UNBLU FOR INSURANCE

Enhance your customer experience and save money in the process

Reduce ongoing expenses and boost your revenue over time. Discover the power of digital experiences.

Request a demoImmediate impact

Unblu ensures a seamless experience from the first moment of contact until a deal is made, empowering insurance companies to ensure customer experience excellence and boost sales.

Bot resolution rate

Support inquiries via email

Positive customer satisfaction

Digital sales conversion rate

Enhance, streamline – and increase efficiency

Increase agent efficiency by more effectively distributing channel requests – while leveraging Conversational AI, Live Chat, and other Unblu capabilities to ease the burden on phone lines and email channels. Beyond freeing agents up for high-impact conversations, the Bot Assistant equips agents with accurate and personalized recommendations to increase first contact resolution rates and reduce handling times.

Excellent customer experience

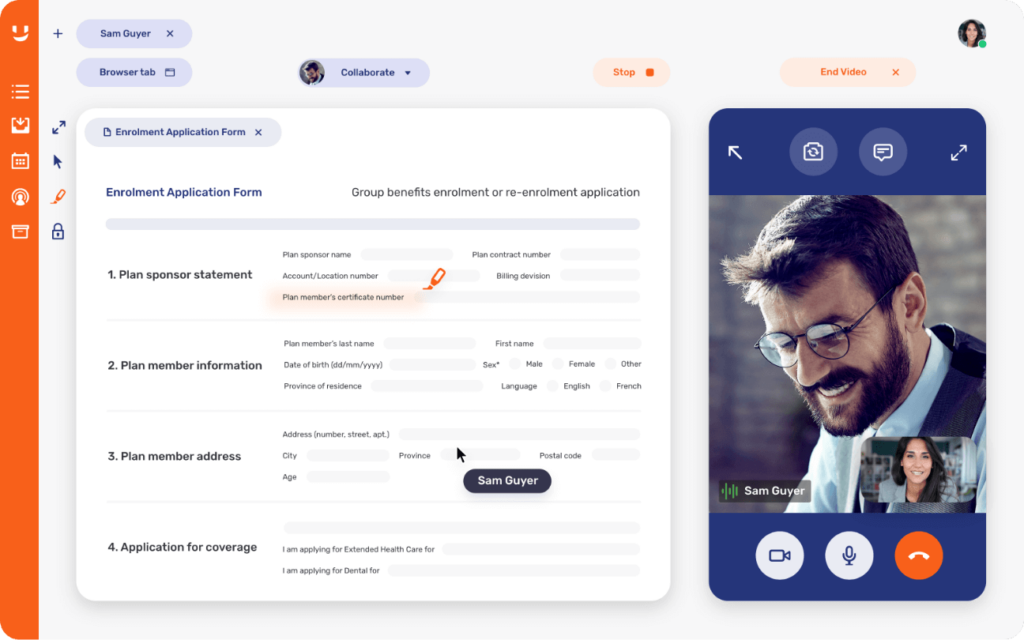

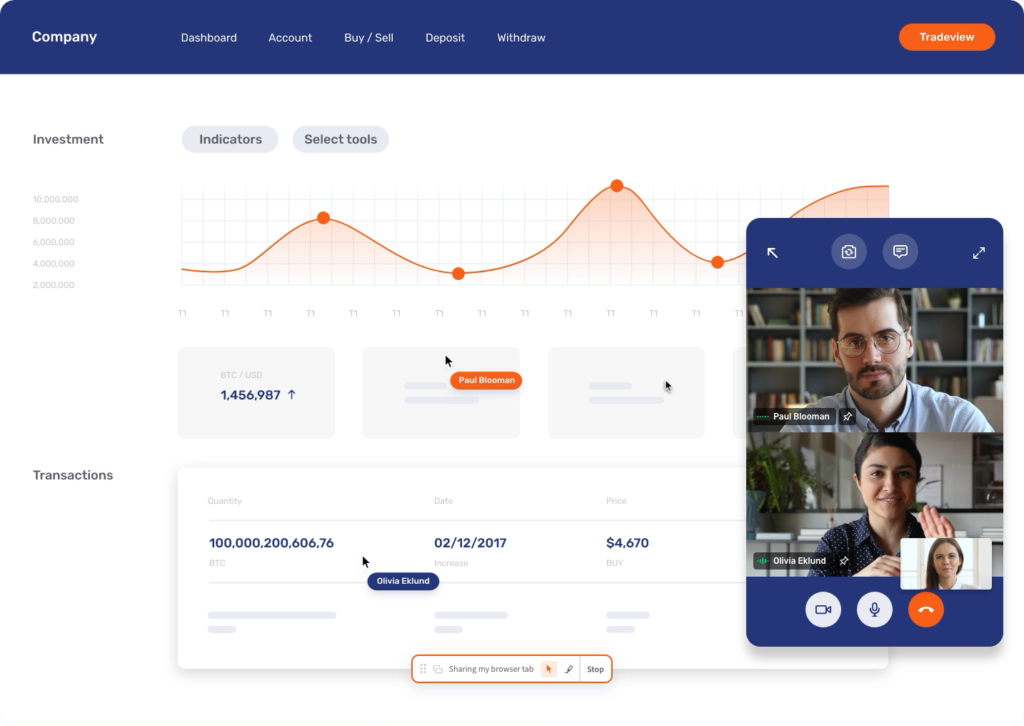

Customers need frictionless claim submission processes and ongoing support. Leverage digital tools like live chat, video calls or Co-Browsing in key moments for maximum collaboration. Need visual confirmation for auto and home insurance claims? Jump on a video call. Customers struggling to navigate their online account or fill in forms and documents? Securely exchange documents or elevate to Co-Browsing. It’s an in-person experience – gone digital.

Boost revenue

Increase inbound and outbound sales on your digital platform. Know where your customers are at any time during quote and application processes – and proactively engage with them to reduce abandonment rate. With Conversational AI capabilities, agents can better qualify potential leads and offer human assistance to accelerate sales and increase upsell opportunities.

The features that drive results

- Conversational AI

- Secure Messenger

- Video & Voice

- Co-Browsing

Conversational AI

Reduce the strain on contact centers and empower customers to find the answers they need. Unblu’s Chatbot can deal with up to 76% of queries – with human support available at any time via Live Chat.

Secure Messenger

Secure Messenger mirrors the way we communicate in our personal lives, while remaining compliant, secure, and omnichannel.

Video & Voice

Securely schedule a call or launch one instantly from any channel. Enhance communication and finalize purchases with whiteboard collaboration, document storage, and e-signatures.

Co-Browsing

View and interact with the same document or web page in a secure remote environment and with visual-enhancement whiteboarding tools, Co-Browsing ensures hassle-free, high-touch collaboration.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice