Today’s consumer expects efficiency and convenience. Banks need to adapt, stepping up and offering them a streamlined online experience. Going digital improves conversion rates and response times and reduces support costs. But to maintain satisfaction, banks also need to offer a personal touch. Over 50% of those surveyed by Accenture wanted to switch between human and digital channels (Accenture, 2019) (https://www.accenture.com/_acnmedia/pdf-95/accenture-2019-global-financial-services-consumer-study.pdf ). Customers want the option to speak to a real advisor at times.

Digital banking in 2020: the trends

Customer service is one area of banking where we are witnessing big changes, with developments such as mobile banking, AI automation, and self-service tools. But we’re also seeing a continued desire for a personal experience with a human touch. The solution? A hybrid service that offers a choice between digital and real-world solutions – between self-service and human-to-human interaction.

From chatbots to mobile apps, self-service solutions are transforming customer service in financial services. But customers still value the personal and human element of banking.

After all, banking is about trust, and building trust requires meaningful human-to-human exchange. And so the best banking solutions offer an omnichannel experience, combining person-to-person interaction and the human capacity for understanding with the convenience of high-tech.

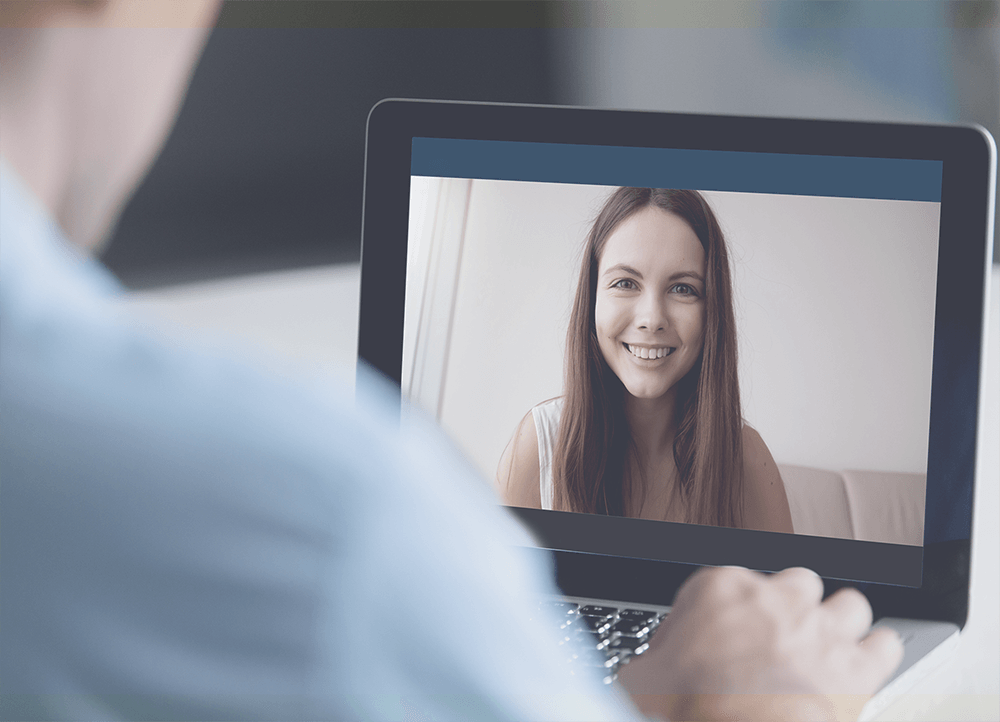

Digital and physical touch points should work together, offering flexibility. A survey by Deloitte shows many customers still prefer traditional channels for complex or advisory services; technology fails to create the necessary emotional connection. Banks need to put more “real in digital and digital in real”, integrating the digital and physical. For example, adding self-service screens in branches, or connecting customers with advisors virtually.

Digital banking in 2020: the tools

Consumers want convenience and efficiency – but they also want to trust their bank and have an experience that is personalized and unique to them. Digital banking in 2020 should offer the tools that make the process of banking streamlined and easy but also offer people that all-important human-to-human contact.

A conversational interface enhances human conversation through digital tools. While self-service is convenient, it can alienate customers when they encounter a problem but there’s no pathway to human help. A hybrid service means they can switch easily between automated services like chatbots, and speaking to a real advisor with live chat. High-tech meets the human, working together to create an improved interaction.

Digital solutions enhance and improve interactions to benefit both customers and banks. For example, a customer with a problem might contact their advisor via live chat. They get a solution without even having to leave home but feel reassured knowing they are speaking to a real person. And the advisor saves time as they can reply to multiple customers at once.

Digital banking and Unblu

Digital transformation enhances the customer experience but only if it prioritizes meaningful interactions; it’s these interactions that build trust. With a flexible omnichannel service, customers can move between self-service and speaking to a real advisor. Banks save time and money through increased automation and reduced support costs. And customers can bank with greater convenience while enjoying the reassurance of human-to-human contact.

Unblu’s Conversational Banking solution allows banks to take their customer service to the next level. Our tools provide the perfect bridge between self-service and face-to-face exchange, dramatically enhancing the customer experience.

Put human conversation at the center of your customer service. Learn more by booking a demo today and an Unblu team member will reach out to help.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice