Co-Browsing

Show and tell

The ultimate in remote visual collaboration to better support, advise – and generate additional revenue.

Request a demoExperience the power of Co-Browsing

Efficient, convenient collaboration

Real-time guidance

Download-free access

Side-by-side support – remotely. Guide customers with a secure, interactive collaboration tool in real time.

Kick off Co-Browsing with a single click from a browser. No downloads or plug-ins needed for customers and agents.

Proactive support

Augment new or existing channels

Cut down on repeat callers with proactive education to avoid common issues or demonstrate self-serve capabilities.

Enrich live chats, voice & video calls to provide an in-person experience in a digital environment.

Better, faster collaboration – reduce Average Handling Time (AHT) and increase customer satisfaction.

Swift issue resolution and happy customers frees your agents up to focus on revenue-driving upsell opportunities.

Equip agents and advisors with the tools for success, increasing employee satisfaction and reducing the turnover rate.

What kind of content can be Co-Browsed with your customers?

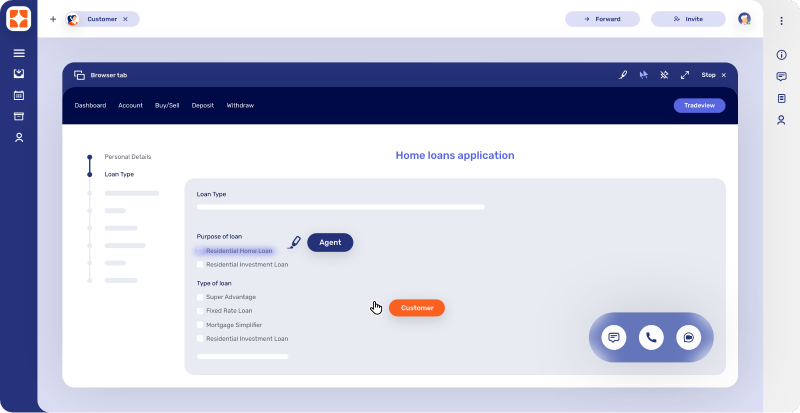

Public website or secure customer portal

Helping customers to find the right product, guiding them performing transactions online, or as simple as showing them how to reset password or update address.

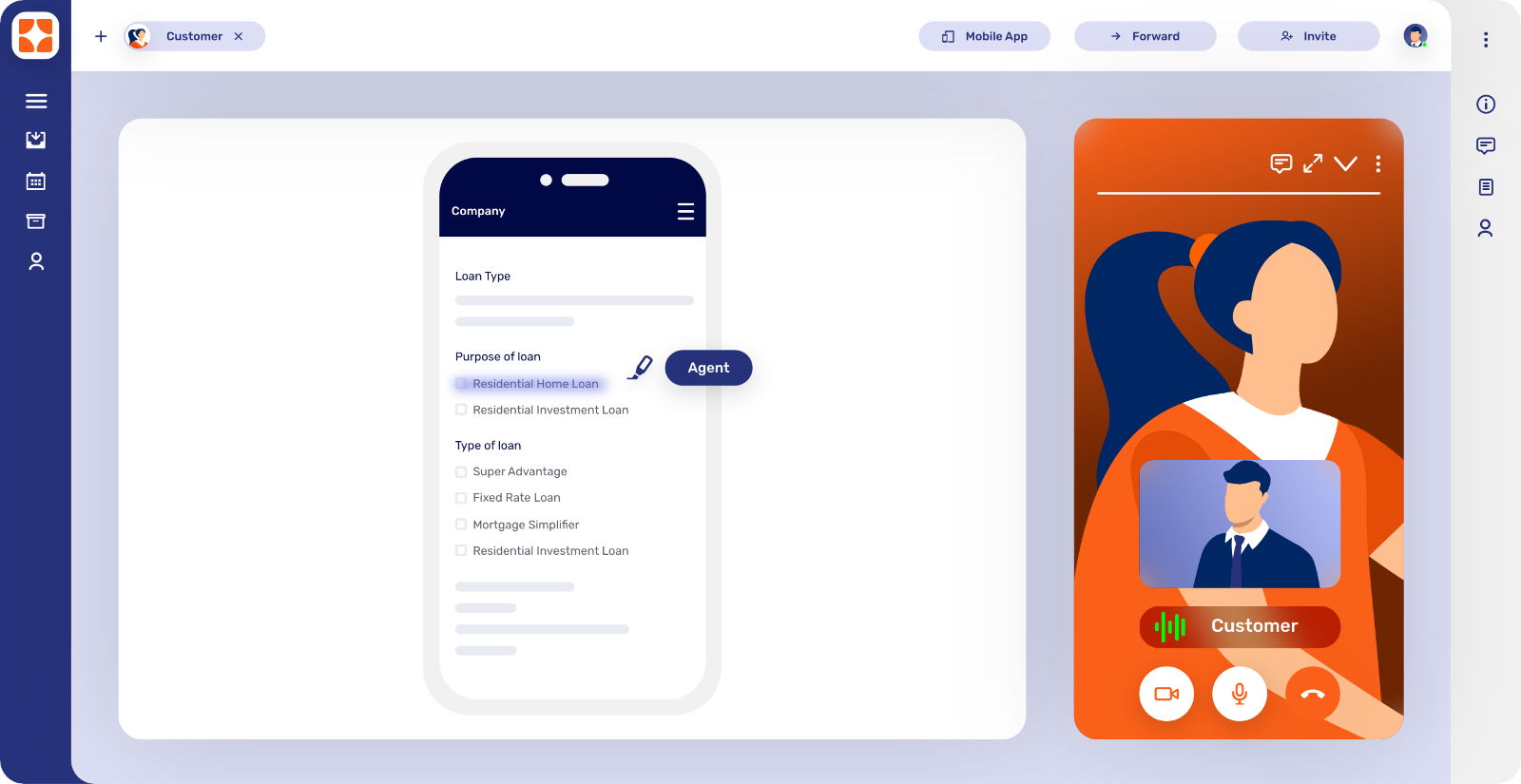

Mobile Co-Apping

Like Embedded Co-Browsing, but specifically engineered for a mobile environment – providing in-app collaboration capabilities exactly where your customers are.

Learn more

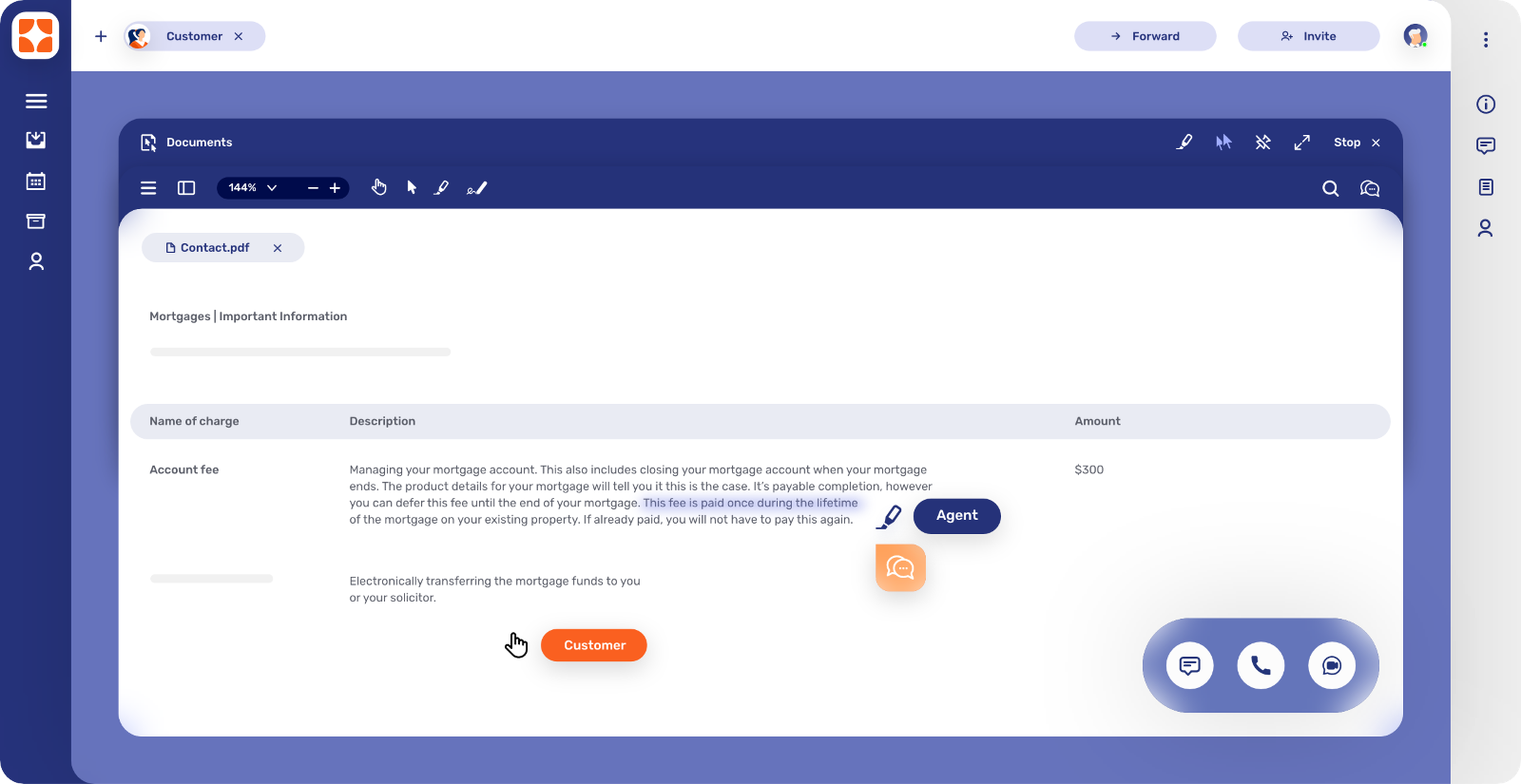

Documents and files

Reports, contracts, agreements, presentations, spreadsheets – view, highlight, or edit the same document, including securing binding signatures.

Learn more

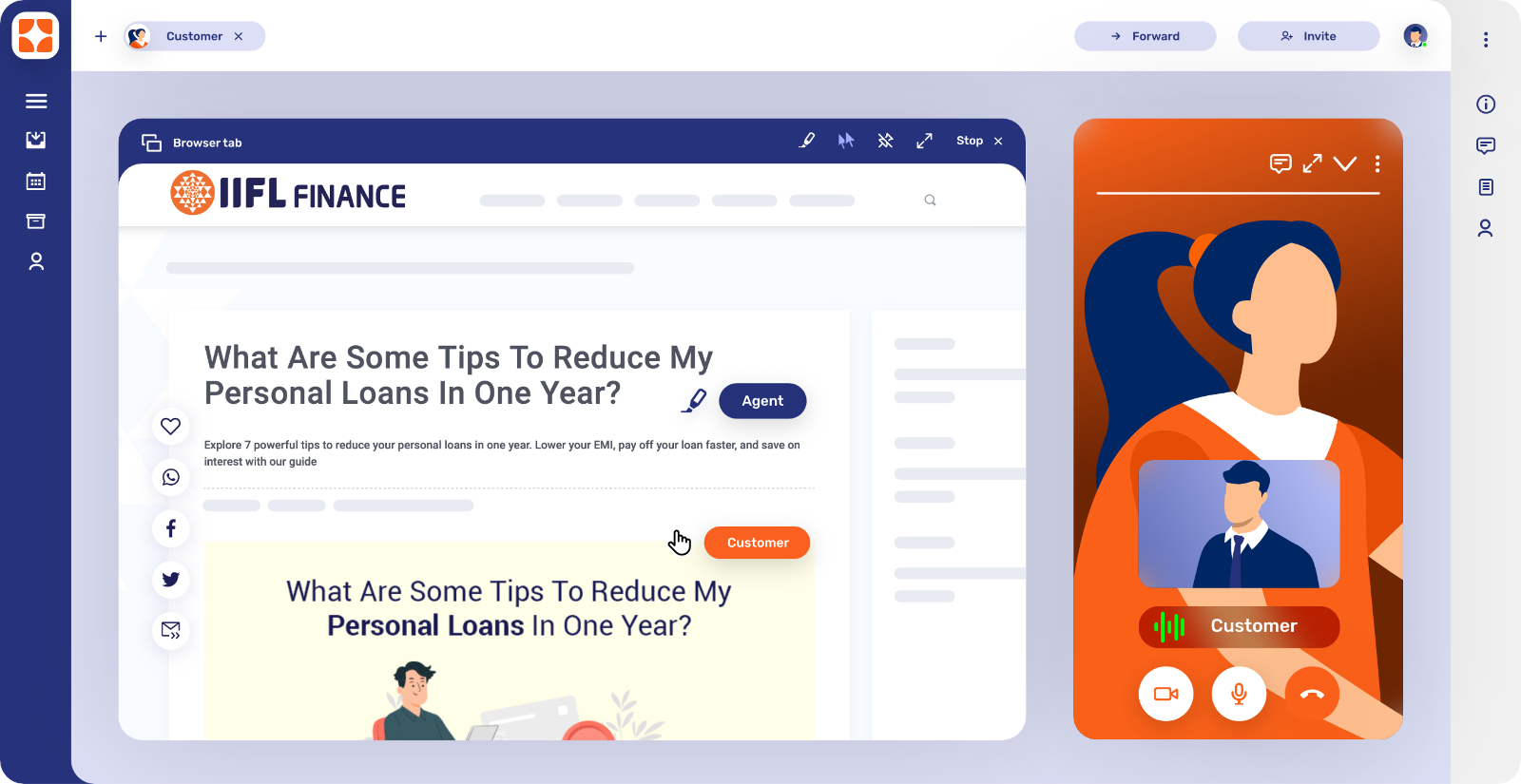

Third-party websites

Co-Browse external websites to carry out joint research, featuring highlighting and other collaboration tools.

Whiteboarding

Leverage highly visual whiteboard capabilities in any Co-Browsing session to ensure complete comprehension.

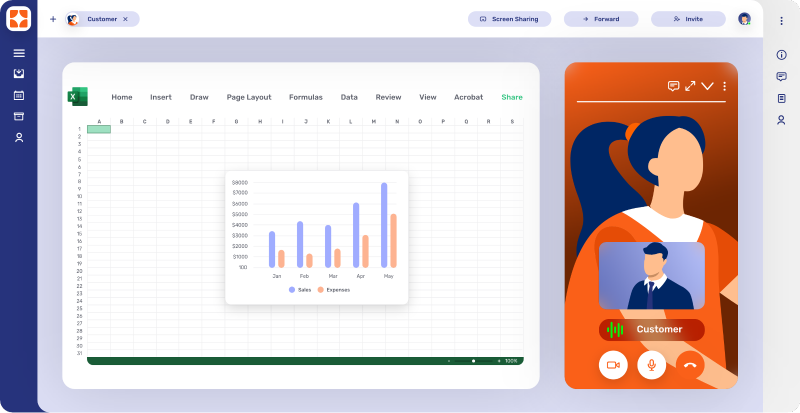

Screen Sharing

Whether from agents to visitors or visitors to agents, screen sharing allows one party to view the other’s entire screen, single application, or browser tab.

Supercharge your contact center experience with Unblu’s engagement tools.

Best-in-class technology tailored to your organization.

Safe, secure experience. Every time.

Full content control

Define what your agents can see or do with a configurable Co-Browsing solution that meets your security needs.

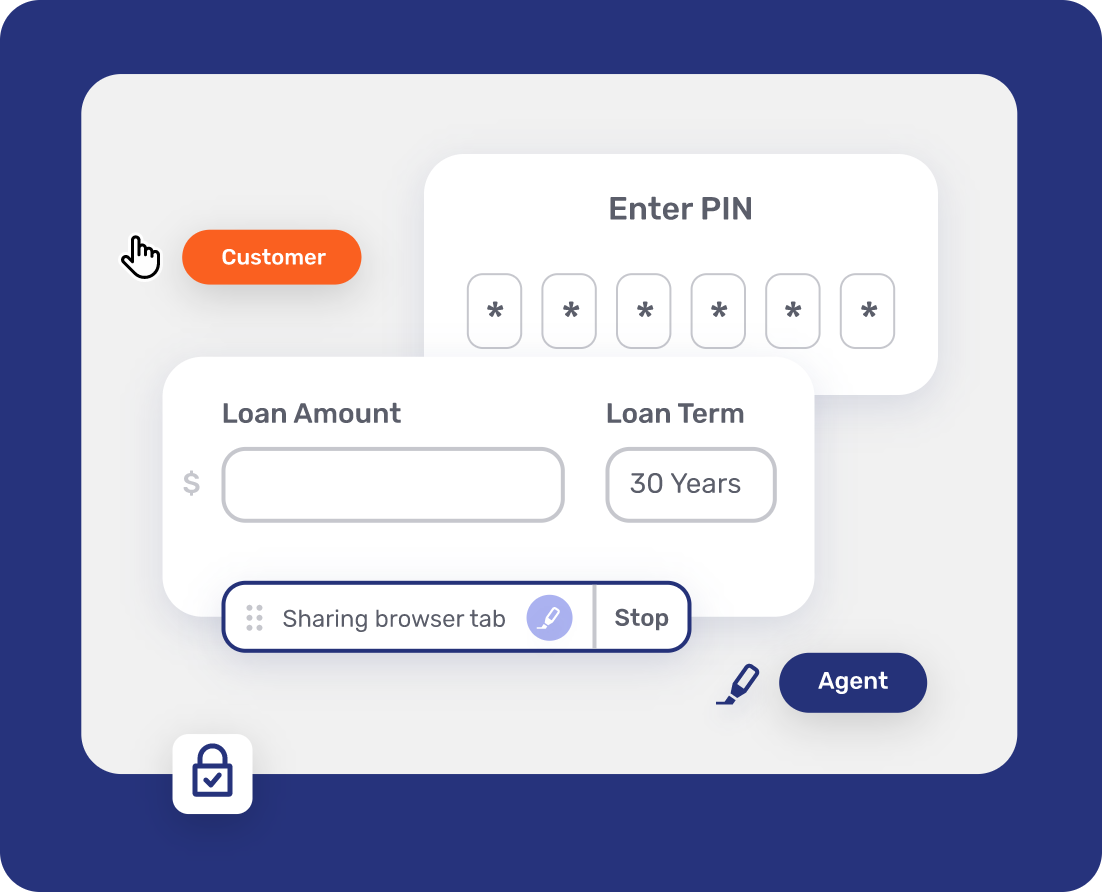

Skip-and-mask browsing

Customer data is never transmitted from the browser to the Unblu server. Retain control over what agents see and their remote access to important buttons or form fields.

Full website integration

Available on the public website – or behind secured areas, with visitor single sign-on to ensure maximum security.

How is Co-Browsing different from screen sharing?

Co-Browsing goes beyond screen sharing to ensure a more immersive, practical, and safer collaboration session.

Co-Browsing software and Screen Sharing side by side:

UNBLU CO-BROWSING

SCREEN SHARING

Content-specific sharing (certain pages on your website, documents, your mobile apps, or a defined list of websites)

UNBLU CO-BROWSING

SCREEN SHARING

Sensitive data masking (no transmission/visibility for agents)

UNBLU CO-BROWSING

SCREEN SHARING

Disable agent remote access to important buttons or form fields

UNBLU CO-BROWSING

SCREEN SHARING

Available on all browsers

UNBLU CO-BROWSING

SCREEN SHARING

No download or plug in required on the customer browser

UNBLU CO-BROWSING

SCREEN SHARING

See the entire screen

UNBLU CO-BROWSING

SCREEN SHARING

Full feature list

Browse Unblu Spark’s full list of features at your own pace.

See in action

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice