ONBOARDING

Increase online conversion

Unblu’s platform of digital tools delivers an onboarding experience that is efficient and convenient yet personal, bringing value to both company and customer.

We allow financial institutions to

Increase sales

A seamlessly integrated customer journey that is clear at every stage reduces the risk of churn and increases conversion rates. Unblu’s digital tools allow you to efficiently onboard customers using chatbots and live chat before collaborating on documents with co-browsing and closing the interaction with e-signature software.

Streamline the process

Bots gather customer information and automate data entry while OCR systems check uploaded documents, reducing any friction in the process that might cause customer drop-offs.

Make onboarding personal

Digital solutions like co-browsing and messaging apps enable a natural and productive conversational flow between advisor and customer, creating a more personalized experience from the very outset.

Delight customers from start to end

Unblu’s integration with chatbot, identity verification, and e-signature software facilitates user adoption with a true omnichannel experience.

Why Unblu?

Different products for diverse needs

Texting: onboard on the go

Customer service teams can use texting to onboard customers in a way they find familiar, easy, and intuitive. For example, an advisor might share a document on messenger for the customer to complete on mobile, desktop, or in branch.

Learn more about secure messaging Learn more about live chatCo-browsing & screen sharing: see what the customer sees

To make the process of filling in applications and signing forms more engaging and efficient, co-browsing or screen-sharing can be initiated. These digital tools allow advisors to undertake visual trouble-shooting, offering more personalized and specific advice to customers.

Learn more about co-browsing Learn more about screen sharing

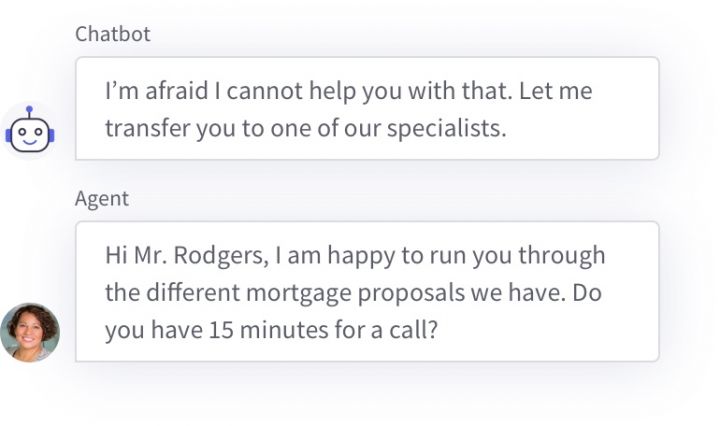

Chatbot: the best of automation and human

Unblu’s chatbot API is an ideal first port of call for customers, offering assistance in the natural form of a conversation. If a customer then wants human help, they can transfer to a real advisor at any time.

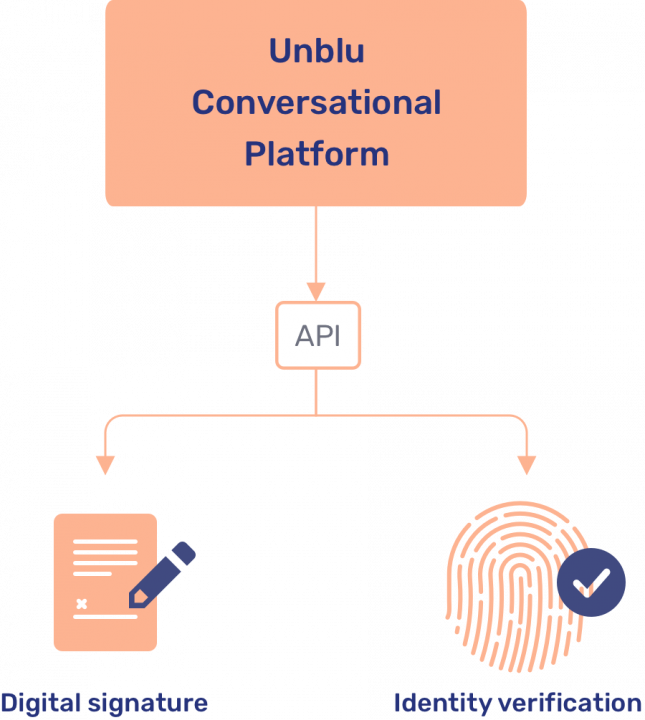

Learn more about chatbot integrationEffortless integration

Unblu’s set of APIs and webhooks allow for the seamless integration of additional services such as identity verification and digital signature software to further enhance the onboarding process. The result? An enjoyable, efficient, and friction-free customer journey.

Learn more about video & audio call

How we are different

Total compliance

Data protection, access to audit trails, masking, encrypted archiving, and geofencing all ensure that Unblu’s conversational tools are compliant with the necessary financial regulations.

Enhanced security

The SecureFlow Manager (SFM) ensures even the most highly secured applications can be safely accessed. Unblu’s technology can also be integrated into existing security set-ups without compromising them.

Innovative technology

Unblu Solutions require no downloads or installations for end users.

Comprehensive usability

Different digital tools can be combined into a single seamless journey, with advisors and customers able to switch smoothly between solutions and channels as necessary.

Flexible integration

On-premise installation is available. Other options are the Unblu Financial Cloud or a dedicated cloud operated by Unblu.

Enhanced efficiency

Unblu’s implementation methodology allows full operationality within a month. Our modular system means you can license some functions now and activate others later, without additional installation projects.

Absolute trust

Unblu has been transforming financial customer service for over ten years, helping more than 170 banks and insurance companies with innovative conversational tools that build trusting and meaningful relationships.

Book a demo

For secure and efficient online advice and a seamlessly integrated customer experience, choose Unblu.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice