Messaging programs can ease the strain on contact centers to boost efficiency. This is an invaluable part of any conversational engagement strategy as agents or advisors only have a finite amount of time. Redirecting simple requests to more convenient digital channels leads to a better, more efficient experience for employees and members alike.

That said, the goal of deflecting, optimizing, and streamlining is only one side of the coin. The time saved on basic support cases can also be better used in offering high-value members more in-depth support.

Augmenting phone calls with quality high-touch collaboration

The credit union industry, even more than other financial institutions, puts emphasis on the quality of member interactions. As digital cements itself as the preferred method of communication particularly among younger generations, it’s essential that credit unions maintain the same level of customer service excellence for high-touch collaboration.

The first step in this is offering convenient access to voice and video calls whenever it is clear that the member or potential member needs more in-depth support. Being able to talk one-on-one in real time goes a long way to building trust in a financial advice or support relationship.

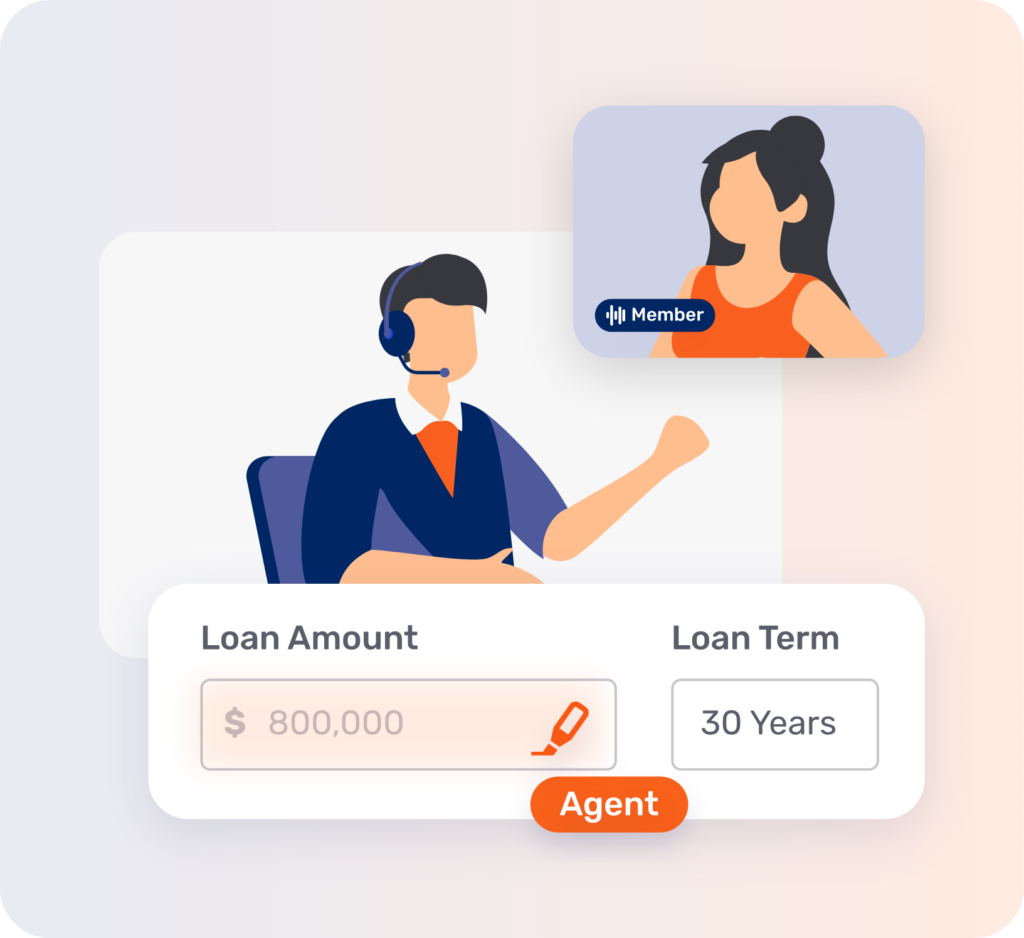

And yet even video calls don’t quite match the level of service that a member would get in person. There isn’t the same ability to carry out internet research together, look at a specific in-app problem, or any other issue that requires collaboration.

What is Co-Browsing?

Co-Browsing – otherwise known as collaborative browsing – is a powerful tool that represents this final step that takes video and voice calls to a new level. With Co-Browsing, members receive a personalized experience that not only emulates in-person interactions but actually enhances them.

The secure collaboration tool allows both parties to view, interact with, and even sign documents remotely – without downloads. Unlike screen sharing, it is fully secure, flexible, and has a range of whiteboarding features.

The benefits of embracing Co-Browsing as a collaboration solution

On both the member side and the agent side, there are many benefits associated with high-touch collaboration solutions like Co-Browsing to boost experience and engagement in credit unions.

Swifter issue resolution for credit union employees

Co-Browsing boosts efficiency to achieve swiffer issue resolution for complex interactions, whether difficult transactions or in-depth, real-time service needs. With video and voice calls, the two parties are only able to use verbal communication to achieve the desired resolution. Co-Browsing, on the other hand, adds an entire visual element to the equations, including whiteboard or highlighter tools to ensure everyone is on the same page.

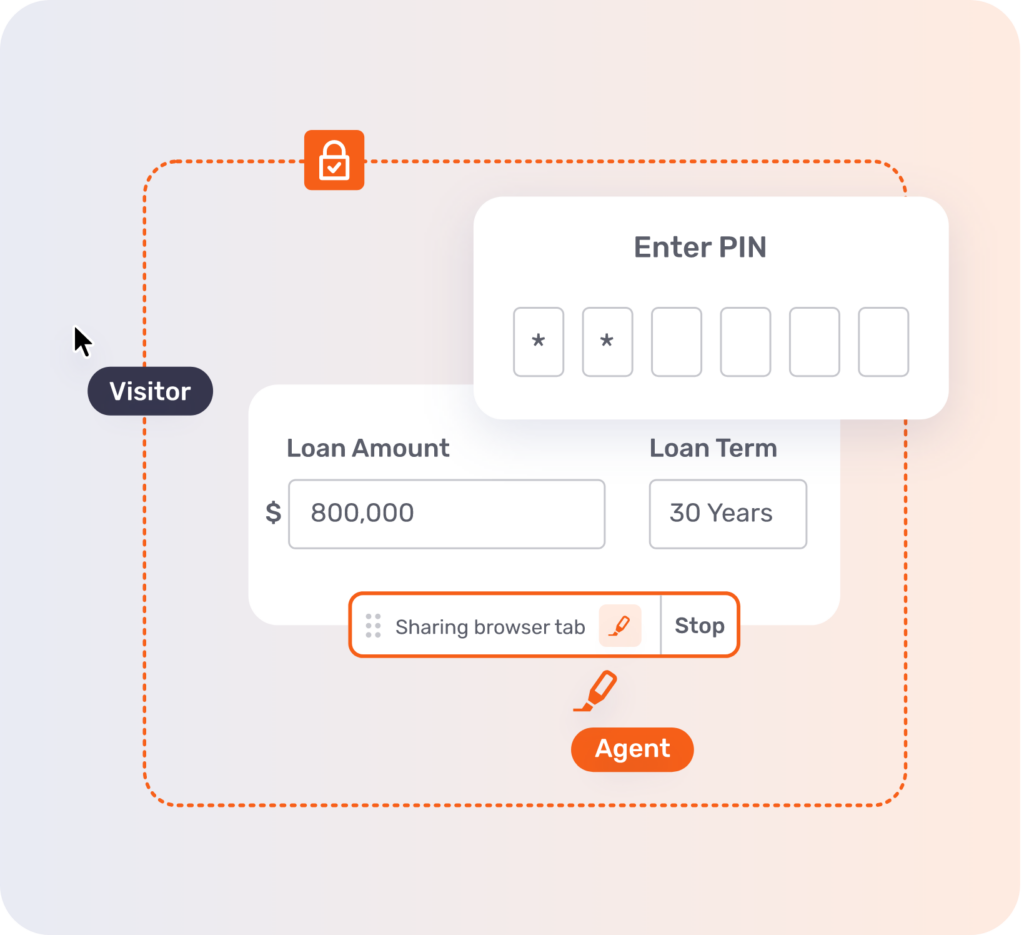

For example, simple issues can occasionally become complex due to the limitation of voice or video calls. Say a member is trying to make a bank transfer using their app but is having difficulty as they are unfamiliar with the process. An agent could launch a Co-Browsing session inside the app to guide the member in real time.

What’s more, the security features of Embedded Co-Browsing mean that any sensitive information is automatically blurred on the agent side, ensuring the member’s privacy. In this way, a potentially long, instruction-heavy call can be resolved in just a few short minutes.

Trust: The ultimate challenge for credit union staff

Trust is essential in a financial services context. Credit unions are, historically, institutions that enjoy very high levels of trust due to the nature of their setup. However, the rise of online banking meant that levels of trust in credit unions has been falling since 2018.

At the heart of this change is the issue of digital banking and digital communication channels. The report cites a fall in perceptions in credit unions providing “online banking capabilities that are convenient or easy to use,” the credit union being “easy to deal with,” “transactions being completed in a timely manner,” and other similar service-level issues.

Regaining and maintaining this sense of trust is about offering a quality service – in the way that members expect. Co-Browsing, by providing the best of “in-person” experiences in a digital environment, goes a long way to increasing trust.

Proactive education to reduce repeat callers

When members approach a service agent with an issue, it’s highly probable that the agent has encountered similar challenges before. A Co-Browsing solution plays a critical role here. Not only does it enables agents to efficiently address member issues with enhanced security features, but it also empowers them to identify recurring problems over time.

During the Co-Browsing session, agents can proactively educate members about these common follow-up issues, thereby decreasing the likelihood of repeated calls.

The ability to minimize unnecessary repetition is a crucial element for sustained member success. Proactive education can enhance efficiency in contact centers, allowing agents to dedicate more time to intricate processes and ensure a personalized experience for members.

Upsell potential: The competitive advantage

While the focus should always be on providing members with the most seamless experience possible, the issue of maximizing conversions is also important to ensure ongoing financial health. The fact is, current members are a key source of revenue. Studies have found that in general 20% of customer interactions within a company result in 80% of the organization’s revenue.

Co-Browsing sessions guarantee the most seamless real-time experience to minimize drop-offs. By enabling users to complete form fields and obtain legal signatures, agents can more effectively finalize deals. Furthermore, this positive encounter extends into the member onboarding phase – a critical point in the journey that significantly influences later member retention rates.

Positive member interactions

The ideal profile for customer service representatives is an individual who genuinely enjoys dealing with people and helping. However, certain realities of customer-facing roles can prove challenging, even for team members with excellent interpersonal skills. If the customer is placed into a frustrating situation, even if it’s no fault of the agent, it can quickly lead to a negative experience for both parties.

The high level of interaction made possible by Co-Browsing serves to streamline the service experience whenever communication-related friction occurs. As the agent has the power to better guide the customer when filling out complex forms, there is a higher number of positive interactions throughout the day to increase satisfaction, customer loyalty, and boost sales as a result.

Would Co-Browsing serve your credit union?

It is essential to develop stronger relationships with members through efficient communication experiences built around a holistic digital strategy. But to serve your members, you first need to serve your team – and that means providing them with the tools they need to offer an experience that boosts trust and satisfaction.

A 2022 EY article found that, for organizations in general, treating staff members like you treat clients is the key to ongoing success. In a credit union context, this takes on an even greater meaning. Credit union employees that rely on phone calls for all member inquiries are losing at both ends of the service-level spectrum.

By leveraging tools like Co-Browsing – as part of an overall conversational engagement strategy – credit union leaders can boost efficiency to reduce the quantity of calls, while ensuring quality interactions during key moments.

Want to find out more about Unblu? Contact us today to request a demo.

Want to find out more?

Reach out to us today for more information or to schedule a demo