As service automation gains pace, artificial intelligence (AI) is playing an evermore significant role in delivering excellent customer service, and this includes digital banking.

Take chatbots, for example, which have transformed the conversational experience customers receive when interacting with brands. Thanks to developments in natural language processing, chatbots are capable of offering relevant advice 24/7 and at the customer’s convenience. By using this technology, banks are able to save time and increase customer satisfaction – or so the theory goes.

While chatbot industry trends are positive overall, they have also led to a number of concerns or pain points that are impacting the experience for banking customers.

Take the issue of security, which is a major question in finance contexts. Can customers trust that interactions via a digital interface are fully compliant? Similarly, we must question to what extent chatbots are capable of dealing with customer requests. For simple transactions or customer queries, there’s rarely an issue. Yet what happens when a customer wants to challenge a payment or has other complex problems to solve?

The chatbot market is growing and financial institutions are correct to embrace the technology. However, by analyzing the trends, we can also ensure that new technological adoption doesn’t come at the expense of vital factors such as security, trust, and the quality of support.

1 // Chatbot usage is increasing

Chatbot statistics show that customers are responding to the technology and are making use of it. According to a Juniper Research study, the total number of chatbot messaging apps accessed globally will increase from 3.5 billion in 2022 to 9.5 billion by 2026.

It’s worth noting, however, that this surge in uptake is directly related to an increase in availability. While the chatbot industry has increased by 169%, this has been primarily driven by an increasing adoption of omnichannel retail strategies by eCommerce players and the rising integration of chatbots within messaging platforms. In other words, an increase in usage does not necessarily equate to an increase in satisfaction based on this trend alone.

2 // Chatbot technology will get smarter

One of the common complaints levied against chatbot technologies is their limitations. While simple chatbots can help automate tasks that aren’t too complex and deal with simple customer requests, for more difficult requests human interaction is vital.

However, according to a recent Forrester report, more sophisticated chatbots are on their way. The report claims that they are set to become a reliable, mainstream solution and will go some way in making up for the failings of earlier models.

Much of these improvements are centered around conversational AI. There was initially a lot of excitement surrounding chatbots that soon gave way to the recognition that they mostly disappoint – especially those built by companies that treat chatbots primarily as IT efforts.

This failure led to a new focus on conversation design, which leverages long-standing principles of good design to help organizations course-correct to create better, more functional chatbots.

Furthermore, companies that focus on conversation design are proving better able to classify customer intent and identify which queries chatbots can handle. In this way, they’re able to design the chatbot’s personality so it’s intentional and aligned with the brand instead of being left to chance. For example, chatbots of this type can recognize human utterances more accurately, even before machine learning training begins.

3 // Automation and AI will play a greater role

Automation is transforming digital banking with artificial intelligence now able to replace various roles previously held by advisors. In fact, in North America, 79% would be willing to receive computer-generated advice on investments, and a similar number say they’d be happy to talk to a bot for advice when opening an account.

Artificial intelligence in banking is now charging full steam ahead and is being implemented in diverse business sectors. In fact, almost all banks currently use AI at least to some extent, or plan to in the next three years.

What’s more, this usage extends across practically all business areas, from operations to customer support operations. Top areas for future growth include personalizing investments (17% plan to adopt in next 1-3 years), credit scoring (15%) and portfolio optimization (13%).

4 // Customers prefer live chat to chatbots

Another critical aspect of AI in customer engagement is the use of chatbots. As the most visible and frequently-used self-service option, banking customers have regular exposure to chatbots. However, poor customer service experiences have left a lot to be desired.

In contrast to a 66% customer satisfaction rate with online chat technology (which connects customers to a human agent), a mere 26% of customers were satisfied with AI-powered chatbots.

Furthermore, over 80% of customers who have used chatbots for product inquiries in the last 12 months wouldn’t want to use them again – and 46% said that they’d prefer to use branches.

5 // Hybrid options are showing most promise

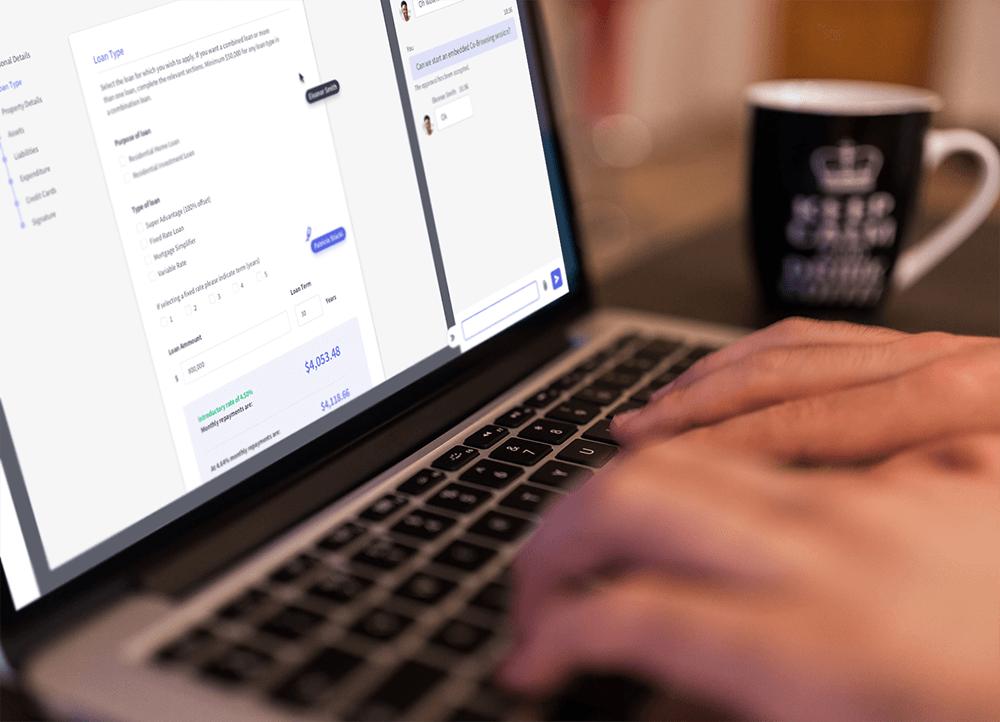

Despite their successes, chatbots still can’t totally replicate the nuances of human conversation and can have a negative impact on customer loyalty. For this reason, advisors have an important role to play. The ideal option for better user experience is a combination of chatbots and live chat, allowing customers to transfer to an advisor for complex issues such as payment disputes.

Customers want to communicate with their banks digitally, at their own convenience, but also have the option to speak to a real person at times for added reassurance and to ensure a personalized experience.

AI is certainly on the horizon of customer service – but as anyone who has engaged with a chatbot will know, it’s far off becoming a mature and self-sufficient technology. It still requires a human touch to guide it and, in any case, the demand for human-led customer interactions isn’t going anywhere. Even the best of AI would struggle to replicate the customer relationships that are built through face-to-face meetings.

A Deloitte survey indicates that consumers will continue to use digital channels for simple transactional activities, but many consumers desire high-touch customer service interactions for more complex products and services, such as mortgages and financial advice.

It’s unsurprising then that hybrid experiences scored higher on effectiveness, ease, and emotion when compared with digital-only or physical-only experiences.

6 // Customer safety and security is paramount

Any new technology that comes on the market inevitably raises questions of security. In banking, where money is involved, maintaining customer trust through rigorous security reviews of new technology is vital.

Chatbots have moved beyond the space where security and user data protections can be afterthoughts. As the market adopts more goal-oriented virtual assistants, features like sensitive data redaction and user entry sanitation will be the required standard.

Even given the blanket necessity for security as standard, advanced security functionalities will increasingly be a value differentiator. Notable features by standout providers will include communicating to users how their data will be protected, contextual user authentication, and supporting technologies like integrated geofencing.

7 // Instant messaging applications increase in popularity

Instant messaging applications now seem to be pulling ahead of conversational AI platforms and more traditional communication methods for contacting businesses. According to Forrester’s latest research, current trends show that 34% of French, 39% of UK, and 43% of US consumers have used text-based chat to messaging and get help from a brand in the past year.

And that’s not just on brand-specific communication channels either. In the US, for example, a total of 28% have used a third-party social media platform like WhatsApp, Instagram or Facebook Messenger to engage with a company customer service agent in real time.

8 // Chat is outperforming virtual assistants

Voice technology continues to grow as a trend, with digital voice assistants like Amazon’s Alexa or Google Home becoming increasingly common. However, when it comes to virtual customer assistants, the use of chat is outpacing voice or digital personal assistants.

Much of this is because there are far more installations of chat and use cases when compared to voice. The trends show that consumers often start with chatbots but bridge to humans or live chat very quickly when more complex conversations are needed.

This isn’t possible with voice, as brands build these applications to execute a limited number of tasks, such as searching the internet or controlling a connected device in the car or at home.

Looking forward, leading financial services firms will evolve their chatbots and voice experiences into virtual assistants that will provide a wide range of services. This will likely involve proactively sending alerts, providing savings tips, making product recommendations, and ultimately helping customers better manage their finances.

It’s true that customers have already started using smart speakers for basic banking activities and the market size is growing. In 2021, 30% of US online adults with a bank account used a smart speaker to check their bank account balances. In the UK, 30% sent money to another person, and 22% of individuals with a bank account in Canada have transferred money between their own accounts.

While there is an increase in the use of smart speakers for financial interactions, Forrester research shows that banking customers remain wary of voice assistants largely due to security or privacy issues.

9 // Chatbot distrust remains high

Despite the many advantages of chatbots, there is also widespread mistrust among consumers. In fact, only a minority of customers feel comfortable using virtual agents for customer service in financial services.

This does tend to vary depending on the type of interaction, however. While around a third of European and American customers trust natural language processing technology to handle simple financial tasks, almost two-thirds don’t trust them to handle complex financial tasks.

Similarly, only a fraction of customers use voice assistants to interact with their financial services providers. Customer expectations, use, and comfort with chatbots and voice assistants lag behind other industries due to the complexity of financial interactions and privacy concerns.

Chatbot software & Unblu

Overall, chatbot trends show a lot of promise for finance institutions, provided customer experience and concerns are kept at the forefront. With Ublu, our chatbot software integration offers your customers the perfect hybrid experience of chatbot interactions combined with the human touch of an advisor.

Aligning with the most important findings, our software allows customers to transfer seamlessly between chatting to a virtual assistant and speaking to a real person – building a bridge between the digital and personal. Book a demo here to find out more.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice