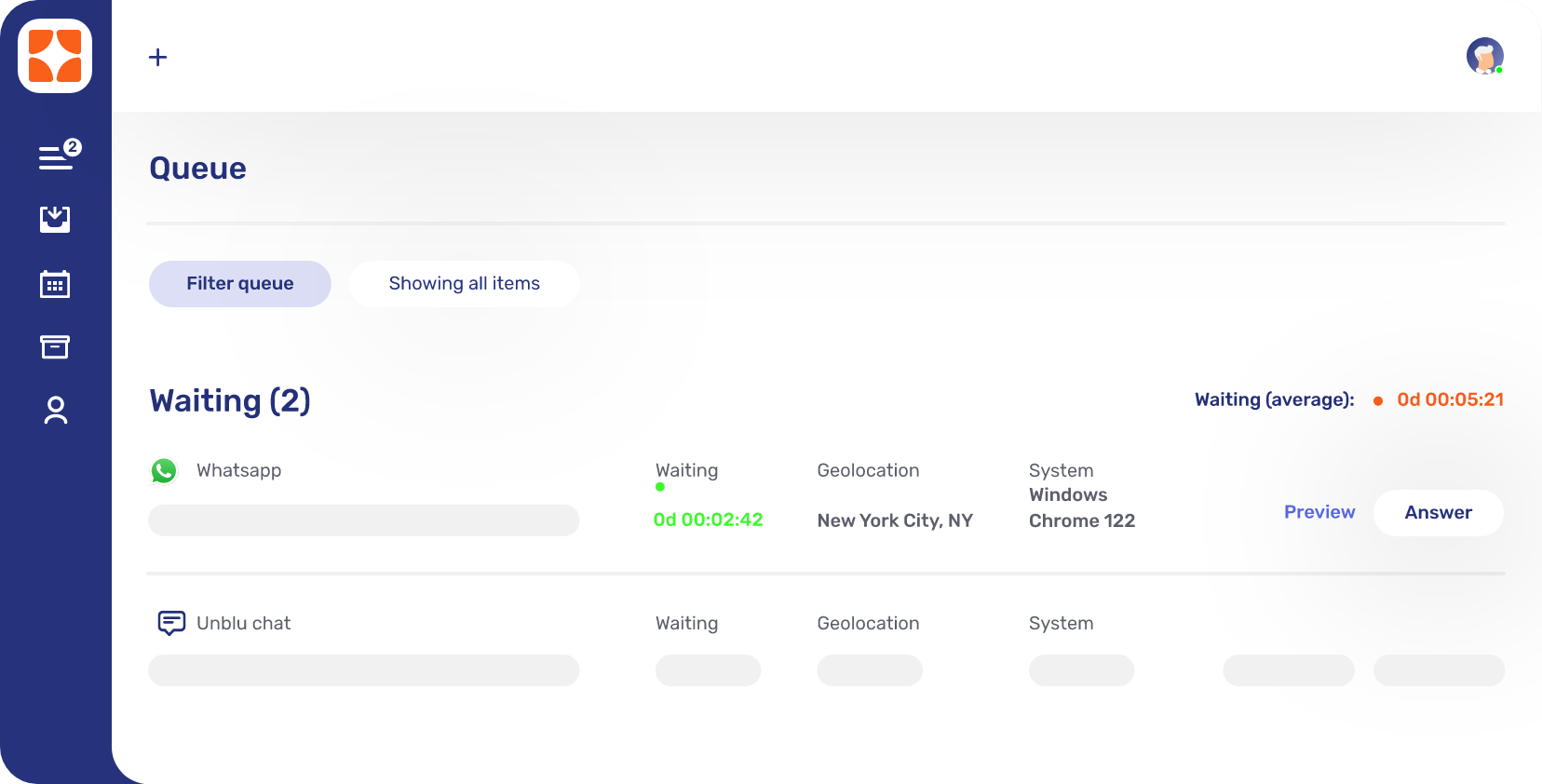

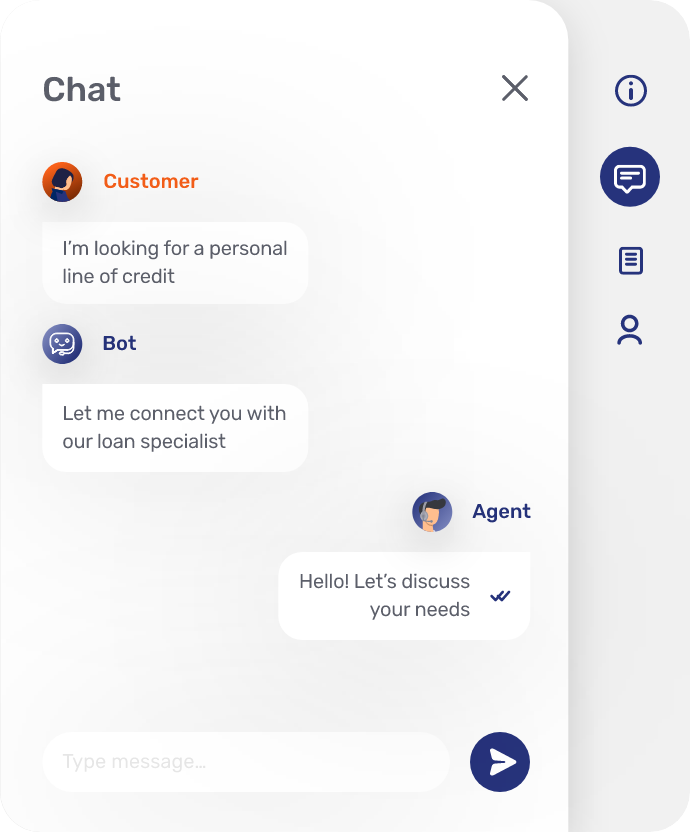

Self-service options with support on hand

Robust 24/7 self-service options – with the option to escalate to Live Chat when needed.

Activate conversation cruise control

Use Unblu’s AI Co-pilot to scour the knowledge base and generate automated answers or provide conversation summaries for rapid insights.

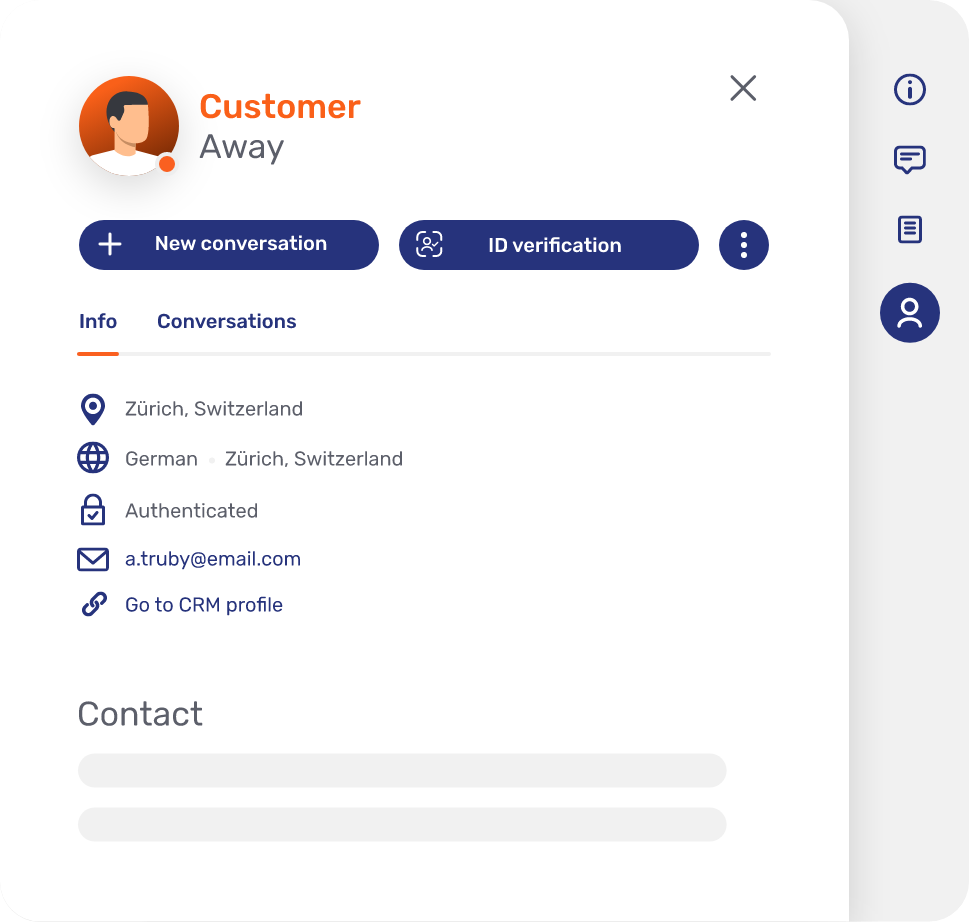

Every customer story at a glance

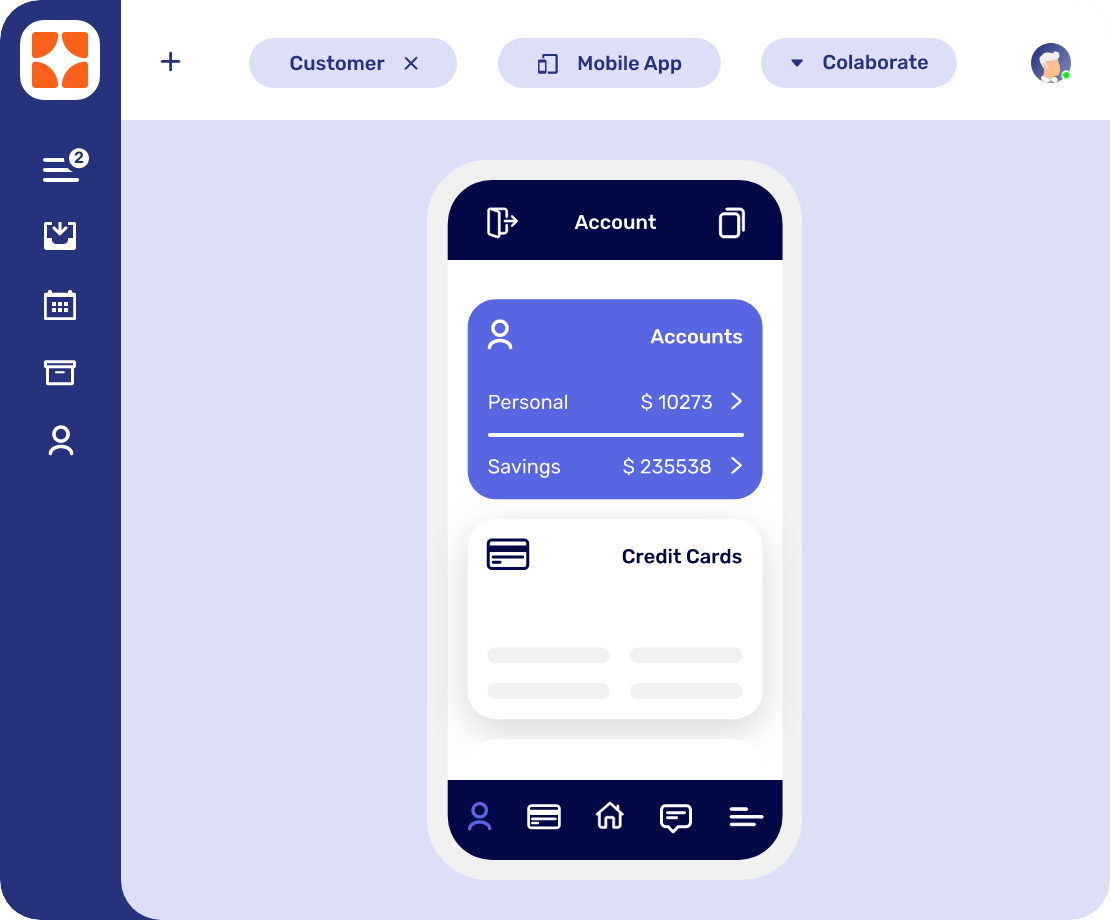

Customer segment. Previous conversations. Contact details. Gain quick access to relevant customer information.

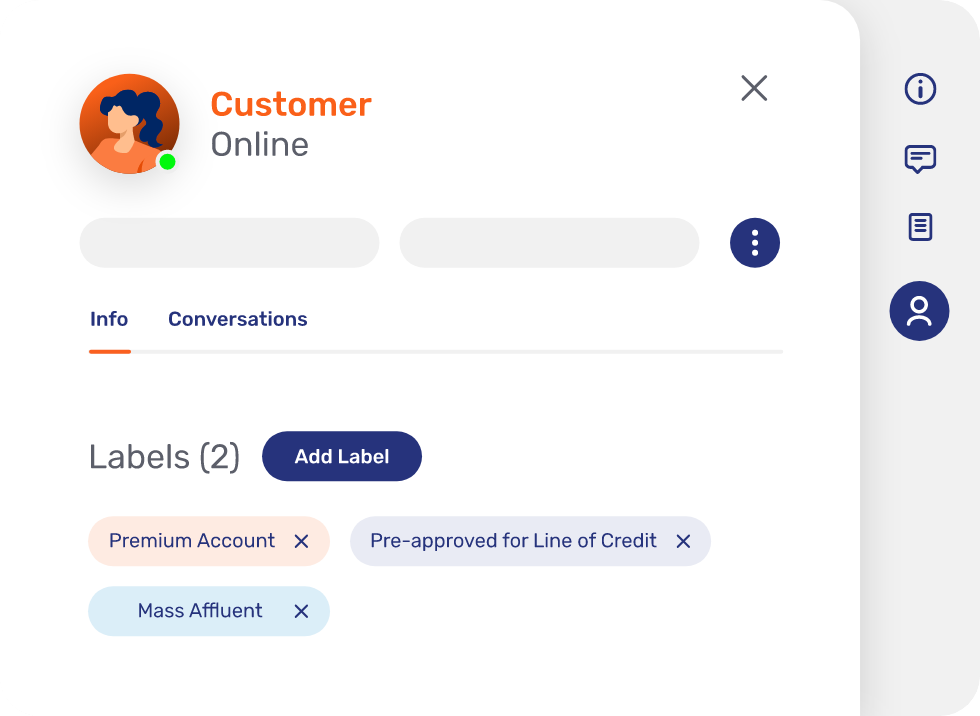

Define and refine

Label customer segments to offer each individual client a more tailored and personalized experience.

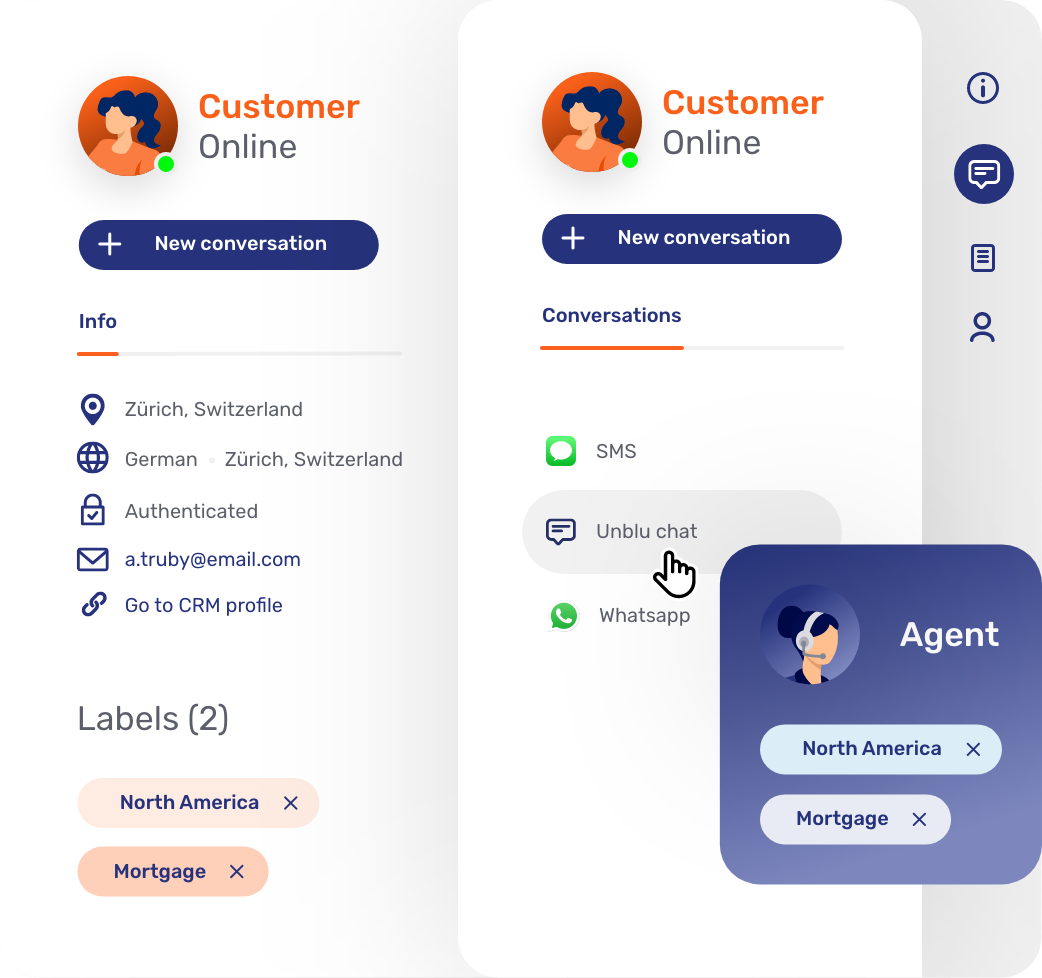

Dynamic team access

Ensure agents only have access to relevant conversations with flexible access capabilities.

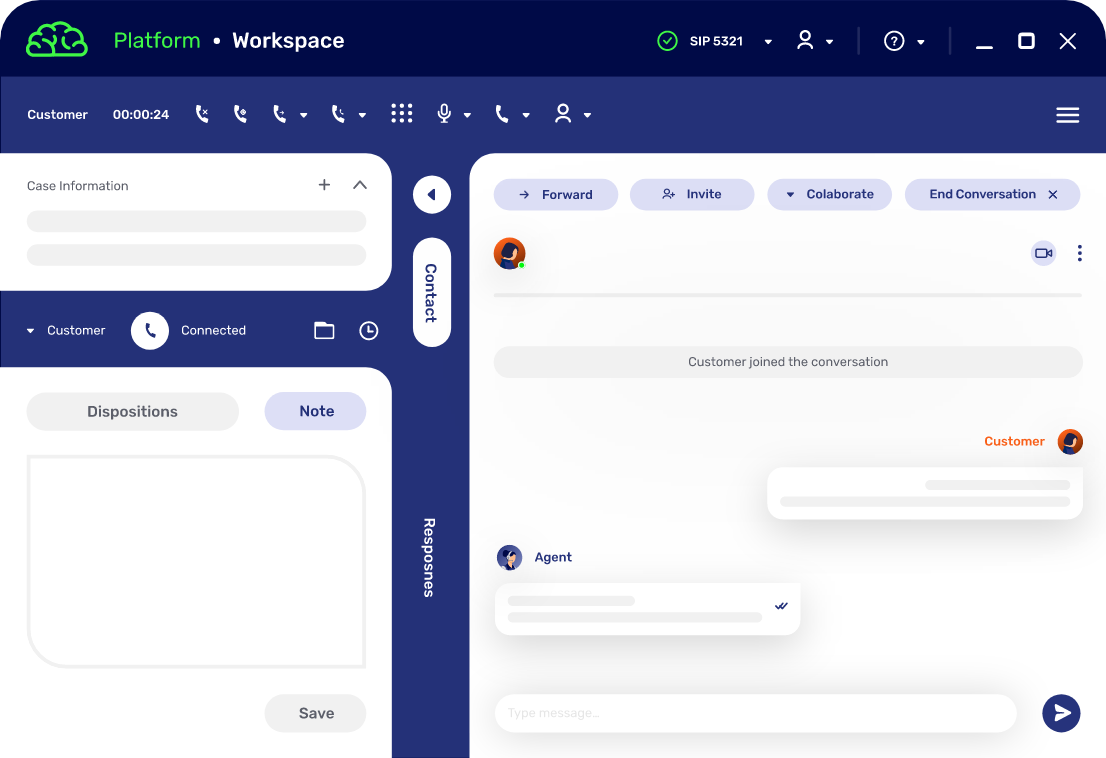

Contact center – seamless integration

Merge Unblu with any current contact center solution for a seamless digital platform consolidation.

How do we do it?

The extra mile for customer smiles

Offer the optimal digital experience that boosts trust and drives ongoing customer loyalty

A bespoke support service

Tailor your support to each customer with high-touch collaboration tools for swift issue resolutions and deeper conversations

Choose any digital channel

Don’t guess what digital channel your customers prefer. Consolidate all communication channels – whether SMS, WhatsApp, or beyond – for fully flexible interactions, accessible from one place.

First-class mobile support

Become truly mobile first with a support experience that is intuitive, native, and accessible behind authenticated areas.

How do we do it?

Unlock hidden revenue growth

Stop leaving money on the table – drive digital sales through service excellence.

Lead them to you

Warm leads without the work. Source and segment potential customers with the Unblu chatbot’s AI capabilities.

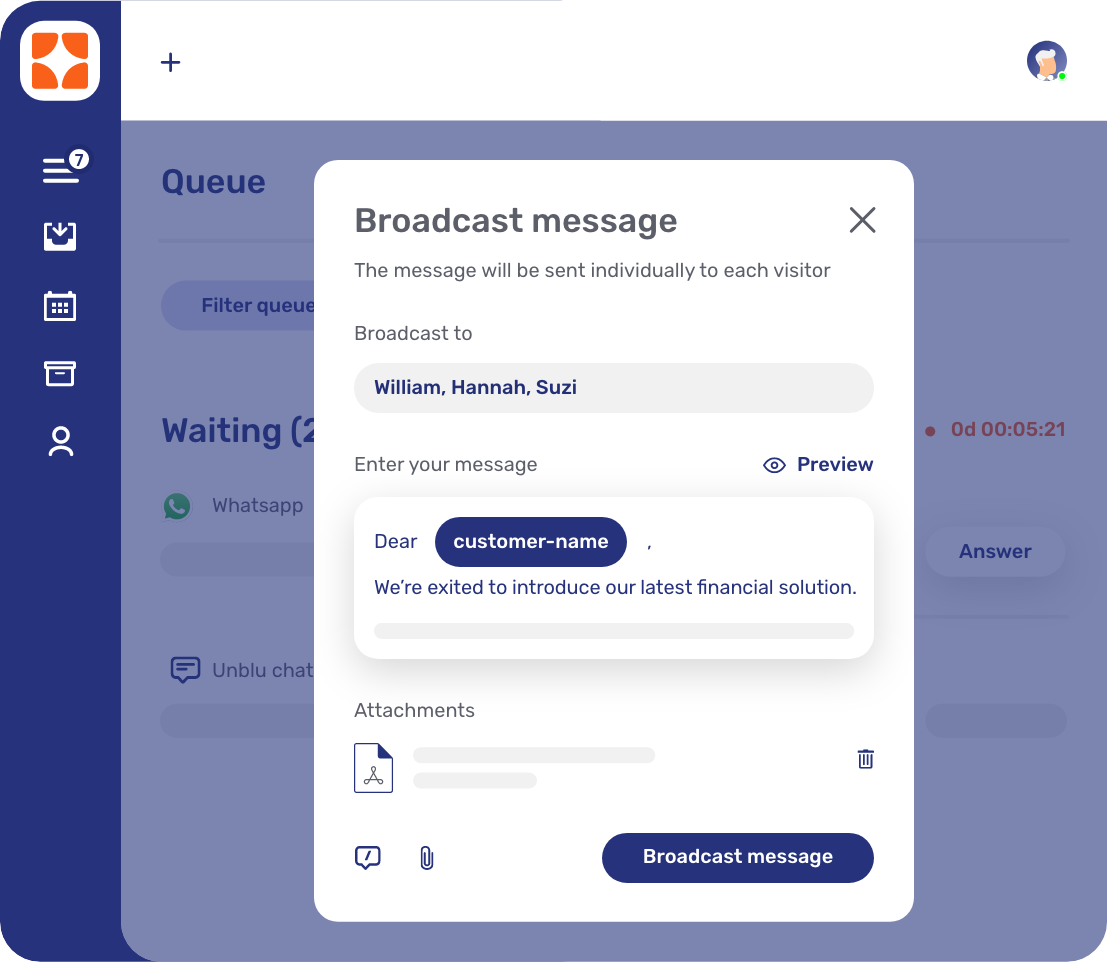

Spark their interest

Broadcast segment-focused product and service, sparking insightful dialogues with current or potential customers.

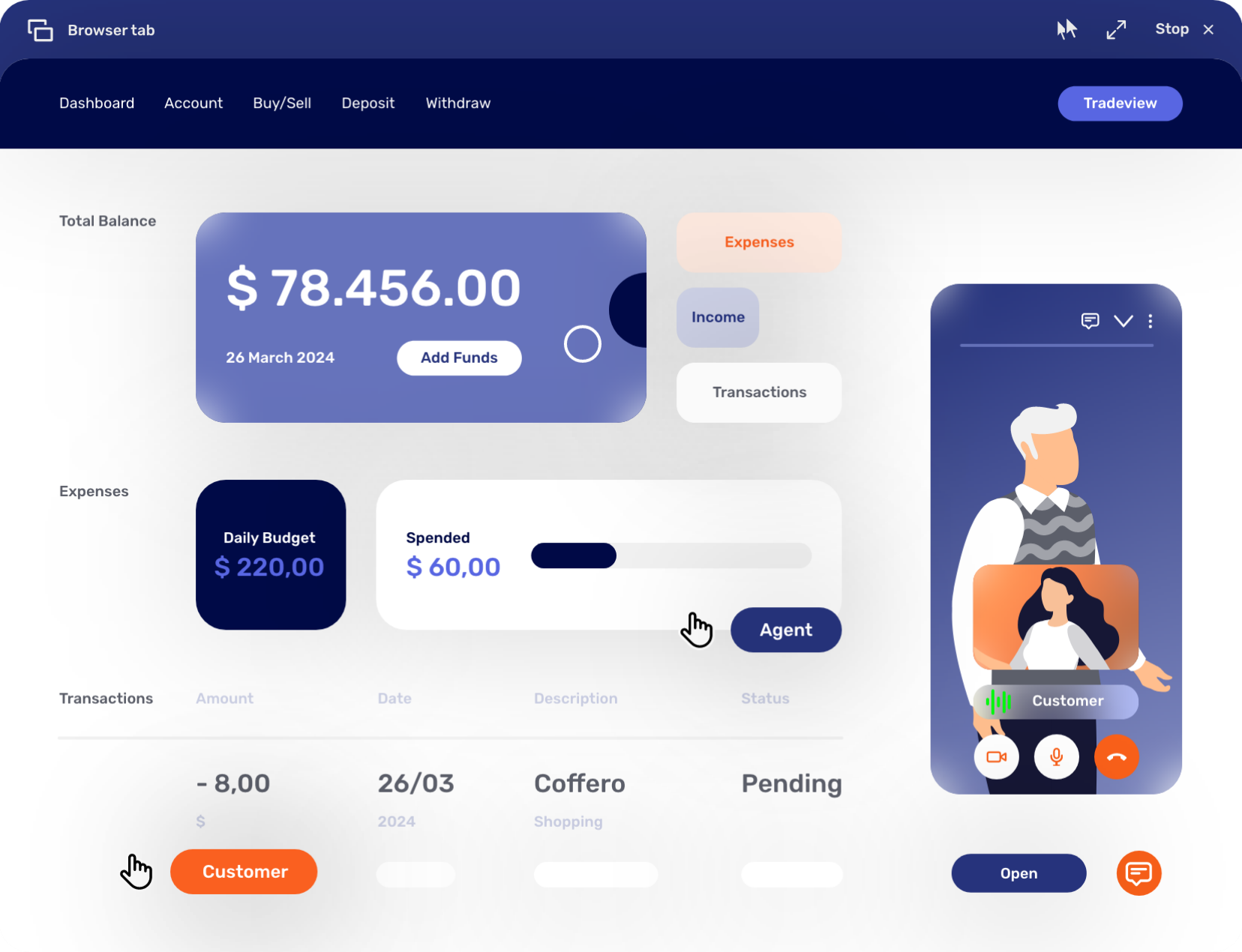

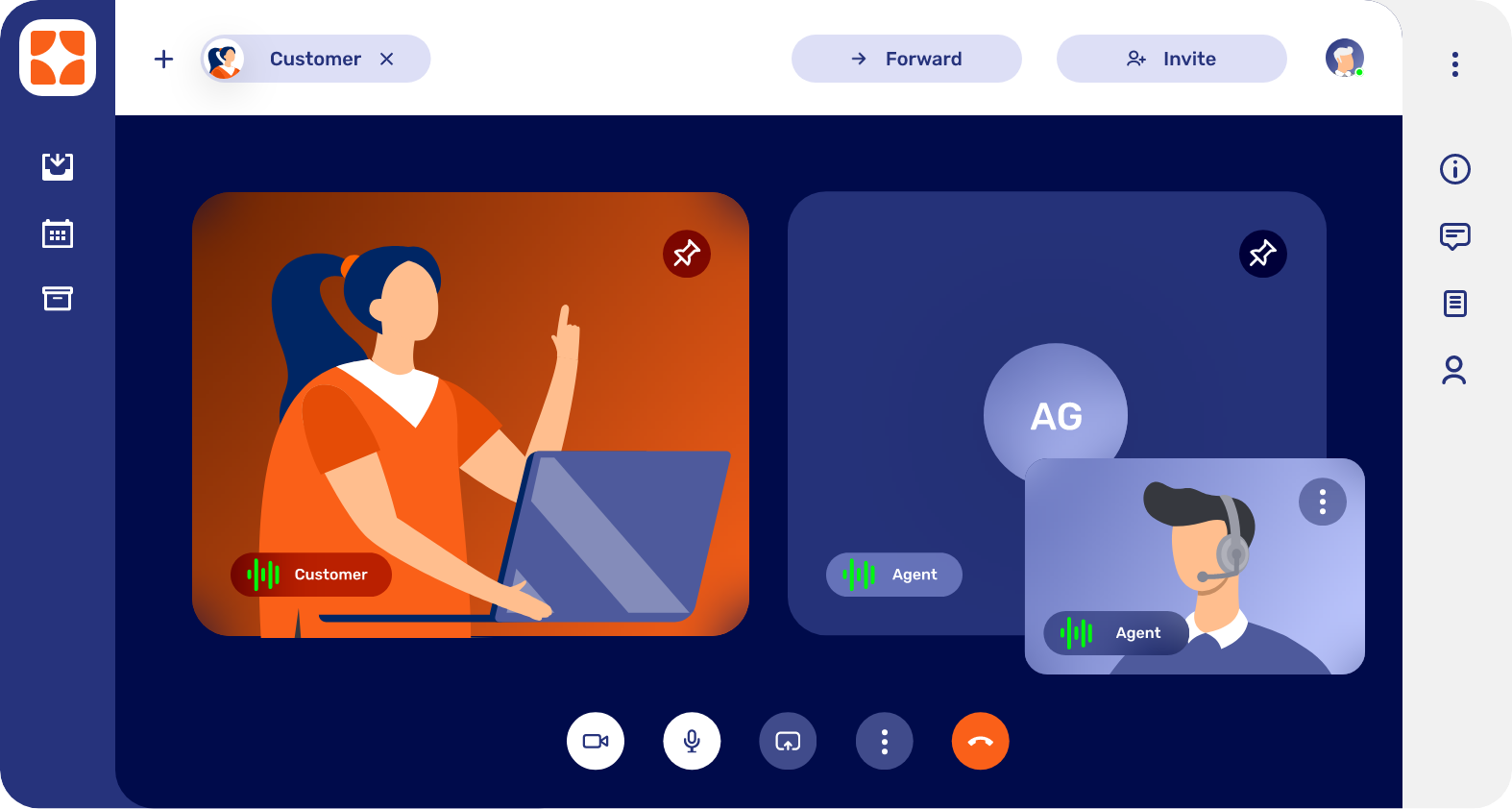

Elevate conversions with immersive calls

Dynamic Video & Voice calls that foster deeper customer service connections and drive sales effortlessly.

Side-by-side support

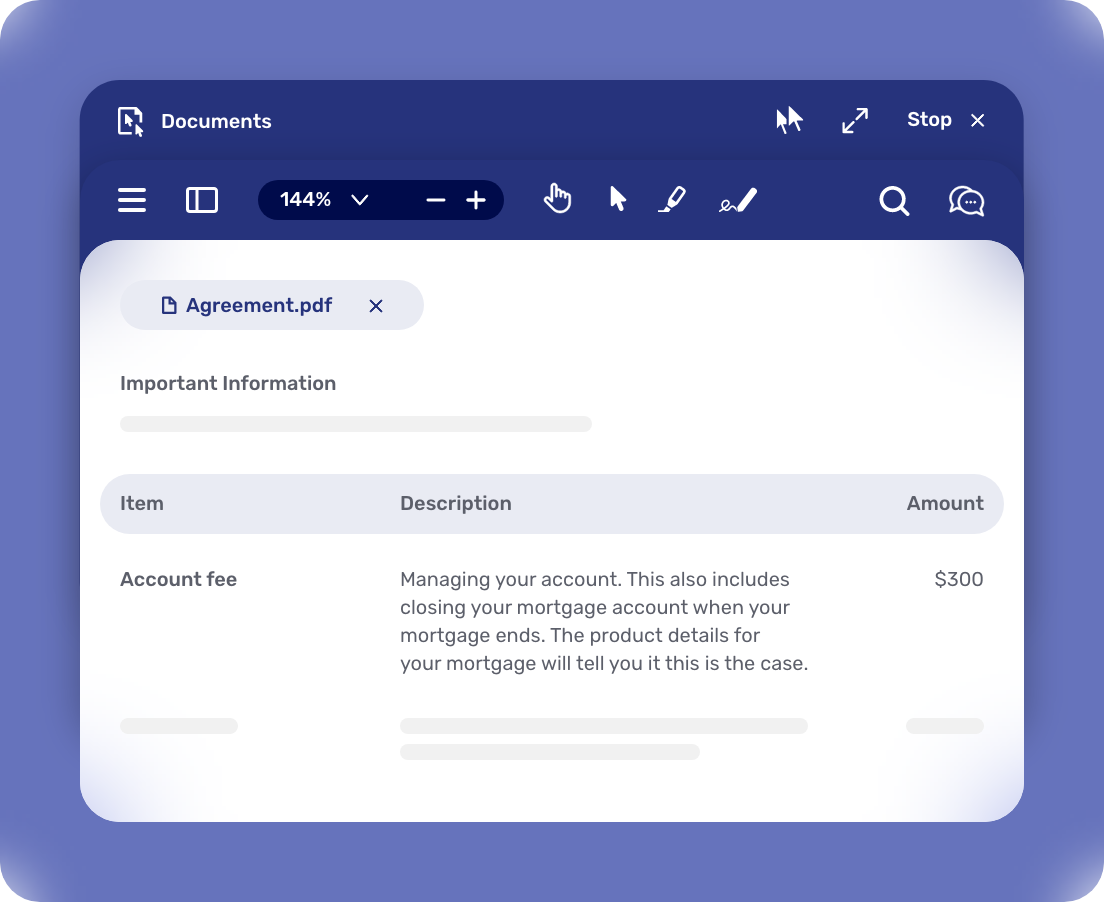

Elevate the conversation with secure Co-Browsing options to navigate, guide, highlight, and even sign as if you were in the same room.

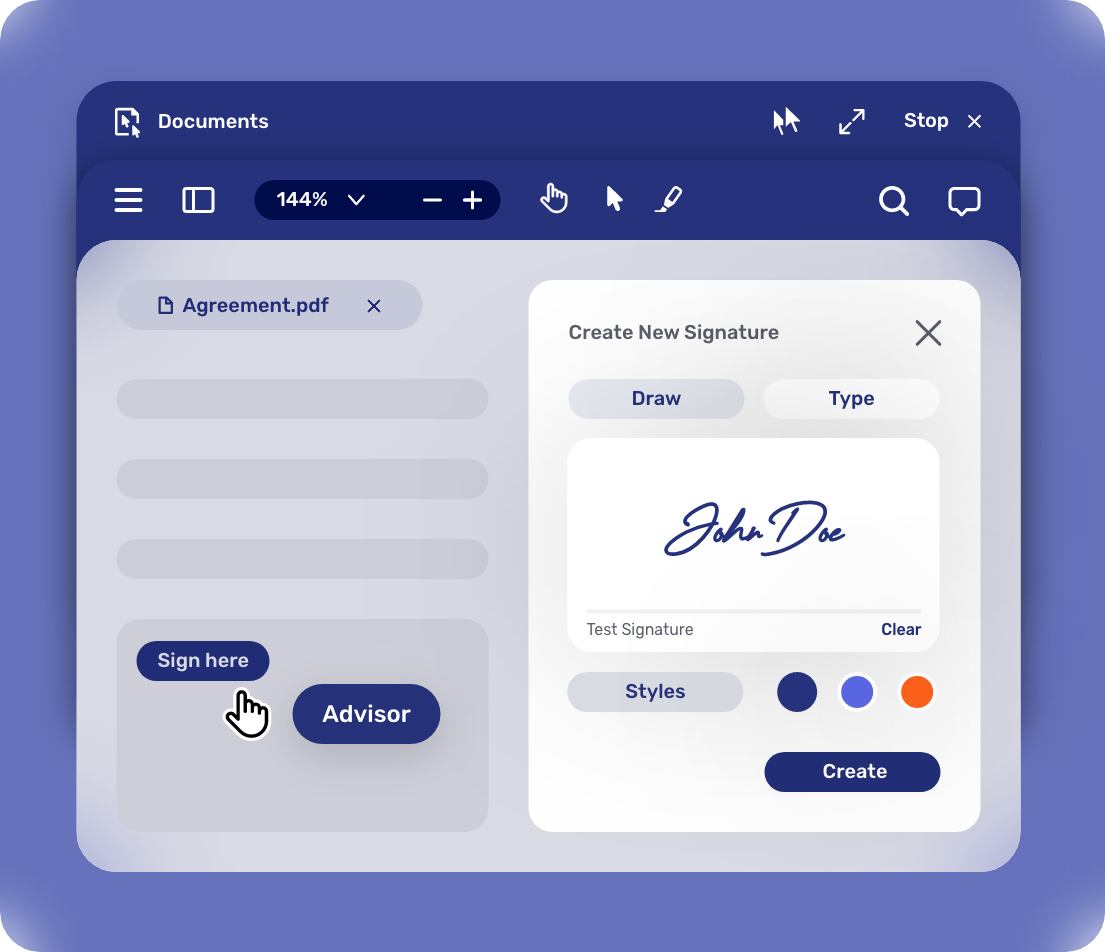

Review and close

Guide the customer journey through complex documentation reviews, remaining alongside them throughout the deal-signing process.

How do we do it?

Protect and serve

The strictest security measures for complete peace of mind

Secured authentication

Ensure user authentication by leveraging your financial organization’s current KYC security protocols such as passwords or biometrics.

Native call solution

Retain full data control with no third party data processing for any elements of voice and video calls.

Communication recording

All interactions – whether texts, calls, or beyond – are recorded and stored to comply with industry regulations.

Data security standards

Data is safely stored and never shared with third parties to protect client privacy and streamline regulatory compliance.

Flexible deployment options

Whether on-premise or on the Unblu Financial Cloud, you can choose the data hosting location and stay compliant with the highest level of security standards.

Data Loss Prevention (DLP)

Intercept sensitive data such as credit card numbers to avoid transmission – or integrate with your existing DLP solution.

Full feature list

Browse Unblu Spark’s full list of features at your own pace.

See in action

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice