CUSTOMER SUPPORT

Turn support into sales

Unblu’s platform of digital tools offers banks and insurers the opportunity to optimize client interactions and deliver support that is customized, efficient, and convenient.

We allow financial institutions to

Demonstrate that every exchange matters

Use customer-centric digital solutions to personalize interactions, leveraging ‘moments of truth’ and stepping in at just the right moment with valuable help. Embedded co-browsing provides call center agents with a visual context to queries. This simplifies and speeds up the task of giving advice on issues like account charges, technical problems, or stolen cards.

Reduce costs while boosting satisfaction

With their problems resolved faster and more easily, customers are left satisfied. Support costs are also reduced thanks to the improved efficiency when features like co-browsing are enabled. With the Unblu platform available on every channel and device, customers have access to remote yet seamless and consistent customer support wherever they are, at any time.

Grow Net Promoter Score

By approaching the relationship from the customer’s perspective, banks and insurers can consistently prove their value, improving the overall service, and increasing satisfaction while reducing costs.

Why Unblu?

Different products for diverse needs

Texting: easy and intuitive communication

Customers can chat with agents asynchronously and in an easy way with secure messenger, which integrates into applications like WhatsApp and Facebook Messenger. Live chat also allows convenient real-time communication, with canned responses to accelerate replies.

Learn more about secure messaging Learn more about live chatCo-browsing & screen sharing: level up with visual troubleshooting

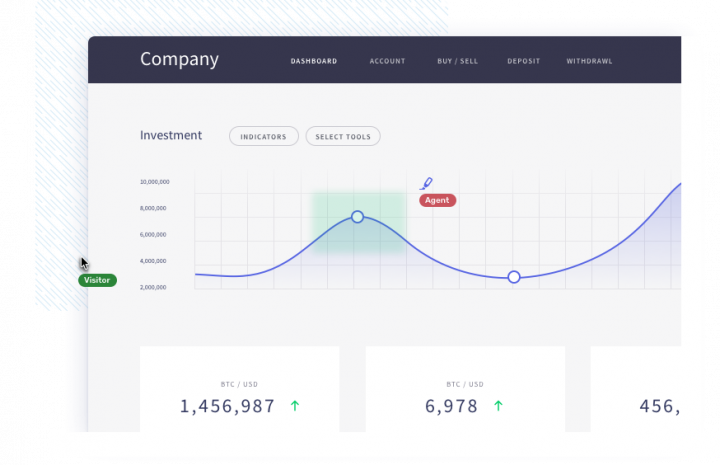

Co-browsing and screen sharing give support teams a visual context. This allows them to offer advice that is clear and specific, responding to the problem with greater precision. Co-browsing also allows for collaboration, making the interaction more engaging.

Learn more about co-browsing Learn more about screen sharing

Chatbot automation without the risk

For low-stakes problems, chatbots offer fast and cost-efficient support, helping to process payments and transfers or answering simple questions. This frees agents for more complex problems — and if a customer needs to speak to them, they can transfer at any moment.

Learn more about chatbot integrationHow we are different

Total compliance

Data protection, access to audit trails, masking, encrypted archiving, and geofencing all ensure that Unblu’s conversational tools are compliant with the necessary financial regulations.

Enhanced security

The SecureFlow Manager (SFM) ensures even the most highly secured applications can be safely accessed. Unblu’s technology can also be integrated into existing security set-ups without compromising them.

Innovative technology

Unblu Solutions require no downloads or installations for end users.

Comprehensive usability

Different digital tools can be combined into a single seamless journey, with advisors and customers able to switch smoothly between solutions and channels as necessary.

Flexible integration

On-premise installation is available. Other options are the Unblu Financial Cloud or a dedicated cloud operated by Unblu.

Enhanced efficiency

Unblu’s implementation methodology allows full operationality within a month. Our modular system means you can license some functions now and activate others later, without additional installation projects.

Absolute trust

Unblu has been transforming financial customer service for over ten years, helping more than 150 banks and insurance companies with innovative conversational tools that build trusting and meaningful relationships.

Book a demo

For secure and efficient online advice and a seamlessly integrated customer experience, choose Unblu.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice