Unblu Product Guide

All that you need to know about our platform: features, deployment options, use cases, customers, and much more.

Download the product guide

Discover the solution to a cost-effective and profitable branch network that exceeds customer service expectations. Bank branches are under threat There has been a downward…

In total, there has been a 20% reduction in physical bank branches since 2017. And this trend is continuing into 2024. The UK’s NatWest has…

This joint Unblu-Compeer report draws on original research from wealth and asset management firms to identify common industry IT trends, challenges, and client expectations. Readers…

Witness the power of conversational engagement Unblu's present and future Panel discussion: The role of Conversational AI in Financial Services The panel will explore the opportunities…

Discover how Unblu’s AI-empowered chatbot can lower the cost per case in a retail banking and insurance customer services context. The chatbot experience we imagined…

Discover how your advisors can benefit from an assistant that provides instant access to relationship-building insights. An AI advisor like no other In a wealth…

In 2017, Valiant Bank first began collaborating with Unblu. The aim was to find a solution to adjust to the decrease of In-Branch human assisted…

In diesem Webinar erörtern Aleksandar Tomic, Abteilungsleiter Digitaler Bereich, VEMA und Jens Rabe, Chief Operating Officer, Unblu, wie sie den Versicherungsmakler in den Mittelpunkt Ihrer…

Deliver an experience that drives revenue In this guide, you will learn about: The power of experience Discover why experience matters in a wealth management…

How to advise female investors on their terms Women constitute half the planet’s population. This makes them a powerful—albeit diverse—demographic. 80% of global purchasing decisions are…

Millennial’s inheritance from Baby Boomers will constitute the largest wealth transfer in history. Discover how to build a value proposition that engages this younger generation and…

More and more of life is taking place online, including taking care of financial matters. While this technological progress brings greater convenience and efficiency, are…

Pax Insurance, a leading Insurance provider in Switzerland has selected Unblu to support them in enhancing both its direct sales and broker network strategy. Implemented…

Crédit Agricole next bank (Suisse) identified and anticipated potential areas of friction in their customer journey when planning to migrate to a new e-banking environment.…

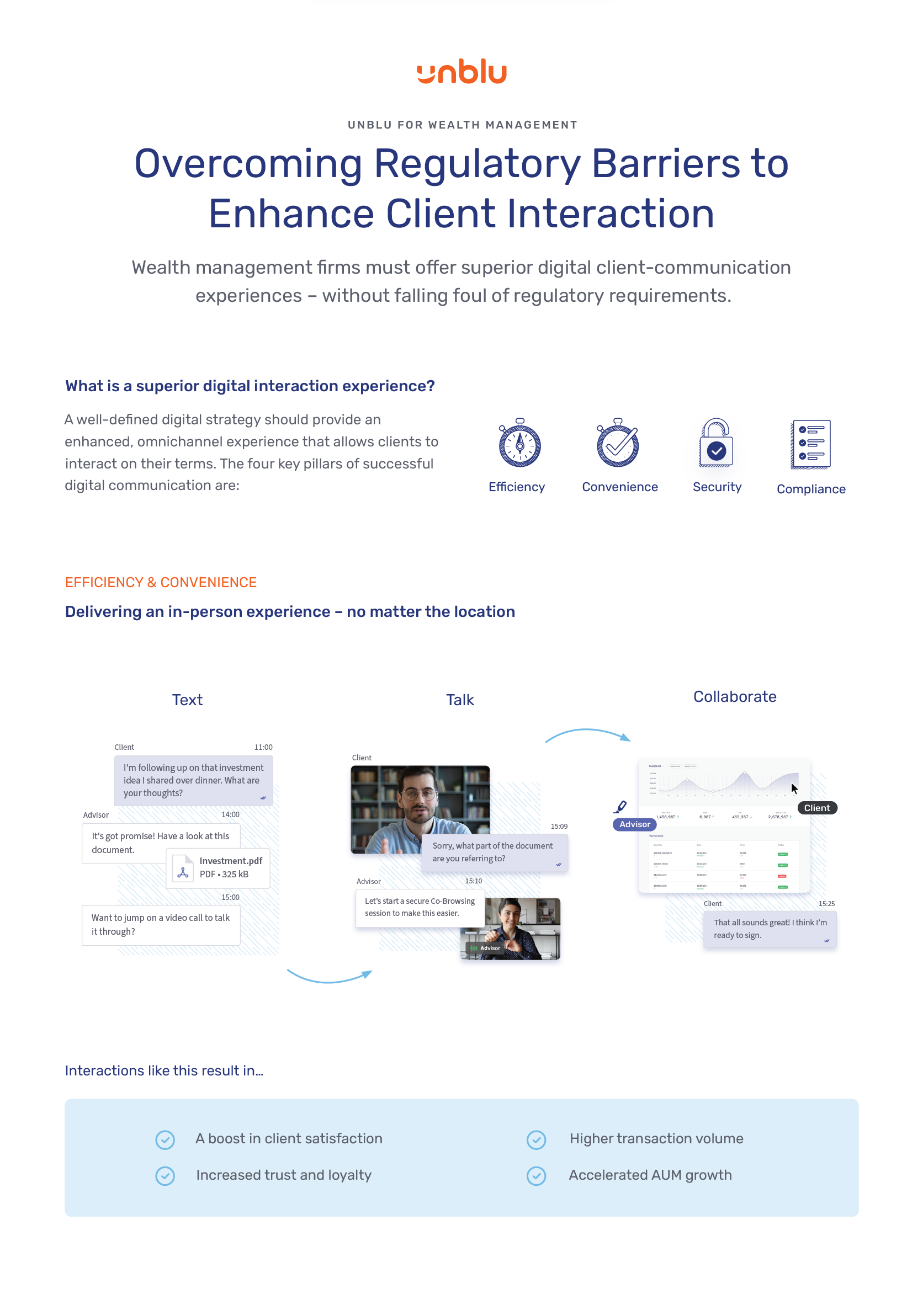

How wealth management firms and private banks communicate with their clients is coming under increased scrutiny from regulators, particularly surrounding the recording of conversations. But…

In 2020, Raiffeisenbank first began collaborating with Unblu. After adding Live Chat and Co-Browsing, their agents were able to offer a higher quality service overall. But that’s just…

Hybrid experiences built on trust Trends long in development will come to fruition in 2023 – requiring an urgent response from retail banks. But faced…

How to level up your digital customer experience in a branchless world No relationship can thrive without trust – and yet that’s exactly what’s missing…

Compliant messaging that’s convenient Clients increasingly prefer to communicate with their wealth management advisors via messaging apps. However, the distinctly mobile-first experience that they crave…

Compliant messaging that’s convenient Clients increasingly prefer to communicate with their wealth management advisors via messaging apps. However, the distinctly mobile-first experience that they crave…

Persönliche Beratung auf digitalen Kanälen: Wie Versicherungen mehr Umsatz durch besseren Kundenservice erzielen können. Das Kundenverhalten hat sich geändert und Versicherungsverträge werden zunehmend über…

Reshaping digital client interactions Over the past year, we’ve seen major firms overlook their regulatory obligations around client communications. Many companies have faced hefty fines…

Reshaping digital client interactions Over the past year, we’ve seen major firms overlook their regulatory obligations around client communications. Many companies have faced hefty fines…

Swiss Post has been working with Unblu to deploy new means of client engagement and support. Acting as the main Swiss Post employee interface, Unblu…

Staying competitive through remote assistance and advisory Our client is a renowned private bank in Belgium. As a market challenger, they have invested in digital…

Founded in 1890, the Schwyzer Kantonalbank (SZKB) operates 22 branches and employs 600+ people. SZKB's customers include private clients, small and medium-sized enterprises, as well…

In today’s financial services landscape, customer experience is a defining factor for brand success and survival. Organizations must stay aware of the seismic shifts in…

In today’s financial services landscape, customer experience is a defining factor for brand success and survival. Organizations must stay aware of the seismic shifts in…

Sweeping changes affecting the wealth management sector The wealth landscape is reaching a point of no return as years of change transform the status quo.…

From Conversational to Generative: One giant leap for botkind In this report, we chart the legacy perceptions, developments, and challenges of AI chatbots – and…

Humanising digital for the new age of member-centricity Member trust is an invaluable asset. Empathy-driven organisations are the ones that secure long-term loyalty—but this…

Humanising digital for the new age of member-centricity Member trust is an invaluable asset. Empathy-driven organisations are the ones that secure long-term loyalty—but this…

Financial advice has responded rapidly to the pandemic-driven digital transformation of operations, client interaction and shifting customer expectations. As customer preferences change, individual demands have…

Financial advice has responded rapidly to the pandemic-driven digital transformation of operations, client interaction and shifting customer expectations. As customer preferences change, individual demands have…

Return to your mutual roots and provide a reassuring digital experience More and more of life is taking place online, including taking care of financial…

In this 60-minute webinar, we explore the new features and their potential impact on your business. With Unblu 7 we focus on: Improving customer experience…

During the Covid-19 pandemic, and ensuing national lockdowns, one of the key challenges for financial services professionals involved in customer or client advisory has…

Unblu’s credit union clients are combining the best of online self-service and traditional communication methods, bringing a much-needed human touch to digital member interactions. …

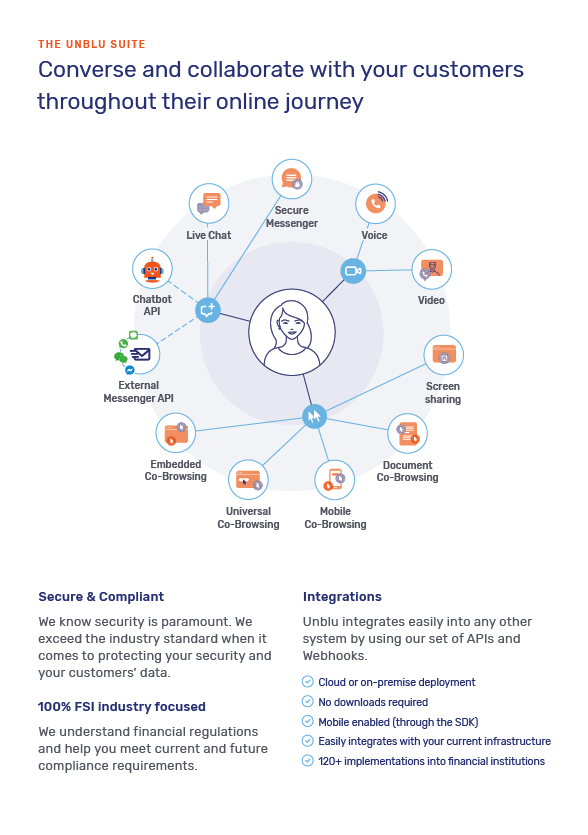

An omnichannel digital strategy is the cornerstone of flexible, engaging, and effective customer service. Learn how financial organizations are undertaking and implementing digital transformation today.…

2020 introduced more customers to mobile services than any financial services’ marketing efforts did. But that doesn’t change the fact that mobile apps still have…

Maintain Client Trust and Loyalty in the Transition to Digital Your clients will advocate for your service if you give them a smooth digital experience.…

Customers want the convenience and practicality of online and omnichannel banking, but they also want personal interaction. Quite simply, they want to be able to…

In this webinar, we discuss how to put the customer at the heart of your strategy. Why? Because most customers interact with their insurer less…

In this webinar, we break down how to integrate Unblu into the most popular messaging platforms. Why? Because this demanding industry requires you to communicate…

In this webinar, we discuss how important it is for insurers to provide customers with reassurance during the claims process and how that is achieved…

90% of customers who were frustrated by an experience with their insurer plan to search for another provider Within this whitepaper, you will find out…

Secure Messenger is part of the Unblu suite and is a natural expansion of the pervasive chatting experience. In this guide, we explain how our Secure…

For all the convenience and efficiency of digital banking, customers tell us something is still missing. Customers definitely want the convenience of digital and omnichannel…

Are you ready to talk with your customers? You need to be, because conversations are at the heart of the next wave of digital growth. …

Facing MiFID II Challenges and Bridging Customer Disconnect Clients have made it clear: they want banks to guide them in their future decisions and provide…

Your customers want you to be with them, wherever they are, moving alongside them from the real world to the virtual world and back. Not…

Discover how banks can keep customer conversations open, interesting and relevant. If you’re looking for an engaging and efficient way of staying in touch with…

Spend quality time with your customers. Our conversational solution, implemented in more than 150 financial institutions and insurance companies worldwide, allows them to interact with…

Secure & Profitable Online Engagement for the Financial Sector “Co-browsing technology is rarely used outside industries like financial services and telecoms, but it merits wider…

Discover how to increase gross margins, exceed customer expectations, speed up digital transformation and comply with upcoming banking regulations. Make existing online channels perform better by…

Discover how one of the leading Swiss banks has implemented co-browsing for improving support and promoting transactions. We've helped more than 100 world leading banks…

Discover in our new FactSheet how in-person customer engagement solutions can help banks to convert and engage customers by increasing their sales through all channels,…

Banks must build bridges between faceless online self-service systems and traditional communication methods in order to have a direct and positive effect on customer satisfaction,…

Traditional banks must rethink their go-to-market and customer strategies if they want to succeed in the online financial industry. In the following example, we demonstrate…

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice