Downloads

Resources about us and opinion pieces about our industry

Branches of the Future: A New Vision of Customer Service in the Banking Sector

In total, there has been a 20% reduction in physical bank branches since 2017.

How an improved client experience is the path to profit growth

This joint Unblu-Compeer report draws on original research from wealth and asset management firms to identify common industry IT trends, challenges, and client expectations.

Leveraging Unblu Branch to deliver a full network of hybrid branches across Switzerland

In 2017, Valiant Bank first began collaborating with Unblu.

Unblu for Private Banking and Wealth Management

Deliver an experience that drives revenue In this guide, you will learn about: The power of experience Discover why experience matters in a wealth management context and how it opens the door to more profitable relationships.

Women and Wealth

How to advise female investors on their terms Women constitute half the planet’s population.

Millennial wealth: how to prepare for imminent change

Millennial’s inheritance from Baby Boomers will constitute the largest wealth transfer in history.

Humanize your Digital Customer Service

More and more of life is taking place online, including taking care of financial matters.

Pax Insurance – Enhancing Hybrid Consulting

Pax Insurance, a leading Insurance provider in Switzerland has selected Unblu to support them in enhancing both its direct sales and broker network strategy.

Ensuring a smooth digital migration

Crédit Agricole next bank (Suisse) identified and anticipated potential areas of friction in their customer journey when planning to migrate to a new e-banking environment.

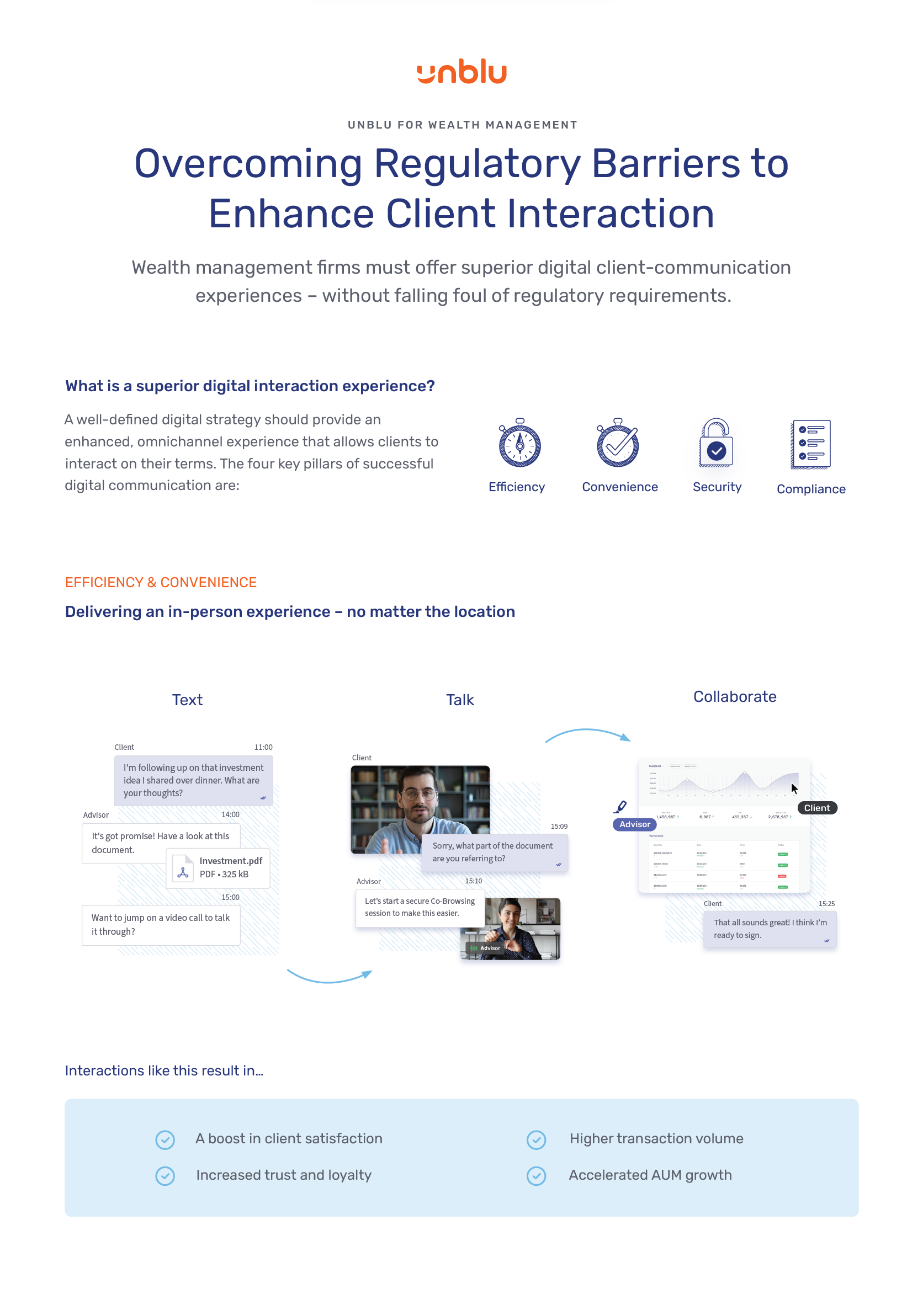

Overcoming Regulatory Barriers to Enhance Client Interaction

How wealth management firms and private banks communicate with their clients is coming under increased scrutiny from regulators, particularly surrounding the recording of conversations.

Leveraging Unblu to increase product conversion

In 2020, Raiffeisenbank first began collaborating with Unblu.

The 2023 Retail Banking Trends

Hybrid experiences built on trust Trends long in development will come to fruition in 2023 – requiring an urgent response from retail banks.

Digital banking, done right

How to level up your digital customer experience in a branchless world No relationship can thrive without trust – and yet that’s exactly what’s missing in today’s challenging digital banking landscape.

Client support and service via Live Chat and WhatsApp

Swiss Post has been working with Unblu to deploy new means of client engagement and support.

Private Banking in Belgium

Staying competitive through remote assistance and advisory Our client is a renowned private bank in Belgium.

Supporting local customers with their financial goals

Founded in 1890, the Schwyzer Kantonalbank (SZKB) operates 22 branches and employs 600+ people.

Тhe Digital Wealth Management Outlook 2023

Sweeping changes affecting the wealth management sector The wealth landscape is reaching a point of no return as years of change transform the status quo.

Thinking outside the bots

From Conversational to Generative: One giant leap for botkind In this report, we chart the legacy perceptions, developments, and challenges of AI chatbots – and explore what the recent advancements mean for financial institutions.

Humanise your Digital Member Experience

Return to your mutual roots and provide a reassuring digital experience More and more of life is taking place online, including taking care of financial matters.

From Surviving to Thriving: Digital Customer Engagement beyond Video Conferencing

During the Covid-19 pandemic, and ensuing national lockdowns, one of the key challenges for financial services professionals involved in customer or client advisory has been ensuring a smooth digital migration – and that consumers are adequately served via video conferencing solutions.

A humanized digital member experience for credit unions

Unblu’s credit union clients are combining the best of online self-service and traditional communication methods, bringing a much-needed human touch to digital member interactions.

Digital banking transformation: moving towards an omnichannel reality

An omnichannel digital strategy is the cornerstone of flexible, engaging, and effective customer service.

Unblu Conversational Solutions for Brokers

Maintain Client Trust and Loyalty in the Transition to Digital Your clients will advocate for your service if you give them a smooth digital experience.

Take the pain out of claims

90% of customers who were frustrated by an experience with their insurer plan to search for another provider Within this whitepaper, you will find out how the right blend of convenience and personalized human interaction will provide your customers with the reassurance they seek and a positive experience they desire.

Unblu Secure Messaging: the ultimate guide

Secure Messenger is part of the Unblu suite and is a natural expansion of the pervasive chatting experience.

Beyond Bots: Real Conversations for a Meaningful Customer Experience

For all the convenience and efficiency of digital banking, customers tell us something is still missing.

The Role of the Financial Advisor

Facing MiFID II Challenges and Bridging Customer Disconnect Clients have made it clear: they want banks to guide them in their future decisions and provide personalized, meaningful advice.

Unblu Product Guide

Your customers want you to be with them, wherever they are, moving alongside them from the real world to the virtual world and back.

Unblu Suite: Advisory Use Case

Discover how banks can keep customer conversations open, interesting and relevant.

Co-Browsing: the ultimate guide

Secure & Profitable Online Engagement for the Financial Sector “Co-browsing technology is rarely used outside industries like financial services and telecoms, but it merits wider implementation.

The road to success in financial services

Discover how to increase gross margins, exceed customer expectations, speed up digital transformation and comply with upcoming banking regulations.

Co-browsing implementation in the financial sector

Discover how one of the leading Swiss banks has implemented co-browsing for improving support and promoting transactions.

Humanizing Online Customer Experience

Discover in our new FactSheet how in-person customer engagement solutions can help banks to convert and engage customers by increasing their sales through all channels, increasing customer loyalty and getting a higher differentiation Increase sales through all channels.

PSD2: Impact on customer experience, self-service and collaboration solutions

Banks must build bridges between faceless online self-service systems and traditional communication methods in order to have a direct and positive effect on customer satisfaction, sales conversion, and customer loyalty.

Customer Experience: Battlefield for the Financial Industry

Traditional banks must rethink their go-to-market and customer strategies if they want to succeed in the online financial industry.

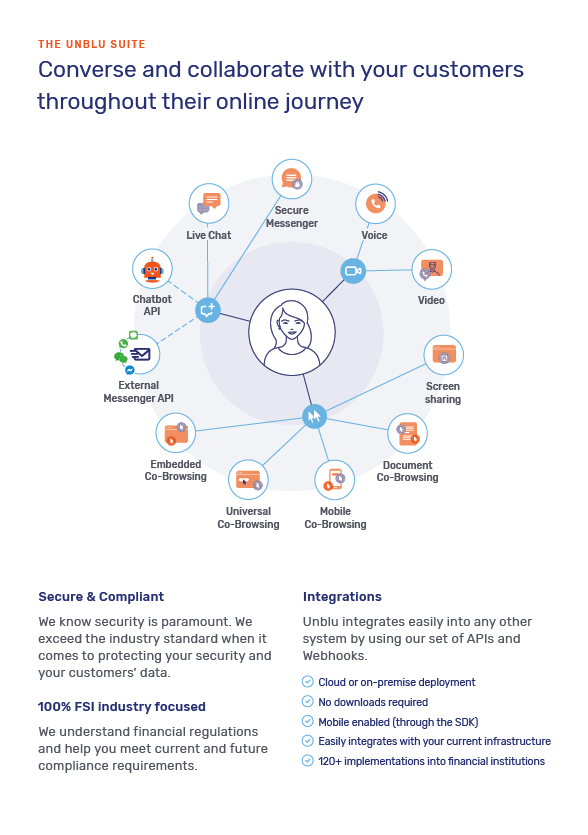

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice